Credit Risk Mitigation for A/R In The Consumer Goods Industry

Balance credit risk within the consumer goods industry with a five-step roadmap created with lessons learned from 2020 and learn more about the value in digitally transforming credit in 2021.

Executive Summary

In the upcoming chapters, we cover how A/R executives in the consumer packaged goods (CPG) industry are able to:

- Enable real-time credit risk monitoring to make well-informed decisions

- Decide which orders should be released and which ones should be kept on hold to keep risk at bay

- Make recovery and growth possible in 2021

- Gain visibility into day-to-day credit and order to cash operations

- Leverage technology and digital transformation for continuous improvement and higher A/R efficiency

Introduction

Before the COVID-19 crisis, major CPG companies were sharpening their execution of the old value creation model, experimenting with ways to own the explosion of small brands in their categories, and pulling the lever of productivity more than ever.

As a typical “black swan” event, the pandemic took the world by complete surprise. Grocery volumes surged 20% with pantry loading and then settled at 5–10%, while restaurants remained closed or tightly restricted. Through this period, large CPG companies mobilized their supply chains and concentrated on top lines, while small players struggled to pivot. But the crisis also accelerated consumer demand for value and reliance on digital. All of this constitutes a call to action for the industry.

One of the recommendations to do so is to focus on cash flow and risk exposure. Supply chain disruptions have cash flow implications across the extended supply chain that can’t be underestimated. This ebook will suggest ways organizations can mitigate damages to their business during this volatile event.

New Risk Mitigation Trends Observed In Response to the COVID Crisis

“When the COVID-19 started really hitting, our data team quickly went into high gear and started coming up with a COVID-19 impact score.”

Head Of Marketing,

CreditSafe USA

“We’re seeing a greater emphasis on frequent portfolio analysis. Clients who weren’t doing it before have now started analyzing it on a more frequent basis.”

Vice President, Solution Consulting,

Experian

“We’re looking at sentiment analysis as a way of giving some additional inputs to the finance teams.”

COO & Senior Vice President,

CreditRiskMonitor

“A/R professionals are using sales teams to connect to their clients to create the right type of terms and understand the status of that organization from a financial position.”

Senior Vice President,

Credit.net

“Coming up with a combined playbook for commercial and finance teams with the course of action for your portfolio of accounts is the key”

Senior Director of Order-To-Cash Operations,

S&P Global

Balancing Credit Risk: Tips To Adjust To The New Reality

When asked what their top priorities would be when re-opening their businesses, focusing on building a more agile credit function was the biggest concern among 42% of respondents, followed by building a long-term business continuity plan.

We here provide you with the five pillars that will help your credit team thrive in these tough times

4.1. Monitoring Credit Risk in Real-Time

A fluctuating economy demands more and more credit data, in real-time!

The most common and instant response to COVID-19 has been the reassessment of the creditworthiness of customers.

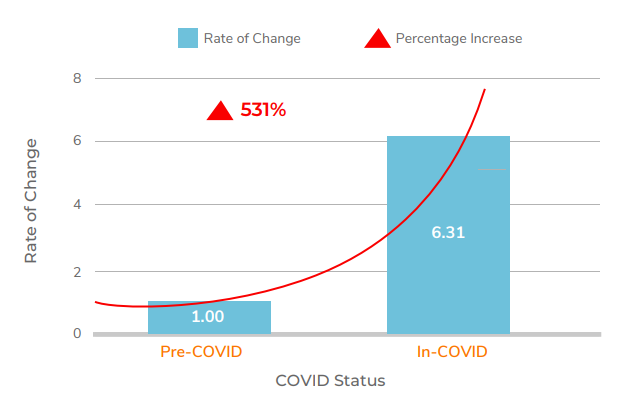

The months of June-July 2020 saw a whopping 6x increase in the number of credit limits changes done on an average by any company.

Credit Limit Trend Change Pre-COVID and In-COVID – June – July

Today, there is a push from executives to know which customers are likely to default on a daily basis. Suppliers are dealing with unpredictability in terms of identifying buyers who are likely to default in making payments.

The short team solution applied by most of the companies worldwide was to pull more financial and credit reports, analyze them, and conduct frequent credit reviews.

While this approach may have helped you to survive but it certainly becomes a problem in the long run. The immediate need for more frequent credit reviews means an increase in cost as more credit reports need to be pulled from credit agencies. For this reason, companies are vexed with D&B, Experian, Equifax of the world. Looking at innumerable credit reports might help you be on top of risks but will also burn a hole in your pocket.

In fact what credit teams need today is a commercially viable solution which also lets them capture and analyze different risk indicators like credit agency data, news alerts, payment behaviors, bankruptcy, and court filings, to monitor the credit risk for every single buyer in real-time and helps them proactively identify at-risk buyers, reassess their creditworthiness and reduce bad debt.

One way to augment credit-assessment capabilities without adding more staff is to deploy new analytics tools that can combine and analyze internal and external data, in real-time and use advanced algorithms to calculate default probabilities of any customer.

4.2. Keeping A Close Eyes On Orders Being Released

Maintaining the synergy between Credit-Sales is crucial – now, more than ever!

Since economic forecasts can change quickly, credit teams, all over the world, are monitoring creditworthiness of their customers more carefully and more frequently. They are fiercely protecting their business againsts portable risks from delinquent customers by locking/holding orders until the outstanding receivables are collected from them.

In fact, the number of orders being locked (in hold) by an organization every month on an average has increased by 5x in 2020, when compared to the same period in 2019.

Blocked Order Trend Pre-COVID and In-COVID – June – July

As companies are deeply concerned about their slowing growth, sales leaders also need to adjust how their organizations sell in the face of new customer habits and trying economic times. They are under a lot of pressure to meet their targets and maintain the revenue of their organization, especially in industries that are experiencing the most impact of the pandemic, like Automotive Manufacturing, Mining, Construction, and others.

Sales are crucial and hard, especially now. In such a scenario, if credit teams are being stringent with extending credit or grace periods, then that will give rise to an intensive battle between the two departments and it will be counterproductive for the organization as a whole.

The best way to resolve this conflict could be to get predictions for a customer about to exceed their credit limit and collect from them proactively to avoid locking the order in the first place.

This can be done by analyzing past order patterns and payment behavior of your customers, in real time. This approach will also result in faster collections and reduced bad-debt. Many companies are implementing this solution through Artificial Intelligence to avoid disruptions to their sales cycle, enable better customer experience, and improve their cash flow.

4.3. Prioritizing Recovery and Cautious Growth For 2021

Credit teams are enabling profitable growth, even in a volatile economy!

Credit managers have long played a crucial role in helping their companies avoid unnecessary risks by providing clear-eyed analyses of prospective customers, managing risks, and collecting payments from existing customers.

But as corporations face increasing pressure to conduct sales while also reducing costs and mitigating risks, the credit department, like every aspect of the business, is under pressure to demonstrate increased value to the company’s bottom line. It is not enough for credit departments to simply act as gatekeepers to prevent bad credit decisions; they are also expected to support sales and help in meeting growth targets for the year.

To do this, here are the most popular strategies being applied by Credit Teams in 2020:

Extending Credit Limits and Grace Periods On A Case-By-Case Basis:

Unsurprisingly, the implications of the pandemic hindered the ability of your customers to pay you on time, as they were scrambling to survive.

To enable customers to pay more easily, Credit teams are extending credit limits, revising the payment terms, or giving one time (extension) period of grace.

Developing A Culture For Fulfilling Fiscal Responsibility in Credit Teams

The average number of hours spent by a credit analyst in performing any type of credit review increased by 2x in April 2020, when compared to the same period in 2019. But over the next few months, the time spent doing the same reviews has rapidly declined.

Credit Leaders need to ensure that a culture of ‘performing due-diligence in analyzing risk, evaluating the creditworthiness of customers and releasing the right orders’ should be maintained always to ensure an efficient credit management system, which is an important necessity for every organization.

4.4. Enabling Visibility and Control Over Global Receivables

Credit Executives Today Need Real-time, Data-driven Analysis for Decision Making.

As per a survey conducted in Q1 in 2020, 62% CFOs identified monitoring team performance as a key challenge in the COVID-19 economy.

With the majority of your credit department working remotely, almost 60% in Q1 and Q2 in 2020, spread across different regions, Credit Executives have been concerned about monitoring the performance of important metrics like DSO, bad-debt, ADD and identifying risk concentration areas, customers likely to default and productivity of credit departments, to name a few.

The economy is fluctuating at a fast pace – and this demands Credit Executives stay on top of their process and team performance and quickly make course corrections based on the changing dynamics of the economy. However, this is easier said than done.

Asking for more reports to be created manually will also not help. By the time these reports reach you, the data in there would already have become stale. These colorful charts and reports prepared on Excel or PowerPoint may look good, but they have very little operational or strategic value!

Credit Executives today need more in-depth visibility into day-to-day finance operations, customizable reports with a 360-degree view of their global credit risk performance, and in real-time.

Expectations from Credit Executives Today

- Stay on top of emerging trends in key credit metrics including credit utilization, bad debt, customer onboarding time, blocked order resolution speed, and periodic review coverage.

- Have crystal clear visibility in the day-to-day activity of local credit teams. Maintain productivity even while working remotely by keeping tabs on the credit analyst’s daily goals and achievements and encourage a high-performance culture always (time spent on customer reviews, blocked orders, and workload distribution).

- Conduct detailed and regular portfolio analysis. For example, by identifying Top 10 customers by Blocked Orders/Credit Exposure and then executing corrective actions timely

- Empower yourselves with ready-to-use intuitive data visualization to drill down into individual reports to identify bottlenecks or issues and make course corrections based on them.

- Conduct various types of internal and industrial benchmarking analysis of key metrics and process health. For example; risk concentration levels (#customers likely to default) across different regions/BUs/industries and make course corrections based on the information.

4.5. Leveraging Technology To Building An Agile Credit Function

To build an agile credit function, technology plays a vital role. A successful digital transformation takes place by radically changing business models and capabilities in measured steps, over time, and as resources allow. This empowers organizations to launch, learn, and re-launch digital initiatives, swiftly reacting to changing market conditions and customer needs.

To give an example, by putting in place real-time credit decision making in the front line, CPG industries can reduce the risk of losing creditworthy clients to competitors as a result of slow approval processes. Credit risk costs can be further reduced through the integration of new data sources and the application of advanced analytics techniques. These improvements generate richer insights for better risk decisions and ensure more effective and forward-looking credit risk monitoring. Further, according to a McKinsey report, the use of machine-learning techniques can help organizations improve the predictability of credit early-warning systems by up to 25%.

HighRadius enables real-time credit risk monitoring for you to get an accurate and instantaneous view of your customer’s credit profile at any time so that you have the most updated information on your fingertips while making credit decisions.

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company which leverages Artificial Intelligence-based Autonomous Systems to help companies automate Accounts Receivable and Treasury processes. The HighRadius® Integrated Receivables platform reduces cycle times in your order-to-cash process through automation of receivables and payments processes across credit, electronic billing and payment processing, cash application, deductions, and collections. HighRadius® Treasury Management Applications help teams achieve touchless cash management, accurate cash forecasting and seamless bank reconciliation. Powered by the Rivana™ Artificial Intelligence Engine and Freeda™ Digital Assistant for order-to-cash teams, HighRadius enables teams to leverage machine learning to predict future outcomes and automate routine labor-intensive tasks. The radiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.