Deciding Who to Contact on Any Given Day

How Fortune 1000 companies and SMEs automate credit and accounts receivable operations to improve productivity and reduce DSO and past-due A/R.

Deciding Who to Contact on Any Given Day

On any given day, collections analysts spend up to 30% deciding on who to contact. Study states that 30% of Collections analyst?s time is spent in prioritizing and preparing for calls. Collections analysts would rather get down to calling customers as soon as they start their day rather than waste time in preparing a list of who to contact. The lack of a collections worklist could lead to unnecessary dunning and wasted calls.

4.1. Challenges in Preparing a Collections Worklist

Most companies assign hundreds to thousands of accounts per collections analyst depending on the size of the company.

Figure 6: 16 Variables that Impact Collections

Figure 12 lists some of the most common attributes including dunning data, credit risk and a number of promises to pays that affect whether a collections analyst should contact a customer on any given day. It is impractical for the collections analyst to take into account so many variables and most often they only look at invoice due date and invoice amount and many of these calls go waste.

4.2. Automating Collections Prioritization Process

Most organizations already have a strong set of credit policies in place but the execution of these credit policies is mostly left to the team. Ideally, all the credit policies should be within the system and the system should be able to suggest who to collect from.

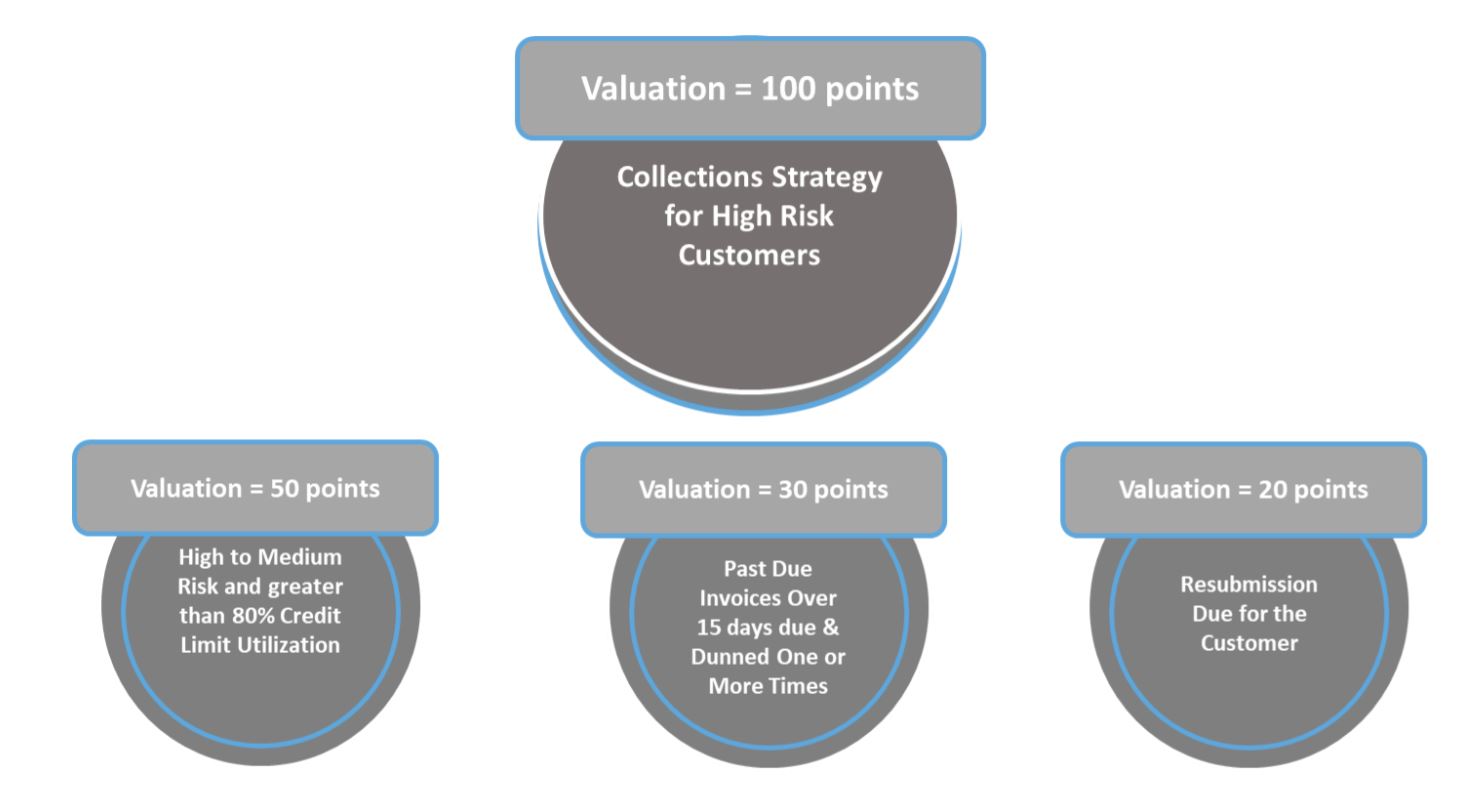

Figure 7: An Illustration Showing How to Assign Scores and Decide on Collections Prioritization

As the figure above shows, credit policies are used to assign scores for each rule the customer account/invoice satisfies and then an overall score is assigned. As an example, a credit policy could be enforced where any account whose cumulative valuation is more than 150 should be contacted on that day. The prioritized worklist helps collectors to contact more accounts and centrally track the activity for review and follow-up. The result is a more efficient collections team that contributes to enhanced cash flow and reduced DSO.