The Must-See Deductions Process Maturity Model for CPG Companies

This eBook outlines six stages of Deductions process maturity and the challenges and benefits involved within each. Then we deep dive into the solutions that CPG companies can deploy to create an intelligent deductions management framework and prevent revenue leakage.

Executive Summary

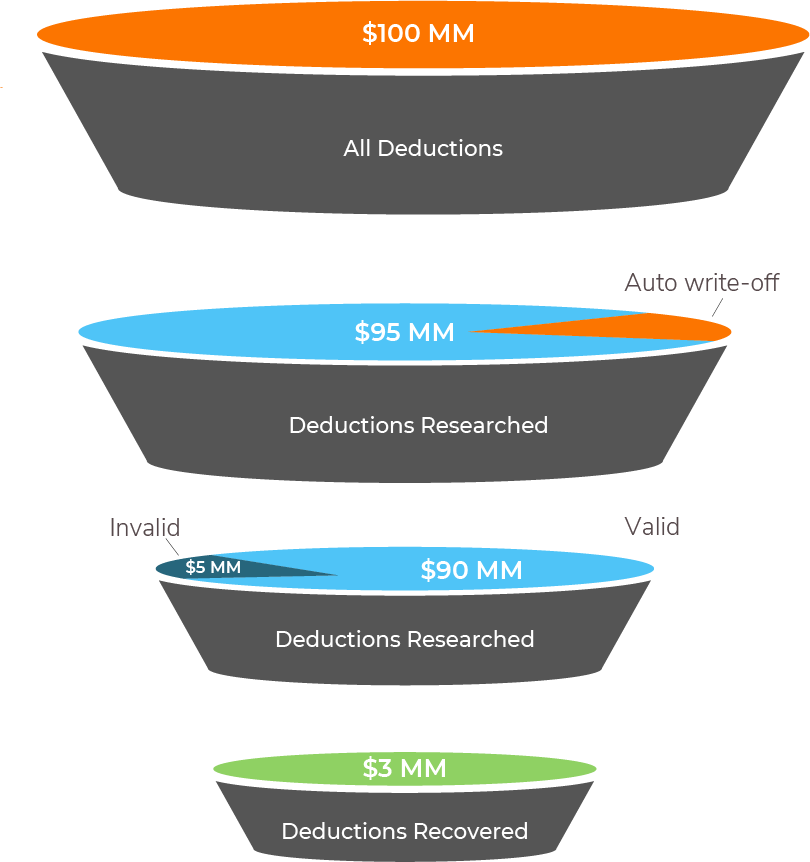

Inefficient deductions processes continue to plague consumer goods companies, leaving deductions teams scrambling to find and stop revenue leakage. They won’t have to look far; having thinned-out margins from revenue leakage is usually a direct result of too many broken processes, limited collaboration between internal departments, and poor communication with customers. Teams that cannot resolve the invalid deductions problem leave money on the table. By not identifying and recovering the sum lost to invalid deductions, claims become one of the primary causes of revenue leakage. But it doesn’t have to be that way.

A CPG company with $1Bn in revenue loses almost $3Mn annually to auto approved write-offs

Improving deductions process management is nothing new to CPG A/R leaders. But now, it’s time to identify the problem’s scope to fast-track a preventive solution.

Best-in-class CPG deduction teams achieve deductions process maturity in an evolution that happens in stages. Therefore, CPG A/R leaders looking for ways to improve their deductions process need to look closely at the deductions process maturity model to enhance productivity, increase effectiveness and prevent revenue leakage along the way.

It’s a great time to be at a CPG company if you’re a bold change leader. But, on the other hand, you may have difficult times ahead if you’re just playing defense due to system and resource limitations within an integrated operation.

The deductions process maturity journey for consumer goods companies is distinct. Here, we outline six stages of maturity and the challenges and benefits involved within each.

Then we deep dive into the solutions that CPG companies can deploy to create intelligent deductions management framework and prevent revenue leakage.

The Deductions Challenge for Consumer Goods Companies

Many CPG A/R Leaders want to drive change in deductions handling, but only those organizations who fully understand the challenges have persisted in fixing the deductions problem. If continuous improvement and prevention of revenue leakage is a top priority for you in today’s economy, you must focus on better deductions management now.

Some of the more common deductions process challenges include:

Nature of Deductions:

While the trade deductions arising from advertising, off-invoice discount, promotion & rebates are relatively easier to resolve, the non-trade deductions arising from shortages, damaged deliveries, warranties, invoicing errors, compliance, post-audit, and other issues are complex, unpredictable and require significant collaboration to investigate and resolve. the high-dollar value disputes that are most likely invalid.

Resolving too many deductions in a short time frame:

Increasing volumes and a lack of the right resources to research all the deductions (valid and invalid) has been a consistent issue for the deductions team. Identifying an invalid deduction is like finding a needle in a haystack.

Cross-department collaboration:

For effective deductions management, cross-department collaboration is a must. While the responsibility of the investigation lies with the A/R teams, it is often other teams like Sales, Supply chain, Logistics, and Customer service that need to execute the investigation.

Inaccurate processing of claims:

Inefficient processing is a significant issue in deductions management due to the high percentage of manual tasks and the high variability in process steps for different types of deductions.

Missing controls in the process chain of deductions:

Lack of proper controls and reviews in the deductions process leads to several issues. Deduction research has to be backed by documentation and proofs, but collecting all the relevant documents and keeping a communication trail remains a significant challenge that incurs added costs.

Lack of visibility into deductions metrics:

Lack of organized data and required set of information means no strategic visibility or insights to drive senior finance executive decision-making.

Customer Experience:

Deduction correspondence letters (denial correspondence or follow-up on invalid deductions) are manually composed, scheduled, and tracked across thousands of cases. Lack of automation leads to disorderly communication and poor customer relationships.

In a recent poll hosted by HighRadius, 79% of the 200+ suppliers surveyed were looking to further improve their deductions management process despite already having some improvement strategies in place.

Stages in Process Maturity of Deductions Management

The deductions management process model has evolved over the years from being a traditional human-driven model to a more robust and effective digital model powered by the concept of humans+machine, against the general world perception of humans and machines.

There are six stages in deductions management process maturity:

Stage 1: Manual Process Model (least mature)

As the starting point for many CPG companies, the deductions processes in Stage 1 are manual and require a lot of staff intervention. Here is how we could categorize these processes:

Resource-intensive: paper-based processing, identifying deduction reasons, and gathering backup manually after payment is received and deductions taken are too time-consuming.

Excessive write-offs: without adding resources, deductions teams have no time for analysis or correction. Recurring problems create large deduction backlogs and ultimately lead to excessive write-offs.

Information Silos: without effective cross-departmental communication or collaboration within the organization or with customers, data analysis is more complicated, and work effort gets duplicated.

CPG companies’ manual processes and data silos need retooling. Information silos and lack of automation lead to disorderly communication and poor customer relationships.

Stage 2: Reactive Process Model

In a reactive model, deductions management processes are well documented, including researching, validating, tracking, and reporting deductions that help align current operations with expansion plans.

However, the process is still manual, time-consuming, and only triggered by receiving a deduction from a customer. In addition, supporting documents sent through the mail require excessive paper handling to reach the deductions analyst. Therefore, ground-level standardization may be adopted in a reactive process to help the deductions team define workflows but still depend on individuals to implement deduction processes and policies.

In what ways do you have a more reactive process in your organization, and how does it affect revenue leakage?

This process is still heavily dependent on human skill and speed to deliver output with very little visibility into efficiency. However, workflow strategies have some definition, and analysts collaborate with different departments and customers manually via email or phone calls.

Internal collaboration in this stage of maturity always takes the form of “firefighting.” Once a problem or deduction occurs, people are thrown together, with the chief objective to minimize the damage.

Resolving and preventing deductions requires input and cooperation from multiple departments, specifically Sales, Logistics, and IT. However, due to a chaotic environment, the discussion about proactive prevention may not even come up.

In summary, reactive companies manage deductions on a case-by-case basis and typically lack a well-defined, streamlined process for gathering the input they need from other groups. In addition, since much of the deductions management activity occurs offline via phone or disparate email, it is not tracked automatically.

Stage 3: Data Standardization Process Model

In this stage, the processes and sub-processes of deductions are well-documented. Companies trying to implement a data standardization process model across their locations may have implemented a Trade Promotion Management (TPM) module within their ERP system.

The data standardization process model begins using data to drive decision-making in deductions processes.

While still a sub-module that acts independently of the accounting system, this method

enables the documentation of every single trade deal, discount information, customer reference, brand management program, and more within one system. In addition, formal claims and resolved deductions are easily accessible to the deduction analyst at any point during an audit.

Registering a deduction with available first-hand information is no longer a challenge since business systems reflect signed deals and the required contractual backup. Compiled data helps to generate prioritized worklists for deductions teams and leverages technology for automating clerical tasks. Master data can be captured from the ERP, but the task involves manually researching, validating, tracking, and reporting deductions. In this approach, technology supports essential processes but only in part.

Even with documenting and communicating trade promotion deals, CPG companies are likely still chasing sales approval on many trade promotion deductions, which takes quite a bit of time (and multiple emails). However, companies are beginning to gain more visibility into deduction data through spreadsheet reporting.

Despite data standardization, information silos still exist in this model. With no single view or common platform for the teams involved to review this information, some groups are dependent on other groups to extract needed info. At the same time, the customer lacks access to up-to-date information, leaving them dependent on supplier companies to share updates or claim status.

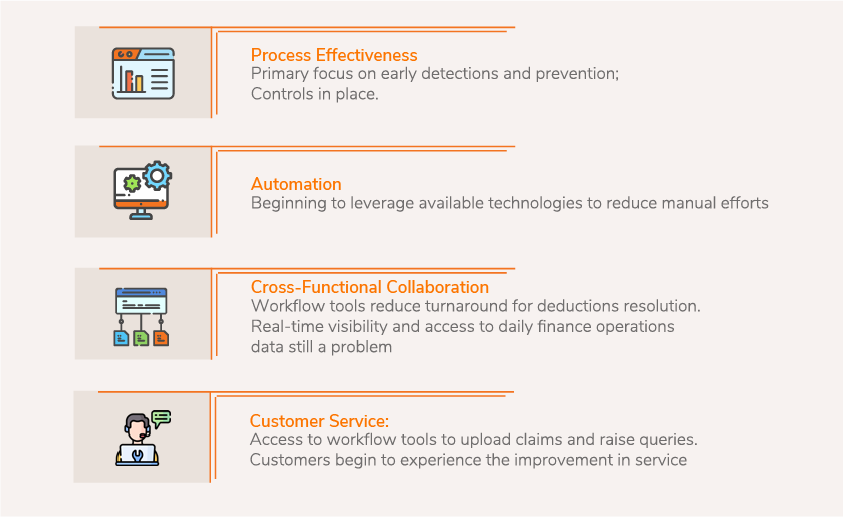

Stage 4: Progressive Process Model

Today, almost 75% of CPG companies want to implement workflow tools covering most of the in-house sub-processes of deductions. For most A/R leaders, workflow automation is the ultimate form of automation when it comes to deductions.

These workflow tools cover sub-processes such as:

- Claims capture and validation

- Claims disputes

- Claims review

- Claims settlement

- Claims reconciliation

CPG companies also want to adopt deductions-related business rules that include auto-approval or tiered approval structure of deduction claims (both trade and non-trade), basis value threshold, and schedule of authority.

A/R leaders believe that embedding all of these processes into a collaborative workflow tool will reduce the turnaround time (TAT) for deductions resolution and improve customer experience. They are not entirely wrong. Such workflow tools can semi-automate the deductions process, giving finance personnel more time to focus and make better decisions for A/R.

However, these workflow tools are still not sufficient for large-scale CPG enterprises that have complex A/R environments. They enable basic automation levels and depend on analysts to do most of the work. They do not provide any analytical support for senior executives looking to gain visibility into the finance department’s day-to-day operations.

Stage 5: Digital Journey Process Model

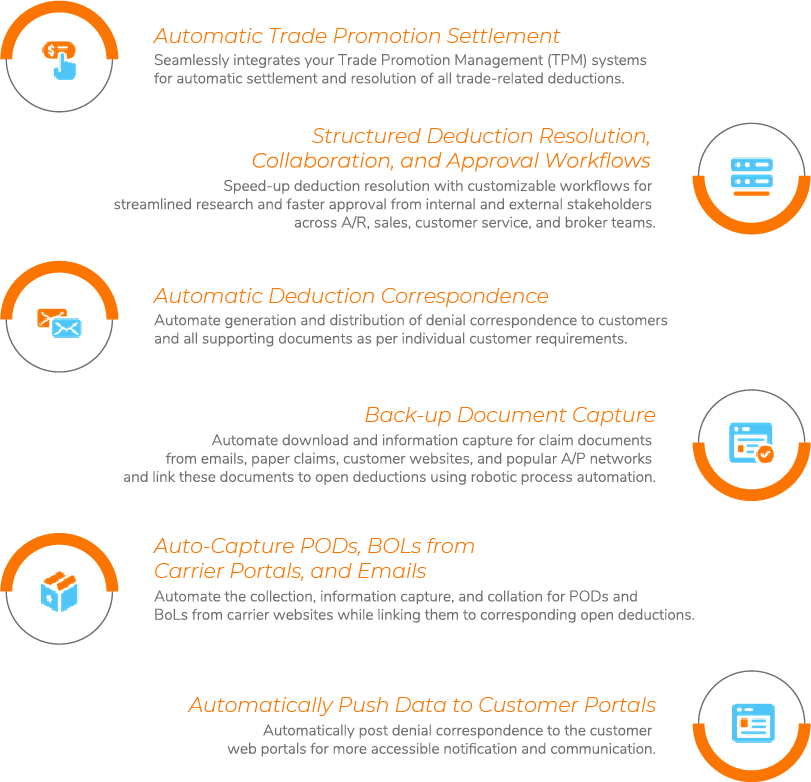

CPG organizations on their digital transformation journey and actively working towards solving their deductions problems fall into this category. These companies will have technology and Robotic Process Automation (RPA) capabilities in place and an automated backup document aggregation process.

Claims and proof of deliveries for non-trade and deal-sheets for trade deductions help manage the increasing volumes of deductions by auto-segregating them into trade and non-trade deductions.

In most scenarios, trade deductions are separate business processes and force deductions analysts to toggle between the ERP, trade promotions management contracts, and deductions management systems to figure out the trade promotion from which the deduction is taken. Data from the trade promotion, such as the promotion ID, committed amount, disbursed amount, and other fields, need to be carefully matched before approving the deduction.

With the integration of the Trade Promotion Management module into the deductions cloud platform, analysts have access to several essential features:

- Anytime and anywhere accessible Deductions solution.

- Centralized notes and tasks as a standard reference.

- Single platform for end-to-end deductions activity.

- Automatic settlement of Trade-related deductions.

- Owner/processor reassignment as per process need.

- Auto-resolve bulk disputes in a single click when found valid, in line with business rules. The solution also provides multiple ways to resolve a dispute, such as initiating a credit note, write-off, etc.

- Automated correspondence to customers informing them whether a deduction was identified as valid or invalid. The correspondence can be sent via email or pushed to the customer’s portal as needed.

A cloud solution combined with robotic automation enables a research-ready deductions process.

A research-ready process allows:

- Deductions analysts to focus on performing the review and communicating the actual decision.

- Better collaboration with sales, supply chain, and customer service teams.

- A seamless and sustainable process that can effectively manage incremental claim volumes at a much faster speed.

There is a vast pool of data available to drive analyst activity. But, unfortunately, while standardization of data becomes the norm, analysts still spend too much time on low-dollar value and invalid deductions instead of the prize.

A stable framework is provided by technology to carry out repetitive, manually intensive tasks through automation. However, there is only limited support and capability to leverage the deductions process as a strategic business operation.

Stage 6: AI-Powered Automated Deductions Process Model (most mature)

In this model, best-in-class CPG deduction teams get an AI-powered cloud solution for deductions management. In addition, predictive analytics based on historical customer behavior forecasts deduction validity with greater accuracy.

With low-dollar value and invalid deductions removed from the worklist due to the automation, teams can prioritize and resolve high-dollar value and valid deductions.

AI-powered deductions validity prediction allows deduction teams to predict a dispute’s validity with 95%+ accuracy even before doing any research.

Analysts get more qualitative time to resolve disputes because manual research is limited to high dollar value deductions, and with all the solutions available at the tip of the fingers. Intelligent systems can directly segregate high-priority deductions and make daily work more accessible for the analyst since time spent on low-priority tasks gets reduced significantly. As a result, resources are freed up and can also be trained to manage other A/R tasks.

Artificial Intelligence leverages technology to minimize manual methods of correspondence. The customer experience is much more improved due to the availability of best-in-class automated solutions that are globally scalable and sustainable. The big win is that CPG companies can eliminate revenue leakage by deductions teams in this stage of deductions process maturity.

The 6-Stage Advance of Effective Deductions Management

Driven by crucial enablers and next-generation capabilities, CPG companies get automation and process maturity as they move along in their digital transformation journey.

Effective Deductions Management is in Your Reach

Start by assessing your current deductions process maturity compared to the above stages of top-performing CPG companies and determine where your organization falls. By advancing to Stage 6 of the Deductions Process Maturity Model, best in class capabilities help you :

- Optimize Efficiency

- Increase Accuracy

- Improve Productivity

- Enhance Controls

- Enrich Decision Making

- Access Real-Time Metrics

- Enable Cross-Department Collaboration

The HighRadius Solution

HighRadius lays the roadmap for a digital process model in Deductions Management. Best in class CPG Companies advancing to Stage 6 with HighRadius say this is where the practical transformation happens:

HighRadius Deductions Software acts as a powerhouse for proactive deduction management to prevent bottom-line erosion. It provides automation, process standardization, and a platform for cross-departmental and customer collaboration.

The result is a proactive deduction management operation that recovers cash usually lost to invalid deductions. Below are some of the outcomes that our CPG customers have been able to achieve with our AI-powered deductions cloud solution:

Danone achieved a 25% reduction in their DDO (Days Deductions Outstanding)

Ferrero achieved 58% Reduction in Open Deductions

Johnsonville brought down their number of open deductions to 4.4%, which is industry best-in-class as per the National Deductions Resolution Group

Land o’ Lakes achieved a $2M increase in closed deduction dollars

Church & Dwight achieved an 85% reduction in unidentified deductions, and 100% of deductions auto-coded at source

Duracell achieved 76% Efficiency Gain In Average Days To Resolve Deductions

Brightstar achieved a 50% reduction in shortage deductions write-off

HighRadius has experience in driving 100+ successful transformation projects for Order to Cash. Today, 8 out of the 10 of the World’s Largest CPG companies trust us to manage their A/R. Some of our top customers are P&G, Unilever, Danone, AB InBev, Ferrero, Church & Dwight, Mondelez, Mars, and Johnsonville.

Outshine with a Matured Deductions Process

Early-stage deduction processes rely on too many manual processes and create departmental silos. With an ongoing lack of visibility, communication silos, and complex A/R environment, revenue leakage will continue to erode the bottom line for CPG companies.

With the right resources and integrated operations, the highest level of deductions process maturity and automation is possible. By understanding the various stages of deductions process maturity and a HighRadius solution designed for driving change, you can finally move toward a level of deductions automation other CPG companies can only dream of.

Are you ready to make the jump?

About HighRadius:

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company that leverages Artificial Intelligence-based Autonomous Systems to help 600+ industry-leading companies automate their Accounts Receivable and Treasury processes.

The HighRadius® Integrated Receivables platform reduces cycle times in your Order to Cash process through automation of receivables and payments processes across credit, electronic billing and payment processing, cash application, deductions, and collections. The HighRadius® RadiusOne A/R Suite offers a pocket-friendly platform for hundreds of midsized businesses to enable faster A/R processing and enhance their working capital. HighRadius® Treasury Management Applications help teams achieve touchless cash management and accurate cash forecasting.

Powered by the RivanaTM Artificial Intelligence Engine and FreedaTM Digital Assistant for Order to Cash teams, HighRadius enables teams to leverage machine learning to predict future outcomes and automate routine labor-intensive tasks.

Processing over $2.23 Trillion in receivables transactions annually, HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months. HighRadius is the industry’s most preferred solution for Accounts Receivable & Treasury and has been named a Leader by IDC MarketScape twice in a row. To learn more, please visit www.highradius.com