Five Hurdles to Beat to Create Accurate Cash Flow Forecasts

Identify the common hurdles in cash flow forecasting and learn the tips to overcome them.

Demystifying cash flow forecast

What is the purpose of a cash flow forecast?

Cash flow forecasts are influenced by various factors, including economic volatility and limited historical data, which contribute to forecast variance and impede decision-making. Because prediction is always fraught with uncertainty, many businesses that lack accurate forecasting processes experience low confidence in their forecasts, particularly long-term forecasts.

Why is cash flow so critical for any business?

The flow of money into and out of business is called cash flow.

Positive cash flow indicates that more money is entering the company than is leaving it. If a company’s cash flow is negative, it signifies that more money is leaving the company than is coming in.

Negative cash flow can make it difficult to cover expenses and keep the business afloat. As a result, cash flow may make or break a company. It’s conceivable to have a lot of sales but still run into liquidity problems and run out of money.

Five cash flow forecast problems and solutions

5 hurdles for creating accurate forecasts

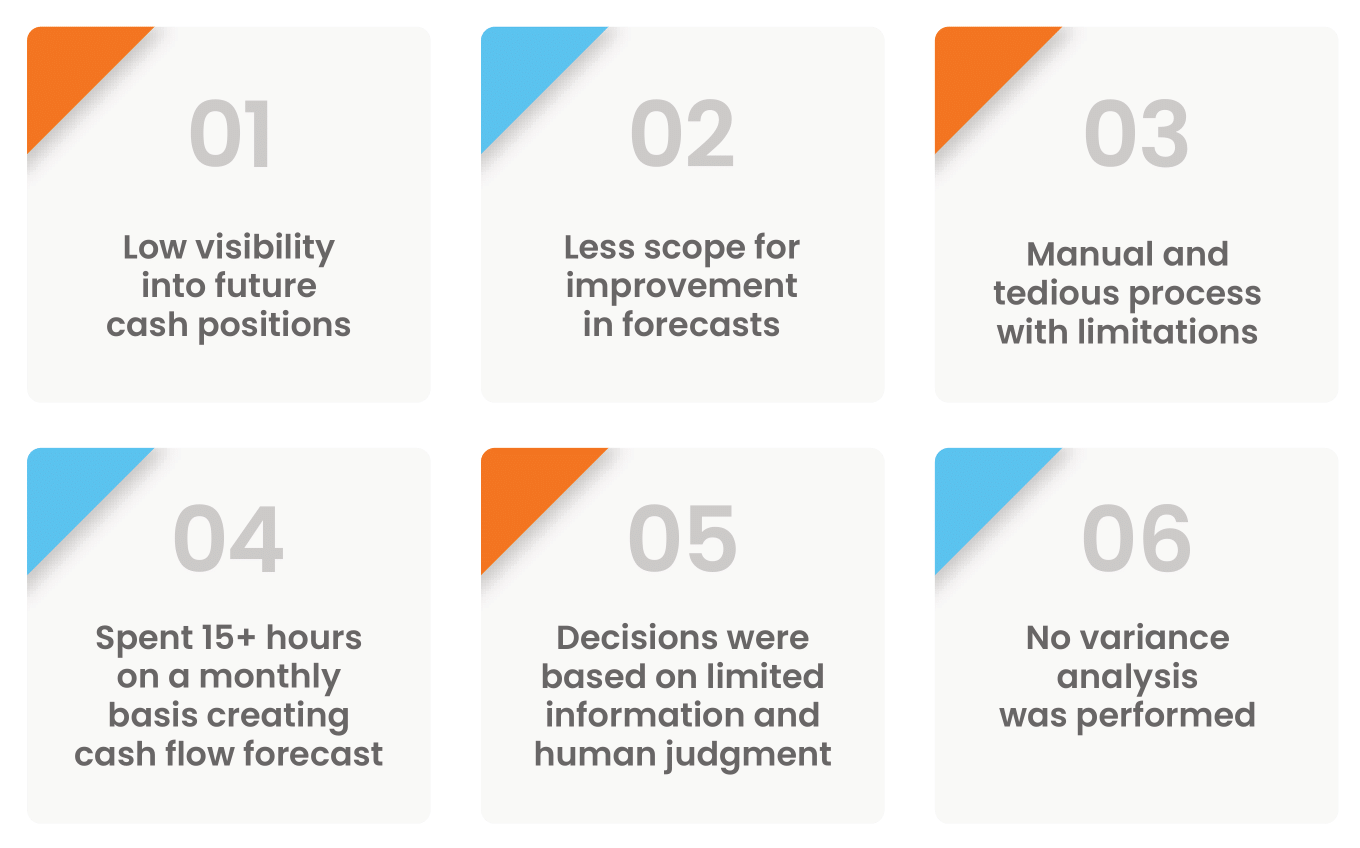

- Non-repeatable and non-comparable methods

Due to the lack of any common forecasting tools or methodologies, each treasury analyst has a very different way of forecasting. They build a forecast template from the ground up each year to fulfill last-minute deadlines and make the statistics appear right. There is no common set of assumptions or forecasting models in any of the templates. As a result, different business units within the organization produce multiple predictions, none of which are comparable or repeatable. - Lack of tools to analyze historical trends

Some large treasury organizations use generalized (non-customizable) cash forecasting software or spreadsheets that don’t meet their industry-specific cash forecasting goals. Hence, they are unable to analyze the historical trends. - Inability to identify the best forecasting model

Technical expertise is frequently lacking among treasury employees. Because some cash flow categories demand distinct models and data, it’s important to identify the best industry-specific forecasting model instead of some general tools. - Inability to identify the root cause of variance

There are different complex cash flow categories like A/R, A/P, and CAPEX at regional and company levels. It takes time for the treasury team to perform variance analysis and send reports to the treasurers. With a spreadsheet, determining the actual reason for the deviation is difficult. - Lack of tools to track market functions

Spreadsheets are incapable of incorporating seasonality into forecasts to identify market opportunities which leads to missing out on long-term investment opportunities and delays in M&A. Additionally, there is continuous a lack of reliability in long-term forecasts due to unpredictable economic downturns.

How can you overcome cash flow problems?

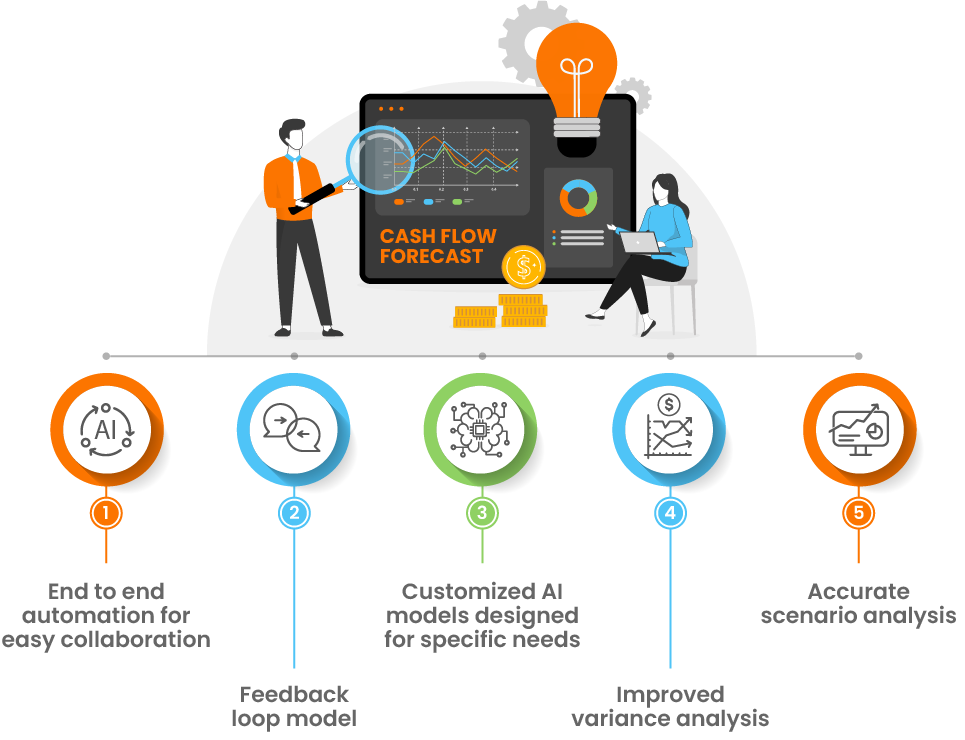

- End to end automation for easy collaboration

AI cash forecasting tool enables treasury to perform end-to-end forecasts with utmost accuracy. Additionally, the SaaS software provides analytical insights into a firm’s liquidity and foresight to its future monetary position and provides confidence to treasurers ensuring business continuity and development. - Feedback loop model

AI feedback loop model allows the system to learn from past mistakes and understand variance drivers to improve performance. It supports reusing the AI model’s predicted outputs to train new versions of the model. Additionally, by using AI, enterprises can adjust their parameters to perform better in the future. - Customized AI models designed for specific needs

Our data scientists create customized cash flow forecasting models based on the company’s data to provide accurate forecasts across cash flow categories, including account receivable and accounts payable. - Improved variance analysis

It supports drill-down-functionality into forecast variances across cash flow category, regional, and company levels to spot, report and fix the reasons for the variations. - Accurate scenario analysis

The AI cash forecasting tool provides manual override (spreadsheet-like feature) to stress-test multiple scenarios easily. It also helps automate modeling scenarios across numerous cash flow categories, regions, and currencies.

How do you make a cash flow forecast more accurate?

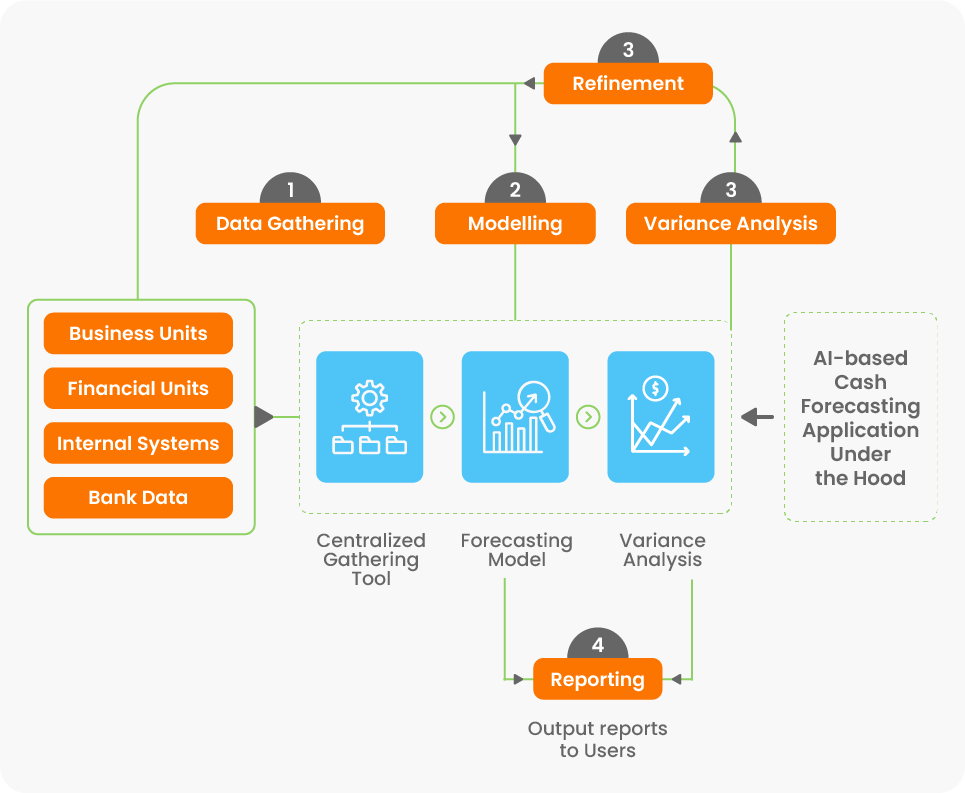

How Artificial Intelligence works under the hood

- Data gathering

In a cash forecasting tool, data gathering is automated over multiple sources like ERPs, banks, and financial systems regionally or globally, providing real-time and rich data for timely forecasting. - Modeling

Sophisticated AI models are used for complex categories like A/R and A/P and heuristic models for simple cash flow categories like Tax, Payroll, etc. - Variance analysis

Variance analysis is performed at entity, region, and cash flow category-level, for multiple durations, providing more accuracy in making confident decisions. - Reporting

The reports are generated after both the modeling and variance analysis stages to draw comparisons. Reports are prepared at frequent time intervals and are utilized to provide accurate data to aid further planning. - Refinement

To refine performance, a closed feedback loop allows the system to learn from past mistakes and understand variance drivers. This helps to make adjustments and build accuracy in cash forecasts.

What are the advantages of an accurate cash flow forecast?

How AI-enabled forecasts add value to the business

Increased forecast accuracy

Customer-specific variables and external components such as raw material price changes are incorporated to increase the accuracy of cash forecasts. Additionally, the AI-based software supports a closed feedback loop model that examines past and present results and adjusts projections to enhance cash forecast accuracy by up to 95%.

Make timely and accurate cash allocation decisions

Allocation of idle cash can be done effectively by using an AI cash forecasting tool. This idle cash can be invested by purchasing new products, extending or restructuring the business, acquiring another company, or pursuing foreign markets. Therefore achieving competitive advantage alongside a plan for the future.

Perform ‘what-if’ scenario assessments with ease and flexibility

By making adjustments to the forecasts, the treasurers can comprehend the extent of the impact on cash flows due to the various best-case and worst-case scenarios. This enables them to design strategies to withstand possible financial problems.

Increase confidence in real-time and data-driven decision-making

An automated cash flow forecasting solution captures real-time data automatically and stores them in a central repository for easy data access. Thus, CFOs can implement data-driven decisions by analyzing real-time cash flow visibility.

Real transformation story

A leading construction company with 900+ projects in hand was facing challenges in its cash forecasting process:

They needed better visibility of their cash flow. They wanted to understand where the business is going in the next few months so they could plan for things like distributing to investors and reinstating payouts.

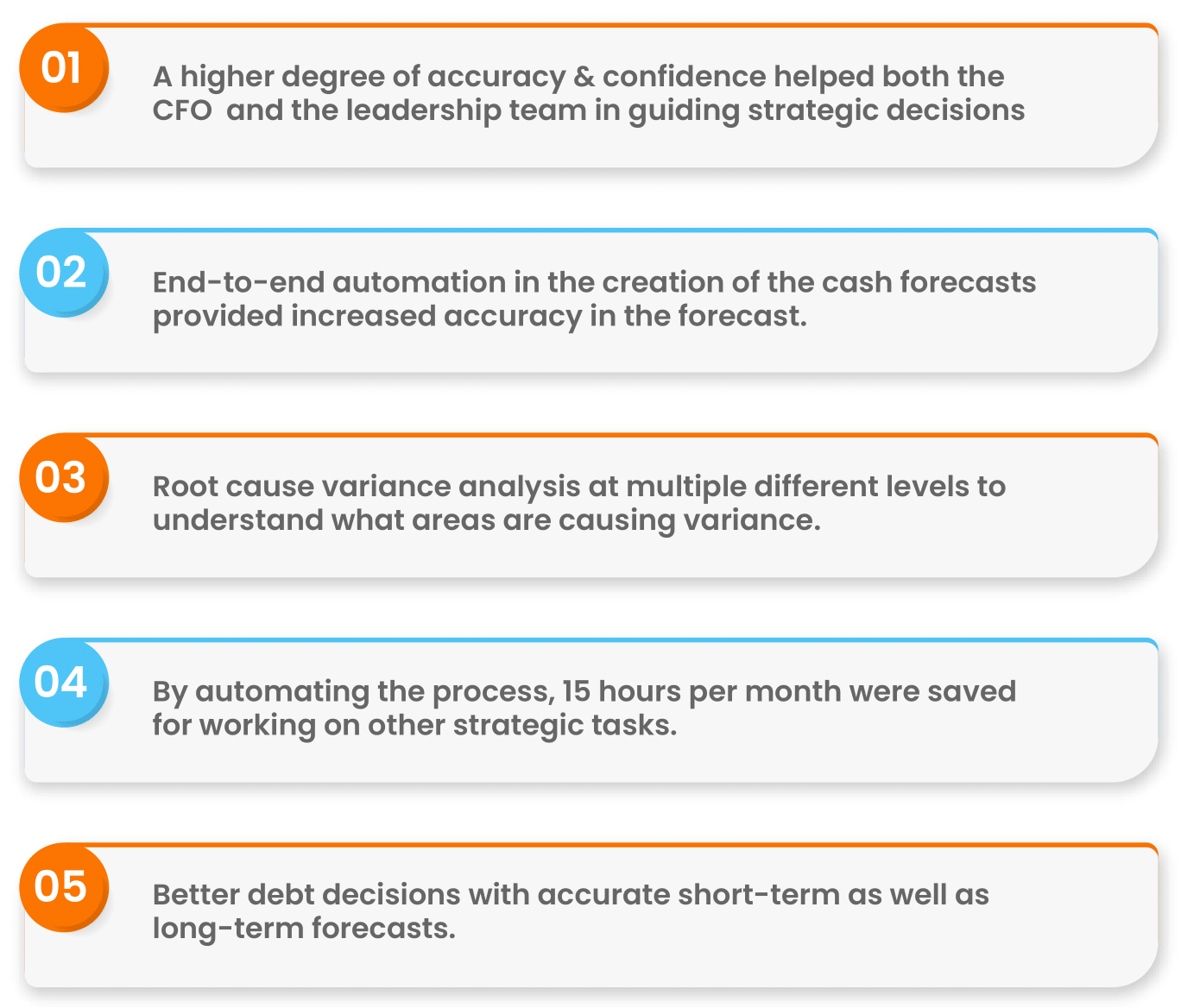

HighRadius cash flow forecasting solution provided them with the following benefits: