Radiance on the Road at The ArcelorMittal Orbit, London: Delivering working capital impact through order to cash transformation

- Discover how the leading European sportswear manufacturer implemented a digital transformation strategy to improve their customer experience

- Hear from EY on why they revolutionised their global business services

- Learn how AstraZeneca accelerated their order-to-cash for long term success

- Get tips from PageGroup on how to elevate your order-to-cash to the front office

- See how Bayer is building a counterplan to future-proof their accounts receivable operations

Customers Share their Transformation Experiences

Leading US Sports Retailer: Introducing the Digital One Office to Become a Next-gen O2C Leader

To change lives, we must build direct relationships with our

consumers. And the best way to create these kinds of relationships

is through digital.”

Vice President & Global Service Owner,

O2C at the largest sportswear manufacturer in Europe

One of the largest sportswear manufacturers in Europe needed to refocus on customer-centricity. They felt they had lost touch with their customers and reprioritised efforts to focus on the customer experience by creating an innovation lab. The lab enabled staff to view the accounts receivable experience through a customer’s eyes.

Here they realised they needed to make changes in three key areas – people, process, and technology, and the ‘Digital One Office’ was born.

“We are known as the lighthouse by other departments.”

Vice President & Global Service Owner,

O2C at the largest sportswear manufacturer in Europe

Digital One Office was introduced to drive significant improvements in the customer experience through the integration of the front, middle, and back-office. Connecting systems and the way employees interact with these tools has become a seamless experience, resulting in increased customer satisfaction and repeat business.

Making a substantial investment in people has been a critical success factor. Upskilling employees, additional training, and bringing dedicated members on board who can work across different functions has also paid dividends, with employees feeling highly motivated and part of the journey.

Through transparent communication and better employee experiences, the organisation has been able to increase cultural alignment, ensuring leaders and their teams all share the same values.

In partnership with HighRadius, several technological advances have been made. By leveraging machine learning through an integrated accounts receivable platform, disputes are now automated so teams can work on higher priority items – increasing productivity and employee satisfaction.

“60-70% disputes are now managed through the power of automation.”

Vice President & Global Service Owner,

O2C at the largest sportswear manufacturer in Europe

Digital One Office has enabled this major sports retailer to redefine its digital presence to create premium experiences across all its customer touchpoints, drive brand desirability and increase sales.

The Future of Global Business Services (GBS): Fast Track Evolution or Risk Extinction

Brought to you by EY and JTI

“Only 20% of GBS organizations create breakthrough value.”

Global Business Services Solution Lead Partner

at EY EMEIA

Many organizations have started their digital transformation journey, but few are delivering. This statistic is especially concerning with the added pressure of Covid where 38% of GBS organisations expect to become more important and 48% of GBS becoming digitalised over the next 2 years.

So, why is this and how can organisations increase their value to the organisation?

The good news is that “more than 80% of CEOs intend to increase spending on technology modernization over the next 12 months (EY CEO Survey 2021)” but for this to continue, organisations need to find better ways to show ROI.

One of the key success factors we learned about in the session is hiring people who can bring transformational capabilities and mindset to the business. These teams can evolve into digital natives and quickly demonstrate value across the organisation as GBS becomes a career accelerator for them.

“GBS organisations today need to evolve radically or prepare for extinction.”

Global Business Services Solution Lead Partner

at EY EMEIA

This means establishing a true end-to-end process backbone, accelerating technology deployments, and breaking down silos.

To achieve this, organisations need to establish a 70-20-10 model (operate-improve-disrupt) and deliver a seamless omnichannel service experience. They should establish lean, measurable, integrated processes and services and focus on predictive, proactive & preventive care.

A recurring theme is the desire to create an integrated “technology universe” for successful digital GBS transformation. This involves cross-functional collaboration with O2C, IT, HR and all GBS partners.

How AstraZeneca is Accelerating Innovation in Order-to-Cash for Long Term Success

This story is a great example of setting realistic expectations and understanding your business needs. “It is not a sprint, it’s a marathon” and here we learn some good training tips for surviving and thriving in this endurance event.

AstraZeneca’s goal is to leverage next-generation transformation and automation capabilities to progress faster than their peers in the industry, enabling them to focus more on their core business. Already this year, they have delivered more than 2 billion doses of the COVID-19 vaccination, contributing 30% to the vaccines provided by all pharmaceutical businesses worldwide.

Global Process Owner, Contact to Cash at AstraZeneca

Given the kind of investment they are willing to make, and the status of their processes, they realistically expect to get 80% of what’s considered ‘best-in-class’ for A/R in the long term.

To accelerate their transformation journey, they have focused on three key areas – standardisation of operations, automation and digital transformation, and effective project management and coordination.

The first goal was to build a robust framework for all BPOs and captive shared service centers to operate with maximum efficiency.

The first task in achieving this goal was to ensure their BPO was at the table when discussing process improvement and transformation efforts across the organisation. From this point, the team was able to align goals and input into standardisation decisions.

They took time to understand business requirements, tailoring their approach to targeted automation areas that would drive the most process efficiency, while establishing a baseline to build from with continuous process improvement at the core.

Extracting a single version of the truth and knowing where to prioritise automation efforts was a significant challenge with multiple SAP systems in place, across geographies, all with different configurations.

AstraZeneca worked with HighRadius to build a simplified architecture and identify several potential automation and digital opportunities across the end-to-end process that consisted of order entry, cash application, deductions, and collections.

By leveraging an end-to-end accounts receivables platform they were able to increase turnaround and response times, increase collections effectiveness and Straight-Through-Processing rates – and track team KPI’s in real-time. This proved to be a critical key success factor in demonstrating value to other parts of the organisation.

Several parameters during a digital transformation program can change without warning and be difficult to control. Effective project management is key to staying on track and driving value in a shorter time frame.

Coordinating with the IT support team and working closely with your ERP and automation partner is key to ensuring alignment throughout the journey. It’s important to set clear expectations for all stakeholders from the starting line. Don’t forget to listen to feedback from your training team along the way – often they have innovative ways to bring teams together.

Elevate your Order-to-Cash to the Front Office – Tips and Strategies from the PageGroup

Global O2C Director at PageGroup

Typically, the front office of any business is a more strategic, revenue-generating, and customer-centric function. The back-office is very transactional and focuses on more administrative tasks and cost reduction.

The challenge with this model arises when underinvested and unsupported back-office operations impact the last mile performance at the front office.

Organisations need to scale their back-office operations to the same level as the front office to achieve maximum business value. Move from being a transactional partner to a trusted partner. Here are some tips to help you accelerate this journey:

- Create visibility in the department vs. working in a black box

- Anchor to the right senior people in the organisation who will support driving the right decisions with operations teams

- Move from a transactional department to a team of excellence and demonstrate the value you are bringing to the front office

PageGroup worked on three key areas for their O2C department to focus on – revenue generation, strategic evolution, and customer experience.

A key focus has been working with the sales team to share customer data that helps them make the right decisions. This has quickly demonstrated value as sales can offer better, more relevant products and services to their clients.

Taking on all areas of revenue within the O2C team and creating risk-based collections strategies to collect past-due receivables faster has also resulted in increased cash flow and efficiency gains.

Customer centricity has been all about building a team of professionals who understand the business and the customer base. Regular reviews of KPI’s also ensure quick course correction, which in turn provides a better client experience.

To accelerate growth, PageGroup have focused on building a strong relationship with HighRadius, who have supported changing business needs and provided powerful AI and automation solutions to reduce time spent on back-office, more transactional activities.

By prioritising these three key areas, PageGroup have automated their cash allocation process and are now realising the following benefits:

- Increased revenue generation by eliminating limited value-added activities in the cash allocations team and helping them focus on more complex tasks that will ultimately raise the profile of the team

- Collections teams are working with a more accurate portfolio (avoiding clients being contacted for paid invoices for example)

- Headcount re-allocation to more strategic tasks, such as collections

Bayer is Building a Counterplan to Future-Proof A/R Operations

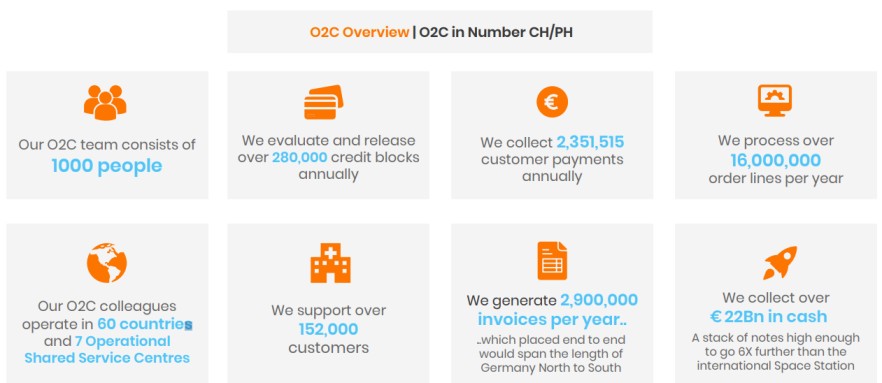

Bayer’s key global business areas focus on crop science, pharmaceuticals, and consumer health. They have close to 100,000 employees and operate in 83 countries, reaching more than one billion people with their products and services.

They collect enough cash to go 6 x further than the international space station!

Bayer’s O2C Team

Managing an organisation of this size, with such high volumes has brought many challenges during the COVID pandemic. Bayer predicted that overdue payments and bad debt would likely double, together with fears over an uncertain economy, volatile customer behavior, and challenges faced with enabling a remote workforce to operate overnight.

The O2C leadership had to quickly establish how to address:

- Focused Strategies for Risk Mitigation and Past Due Collections

- Real-time customer credit risk monitoring

- Updating collections strategies based on the changing credit data

- Order-to-Cash Automation

- Increased productivity across B2C processes

- Better customer experience

- Optimized working capital and cash flow

- Use of Collaborative Tools

- To operate seamlessly in a remote work environment

Bayer established the following three priorities to address these issues and quickly saw this as an opportunity to drive change and add value across the organisation:

- Make customer-centricity a priority – everything we do is about the customer

- Expand automation capabilities within O2C

- Optimise receivables management

Changing the Focus to Customer Centricity

Many O2C organisations forget how much choice customers have and how quickly they can change providers or brands after a negative experience. Blocked orders, multiple collections calls even when a payment has been made and dispute resolution issues are all inherent issues faced when using multiple solutions and manual processes.

Bayer saw this as an opportunity for change. They increased the voice of customer surveys and redefined KPI’s in the cash and finance teams to ensure that customer experience was ranked above other priorities. Training was delivered to all teams to change their view from being internally focused to a customer’s perspective with multiple simulations to demonstrate their experiences with Bayer.

Expand Automation for Improved Accuracy and a Seamless Customer Experience

Bayer has developed a multi-year, digital roadmap that includes connecting multiple systems across multiple countries, all with different versions and customer needs. It’s a long journey but clear and well thought out with buy-in from all functions across the business. Every employee understands the roadmap and the role they play in making this a success.

To understand the scale of this type of transformation, Bayer alone has 700 projects planned for 2022, all of which aim to optimise efficiencies, reduce risk, and improve the customer experience in some way, shape, or form.

Head of Global O2C at Bayer

Optimize Receivables Management to Increase Cash Flow

Cash is now deemed as equally as important as sales and profit. There is a realisation that cash drives trust, accelerates growth and in today’s volatile market, determines a company’s valuation.

The goals are clear – establish end to end operations and mindsets to win with customers and suppliers, increase contribution to gross profit and increase cash flow to an agreed level by 2024.

HighRadius and Bayer are working together to accelerate their cash application journey with 12 countries going live on the new platform in 2018 and 51 in 2019. Leveraging an end-to-end receivables platform globally has a huge impact on achieving these goals – the journey is long but working with a trusted partner is rewarding.

Key Takeaways from the ArcelorMittal Orbit

Hearing customers talk about overcoming challenges at varying stages of their digital maturity has given a real insight into how organisations are leading from the front to drive growth, increase cash flow and truly impact the customer experience. There are dips, drops, and fast turns along the way but it’s an exhilarating ride that you don’t want to miss!

We hope we achieved our goal of providing practical advice and best practices to make organisations think differently about how they tackle and accelerate digital transformation.

We have summarized the 5 key reoccurring best practices from the sessions:

- Establish strong foundations from the start – review processes and prioritise where digitalisation will make the most impact

- Infuse a transformative mindset, attract new talent, and build high-performing teams – this came up in several client sessions and can often be overlooked. The most successful organisations driving change in their organizations have the best employee onboarding and career growth and training programs within the GBS

- Choose the right automation partner – a partner needs to be part of the culture and sign up for the overall goals and KPIs. They need to have skin in the game and be a trusted advisor to deliver, adapt and have the right expertise to add value

- Orchestrate the enterprise’s technology ecosystem – front, back and middle office solutions and tools should have a way of talking to each other to ensure a seamless client experience. Build out goals and roadmaps to ensure this happens. One tool for one department doesn’t always make sense

- Balance ambition and change efforts – it is important to be realistic and ensure your journey goes at the right

pace. There will be traffic along the way, you just need to stick to the agreed path