Doing More With Less

Four ways to achieve process excellence

Doing More With Less

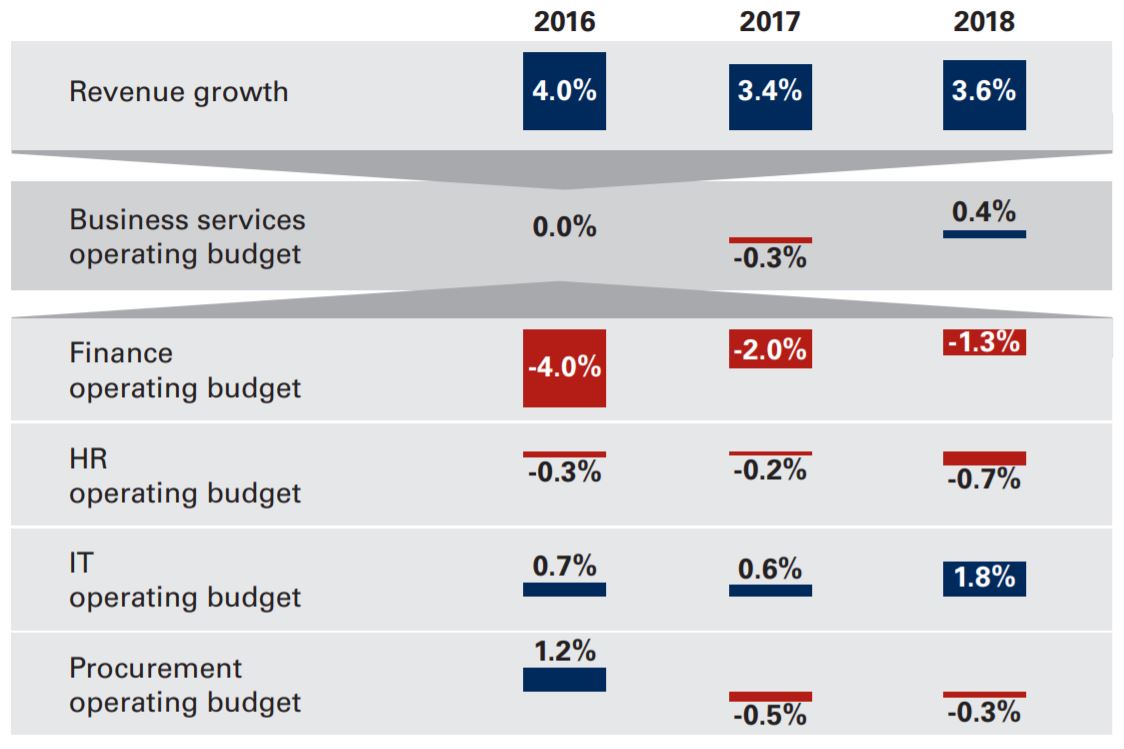

Disruptive technologies, new business models, intensified competition and increased customer expectations are compelling finance organizations to transform how they deliver services to stakeholders. The challenge is to enhance process performance while managing costs. According to our 2018 Key Issues Study, finance functions have seen their budgets contract for the past several years, with more cuts expected. In fact, finance has experienced the greatest year-over-year declines in operating budget of all the business services we study (Fig. 1)  According to our process taxonomy, customer-to-cash consists of five elements: credit management, customer billing, cash application, collections management and dispute management (Fig. 2). Each has several sub-processes. To realize the greatest gains in efficiency and effectiveness, all these elements must be well-aligned. This is particularly important given that different parts of a company (including finance as well as front-office functions and shared-services teams) are jointly responsible for delivering parts of the overall customer-to-cash process.

According to our process taxonomy, customer-to-cash consists of five elements: credit management, customer billing, cash application, collections management and dispute management (Fig. 2). Each has several sub-processes. To realize the greatest gains in efficiency and effectiveness, all these elements must be well-aligned. This is particularly important given that different parts of a company (including finance as well as front-office functions and shared-services teams) are jointly responsible for delivering parts of the overall customer-to-cash process.  As a result, it?s critical that finance executives assign an end-to-end process owner who is responsible for policies, procedures, and measurement. For example, credit policies developed in the finance function inform order-management activities performed by sales personnel. Using best-practice credit management approaches achieves little if they aren?t applied properly during order management and subsequent parts of the customer-to-cash process. Instead, there will be downstream consequences. For example, collections will need more time to address delinquent accounts.

As a result, it?s critical that finance executives assign an end-to-end process owner who is responsible for policies, procedures, and measurement. For example, credit policies developed in the finance function inform order-management activities performed by sales personnel. Using best-practice credit management approaches achieves little if they aren?t applied properly during order management and subsequent parts of the customer-to-cash process. Instead, there will be downstream consequences. For example, collections will need more time to address delinquent accounts.

Action Item # 1: Automate

World-class finance organizations exhibit a higher level of customer-to-cash process automation. They outperform more typical organizations (i.e., the peer group) in metrics such as percentage of automated order entry, automated customer invoices and straight-through processing of customer remittances. Research-based on our 2018 finance benchmark data illustrates just how significant is the gap in automation levels between world-class and peer-group organizations. World-class finance functions:

- Automate the processing of 71% of orders received, compared to 25% for peers. As a result, they can process nearly twice as many orders per FTE.

- Automate 75% of credit modeling and scoring, compared to just 16% for peers. Thus, they can complete credit reviews 50% faster, leading to improved customer experience.

- Generate and distribute 58% of customer invoices electronically, compared to 50% for peers. Consequently, it takes them 50% less time to bill customers, leading to faster payment. Our benchmark research also found that average days delinquent in organizations with a high degree of invoice automation (i.e., over 75%) is half that of companies with low levels of invoice automation (i.e., 25% or less).

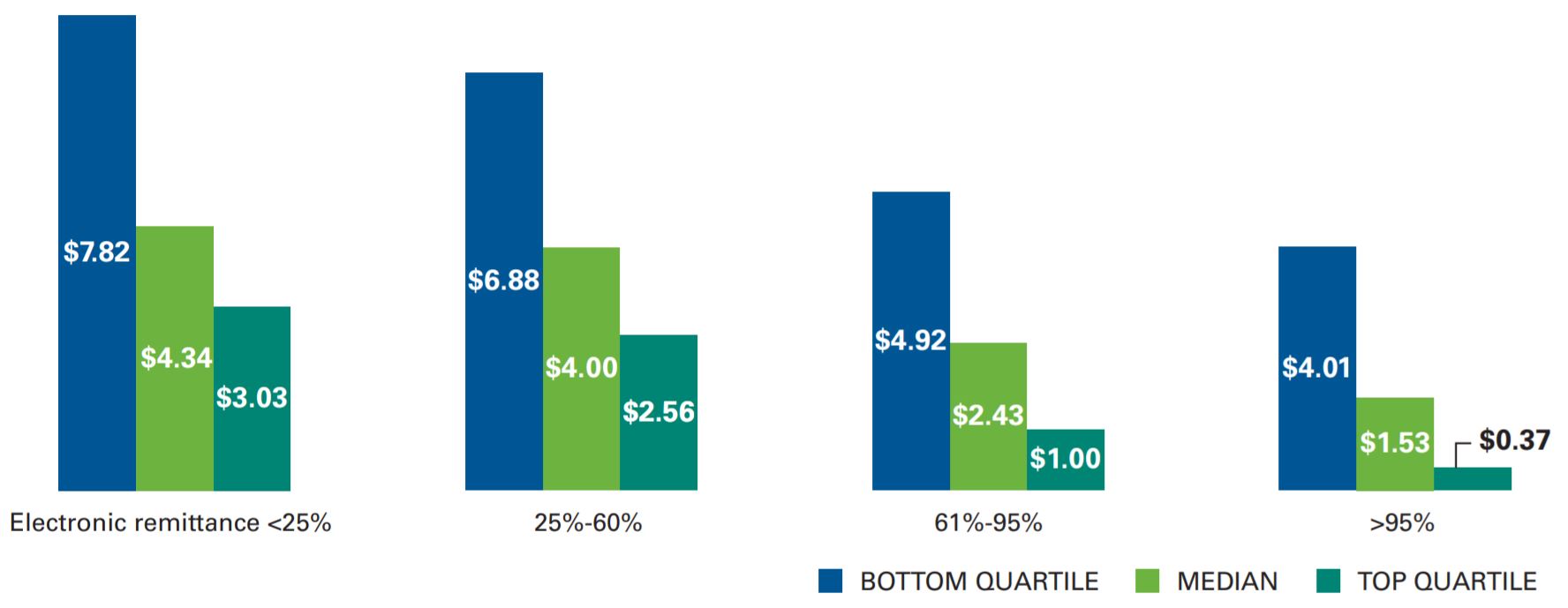

Fig. 3 illustrates how greater automation affects the cash application. Top-quartile finance functions with 95% or higher rate of electronic remittances spend $0.37 per cash application transaction, compared to $3.03 when electronic remittance occurs in under 25% of transactions. Furthermore, top-quartile organizations with high (>95%) use of electronic remittance enjoy a 76% cost advantage over the median company with the same degree of electronic remittance. This example illustrates the vast potential to accelerate improvements by increasing process automation.

Action Item # 2: Leverage Analytics and Data Management

To meet elevated performance demands, senior management expects better insight so it can make faster, smarter decisions about resource allocation. Sophisticated analytics are also critical for anticipating and responding to customer expectations. Not surprisingly, the finance function?s top priority this year is supporting enterprise information/analytics needs (Fig. 4).  In addition to supporting enterprise information needs, data and analytics play a central role in driving customer-to-cash process excellence. For example, using sophisticated analytics tools that are fed by big data, finance can improve the credit-evaluation process by combining internal customer payment history with external data such as industry performance and credit ratings. For example, finance can make collection activities more effective with more accurate identification of at-risk and critical accounts, using sophisticated analytic tools and machine learning algorithms that are fed by big data. Advanced analytics also enables finance to refine customer segmentation for the purpose of applying credit and collection policies.

In addition to supporting enterprise information needs, data and analytics play a central role in driving customer-to-cash process excellence. For example, using sophisticated analytics tools that are fed by big data, finance can improve the credit-evaluation process by combining internal customer payment history with external data such as industry performance and credit ratings. For example, finance can make collection activities more effective with more accurate identification of at-risk and critical accounts, using sophisticated analytic tools and machine learning algorithms that are fed by big data. Advanced analytics also enables finance to refine customer segmentation for the purpose of applying credit and collection policies.