6 Bank Reconciliation Improvements in Microsoft Business Central 365

- Must know features and tricks to optimize bank reconciliation in MS Dynamics 365

- Learn how to auto import bank statement lines, redo reconciliation and credit card transactions

Introduction

Finance leaders should monitor their cash balance and verify the accuracy of their transactions. Bank reconciliation is a vital part of all finance and accounting activities. In this whitepaper, we shall discuss implementing best practices to simplify bank reconciliation.

Bank reconciliation is comparing entries in the general ledger with

bank’s statements to see if they match while cash reconciliation is

comparing received payments with their invoices to see if they match.

6 Key Improvements in Business Central 365 that Support Bank Reconciliation

- View bank account statements and ledger parallely

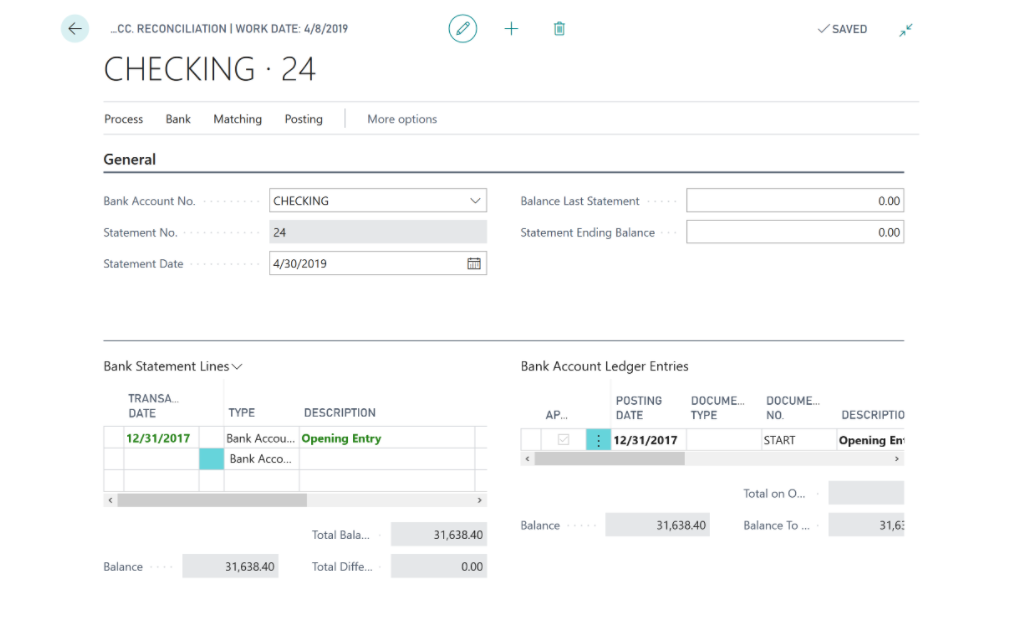

Bank statement lines and bank account ledger entries can now be viewed parallelly on Dynamics 365. This makes reconciliation easier.On the left side of the reconciliation page, transaction lines will display the amounts from your bank statement. On the right side, the bank account ledger entries will display the amount posted in Business Central.

The applied matching lines will appear green if the difference is 0.

If the balances don’t match, it won’t be posted unless it’s reconciled. - Adjust and match statement lines

You can adjust lines to match the bank statement to ledger entries if they don’t match. Below are the three types of adjustments:- Users can delete lines from the bank statement side to match the statement to ledger entries.

- If something is missing from imported bank files, users can still add lines manually. Simply click add a new line and then add that statement line on the business central side.

- By selecting more and expanding the data range, more lines can be viewed and added.

- Suggest lines

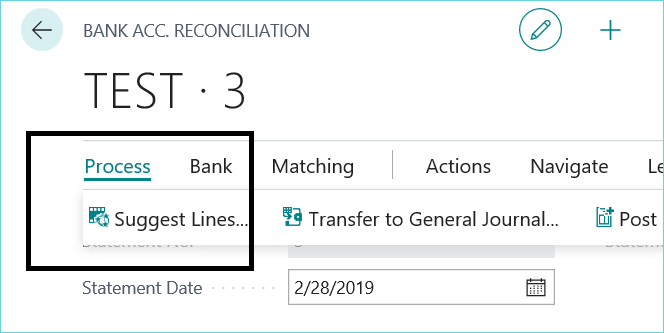

Suggested lines is an automated way to import bank statements into Business Central. This option can only be used If your bank is configured for reconciliation. Below are the steps to use this feature:- On the bank reconciliation screen, click on process.

- Click on the suggested lines.

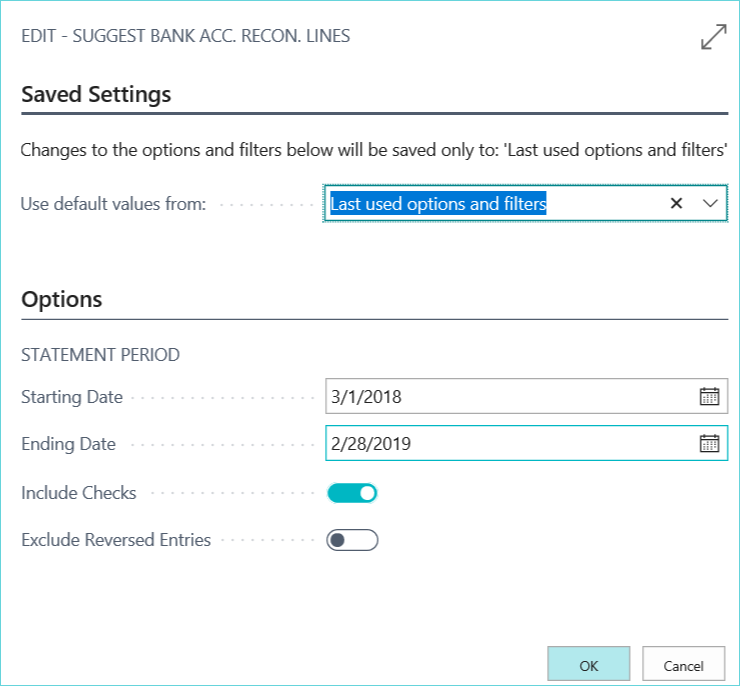

- Select the date range and format.

- The system will display the bank statement lines to add.

Business Central also gives you the ability to reverse entries, or include checks.

Please note- If your bank account is not configured or does not support reconciliations, the system will not be able to suggest any lines. - Import bank statement:

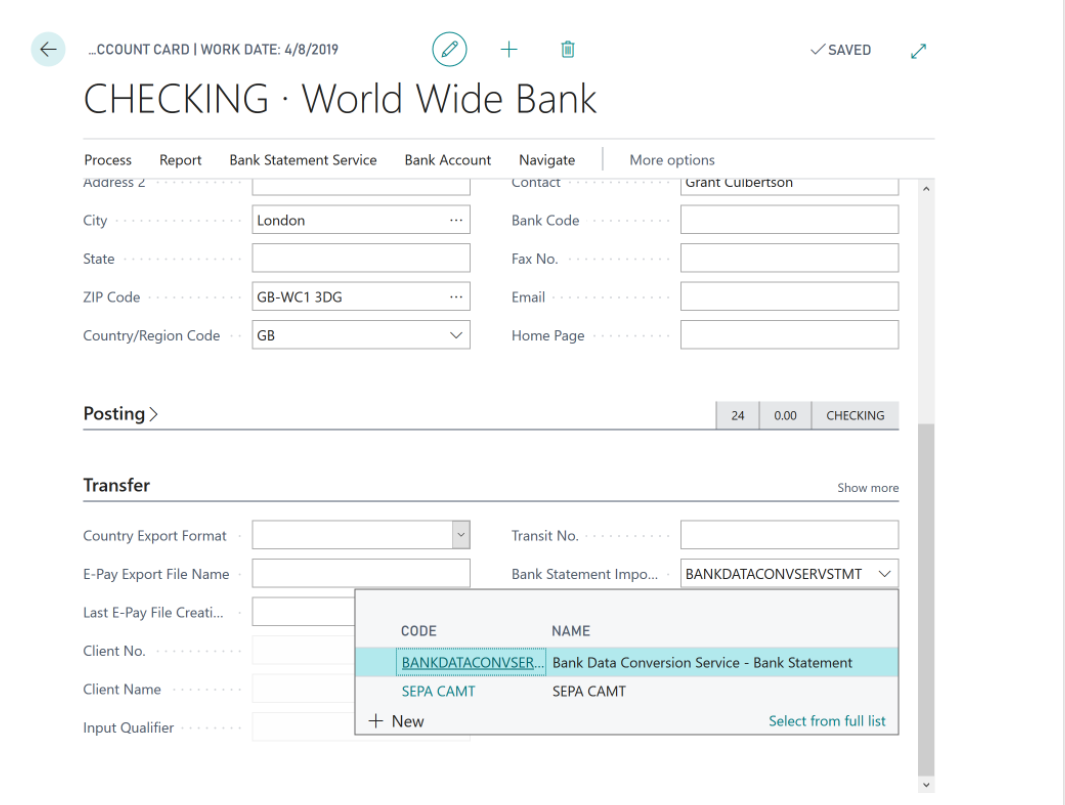

Business Central allows you to import bank statements directly from the bank.

The Business Central data layout is customizable to match the import statement layout. In some cases the bank charges to import statements. In that case, you can ask the bank to change their statement layout so that it can match with your data layout.

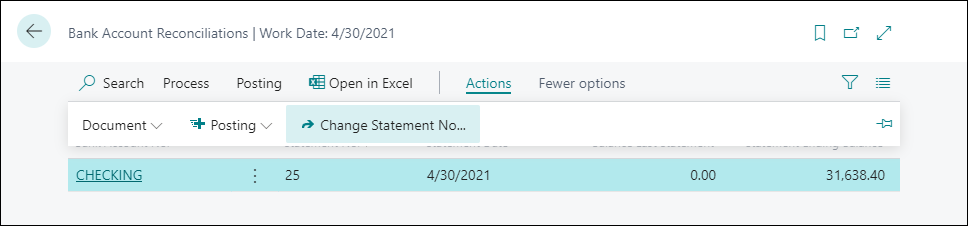

- Cancel or redo reconciliation

Previously, Dynamics users couldn’t reverse or change the reconciliation. Business Central 365 allows canceling posted statements and re-doing them.

Users can choose a subsequent statement number for revised reconciliation, as well as reuse the same statement number as the canceled bank reconciliation.

The update will improve flexibility of the reconciliation process and lower the manual effort.

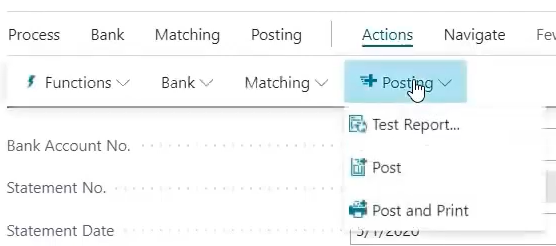

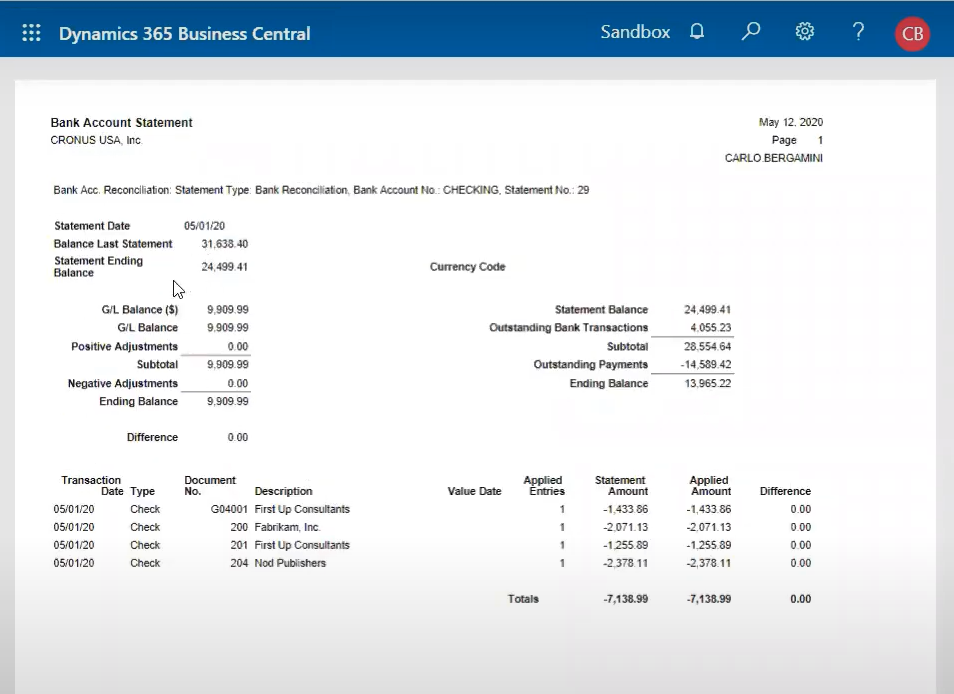

- Test reports and posted statement reports

Business Central 365 allows users to generate reports before and after posting the statements.

Test report layouts have been simplified, making it easier to read.

- Test report: Before posting, users can run a test report and make a copy. Unless it’s saved, the report can’t be accessed after posting. Users can additionally alter the layout by excluding or including data entries like vendor number, vendor ID, credit, debit, and description.

- Posted statement report: After posting the statement, users can generate a report which has the same layout as a test report. This makes it easier to match both the reports.

Other handy features in Business Central 365

- Many-to-one matching: Assume, your bank statement shows only one statement line for a customer account, but the payment was received in two different ways- ACH and check payments. The bank ledger will have 2 statement lines for the same vendor.

Business central 365 now allows users to sum up transactions prior to matching. Multiple ledger lines can be grouped and reconciled against one bank statement line.

- Reconciling credit card transactions: Business Central now enables users to import data from credit card vendors and reconcile credit card transactions just like bank accounts. The imported statements can be used to apply credit card entries based on matches from ledger statements.

Next steps: Optimizing cash reconciliation

Cash application is often overlooked as a back-office process, but it has a vital upstream impact on working capital optimization. Although new-age ERPs support cash application, they are far from optimal.

Key challenges plaguing cash application are:

- High lockbox fees and overheads

- Manual remittance aggregation

- Manual invoice matching and exception handling

Modern organizations have deployed advanced out-of-box technologies integrated with ERPs like Microsoft BC 365. These systems can achieve straight-through cash posting rates up to 95%.

Best-in-class tools help aggregate remittances from various sources, including emails, EDIs, customer web portals, and even non-standardized remittance formats. In the case of checks, modern systems leverage optical character recognition(OCR) to auto-extract check stub information with increased accuracy. Apart from this, with auto invoice matching and deduction coding, cash application teams can meet their accuracy and speed goals.