Eliminating Subjectivity from the Credit Review Process

How Fortune 1000 companies and SMEs automate credit and accounts receivable operations to improve productivity and reduce DSO and past-due A/R.

Eliminating Subjectivity from the Credit Review Process

In the previous section, we discussed how inappropriate assignment of credit limits to new customers could lead to higher bad-debt and DSO. This section is about problems associated with the credit review process for existing customers. Credit analysts are assigned hundreds to thousands of accounts for reviewing credit limits, onboarding new customers and unblocking blocked orders. Since reducing credit risk exposure is a responsibility of the credit team, credit review processes need to be airtight. However, the sheer volume of accounts makes it impossible for credit teams to successfully cover all accounts which are due for periodic reviews. Constantly chasing the backlog of accounts means that credit analysts are often unable to focus on conducting a focused and accurate credit analysis.

2.1. Top Challenges in the Credit Review Process

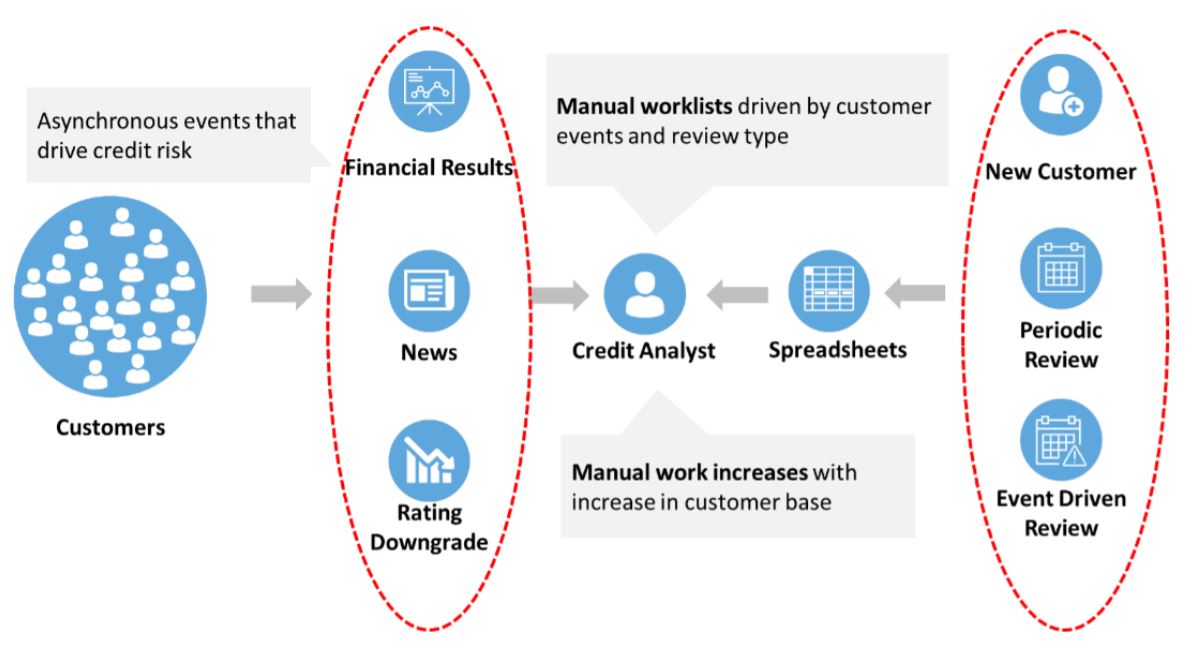

Only after an objective analysis can a credit manager make an informed decision about extending credit [or continuing the existing credit] to the customer. While inconsistency in periodically reviewing existing customer credit lines is an issue, asynchronous events such as financial results, rating downgrades, and M&A activity could also be responsible for escalating credit risk. Figure 4 illustrates challenges related to both asynchronous events and internal SLA requirements that create a need for credit analysts to manually prioritize accounts for credit review.

Figure 4: Challenges with a Manual Credit Analyst Driven Process

2.2. How Top Organizations Handle the Credit Review Process

The first step that organizations undertake to remove the subjectivity out of the process, is to make sure that all the credit workflows reside within a system. The system generates a worklist for credit analysts for any given day and consists of:

Figure 5: Process and System Driven Credit Operations

Figure 5 illustrates how the system automates the above workflows and assigns them to the respected credit analyst or manager and allows them to scale operations to thousands of accounts.

2.3. Credit Management Success Stories: Air Products and TechData

Air Products and Chemicals is a Pennsylvania-based global leader for industrial gas and chemicals. The credit team had to deal with a fair amount of wastage in the credit operations – getting approvals on credit limits with credit managers on emails, downloading credit agency data for a large portfolio of customers and was challenged with compliance and inaccurate credit data. The team faced an uphill task of controlling credit risk exposure in the absence of the right tools. Today, the team uses a single solution to employ a global credit policy and automated credit review process for 320,000 customers worldwide. Tech Data Corporation, currently ranked #108 in Fortune 500, is one of the world’s largest wholesale distributors of technology products. The credit team at Tech Data dealt with legacy systems and manual processes for credit reviews. Given a large portfolio of customers worldwide, the team had to daily log in to multiple portals for each geography to fetch data from credit agencies. The team automated credit data aggregation and workflows to achieve a productivity boost of 120% in the credit review process and also saved $160,000 annually through improved efficiencies.