Evolution of Accounts Receivable into a Crucial Business Function

- Understand how AR is a critical function of any ERP

- Learn about the consequences of neglecting AR

- Importance of improvement in AR

- Impact of technology and automation on AR

What is AR and how does it work?

AR is the money or cash that a customer owes an organization for the products or services that were brought by them. Receivables, in general, are considered a liquid asset because most businesses expect to collect their receivables within a short period of time. This act of receiving the cash in a given period of time creates a constant flow of cash which keeps coming in and is then utilized further for business purposes. Thus, the AR process creates the machinery necessary to keep a business afloat.

But AR functions till date mostly work on legacy systems, even though the process is cumbersome and inefficient. The core reasons why organizations have stuck to such legacy systems include high dependency on manually intensive AR processes and human advisors, doubts about the cost-effectiveness of digitizing the AR processes and the time required to implement the company-wide changes. Thus, traditionally, organizations have been averse to spending large amounts on digital transformation of the AR function.

But the current unpredictability of covid-19 pandemic and continued usage of legacy technologies has brought accounts receivables to the forefront and companies want to optimize the management and recovery of their existing capital. Companies are more inclined to invest in modern accounts receivable automation software to facilitate improved collections and overcome the rigidity of the legacy solutions.

Digitization of AR processes will have a direct and positive impact on the cash flow of the organization. Businesses now possess the option to automate any and all routine AR tasks in the cloud by digitizing their accounts receivable processes including invoicing, reminders, payment processing, collections and dispute management, and invoice matching and reconciliation. All of these will contribute to bringing in payments faster and more efficiently through better communication and coordination.

Why should organizations prioritize AR?

Improvements in AR performance directly leads to faster payments and a steady cash flow. If a company’s accounts receivable is in order, they would be able to book the expected profits, focus on increasing their business by investing in other places and enhance shareholder value.

The 5 key functions within AR that help generate cash when streamlined include:

- Credit approval process:

To recover debts in a timely fashion, create a clear and concise policy for credit transactions. Furthermore, undertake stringent background and credit history checks, and regularly review the credit approval process to keep the process optimized. - Invoicing or Billing:

To establish an efficient billing process, ensure that accurate invoices are sent on a timely basis via customer-preferred channels and formats(EDI). - Cash application process:

Providing flexible options for the customer to pay and efficiently allocating the incoming remittances to the right accounts and invoices is crucial to understand the organization’s cash flow. - Collections process:

Ensure that you have a proactive approach to follow up and remind customers of their payment dues. Having a streamlined approach is crucial to strengthen the accounts receivable process. - Deductions process:

Identify invalid deductions accurately, research and gather backup data to validate claims. This process will help ensure that customers pay the invoiced amount.

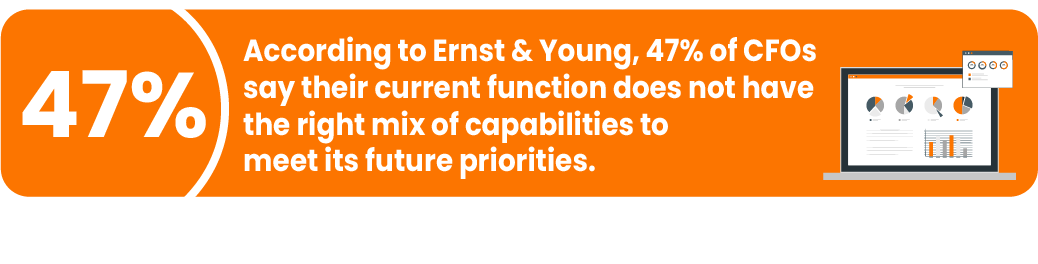

AR encompasses all the processes that take place between the creation of an invoice for goods or services sold, and the collection of the funds from that invoice. This makes it logical for the CFOs and leaders to keep a pulse check on the receivables since it helps them account for any billing and collections across the organization.

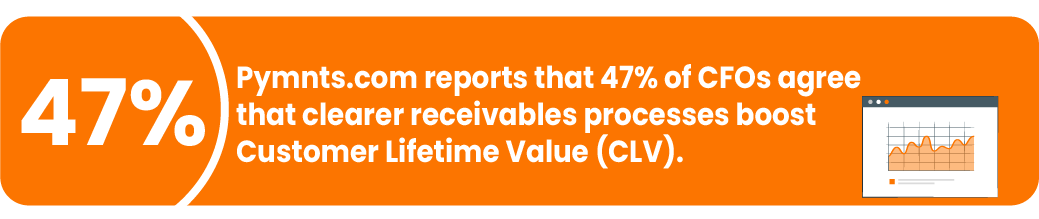

Along with all the benefits that AR focus will generate, organizations will also enhance the customer experience when they streamline their invoicing, collections and deductions processes. This also reduces churn rates and increases repeat purchases. The continued benefits of AR as a function along with the resulting great customer experience continues to remain a top priority for the CFOs and the financial leaders. This helps increase the lifetime value for both – the customer and the business.

Companies that ignore the AR aspect face difficulties while billing and collections, and risk going out of business, if the AR process is not streamlined in a time-bound manner.

How does neglecting AR affect businesses?

A subpar AR system will affect the cash due to a company and cover up flaws in the company’s business processes.

Some of the most common problems arising due to negligence of AR include:

- Missed payments and disputes:

Inefficient data storage or data stored in multiple places in varied formats can make it difficult to identify remittances and resolve disputes raised by customers on specific invoices. When you organize your AR data, it is easy to track how much money you own and how much money you owe. Poor accounts receivable management will often result in poor cash flow. - Lack of insight into customers who face bankruptcy:

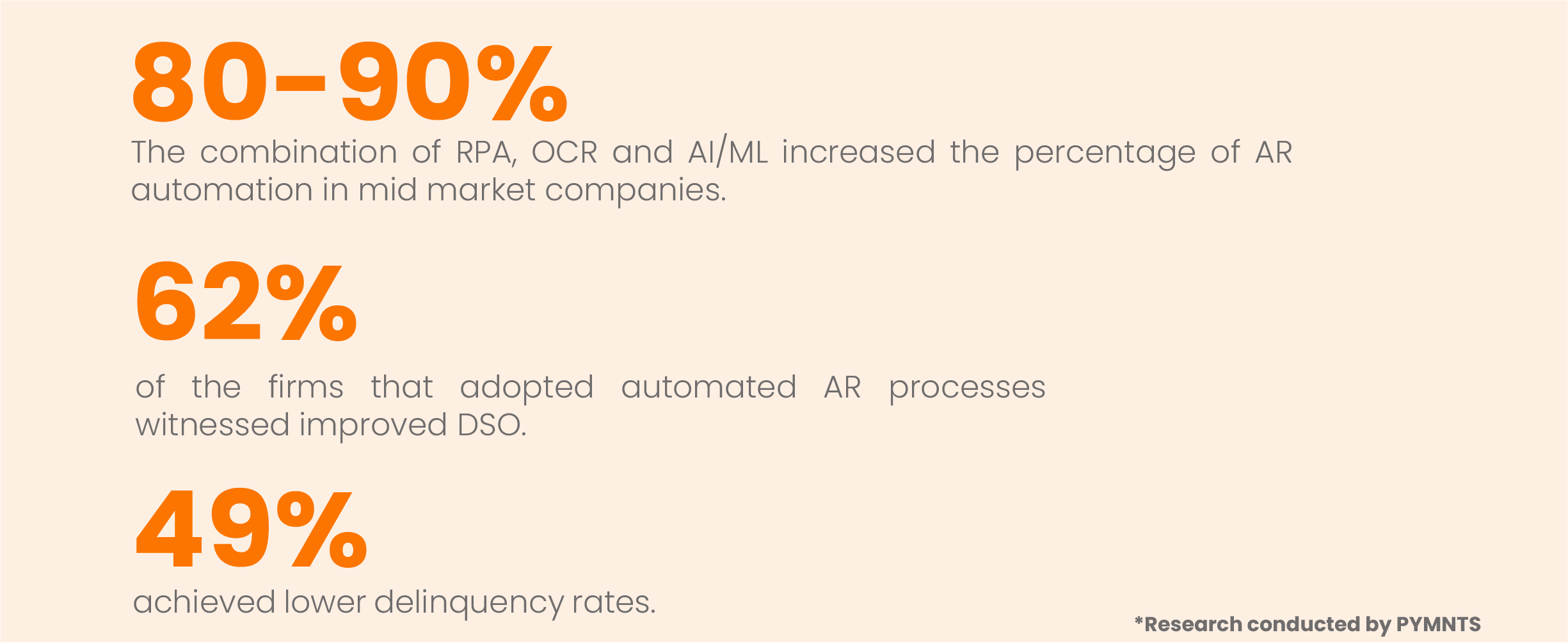

An optimized AR process will ensure that you have clear timelines to contact customers and inform them about the amount due and the date of payment. Often businesses that do not have insights into the customers’ business do not contact customers with the assumption that payment will automatically occur. This can result in delinquent accounts turning to bad debt and write-offs and, eventually, resulting in a loss of revenue for your business. - Increased DSO:

DSO (Days Sales Outstanding) is the average time taken for a credit sale to be converted to cash. If this KPI runs higher than the industry’s average, it indicates your clients are going over the agreed time to finalize their debts. Make sure the credit plans you offer your customers are not more than what you can handle. - Handling credit approvals and management:

Extending credits to clients without due diligence and having credit records that aren’t updated can backfire when the clients fail to pay and you ultimately have to write off the overdue amount.

- Strained customer relations:

Some customers will understand if you make accounts receivable mistakes. But the more often you make those errors, the less forgiving they’ll be. Wrong invoice amounts, follow-up for payments received, choked credit lines, and more are a few of the instances that can annoy customers.

HighRadius research

Highradius conducted a research to find the common AR pitfalls across organizations and industries, which has thrown light on some critical focus areas.

The frequently encountered problems as found from the research include:

- Inefficient collection strategies slow down the process and lead to large overdue balances

- Reporting is difficult and clumsy when companies use scattered tools like excel

- Tracking information through a manual record of reminder calls, emails and blocked orders is taxing and error-prone

- Pulling in remittance information hosted on web portals manually makes the process quite tedious and time-consuming

- Manual cash posting and manual identification of deductions weigh organizations down because of slow and error-prone processes

- Businesses require multiple payment options and user friendly accounting functions

- Many organizations are plagued by excess customization of their ERPs which slows the ERPs down

Best practices and policies to stay on top

We know that there’s no ‘one-size-fits-all’ policy when it comes to dealing with customers. But the practices and policies below have brought about significant changes in how companies approach AR and how it helps them reorganize their business processes and improve cash flow.

- Leverage financial data such as payment behavior, profitability, and failure risk information to prioritize open accounts and reduce delinquency

- Use AR automation solutions to provide out-of-the-box reporting and actionable insights by analyzing data across your receivables processes

- Create a centralized data repository to enable all stakeholders to access crucial AR information

- Use smart tools to get cash fit: AR automation solutions help reduce manual effort in pulling remittance data from web portals, checks, and emails. Finance teams can better utilize their time on strategic functions as a result

- Leverage AI-powered automation tools to auto-capture remittance data from checks, emails, and web portals and enable straight-through cash posting. Finance teams can sit back and focus on more strategic tasks.

- Proactive dispute identification will help reduce the resolution time and safeguard you from financial losses. Technology offerings that optimize AR processes can identify deductions at the source. This will help filter short payments or overpayment scenarios to enable early resolution and faster recovery

- Automation helps enhance the power of your ERP. With an ERP optimization platform, you can put your AR on auto-pilot and take full advantage of rich functionalities that can scale with your business

- Integrate digital payments such as ACH, Credit Cards, wire transfers, Mobile Remote Deposit Capture (mRDC), etc. to improve customer experience, and benefit from cost savings and efficiency gains. According to Mastercard, 81% of businesses that adopted digital payments say it has improved customer satisfaction levels

- Adopt a well-designed platform with an intuitive user interface to enable your finance teams to navigate the system smoothly, curbing any potential delays in operations. This also helps improve the dependability and responsiveness of the system. It’s crucial to analyze the usability of the system before implementation

The above best practices and policies give you a bird’s eye view of how technology has even further revolutionized AR. All the key functions within AR can now be automated and this leads to limited human intervention, reduction of errors, and simplified business processes.

Impact of technology and automation on AR

Over the last few years, companies have had to embrace technology and automation to support operations and maintain the best customer experience. Even though these trends existed before 2020, the last year saw unprecedented acceleration and it is likely to continue.

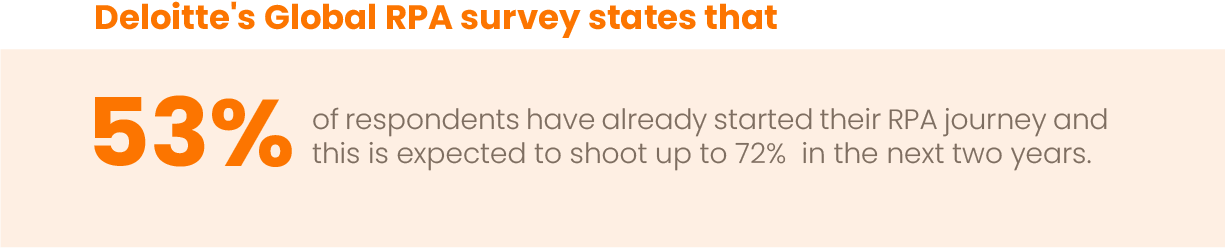

Business owners now understand the benefits of automating processes with advanced IT infrastructure. Technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) have now become a part of business strategies.

Deloitte’s Global RPA

If this transformation continues RPA will achieve near-universal adoption within the next five years.

Automation is not just limited to RPA but also includes APIs along with RPA, customized code, AI or ML, or off-the-shelf software. RPA typically automates routine processes. Applying AI to RPA will orchestrate human-like intelligence to the bot-driven processes, aiding quicker business decisions.

A pure RPA automation can automate rule-based repetitive tasks, like sending out reminders or correspondence letters to customers based on pre-defined templates. It can also assist in creating collection notes and tracking payment commitments.

Artificial Intelligence helps in finding patterns from historical data to identify the most relevant information required to make informed decisions. When AI is employed in the accounts receivable process, it predicts data like blocked orders or when customers are likely to make payments. This inference then can be used to alert the collectors to take proactive measures.

The combination of RPA, integrated workflows, and AI/ML creates a holistic and formidable automation process for AR. It helps in decision-making on matters such as delinquent account prioritization and setting customers’ credit limits. At the same time, it allows finance teams to focus on root cause analysis to speed up AR processes.

Conclusion

Organizations are increasingly digitizing their AR functions now and strengthening their cash flow. Furthermore, with automation in full swing, it is not a far-fetched idea that the majority of the companies would eventually shift to hyperautomation with maximum straight-through processing (mechanism that automates the end-to-end processing of transactions of the financial instruments), helping employees in finance department to focus on more crucial aspects of the business and not on the mundane manual and repetitive tasks.