The CFO Mandate: Understanding the Future of Automation in the Mid-Market CFO Office

- Ways to rethink costs and collections with finance automation to improve cash flow, customer relations, and working capital

- Learn how to supercharge data, AI, analytics, and emerging technologies to build a digital finance footprint

- Understand digital transformation strategies and ERP integrations in finance division for 2022 and beyond

- Know from experts how to rebuild finance processes and talent profiles to meet digital needs of the new normal

Finance Automation in Mid-Market CFO Office

1.1. Why is automation important for the CFO Office?

It would have been unheard of for IT to be anywhere near a CFO back in the day. However, they are now tightly integrated with the financial division and operate effortlessly because of the increased reliance on technology.

Only 13% of CFOs and other senior company executives stated their finance function uses automation technologies like robotic process automation (RPA) and machine learning, according to a survey. Furthermore, when asked how much return on investment the finance organization has gotten from digitalization and automation in the last 12 months, just 5% thought it was significant; the more typical response was ‘moderate’ or ‘minimum.

While the number may appear low, automation is knocking on the finance function’s door, and it will play a critical part in the CFO’s advancement in the C-suite. When there are so many different technologies to choose from, it is vital to consider how your tech stack fits together and where information is stored. It’s great to have data and skills, but the finance department also needs to think about using automation and technology effectively.

1.2. CFO Exclusive Panel Session

At HighRadius, our vision is to create long-term value in the finance realm through automation, innovation, and trend analysis. In March 2022, we conducted an exclusive CFO roundtable with four distinguished panel members.

This unique roundtable series brought together CFOs from across the globe to discuss the future of automation in the mid-market CFO office. Panel members from different industries expressed their views and perspective on finance automation, challenges in cash-flow management, and how to expand business efficiency with technology and ERP integrations.

We covered the following topics, which also forms the primary essence of this dossier:

- CFO Mandate in 2022

Rethinking costs and collections with finance automation to improve cash flow, customer relations, and working capital - Data and tech-driven financial strategy

Supercharging data, AI, analytics and emerging technologies to build a digital finance footprint - Forward-thinking leadership

Digital transformation strategies and ERP integrations in finance division for 2022 and beyond - Finance teams of the future

Rebuilding finance processes and talent profiles to meet digital needs of the new normal

Key Insights from the CFO Roundtable

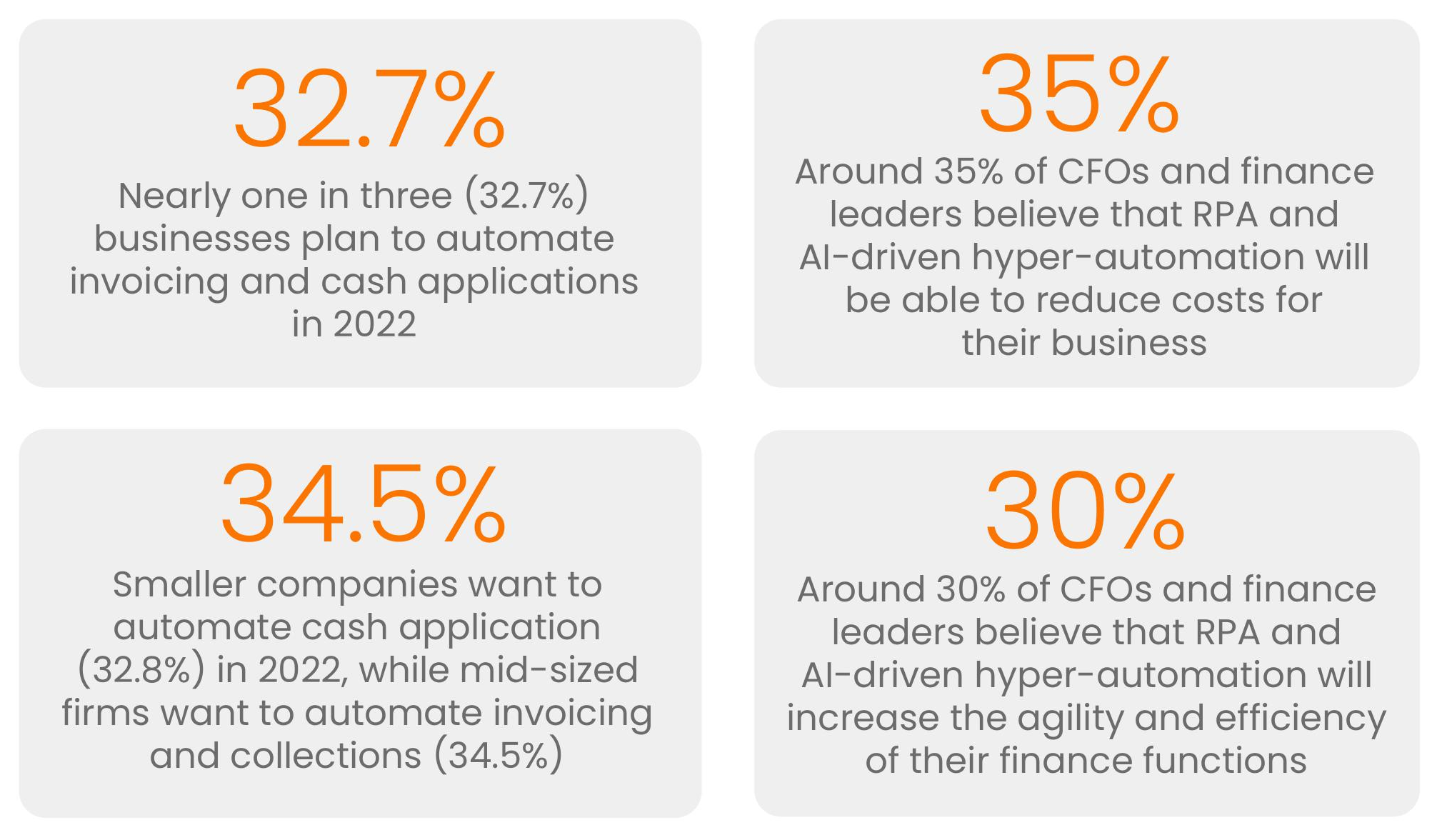

Technology has presented an optimistic image of the corporate finance department’s

future in recent times. It is believed that a mix of cloud platforms and trending technologies

like AI, ML, or RPA, will revolutionize the way finance teams function. However, today’s reality is somewhat different. Many finance professionals are still struggling to complete their month-end closing and dealing with laborious processes and manual processing.

To better understand the disconnect, we conducted a roundtable in March 2022 to discuss the future of finance automation in the mid-market CFO office. Automation is knocking on the finance function’s door, and it will play a critical part in the CFO’s advancement in the C-suite. When there is an array of different technologies to choose from, it is crucial to consider what works best for your business and how you manage your information. It’s great to have data and skills, but the finance department also needs to think about using automation and technology effectively.

Finance professionals constantly seek insights on boosting working capital for their business and the latest tech trends to follow. Our roundtable covered everything from finance trends to AI in finance, transforming finance roles, and much more. For starters, it was a one-of-its-kind event featuring mid-market CFOs.

We wanted to bring in a CFO-centric perspective from various industries and experience backgrounds, and that’s exactly how we chose our speaker line-up, which included the likes of:

Anders Liu-Lindberg, Partner, COO, CMO, BPI, on the Shift to Finance Automation and Evolving Trends

Q1. What challenges have you faced so far while automating finance functions? Which areas of finance have you already automated or are planning to automate?

A company’s most significant challenge in automating the finance function is the mindset change from producing numbers to using numbers. This is outside the comfort zone of most finance and accounting professionals, and they’ll need significant support to work in new ways. Companies have been too slow and gone too light in providing this support, which has hampered the overall automation efforts. However, now 60+% of the transactional processes in finance have been automated, so we’re getting somewhere!

Q2. What is your take on the future of finance teams in the metaverse? Do you believe in this much-talked digital disruption?

Finance teams are already working remotely in many ways, and doubts arise if professionals will ever go fully back to the office. Instead, meeting in the Metaverse could make a lot of sense. It would probably also help better understand transactions and business conducted there. This is not as much science fiction as we might think, and it could be happening within the next 5-10 years.

Which technologies do you think will change the face of finance automation in 2022? Is it RPA, intelligent automation, hyper-automation, blockchain, or any other? And why do you think so?

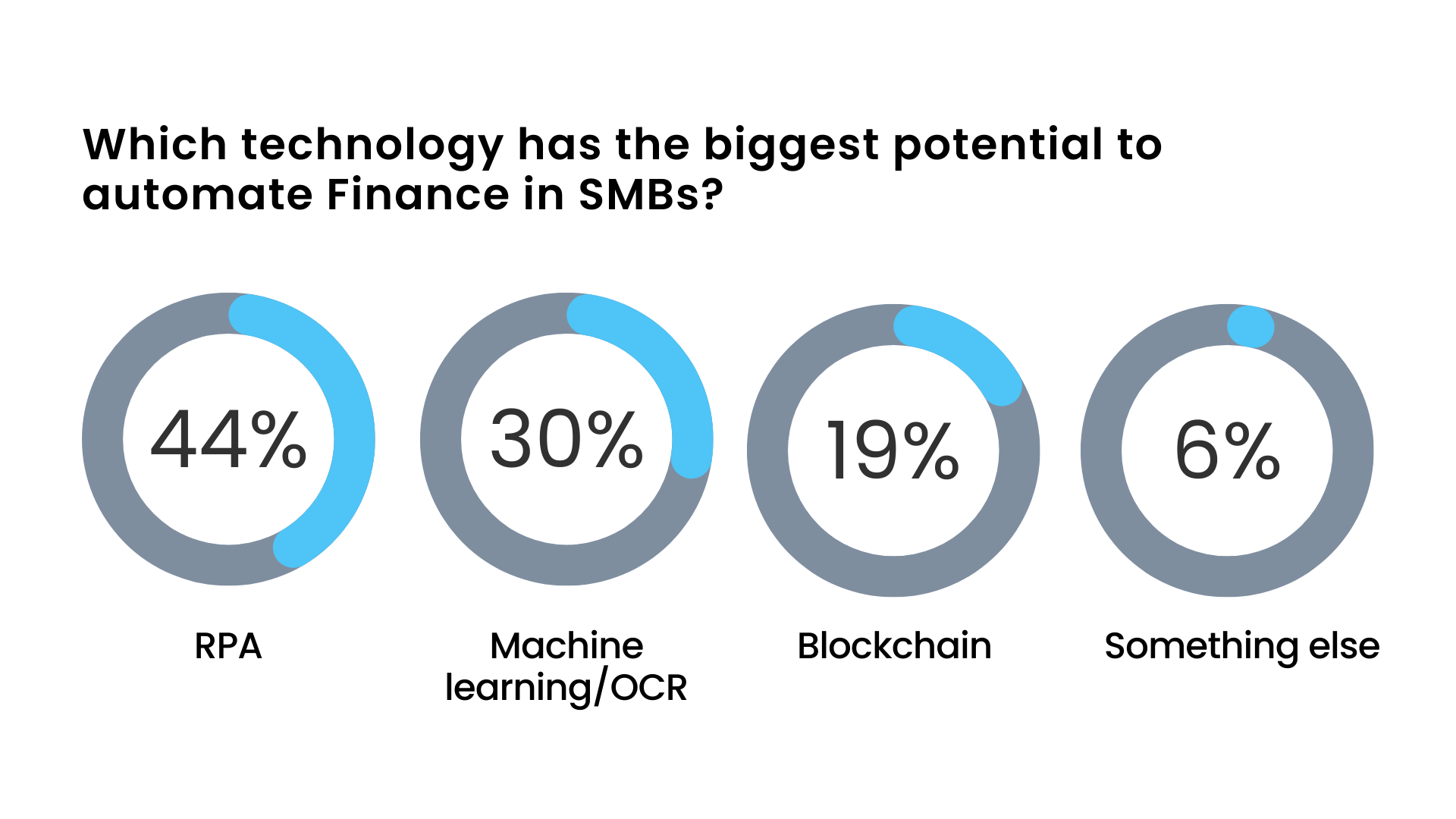

RPA is changing the finance function right now, but it will soon be surpassed by machine learning practices such as OCR and advanced forecasting and analytics. Long-term, I could imagine accounting being 100% automated on the blockchain, but I’m not sure the economy will ever be so connected that it could happen.

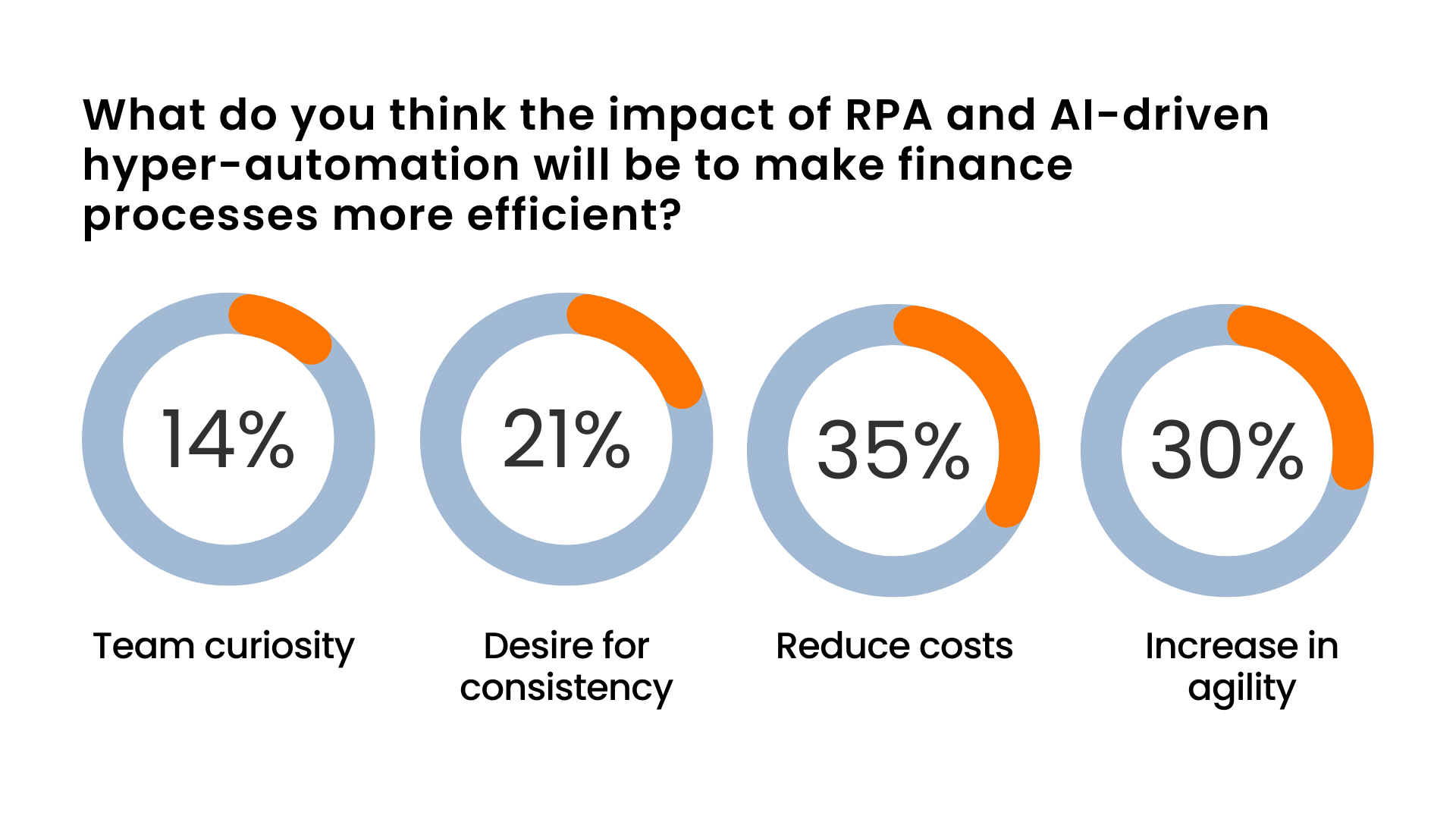

This is the result of an exclusive LinkedIn poll conducted by Anders on his profile

Q4. How should a finance leader adopt ESG measures to perform sustainable business operations?

Adopting ESG tackles and reduces risk mitigation, and CFOs should consider that as a proactive plan. For instance, in a shipping company, which is probably one of the most polluting industries, CFOs can take the lead by choosing a less-pollution position that the company needs. It may not be easy, but finance leaders need to drive that as much as possible in the coming years.

Q5. How tech-savvy does a CFO need to become to automate finance processes?

I’ve invented the term ‘techno.’ Not a techie, but techno. CFOs need to know what technology is available and how to employ it for their company’s benefit. To implement, organizations can consider solutions like HighRadius. Let’s all become technos and embrace technology in the right way, rather than being the ones that are left behind.

Dan Piscatelli, Founder & Fractional CFO, Hurd House Advisors, on Customer Experience, Emerging Technologies in Finance, and the Workplace Shift

Q1. As a CFO, do you believe in improving the customer experience by executing best-in-class finance automation, like an accounts receivable software?

Companies can improve customer experience by adopting automation and a portal where the payment information is transparent and streamlined. If you properly automate collection processes, customers will be able to track what their complete obligations are.

As more businesses reduce their workforce, it becomes increasingly difficult for both parties to evaluate bills presented in diverse formats, such as electronic documents or snail mail. As a CFO, I like to pay my bills on time. Do I like to pay them early? Not necessarily. Do I want to pay them on time and extend my credit terms as much as I can do that? Maybe yes. It all impacts cash flows.

With automation, companies can look into the creditworthiness of a customer track and understand them. The accounts receivable software of HighRadius helps companies determine what their exposure to a specific customer might be.

Q2. How can we use emerging technologies like AI and RPA to build a digital finance function? What challenges have you personally faced with customers to automate their finance function?

The real problem today is that finance organizations are being stressed by companies that have business intelligence departments that usually fit under the R&D of a CFO office. CEOs and leadership teams see the enormous amounts of data available to them, but the finance division is stuck in the traditional closing cycle methods. The other challenge is getting priority inside companies, especially startups.

It can be liberating to get as much data available to the finance team to help make decisions and stop them from doing some of these automated processes. It will keep them happier in their roles and provide insights into the business to make better decisions to grow both top-line and expense. It’s time for the finance division to step in, provide valuable data, make timely decisions, and gain insights into what’s going on in the business. It’s not going to happen unless the company invests in an automated tool.

Q3. Which technology or technologies do you think will make the biggest impact in the finance division, and why?

All types of technologies and automation are valuable to customers more than others. Especially RPA, Robotic Process Automation, is out there today. AI is beneficial when a human would typically interact. AI and ML tools look at unstructured data and help make decisions, analyze, and identify available patterns. A sound AI system needs an RPA system below it to run. Blockchain is valuable in a physical or virtual custody industrial environment. When you bring these technologies together, your finance processes get supercharged.

Q4. How successful has your organization been in implementing hybrid and remote working models suitable for finance teams?

I think there are a couple of risks involved with remote working. If you think about the average finance person, we’re somewhat risk-averse. We talk about the great resignation, but we may soon see a great migration. The more finance functions you automate, the less painful migrations will be. Remote working is sometimes making the job of a CFO and HR more complex, and it does pose a risk. I think people need to be very concerned with that going forward.

Q5. How tech-savvy should a CFO be for automation of finance processes?

A CFO needs to know the operations strategy and have business intelligence. Finance-oriented people need to take degrees and courses in business intelligence. A CFOs vital responsibility is also to safeguard the company’s assets, so they even need to play the role of a security officer. Especially in today’s environment, where everything is in the cloud, a CFOs job is to protect the assets of the company’s investors, employees, customers, and other stakeholders.

Q6. How do you see Metaverse being relevant for finance? Is it too spacey now, or should CFOs figure out how it will change the finance function?

Baby steps will get finance into the metaverse world. The next significant shift will be more towards autonomous accounting, where AI and other trending technologies will be employed. Easy decisions will be made with machine learning.

Lawrence Chester, President & Fractional CFO, CFO Simplified, on the Significance of Finance Automation and Addressing the Finance Teams of the Future

Q1. As a CFO, how do you advise clients to adapt finance automation in 2022 to improve some of the important finance metrics like working capital. Also, which part of the finance function would you definitely suggest to automate?

There is nothing more critical to a company than cash flow and the availability of working capital, especially coming out of the pandemic and moving into a high inflationary period. And there is no better stable supply of cash than getting money from your invoiced clients and customers. The key is to put together a reliable automated process with a defined structure so that the finance team managing collections do not have to wonder what they should do next. I’ve worked with companies that spend a lot of time putting together a credit policy. Then they spend a lot of time evaluating the credit limit for anewly onboarded customer. Being in a position where you have automated software that analyzes real-time data and provides inputs on a customer’s creditworthiness is significant. It helps determine the extent of credit limit you can offer to them.

Q2. How do you see the interplay of automation while at the same time creating more customer stickiness and improving the customer relationship?

I think the exciting part is not whether you’re using automation but how effectively companies are using it. For instance, sending emails or memos and then following up with copies of invoices can be easily handled with automation. Good automation software will allow structured emails that don’t necessarily sound like a computer created them. That also enhances the email templates, and appropriate dunning follow-ups build trust and transparency with the customers.

Q3. What are your thoughts on the interpretation of finance division as a cost center or a profit center?

A sale is only completed after the cash is received. I think the issue of finance is a cost center or a profit center is an interesting one. A CFOs impact on a company follows the changes that affect the bottom line and help generate actual cash. Unfortunately, most businesses look at the money spent on technology as an expense and not a cost-savings move.

I remember when I did a major ERP implementation for a client, he asked me afterward, “How many people can I fire?” I responded that this tech implementation was not intended to reduce the staff but to get you faster information, improve cash flow, and grow without adding more staff to the bottom line. So I think business owners who look at an immediate payback on a tool, primarily within finance, are not looking strategically at their business.

Q4. What advice and suggestions do you offer your clients in the shift to automate finance functions? How do you address their challenges?

My mother used to be a data entry clerk for a large manufacturer. She would keep keying in invoices and data entry cards. What was she contributing to the overall growth of the business? So, when we automate tedious finance processes, we allow our teams to think beyond the regular activities and contribute to improving operations. The best way to find out how a business can be improved is by talking to people on the production floor. Talk to the people in the warehouse and those in the accounting and purchasing department. They will highlight the actual processes that need automation and improvement.

Q5. What is your favorite technology for automating finance?

It is interesting when you’re dealing with AI in an operation where it gathers all valuable data and feeds information to the finance function. AI is a time-saver and provides additional utility to the finance teams. Imagine an individual manually overviewing the creditworthiness of 100 different customers!

Q6. How do you make remote and hybrid working environments suitable for yourself, your teams, and customers?

It is interesting to see companies using hybrid employment methods. A Brazilian industrialist wrote a book 15 years ago, highlighting that he reduced his office staff and space by more than 50% because people can work just as effectively from home. And that was a radical idea! The concept of what it takes to get a job done and how we do that is radically different now than ever before.

And I think that allowing employees to have a higher level of involvement in their jobs makes it easier for them to have that job satisfaction and get past the 70% of employee disengagement. That’s an essential aspect of the future!

Q7. What kind of talent profiles do organizations need to succeed in this new normal? How tech savvy does a CFO need to be?

Firstly, the CFO needs to be operations-oriented. You don’t drive profitability by moving numbers around the balance sheet or the income statement. Instead, you drive profitability by changing business operations.

Secondly, the CFO needs to be strategically oriented. You need to look not at what will happen over the next six or seven weeks or months but over the next six to ten years. And the third thing is you need to be data-oriented. You need to use the data to help make decisions and drive those ecisions forward.

Q8. How should organizations adopt and adapt to stay relevant in this fast-moving finance world?

I think the key is giving people the freedom to think and come up with ideas. There’s so much job movement. I have always looked at hiring people from outside an organization because they bring in new concepts. Being a disruptor is essential in the future. Coming up with something different from what nobody else has thought is incredible.

Travis Smith, Chief Financial Officer at Dalyte, on the Rise of Digital Payments, Automation and Trends in the Finance Function

Q1. What are your views on the rise of digital payments and accelerated shift from checks to ACH, online payment portals, and other contactless real-time payment options?

We need to make it easy for our customers to pay us. There is no better cash-flow model than getting the invoices collected. Make the processes simpler with automation. For example, when you use automated systems and send reminder emails like attaching statements and invoices, it’s better to embed a secure payment link. Next, your customer will click on the link and pay faster and easier. While dealing with customers, the tone of messaging is also important. When you go automated and provide that consistent feedback, it becomes effortless to control the tone and ensure it’s a positive tone.

Q2. How can organizations use emerging technologies to build a digital-friendly finance function?

As a company scales, they need to spend time and money building the infrastructure using technology. This can help them avoid cost discrepancies in the future. Investing in emerging technologies is also one of the primary responsibilities. As a CFO, we should be able to tell a story to our executive team or board members on the importance of automation and tech investment. For that to happen, we need to understand how technologies like AI, RPA, or ML can help build and scale the finance function. This may be a short-term cost. However, it brings a long-term benefit.

Q3. Which finance functions do you think should be definitely automated, and why?

For me, it is the accounts receivable function where I would want to focus my automation, owing to all the benefits. Accounts payable is also an excellent function to automate, especially if you have a large volume of payables, as it can get very time-intensive. However, getting the invoices out and getting paid is paramount. Cash is king, and it’s always better if you can automate that process and streamline collections.

Q4. Which trends are you seeing right now that you think finance leadership teams should take note of?

First is the labor challenges that almost every industry is facing. Automation lowers the dependence on hiring and keeps staff in high-volume operation areas. Another important aspect is allowing CFOs to advance personally and professionally. We can use automation to minimize our dependencies in a short or tight labor market, but we can also use it as a retention tool.

Q5. How suitable is the implementation of hybrid and remote working models for the finance teams?

It is all about embracing technology, especially the tools and ways to communicate with our teams, even while working remotely. Take, for example, adding critical documents in the cloud from which people can access anywhere. All of this plays a massive role in allowing finance teams to do things strategically. As payments are getting automated, you don’t necessarily have to write checks. You can safeguard that through dual authentication on payments such as ACH or wires.

Q6. As a finance leader, how are you adopting ESG measures to perform your business operations sustainability, while winning the trust of employees, investors, and shareholders?

Every aside, a CFO also has to play the role of risk mitigation and the risk-reward return on investment. The CFO is the head of risk management in many areas, and I think ESG is also in the same boat. Therefore, it is essential to stay up-to-date with trends, making sure we manage and understand those risks while creating a better business case for the executive leadership team. Also, employee engagement is critical so that everybody truly understands the purpose and benefits of business operations.

Q7. How tech-savvy does a CFO have to become to automate finance processes?

I love being operational-oriented from a CFO seat, and I think we must bring that knowledge down to our finance team. Whether AP or AR, general ledger, or even senior accountants, the more operationally knowledgeable the accounting staff is, the more opportunities a team has to drive profitability metrics.

Q8. How do you see Metaverse being relevant for finance? Is it too spacey now, or should CFOs figure out how it will change the finance function?

I think CFOs should pay attention to it. We’ve got to learn about this concept and wait and watch to observe how it is developing into something that will make it worth investing time, resources, and energy towards.

This information document is an exclusive content of HighRadius, a data-driven AI software platform to lower DSO, optimize working capital, fast-track financial close, and improve productivity.

Special Thanks:

Anders Liu-Lindberg, Partner, COO, CMO, BPI

Dan Piscatelli, Founder & Fractional CFO, Hurd House Advisors

Lawrence Chester, President & Fractional CFO, CFO Simplified

Travis Smith, Chief Financial Officer at DALYTE