Gartner Recommended – Five-Step Guide For CFOs To Achieve Digital Finance in 2022

1. Align digital strategies and business outcomes

The pulse today: To keep up with their peers, finance executives have grown more appreciative of the upcoming digital innovations in the market today. As per the Gartner survey, 69% of the CFOs claimed the evolving business dynamics accelerated their digital initiatives. Many expect technology to lead to a substantial or total transformation in their finance function by 2026.

What it implies: The pandemic has exposed a different customer behavior across industries – whether that’s good different or bad, that’s something which is yet to be determined.

Next Steps for Finance Execs: CFOs are critical enablers of these enterprise ambitions. They should work with finance leaders to optimize the business model to account for the new-age customer.

2. Design flexible budgeting to fund digital growth

The pulse today: The Gartner study reveals 64% of the finance execs expect to use the changing business environment as an opportunity to focus on redesigning their businesses in 2021. CFOs are looking to set their organizations up for financial success in 2022 and beyond, and their top priority is to fund new (or existing) growth.

Planning and budgeting activities are historically conducted by finance executives annually in most organizations. But the volatile new economy demands this to be taken up on a more frequent basis.

What it implies: Budget constraints imposed by national financial authorities disrupt the ability of CFOs and finance leaders to pivot and capture new opportunities. Finance executives need a fresh perspective to evaluate costs and growth opportunities.

Next Steps for Finance Execs: These executives need to be clear on their business priorities and realign the budget to support the finance function. Instead of prioritizing investments based on external factors like what their peers are doing, they should focus on investments that make a significant difference.

Taking the differentiating approach that aligns the digital growth with the new business models will help keep the organization focused on costs. They should identify the cost categories (labor, utilities, and marketing expenses) that need to be considered to update the contingency budgets. Additionally, they should also identify new metrics to evaluate the potential of these digital initiatives.

3. Invest in value-driven finance technology

The pulse today: Finance operations in most organizations continue to run on technology that has grown old. This doesn’t allow the function to reach its full potential. The Gartner study claims that less than one-third of CFOs are confident that their technologies are aligned with their requirements for ensuring the future success of the finance function.

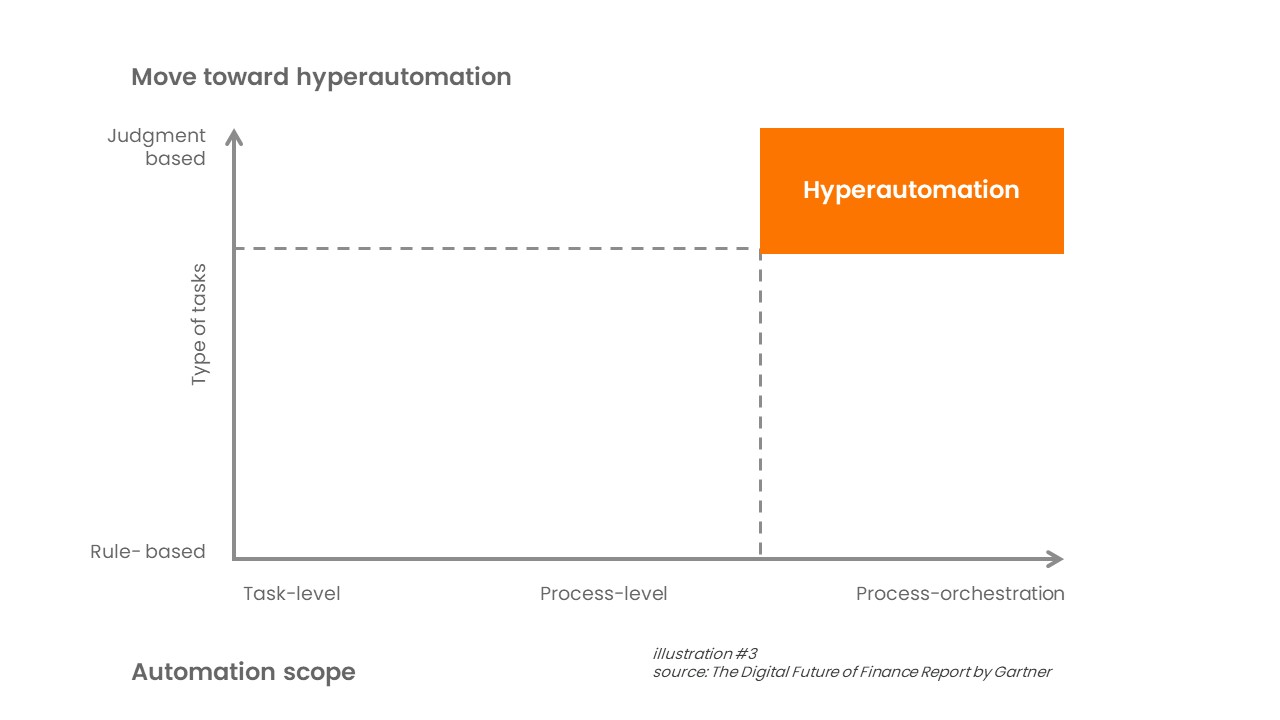

What it implies: Finance leaders need to invest in technology that can help elevate transactional teams like accounts receivable (A/R) to move to more strategic decision-making roles – all of this while reducing costs. This requires them to move from Robotic Process Automation (RPA) bots as a tool and leverage more advanced technologies like Artificial Intelligence (AI).

Next Steps for Finance Execs: RPA is limited by its adherence to rigid rules, and it can’t execute decision-oriented tasks. By adding Artificial Intelligence (AI), RPA can be used for more complex activities, such as prioritizing, strategizing, and forecasting. This will allow the A/R teams to shift their bandwidth on more high-impact tasks and create working capital impact.

These next-generation technologies can also process complex or unstructured data, forecast short and long-term cash positions, and learn about customer behavior based on their buying patterns. All of this with minimal human intervention – giving more room for the team to focus on making informed decisions.

4. Deploy data and analytics insights for informed decision-making

The pulse today: Most finance teams (including A/R) complain about having insufficient technical or domain expertise to perform complex data analysis. The Gartner survey reveals that 84% of the executives, on average, stated they expect to spend more time towards this initiative.

What it implies: The finance function is challenged with generating insights that finance executives can use to make data-driven decisions.

Next Steps for Finance Execs: These executives need to consider investing in an advanced data-analytics solution that collects good-quality data from different sources, integrates it into their existing system, and minimizes human errors in transactional A/R processes as much as possible.

5. Hire, retain and develop digital skills in finance

The pulse today: Simply providing the necessary tools and technology to the finance team would not suffice anymore. In the Gartner survey, only one-third of the finance leaders agreed that their teams have sufficient skills to effectively work a digital finance function.

What it implies: The growing digital skills gap across finance teams reduces the team’s ability to leverage digital technology capabilities successfully.

Next Steps for Finance Execs: Finance leaders must lead a digital-first mindset of leveraging the technology and help the workforce develop the skills to use the technology. The first step for CFOs and finance leaders is to identify relevant digital skills.

Based on the Gartner study, we have listed the five critical digital skills that the finance team should be equipped with:

- Technological literacy – Knowledge of how to leverage digital technology to drive better outcomes for the finance function.

- Digital translation – Ability to explain how the technology interacts with the people involved, processes, and systems.

- Digital learning and development – Ability to adapt to the new technology and identify the learning requirements to significantly impact finance operations.

- Digital bias management – Ability to identify a bias that advanced technology like Machine Learning (ML) develops based on the data it is fed and manage the risk using human intelligence.

- Digital ambition – Developing a digital mindset of looking for further automation scopes and innovative ways of supporting different finance functions.

Conclusion

Digitization is profoundly changing how finance organizations operate across the industry. The question isn’t whether you need to transform the finance function – it’s what all you need to do to transform it. CFOs need to also keep a close watch on their peers and their innovative models. This pushes the executives to focus on a critical dual mandate – lead the finance function through a digital transformation and enable the organization to accelerate digitalization.

To do this, CFOs must perform the multiple tasks mentioned in the report religiously. The ones who can do this successfully will ensure that their finance function sails through this looming storm of uncertainty with ease.