Role of scenario analysis in risk management

Companies flourish when they are better at anticipating change, learning from it, and responding to it. Read this eBook to learn how scenario planning can help you manage risks during uncertain times.

Why do businesses need scenario analysis to navigate risks during uncertainty?

Where should corporate treasury be focused in during economic volatility?

A natural conflict exists between taking immediate, short-term action and long-term planning. Treasury teams planning for a potential recession must prepare for their company’s post-event future and focus resources on initiatives that will have the most significant long-term impact on the organization. Scenario planning is where treasurers should put all their focus during such times.

Importance of scenario planning during uncertainty in managing risks

The ability to effectively prepare for periods of high unpredictability and market volatility can make or break a company. Companies can use scenario analysis in cash forecasting to generate long-term financial estimates. Customer needs, demography, and corporate practices have all undergone fast change due to technology. The market is competitive and constantly evolving.

Scenario analysis enables firms to assess the impact that unanticipated changes in the business environment will have on investment and other choices. It allows them to test the robustness of future decisions to comprehend the possible impact of unexpected influences and discover prospective opportunities and risks.

What does scenario analysis in risk management entail?

Scenario analysis involves looking closely at a wide range of potential outcomes, including the less desirable ones. Risk managers or treasurers can use this to identify, plan for, and manage risk exposures.

What does scenario analysis mean in terms of strategic management?

Nearly all administrative decisions can benefit from scenario analysis, especially competitive strategy. In other words, scenario analysis enables treasurers to test strategic hypotheses and determine how they would perform under various circumstances.

Limitations of traditional scenario analysis

There are some limitations to the traditional scenario analysis process as performed in many organizations, such as:

- Requires a lot of time: A traditional scenario analysis requires a significant amount of time and resources because the process must encompass a good cross-section of the company. Numerous meetings and workshops are required to discover and reach a consensus on variables, analyze possibilities, and develop various scenarios.

- Needs excess fund allocation: Manual scenario analysis techniques are expensive, which prompts treasury teams to limit the frequency of scenario analysis.

- Leads to human errors: It’s challenging to accurately quantify known variables’ numerical and financial value, mainly because variables often have constant and flexible components that change over time.

Common mistakes made by teams while performing scenario analysis

- Analyzing trends only within particular regions or globally

- Making decisions based on what is already known or being overly optimistic

- Not performing scenario analysis weekly or monthly

- Outsourcing the creation of scenarios

- Considering only seasonality while ignoring unforeseen circumstances

Best practices in scenario analysis that treasurers should adopt

How cash forecasting software helps?

In an uncertain and volatile market, the value of cash forecasting solutions has never been more evident. Treasurers must act to keep costs low and manage risks, so their organizations are ready for the challenges. Cash flow forecasting software has a lot to offer to accomplish these goals.

Here are the following advantages that cash flow forecasting software provides in scenario analysis:

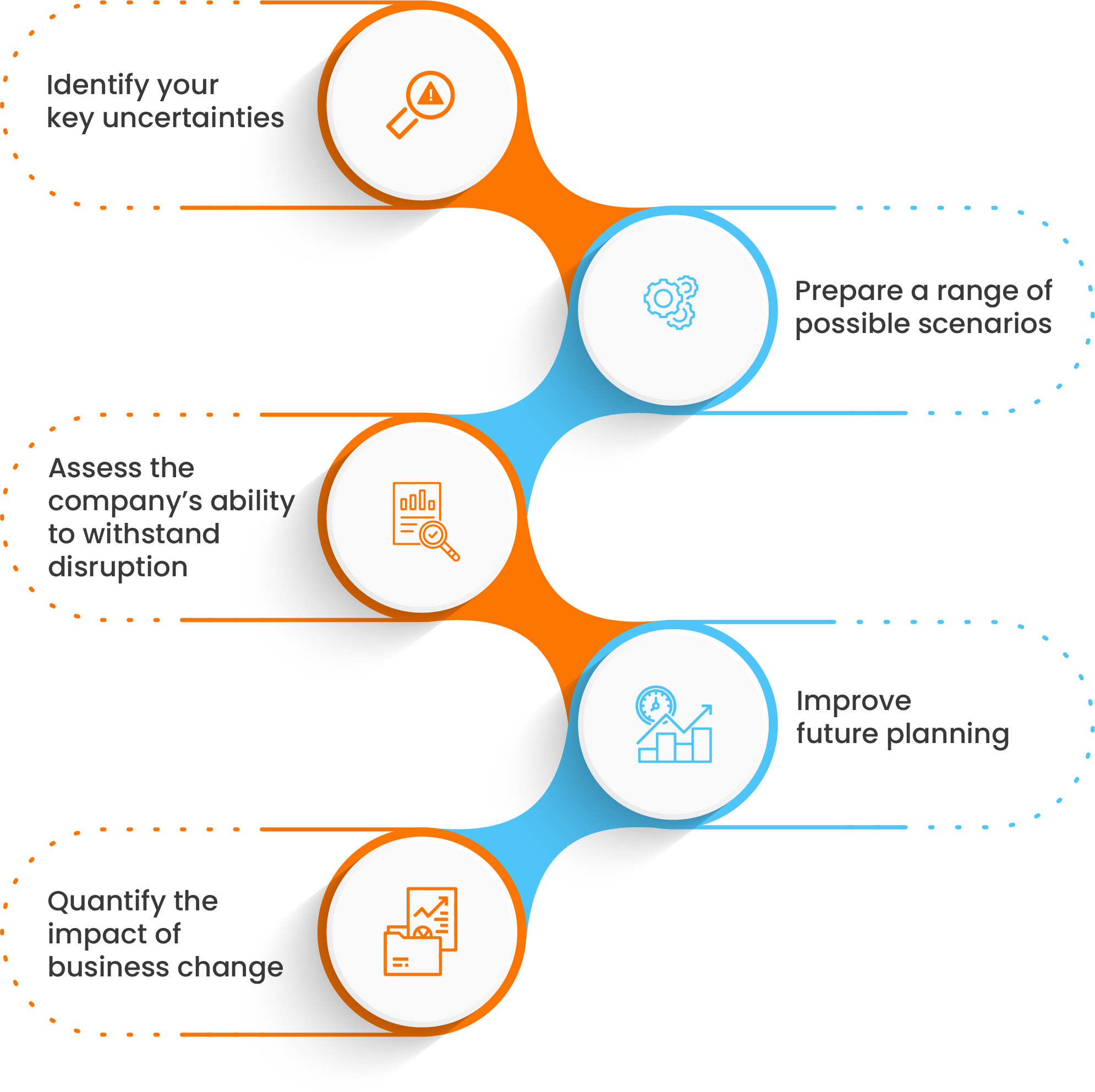

- Identify your key uncertainties: Future risks that can impact your business include changes in the economy, consumer trends, and political legislation. First, consider how these uncertainties will affect your future financial inflows and outflows.

- Prepare a range of possible scenarios: Scenario analysis allows businesses or independent investors to assess investment prospects to avoid making poor investment decisions. Scenario analysis considers the best and worst-case scenarios so investors can make informed decisions. Scenario analysis with cash flow forecasting software calculates the values or figures of potential gains or losses from an investment. Investors can base their strategies on these specific, quantifiable data to achieve better results.

- Assess the company’s ability to withstand disruption: Future-proofing your data strategy is the primary goal of scenario planning. Making sure the department has easy access to the data they require is the most crucial thing to do. Automation workflows and APIs ensure that all departments use the same data set and that your team can easily access cash data.

Delays in manual data collection will result in the business making decisions based on outdated information. Finally, this can force a company to react to disruptions rather than planning for cash shortages ahead of time. - Improve future planning: When planning for the future, scenarios can be helpful for advisers and SMEs to obtain a picture of the financial position and predicted returns. Small and medium-sized firms have one of the largest obstacles regarding cash flow, but cash flow plan. A scenario analysis assists them in keeping careful tabs on their finances by employing accurate calculations.

- Quantify the impact of business change: Businesses can prevent losses and poor cash flow issues by investigating the circumstances and events that might produce unfavorable outcomes. Scenario analysis can be helpful if you plan to make changes to your business, such as launching new product lines, purchasing an office, leasing new equipment, hiring new employees, etc.

How does HighRadius Cash Flow Forecasting Software track different scenarios?

Uncertainty can be a significant impediment to effective decision-making. Treasury executives can, however, use scenario analysis to improve their decision-making in uncertain situations. HighRadius Cash Flow Forecasting Software helps CFOs perform accurate scenario analysis in the following ways:

- Creates various scenarios for worst case, best case, and most likely outcome

- Understands the impact of distinct scenarios on cash flows with detailed insights and variance heatmap

- Compares snapshots to view forecast vs. forecast, forecast vs. budget, and forecast vs. actual reports

- Helps factor in unexpected events and plan future cash flows

- Schedules snapshots and downloads or export to the workspace to track changes in forecasts over time

- Compares any forecasts, scenarios, and actuals side-by-side for the company or category-level analysis

- Reports business outcomes with confidence, leveraging amount and percentage differences between multiple scenarios

Benefits of performing scenario analysis with HighRadius Cash Forecasting Software

- Better planning – Modify forecasts easily to incorporate and measure the output of business strategies, changes, and unforeseen circumstances to plan for rainy days.

- Flexibility/adjustability in variations – Save unlimited snapshots by creating and tweaking scenarios to understand the impact of every decision.

- Increased efficiency – Automatically save snapshots of generated forecasts and comparisons for detailed analysis.

- Higher visibility – Get a clear understanding of how and why each scenario changes over time.

- Intuitive and easy – Compare individual cells side-by-side with differences highlighted in colors.