How does Artificial Intelligence Revolutionize Cash Flow Forecasts?

Learn tools or methods businesses use to keep track of the cash flow and the advantage of using AI cash flow forecasting software. Identify what makes forecasting future cash flows so difficult.

What is the use of a cash flow forecast?

Cash flow forecasting tracks how much cash will flow in and out of business over a set period of time. It should be a top priority for any organization since cash flow forecasts help:

- To keep track of cash flows

- Plan for potential cash flow concerns

- Increase profits with any cash surpluses

- Make better and proactive decisions

Any company can suffer from negative cash flow. If the company’s underlying difficulties are not addressed, it leads to losses. Poor cash flow is when the company spends more than it receives. For example, if firms receive accounts receivable late constantly, it can lead to a cash flow crisis.

Cash flow forecasting helps businesses prevent cash flow crises more effectively. It improves the company’s performance, returns, and growth.

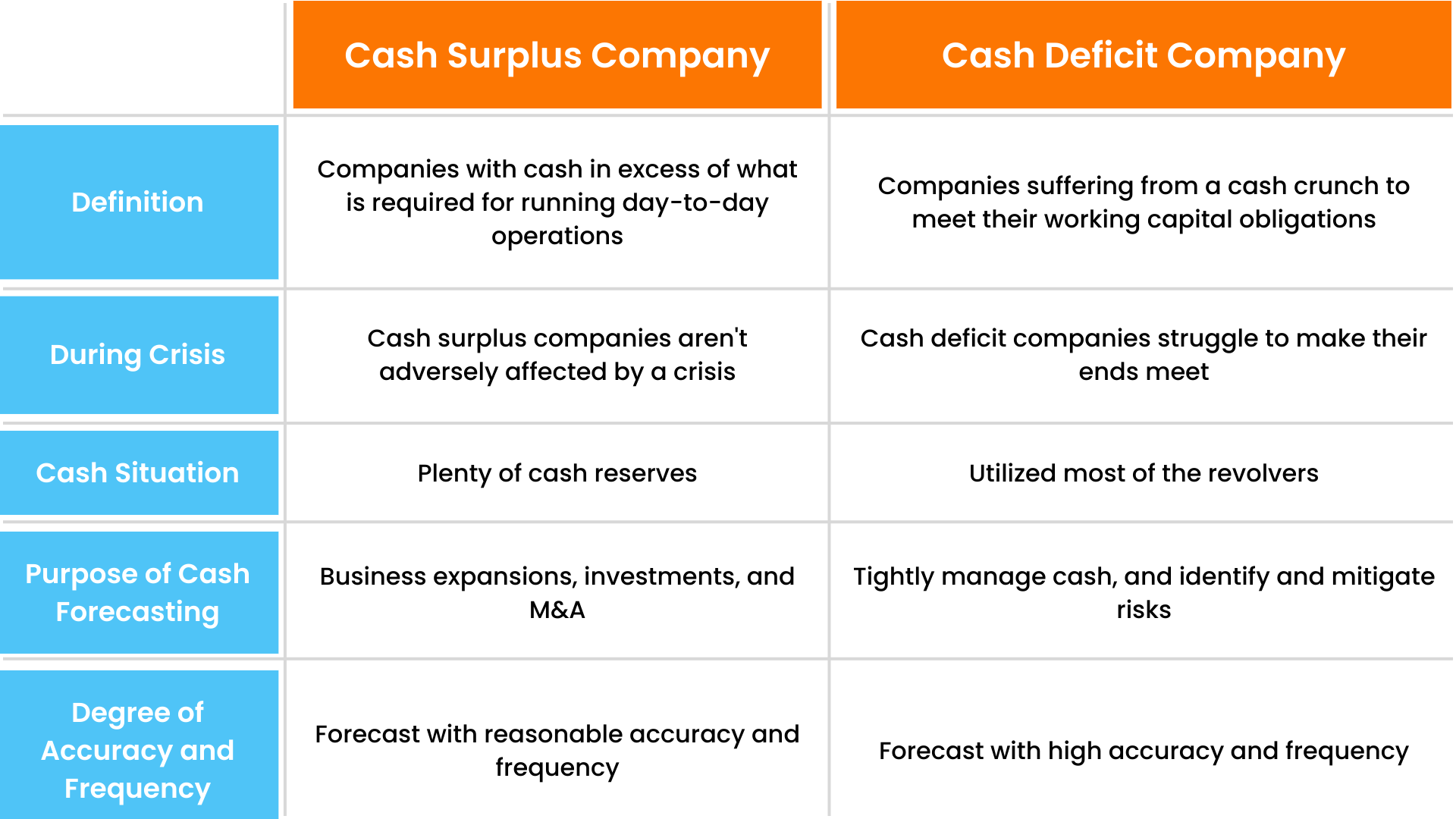

The purpose of cash forecasting varies for cash surplus and cash deficit businesses. The differences between both types of business are mentioned below:

Both cash surplus and cash deficit firms need to forecast accurately to make better decisions. This can often be challenging due to the difficulty in creating accurate forecasts.

What makes forecasting future cash flows difficult?

One of the essential aspects of growing a successful business is having a good cash flow. Cashflow forecasting is a time-consuming activity that requires a large amount of data. Treasury needs to gather data from several sources into a single system. Yet, the fundamental problem with these forecasts is that they are prone to errors.

A cash flow projection must be as detailed as possible to be accurate. But most firms are unable to forecast cash flows accurately due to some challenges.

Cash flow forecasting challenges are:

- Manual data collection from multiple bank accounts and systems

- Variables causing uncertainty in A/R and A/P. Those variables are:

- Different payment terms

- Economic cycles

- Seasonal demand

- Changing FX rates

- Macroeconomic fluctuations

- Data overload in multiple sources with a scope of error

- Low visibility into cash positions

- Static and outdated reporting

- Not able to select the right forecasting methods (short-term vs. long-term forecasting) and models (AI vs. Heuristic model)

- Not making adjustments to the forecasts for analyzing scenarios, trends, and patterns

- Lack of technologies to track and reduce variance

What tools or methods do businesses use to keep track of the cash flow?

Many organizations use spreadsheets as the primary tool for forecasting cash flows. The forecasts are usually high in inaccuracy due to the limitations of spreadsheets.

Limitations of spreadsheets

As a company grows, many entities, accounts, and systems increase. With so many views and data entry points, spreadsheets struggle to keep up. In most situations, a single user can only work on a file at a time.

The Global Treasurer’s survey found that the treasury spends almost 5,000 hours on Excel per year. Also, generating cash flow forecasts takes an average of 792 hours. Automated cash forecasting can save those 792 hours from focusing on strategic decision-making.

These are the additional challenges of using spreadsheets for cash forecasting:

- Completely manual and prone to errors

- Difficulty in sharing visual updates and collaboration

- Slow calculations and low visibility

- Difficulty in making changes or updates

- Challenging to test different scenarios

Some businesses also use legacy systems like TMS for cash forecasting. But, a TMS is usually expensive and doesn’t provide a lot of returns due to these reasons:

- Implementation and maintenance are costly

- Isn’t easy to use

- Prone to security problems

- Has compatibility issues

- Isn’t cost-effective

Companies should use Artificial Intelligence to overcome these drawbacks and improve the efficacy of cash forecasts.

Improving efficiency in cash flow forecasts with Artificial Intelligence

Advantages of using AI cash flow forecasting software

-

Integrates with data systems:

-

Enhances collaboration:

-

Improves accuracy and frequency:

- Invoice dates

- Customer-specific days payable

- Bill amounts

-

Improves treasury leader’s confidence to make decisions:

- Forecast model with low accuracy

- Low visibility into future cash positions

- Manual and tedious process with limitations

- No variance analysis, only cash position comparisons

- No control over data from Receivables and Payable teams

- Slow data gathering from multiple sources

- 50% and 47% increase in A/R and A/P forecast accuracy for a month of continuous visibility into 1800+ projects

- Improved visibility Into each project with daily and monthly forecasts

- End-to-end automation from data gathering to reporting

- Project-level drill down to find variances

- Better debt planning & management

- Higher confidence among investors with accurate & timely reporting

AI-based cash flow forecasting system integrates with ERP systems, bank portals, and TMS by using API or sFTP. This increases data visibility and reduces errors.

AI cash forecasting system provides real-time access to data in a single repository and multi-user access. Different departments can access the same data in real-time. Hence, it improves collaboration between departments.

It improves the accuracy of cash forecasting through the following ways:

-

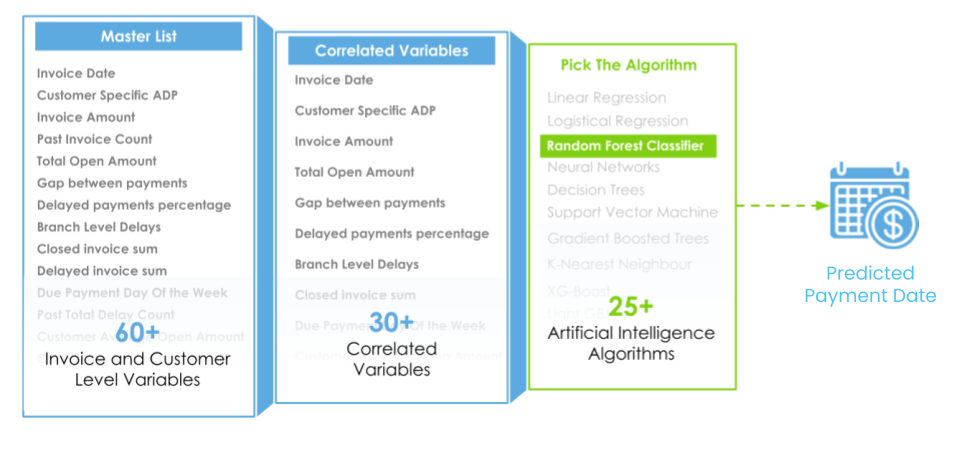

a. Captures customer-specific variables:

AI is capable of capturing multiple variables related to customer accounts. The variables are then correlated and selected for modeling. This helps to forecast cash flow categories with high accuracy.

For example, a single transaction may have over 60 invoice and customer-level variables, such as:

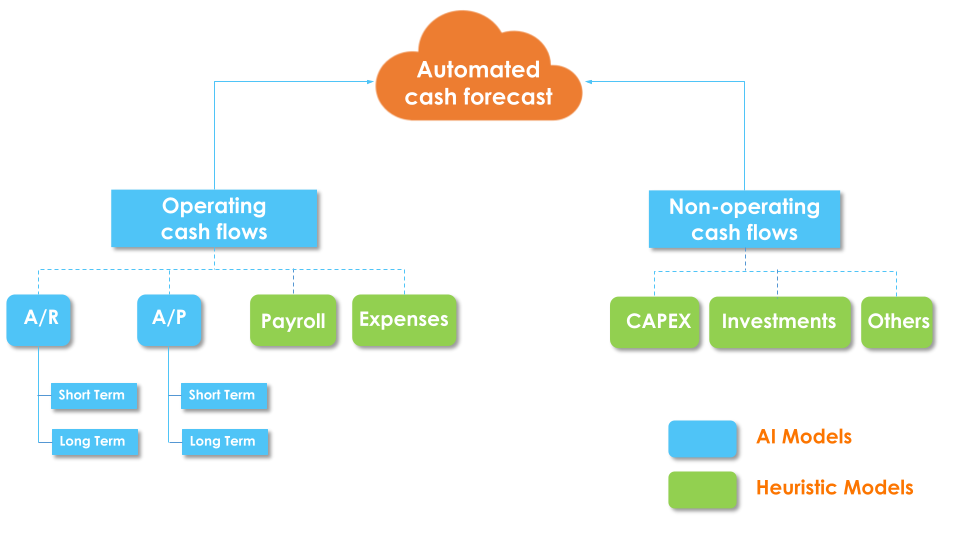

b. Uses suitable models for different cash flow categories:

AI-based solutions use suitable models for each cash flow category, such as heuristic models for payroll, taxes, etc., and AI models for A/R and A/P.

c. Includes scenarios in forecasts:

Scenario analysis investigates potential events or scenarios and assesses the many possible repercussions. The approach is generally used in financial modeling to estimate changes in the value of a business or cash flow.

To determine how scenarios affect the future financial position. AI enables businesses to simulate a vast number of scenarios. It does so with the use of a time series model.

Time series model:

Time-series forecasts are made by identifying trends in historical data and extending these patterns into the future. Businesses currently use a wide variety of time series forecasting tools for scenario analysis.

d. Tracks variance drivers and increases the frequency of variance analysis:

Treasurers need to use AI cash forecasting model to determine the root cause of the variance between forecasts and actuals.

By utilizing cash forecasting automation, companies can get a low variance and high accuracy. Cash forecasting automation helps identify, report, and resolve deviations and check the accuracy of forecasts.

AI-based cash forecasting solution analyzes variances across many cash flow categories and geographies. It includes entity-level disputes and conducts a root problem investigation. It uses closed-loop feedback to review historical forecasts and analyze the risk variance. CFOs get actionable data and make a wise investment, borrowing, and financial decisions.

In a spreadsheet, accounting for all variables is problematic and takes excessive time. Treasury teams can streamline the process by using AI-based cash forecasting. It takes 60+ variables and correlates them. Then, it constructs more than a dozen methods to forecast accurately.

Optimal cash forecasting software assists businesses in overcoming forecasting issues. They help manage and track all of the company’s current and prospective corporate cash flows. AI forecasting software builds real-time and accurate cash flow forecasts. This allows CFOs to make intelligent decisions about M&A, borrowing, investments, repatriation, etc.

Customer success story with HighRadius Cash Forecasting Cloud

Challenges a $1.5 Billion firm faced in treasury:

The firm achieved up to 95% accuracy in A/R & A/P forecasts after using the HighRadius cloud treasury solution. They got these additional benefits: