Implementation Best Practices

Credit and A/R projects are large, complex, expensive and fraught with risks. This e-book demystifies technologies such as Robotic Process Automation and Artificial Intelligence to help finance leaders transform operations.

Implementation Best Practices

This chapter captures the best practices once a receivables transformation project is officially budgeted and kicked off. To ensure user acceptance and a successful implementation follow the practices described in this section.

Implementation Methodology

Follow a proven project implementation methodology. Figure 14 is a summary of the HighRadius implementation methodology:  This document does not cover all the details of each phase and sub-phases. It only highlights the key aspects that are important from a receivables technology project implementation stand-point.

This document does not cover all the details of each phase and sub-phases. It only highlights the key aspects that are important from a receivables technology project implementation stand-point.

Executive Sponsorship

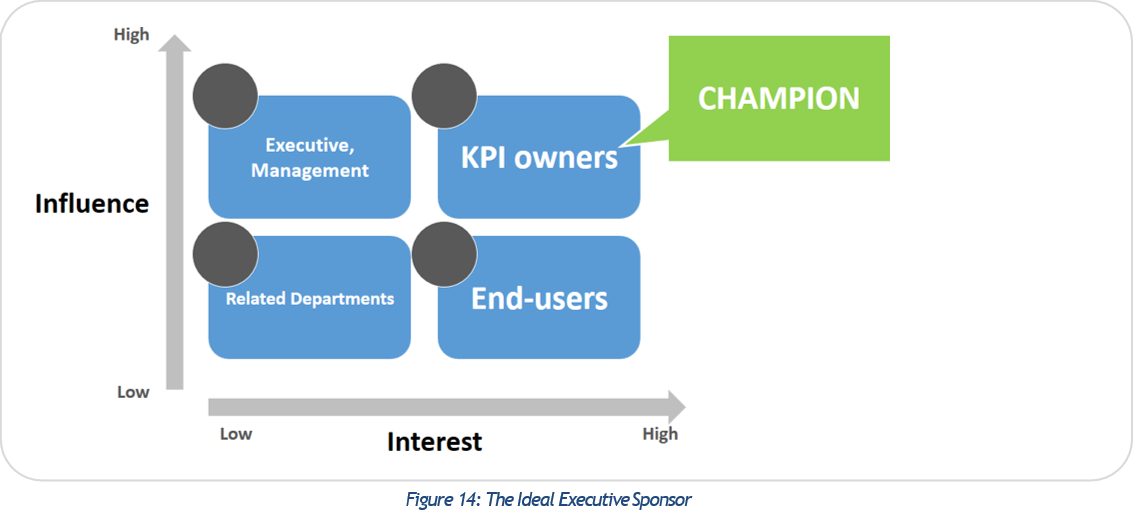

Having the commitment and support of a senior executive to the project will set the context for serious engagement from both business and IT teams to the project. The senior executive who is actively involved will stay informed on the project status and will help with clearing roadblocks, allocate resources, etc. An ideal sponsor for the project would be a senior executive who believes that technology will impact the performance of KPIs. Such executives fall in the sweet spot of having both the interest in the project and also the necessary influence to sponsor it. Figure 15 highlights the ideal champion to pick for executive sponsorship.

Project Team Selection

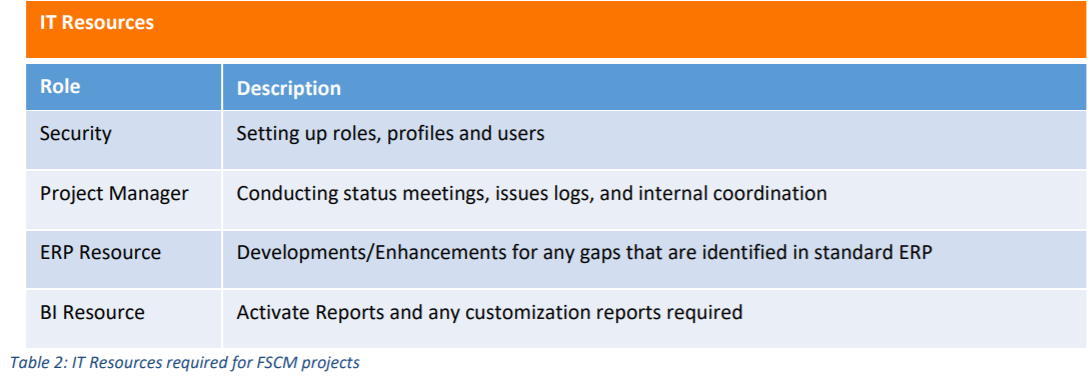

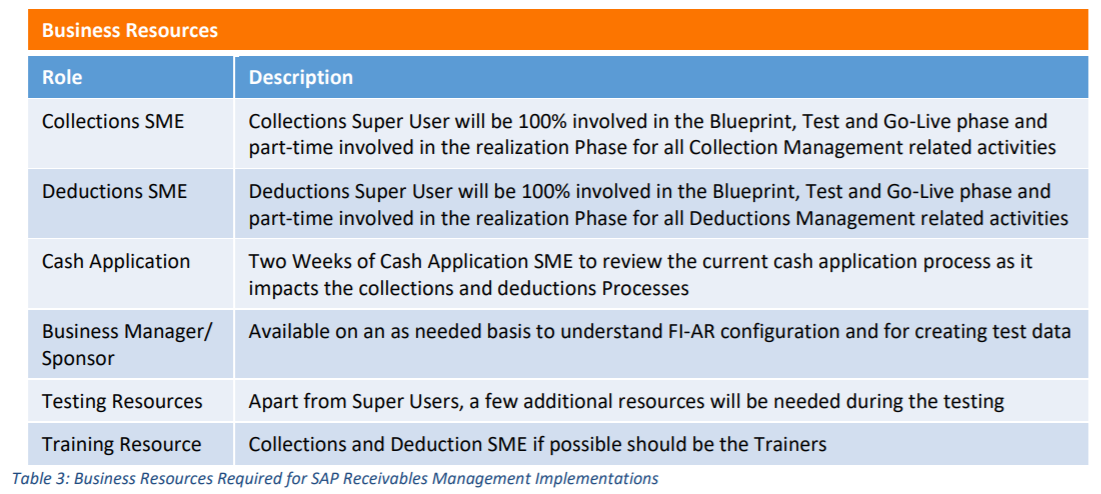

Staff the project team to include representation from both IT and Business. The following is a summary of internal resources recommended for allocation to the project. NOTE: The resource list below does not account for the specialty consultants that might be required from a credit and A/R technology vendor. Tables 2 and 3 outline the IT and business resources needed to implement SAP Receivables Management.

Testing

The following is a summary of testing best practices:

- Conduct at least two, preferably three, system integration testing (SIT) cycles

- Create test scripts beyond feature testing, for every possible business process scenario

- Test scalability as it is extremely critical for high invoice and deductions volumes

- More than one million invoices in a year would be considered high volume

- For a multi-system scenario (refer to section 2.5.1), scalability is extremely critical

Training

Training is key to the success of an implementation and is often overlooked when prioritizing. Implementations tend to be focused on the realization phase due to their technical nature. One of the biggest challenges in software implementation is accurately capturing the right criteria and requirements. What is intuitive to a consultant or an IT employee might not be to an end user. The following is a summary of recommendations to ensure users receive rigorous training and are not ?left out? until the very end of the implementation.

- Be sure the consultants train the users before the wrap-up of the implementation. Have the consultants ?Train the Trainer? and assist the ?Trainer? in conducting training sessions

- Choose a Super User from the credit and collections department as the ?Trainer?

- Since they understand the business side and have working relationships with the users, they will also be available beyond a formal training session as a ?go to? contact

- Conduct training on day-to-day business processes versus system features and functions

- For, example, a credit hold on an order emerges in a call to the customer that was conducted to check the status of open invoices, and results in a promise-to-pay creation in the system

- Create detailed training documentation with systematic screenshots of the system