State of Cash Forecasting: 2022 and Beyond

Understand the importance of accurate forecasting in new normal and learn how AI and automation are transforming treasury.

Executive Summary

“There is really only one way to address cash flow crunches, and it’s planning so you can prevent them in advance.” — Elaine Pofeldt

The way an organization forecasts, determines what its future is going to be. Even though cash forecasting had been the top priority of the treasury for decades, with the emergence of COVID-19, it has increased by many folds.

The Strategic role of treasury at my company over the past 12 months has:

Purpose(s) of cash forecasting and its accuracy

The recent joint survey conducted by HighRadius in association with Treasury Webinars during Q2 of 2021 showed that 60% of the respondents agreed to the fact that the frequency of forecasting cash has increased largely due to COVID-19. But the priorities remain different. While the smaller organizations need to deal with cash crunches to stay afloat in the market, the larger organizations prioritize more on dividend planning to maintain their market share.

The same survey also conveyed that larger organizations achieve the highest accuracy of 95% and above in their forecasts while the smaller organizations tend to have less than 80% accuracy.

It can also be inferred that the majority of the respondents, around 50-51% forecast cash on a daily and Ad Hoc basis to have a better insight on market fluctuations, day-to-day business, and cash buffers.

This ebook provides insights on the current state of cash forecasting & how COVID-19 has impacted the treasury’s influence over the organization.

Survey- Demographics

Overview

HighRadius conducted a joint survey in partnership with Treasury Webinars in Q2 of 2021, focused to help the treasury align with the current state of cash forecasting.

There were 282 active respondents involved in the study. Respondents belong to small organizations with around 25 employees to large organizations with more than 5,000 employees.

| Industries | Percentage |

| Software/Technology | 39% |

| Construction | 14% |

| Manufacturing | 12% |

| Healthcare | 8% |

| Telecommunication | 5% |

Why Is Cash Forecasting Important?

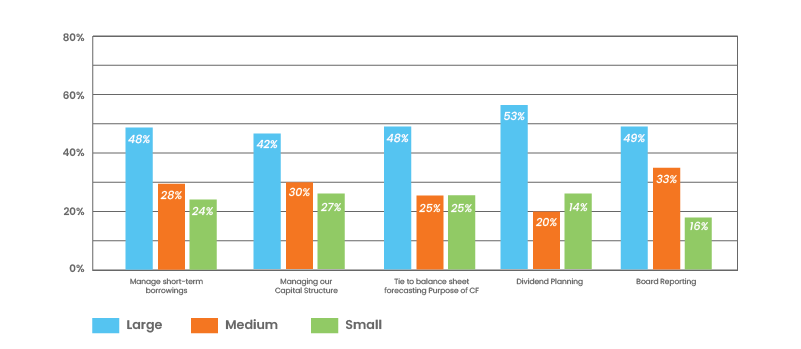

Different firms forecast cash for different objectives based on their organization goals.

- 53%of large organizations focus more on dividend planning to manage liquid cash and returns for its shareholders and investors due to their cash surplus state.

- 27% of medium organizations’ focus on managing their capital structure in order to grow and expand their business.

- 33% of small organizations focus more on reporting as they need to regularly update to C-suite about where the business is going and plan accordingly to prevent cash deficit situations.

Cash forecasts, when accurate and used properly can be very valuable for an organization as it enables in

- Managing short-terms borrowings

- Managing capital structure

- Planning on dividends

- Reporting to the C-suite

Automated forecasting models with accurate forecasted numbers enable organizations to make precise financial decisions.

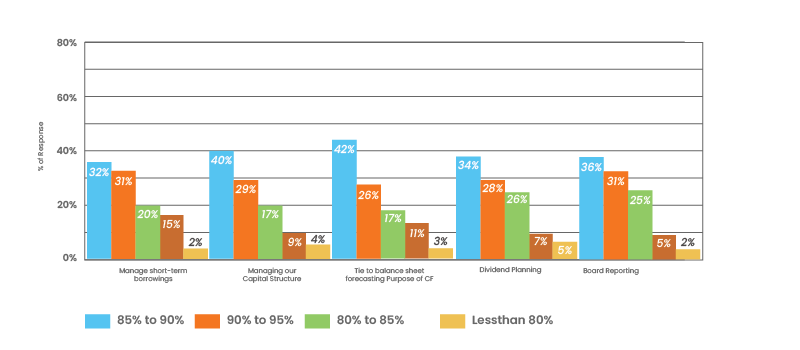

- 42% of the organizations achieve 85%-90% accuracy with their balance sheet forecasting that helps them to estimate the impact of the income statement, liability, assets, and cash flow.

- 15% of the organizations have 95% or more accuracy in managing short-term borrowings which leads to efficient A/P, short-term loans, wages, and taxes.

- 5% of the organizations having less than 80% accuracy, in the case of dividend planning, are unable to make reliable financial decisions due to a lack of confidence.

With the emergence of COVID-19, it is evident that organizations are focusing more and more on cash forecasting.

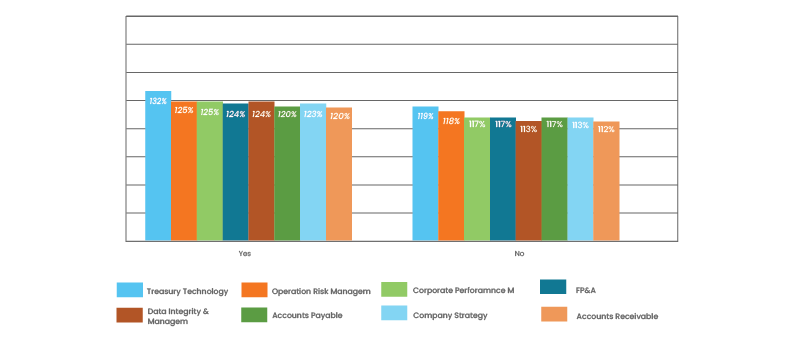

Impact of COVID-19 on the different departments

- Frequency of cash flow forecasting has seen substantial growth across all departments due to the business impacts of COVID-19.

- The use of treasury technology to forecast has increased for having a clear picture of the cash flow so that they can easily navigate through cash crunches.

- A/R & A/P being the toughest category to forecast which helps businesses to balance revenue and expenditures also saw the same trend.

Adapting To The New Normal: Cash Forecasting Leading The Way

Cash forecasting has been the top priority of treasurers over the past two decades. However, organizations are still forecasting cash manually. The shortcomings of the manual cash forecasting process have been brought to the forefront by COVID-19.

According to a AFP survey, during COVID-19, the forecast frequency (daily, weekly, monthly) has increased to 80% from roughly 57% in 2020 and 2021.

The various uncertainties faced during COVID-19 have forced firms to rethink their cash forecasting strategy. More and more firms are looking out for data-driven, timely and flexible cash forecasting systems. To generate best-in-class and accurate forecasts, treasuries need to focus on the below core areas of cash forecasting:

- Frequency: How often we forecast is what defines its frequency.

- Accuracy: The precision and reliability of the cash forecasting reports.

Irrespective of size, treasury teams across organizations strive to increase their forecasting cadence, improve accuracy and gain better visibility of their cash flows.

Performance Levelers Of Cash Forecasting

The key performance levers of cash forecasting, frequency, and accuracy enable the organization to react appropriately to market fluctuations in order to take adequate strategic decisions. They serve as a catalyst for determining the current state of your organization and its requirements.

For cash surplus organizations, business expansion or investment planning becomes a key driving factor to have accurate cash forecasting reports. On the other hand, for cash deficit organizations, higher frequency forecasts, and accuracy can help them in making key strategic decisions to overcome the situation.

Frequency – How often do you forecast?

Increased frequency of cash forecasting provides insights into the daily cash movements of organizations, across various time horizons leading to the generation of timely information. As a result, C-suite executives can make informed decisions and receive better strategic counsel

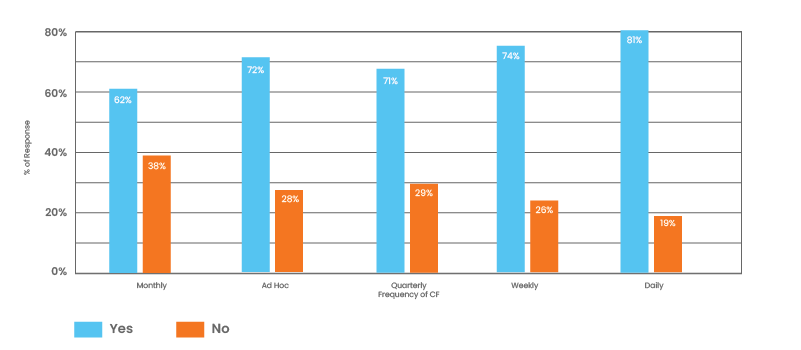

Impact of COVID-19 on the frequency of cash flow forecasting

The advent of COVID-19 has led organizations to significantly increase their frequency of forecasting to counter high volatile market fluctuations.

Has the Frequency of cash flow forecasting Increased due to the business Impacts of COVID -19?

Increase of cash flow forecasting due to business impacts of COVID-19

Has the Frequency of cash flow forecasting Increased due to the business Impacts of COVID -19?

Business impacts of COVID-19 on the frequency of cash flow forecasting w.r.t. organization size

- Daily cash forecasting has increased by 81% as it gives the insights to make the right operational decisions and helps to identify areas of improvement to prevent cash deficit situations.

Though there are some variations, all organizations, from large to small, have changed their approach to forecast cash since the pandemic hit. While larger organizations focus more on maintaining their market share, the small organizations need to stay afloat in the market and deal with liquidity shortages leading them to increase their forecasting frequency.

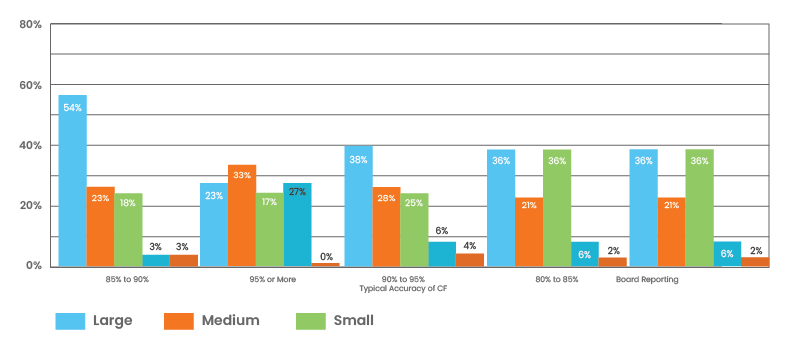

Frequency of cash flow forecasting on the basis of organization size

Frequency of cash flow forecasting w.r.t. organization size

- 72% of the large organizations perform cash forecasting more on an Ad Hoc basis to counter sudden business concerns without waiting for standard analysis.

- 34% of the medium organizations forecast on a monthly basis, as they focus more on long-term planning for strategic and tactical purposes.

- 29% of the smaller organizations go for forecasting on a daily & weekly basis respectively. This is because they need both daily cash visibility to counter cash crunches to stay afloat in the market and long-term planning.

The objective of the treasury is to pair the forecasting model with the right time horizon for meeting business requirements.

The time horizon of your cash flow forecast

The time horizon of cash flow forecast- Sliced by frequency

- 57% of the organizations forecast cash for one week to one month out on a weekly basis to have the proper insight on cash inflow and outflow.

- 51% of the organizations forecast cash for one week out or less on a daily basis to utilize the credit line carefully and have an idea of the immediate future.

- 43% of the organizations forecast cash for three or months out on a quarterly basis to have a better long-term visualization enabling them to make relevant investment and debt decisions.

Appropriate frequency & time horizon together ensures that your cash flow forecast serves its purpose and is recognized as a useful tool.

Tips :

- Establishing the right frequency cadence for forecasting is necessary.

- Real-time data gathering using RPA and APIs can provide scalability.

- Time-series algorithms can be incorporated for factoring seasonality.

Accuracy – How accurate is your cash forecast?

Accurate cash forecasting enables the CFO to make proactive and informed decisions for the organization, as well as provide more specific future growth initiatives.

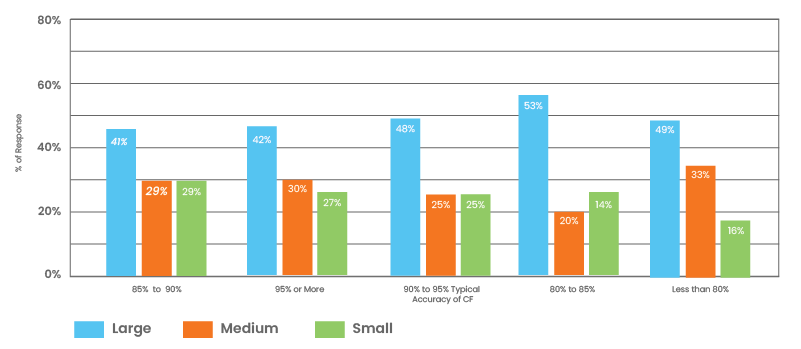

Accuracy of your cash flow forecasts

What is the typical accuracy of your cash flow forecasts?

Accuracy of cash flow forecasting w.r.t. organization size

- 57% of large organizations are able to achieve 95% or more accuracy as a result of using technology such as AI, APIs, RPAs, etc, enabling them to utilize the data efficiently.

- 33% of the small organizations reported <80% accuracy since they lack relevant tools to utilize the available data adequately.

- 34% of the medium organizations have 80% to 85% accuracy because they are still in the developing phase and are unable to utilize the data effectively.

Frequency of your cash flow forecasts & it’s typical accuracy

What best characterizes the frequency of your cash flow forecasting?

Best characteristics of cash flow forecasting frequency

what is the typical accuracy of your cash flow forecasts?

Typical accuracy of cash flow forecasts

| Accuracy Achieved | Key Takeaways |

| 95% or more |

|

| 85% to 90% |

|

| Less than 80% |

|

Tips:

- Incorporating AI to gather data and automate cash flow forecasts.

- Having clarity at utilizing the right models for different categories.

- Human intervention is extremely necessary to provide vital inputs and feedback to generate accurate reports.

Organizations that have accurate projections are able to eliminate wasteful expenditure and manage total cash flow.

To summarize, organizations have increased their forecasting frequency. They are adopting technologies to utilize data optimally and generate accurate reports, allowing them to have better credibility and build up forecasts to a global level.

Moving From Traditional to Digital

More and more organizations are incorporating technologies like APIs, RPA, Artificial Intelligence, etc, which significantly enhances the ability to update forecasts, perform variance analysis as well as provide “what-if” scenarios for short-term and long-term liquidity planning needs.

With Artificial Intelligence and Machine Learning technologies, organizations can perform variance analysis to quickly identify the accuracy of the forecasting and fine-tune it. Variance analysis capability can result in a more accurate and timely forecast for the organization.

The importance of forecasting has become abundantly clear during the COVID-19 crisis. It is key to elevate the importance of accurate forecasting within the organizations. The old models and processes might not suit anymore with so much uncertainty around. Companies must make it a priority to reduce dependency from spreadsheets and deploy technology.