Why is it essential to embrace digital treasury?

Discover how companies are utilizing technology to embrace treasury transformation and benefiting from it.

Bringing digital treasury: What is digital treasury

The treasury department oversees short-term and long-term cash management and risk management to meet company objectives. However, it must be modernized, just like every other company function, and treasury digitalization can reshape treasurers’ roles globally.

What is digital transformation in treasury?

Digital transformation is the integration of digital solutions into the very core of a business, significantly changing how it operates by creating:

- New business processes

- Customer experiences

- Organizational culture

However, the essence of digital treasury management may be summed up as a technique for utilizing digital technology to enhance financial visibility and control. It is improving traditional methods and reinventing them for the digital age to meet changing market expectations.

Implementations of digital treasury solutions may be confined to the straightforward automation of particular processes, such as cash flow forecasting. Others might be full-spectrum, covering every sub-process for which the treasury department is accountable and entailing technological connections with other systems, such as ERP.

What are the four key challenges of digital transformation in treasury?

- Dealing with employee pushback during the digital transformation

- Creating a company-wide digital transformation strategy

- Obtaining the knowledge to guide treasury digitization initiatives

- Managing the budget through the digital transformation

Areas to consider for digital transformation in treasury

Today’s treasurers must deal with volatile markets, increased regulatory scrutiny, and reduced budgets in an increasingly complex environment. To address these and other issues, more treasurers are looking to implement sophisticated systems and best practices in order to achieve the following goals:

- Process transformation

Surprisingly, many firms still rely on relatively manual processes and technologies for cash management and forecasting, such as spreadsheets. Many businesses recognize the need to alter core processes to reduce operational risk and foster the agility required to adapt to economic shifts and technological advancements that may impact revenues, interest rates, credit ratings, and borrowing costs. - Transforming business model

By adopting digital treasury management, treasurers are seeing a compelling need to digitize treasury and investment IT infrastructure, replace old, custom-developed solutions with off-the-shelf vendor packages, and re-engineer excessively manual procedures. - Domain transformation

Most companies undergoing a digital transformation in treasury should be aware of the new opportunities for domain change that come with new technologies. Implementing digital treasury solutions can help companies reach the following goals:- Reshape products and services

- Blur industry lines

- Create new value

- Organizational transformation

A successful digital transformation requires more than upgrading technology or reimagining products. Treasury digital transformation attempts that aren’t connected with a company’s internal values and habits might negatively influence the culture. The following are the negative consequences:- Slow adoption of digital technology

- Loss of market competitiveness

- Initiative’s ultimate failure

- Loss of productivity and money.

How can treasury benefit from digital treasury services?

Treasury can benefit from treasury digitalization to stay up with the following trends:

- Becoming value-added strategic partners to the CFO and other business areas through the use of digitalization as a key driver

- Focusing on liquidity risk management

- Increasing the cost-effectiveness and efficiency of treasury operations

- Taking the lead on initiatives to boost working capital

Building a digital treasury

Steps before implementing a digital treasury management

Transitioning to digital treasury helps existing treasury operations run better, faster, smarter, and leaner operations.

- Conduct a digital treasury evaluation by analyzing the current methods, identifying the most important issues, and assessing the willingness to take a technological leap.

- Secure the necessary budget such that treasury departments can feel confident in requesting funds knowing there will be an almost immediate ROI.

- Focus on the most significant challenges to easily pursue progress.

- Create a digital roadmap of what is necessary to implement the prioritized opportunities and begin implementation. The focus should be on IT requirements, team structure, and capabilities.

- Fast track initiatives can enact the most significant challenges such as forecasting and automation and deliver on those improvements to pave the way for further improvements.

- Prioritize opportunities where initiatives should be evaluated based on profit and loss impact and expected value.

Benefits of digital treasury management

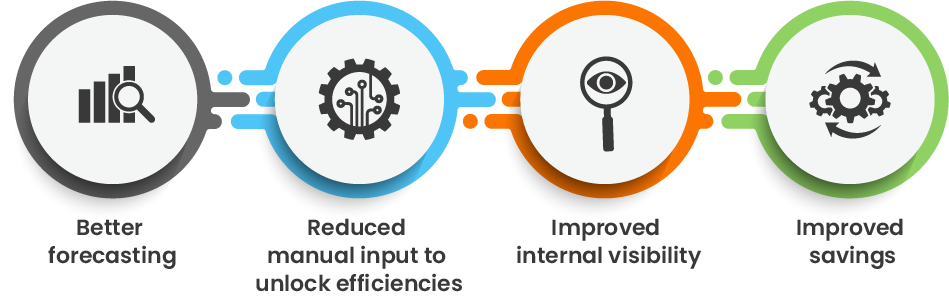

The switch to centralized digital administration can be challenging, but the advantages of a digitized treasury department outweigh the difficulties. The following are a few of the main benefits of digital treasury management:

- Better forecasting: Good data is essential for accurate forecasting, and digital technology dramatically improves the data capabilities available to treasurers. It provides the highest accuracy of data served in real-time, improved decision-making, liquidity management, and reporting through integration with financial APIs and extraction of internal statistics.

- Reduced manual input to unlock efficiencies: Many of the fundamental responsibilities of the treasurer have traditionally required a significant amount of manual input, from manual data sourcing to thorough risk assessment.

The benefits of a system that can automate many operations are apparent: Less time spent on manual input by treasury department staff provides more time for other value-adding tasks. It also reduces the potential for human mistakes to cause inaccuracy.

Digital treasury systems’ enhanced features make data more immediate, insights more valuable, and decisions more transparent. Because of these characteristics, the treasurer’s ability to use capital effectively is not as constrained as in more conventional systems. Efficiencies can take a variety of shapes, from better working capital management to quicker financial crisis responses.

- Improved internal visibility: One of the more smooth advantages of treasury digitalization is resolving this visibility issue, or, in other words, enabling access to real-time treasury data for all pertinent stakeholders. In most cases, digital treasury management uses a central dashboard or system that understandably provides important data in real-time. Because of the quicker decision-making, all pertinent stakeholders can effectively use the insights of the treasury department.

- Improved savings: Improved savings by companies with high global visibility can considerably improve risk modeling and cash flow forecasts. The secret to financial success in any organization is accurate and timely cash flow visibility, which assists the treasury in proactively reducing debt through proactive borrowing and lowers a company’s risk exposure by recognizing expansion prospects. Companies can avoid borrowing costs and late payment penalties or make proactive investments for growth by improving their global cash flow visibility.

What makes a successful digital transformation?

What are the three key elements of successful digital transformation?

Three main elements that must be present for implementation to be successful are:

- Safe: Making sure a digital business solution is safe and secure from cybersecurity threats should be the first focus when adopting it. The reliability of the data environment and the system’s complete protection against unauthorized access make up the safety of a digital treasury solution. This is especially critical for treasuries, whose data is very sensitive and precious, making them a prime target for fraud or hacking.

- Sustainable: The long-term viability of the digital system you choose to use must also be guaranteed. The correct implementation of digital treasury solutions necessitates a significant monetary and manual investment; thus, picking a reputable and well-established service is advisable. Selecting a provider with an uncertain lifespan could result in additional charges.

- Effective: Finally, it’s crucial that the solution you select be verifiably successful. Making impulsive decisions can lead to adopting a system that doesn’t entirely meet your needs, which can lead to additional costs and process disruption in the future. Utilize all the tools at your disposal to prevent making that error, including reading reviews and case studies, consulting an advisor, and even trying other solutions.