How to evaluate risks and improve risk management for enterprise treasury?

Learn about the aspects that impact risk management decisions and the role of treasury software in overcoming risks.

What is risk management in business? What are the benefits of risk management?

Risk management identifies, assesses, and controls risks to a company’s capital. Macroeconomic fluctuations, legal obligations, data theft/fraud, and natural disasters are the common causes of treasury risks.

An effective risk management plan allows a company to analyze all its hazards. Risk management identifies risks and their ability to impact an organization’s objectives.

Treasury risks are limited to several types of financial concerns. In contrast, the treasury is not in charge of general business hazards. Some treasurers are in charge of insurance and enterprise risk management.

What are the types of risks in treasury enterprises?

Treasury’s key financial risks are divided into the following categories:

- Risk of liquidity (availability of funds):

Property liquidity and operational funding liquidity are two types of liquidity risk. - Market risk (commodity price risk):

The risk of changing market conditions in the competitive market where firms compete for business is referred to as market risk. - Credit risk (financial loss):

The risk that companies make when they give credit to clients is known as credit risk. It can also be used to describe the company’s overall credit risk with suppliers. - Operational risk (payments and processes):

It refers to the risks and uncertainties that a company faces when conducting day-to-day business operations in a certain sector or industry.

Challenges in managing risks

- Market risk:

Treasurers have improved their ability to manage specific risk areas. Many treasurers still find managing the complete spectrum of market risk difficult. It will be challenging for companies with an outdated market risk system to get real-time measurements and greater data availability. - Working capital management risk:

Working capital management is a challenge for all types of businesses, whether it’s due to risks associated with international trade or the need to compromise on payment terms in order to remain competitive. - Credit risk:

Businesses that use ERP software or manual techniques such as spreadsheets rather than specialized credit and collections technologies find it challenging to manage their credit risk. - Bank counterparty risk:

In recent years, managing bank credit risk has gotten difficult due to the increased incidence of credit score downgrades. As a result, there are fewer banks that match treasurers’ requirements, and establishing enough credit limits might be challenging. - Liquidity risk:

Treasurers have difficulty finding acceptable cash repositories to fit their liquidity needs. A liquidity crisis can arise when multiple financial institutions encounter a liquidity shortfall and start withdrawing their self-financed reserves or trying to sell assets to generate cash.

What is the process of a risk assessment in the treasury?

All firms must have a risk management process in place. Risk management does not have to be time-consuming or complicated to implement. The risk management process can be beneficial with formalization, structure, and a deep understanding of the company.

Risk management might need some time and financial effort, but it does not have to be significant to be effective. If implemented gradually over time, it is more likely to be used and sustained.

The most important thing is to have a fundamental awareness of the process before moving on with its implementation.

The following is a five-step risk management process that any organization can use.

- Identify potential risks

A company’s risks can be identified through- Expertise and internal history

- Consultation with industry experts

- External research

Because the risk situation is changing, this stage should be evaluated regularly.

- Measure frequency and severity

Many businesses use a heat map to assess their risk levels on this scale. A risk map is a visual representation of which risks are common and serious (but need more resources). This will help determine which have a minor influence and which have a huge impact. - Examine alternative solutions

A risk can usually be accepted, avoided, controlled, or transferred by an organization. Risk control can be divided into two categories:- Prevention (cutting the possibility of the risk occurring)

- Mitigation (lowering the impact of the risk if it does happen)

Risk transfer occurs when an organization purchases insurance and assigns responsibility for undesirable results to another entity.

- Decide which solution to use and implement it

After listing all realistic possible solutions, choose the one that is most likely to provide the desired results. Find the necessary resources, such as employees and finance, and secure the required buy-in.The plan will almost certainly need to be approved by senior management, and team members will need to be notified and educated if necessary. Also, create a clear procedure for implementing the solution across the organization and supporting individuals.

- Monitor results

Risk management is a continuous process, not a task that can be completed and abandoned. The process is regularly monitored because the organization, environment, and threats constantly change.

What are the factors that impact risk management decisions?

Risk management is detecting threats and creating strategies to reduce them. The identified risks are analyzed and prioritized. Only the most serious risks are addressed. Selecting the best choices for a certain risk management goal is risk management decision-making. The overall goal is to produce, protect, and improve value for shareholders by managing risks that affect the firm’s ability to achieve its goals.

Many conflicting variables and alternatives are present in risk management decision problems. Soft skills influence many aspects of decision-making. Risk managers are frequently forced to make high-stakes judgments based on unlimited data but limited time to manage it.

The uncertainty and unpredictability of the corporate environment increase the difficulty of risk management decision-making. In the world of finance, a similar problem exists. With several conflicting aspects in the situation, increased complexity requires financial decision-making to use multi-criteria decision making (Multi-criteria decision making is an operations research sub-discipline that analyzes many conflicting criteria in decision-making ).

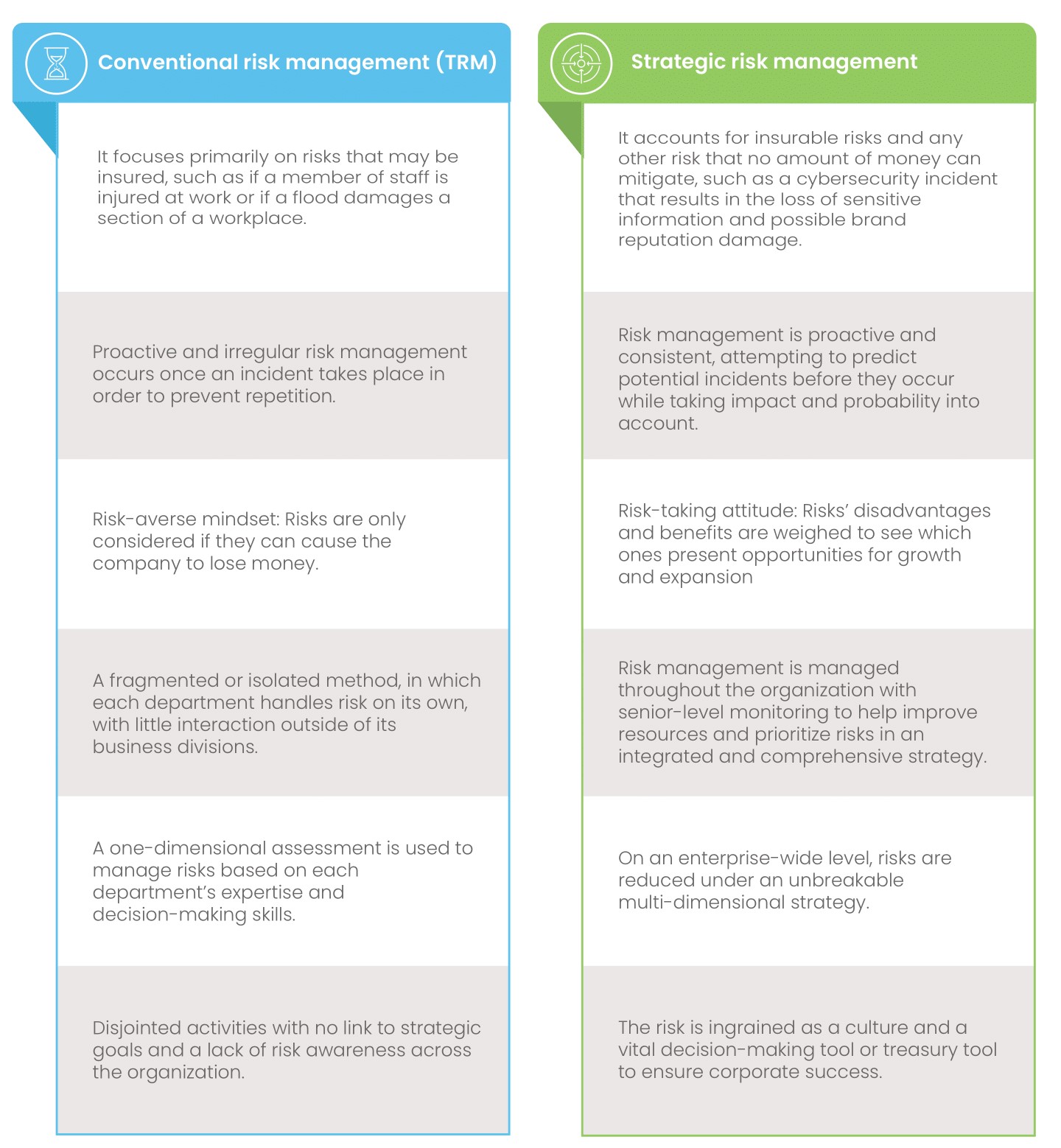

Conventional risk management vs. strategic risk management

Both approaches aim to reduce hazards to businesses. Both purchase insurance to cover a variety of hazards, including theft losses and cyber liability. Yet, experts claim that conventional risk management lacks the attitude and procedures.

Risk management is a collaborative, cross-functional, big-picture activity in an enterprise. An ERM team, which can be as small as five individuals, works with company business leaders and employees to review them. They help treasurers use the appropriate treasury tools to work through risks, gather relevant information, and deliver it to the firm’s executive leadership and management.

Conventional risk management vs. strategic risk management

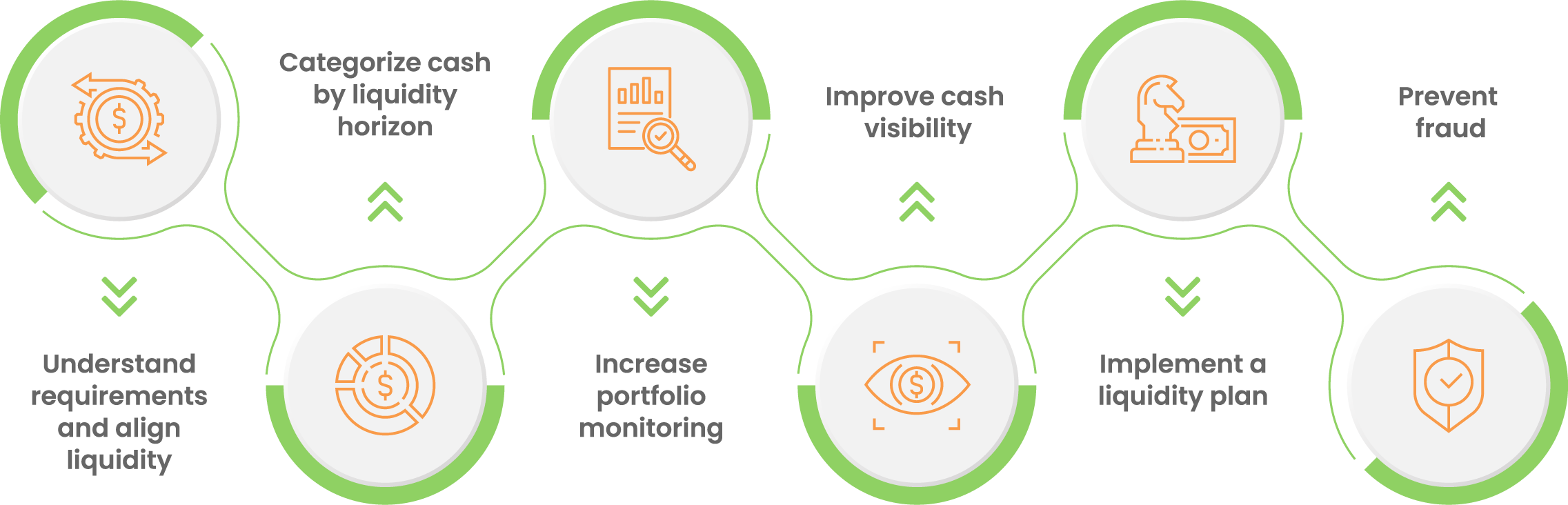

Best practices to prevent treasury risks

- Understand requirements and align liquidity:

Define the objectives for the cash portfolio, bearing in mind the general needs of security, liquidity, and return on investment.

To attain these objectives, separate various liquidity categories based on the business purpose. - Categorize cash by liquidity horizon:

Maturity fitting is an effective way to classify cash. In the current context, companies may not offer the same level of insight to match investments to the same time horizon when capital is needed. Liquidity portfolios need to incorporate an additional financial cushion to prepare for more significant uncertainty. - Increase portfolio monitoring:

The investment committee meets regularly to review portfolio layout and allocations because of cash flow projected liquidity needs. A monitoring and reporting component should be included in the investment policy to track the portfolio over the period and enable more regular reporting during periods of uncertainty. - Improve cash visibility:

Financial transparency is required to examine internal control systems and determine a company’s financial health. If the company does not have access to all financial data, it will be subject to unanticipated and disastrous events. - Implement a liquidity plan:

Creating a robust liquidity plan can help keep track of and control the cash flow. A business will be able to meet its financial obligations if there is enough cash on hand. - Prevent fraud:

While attempting to avoid fraud, it’s vital to understand what’s going on across the firm. A treasury and risk management solution can be quite valuable in preventing fraud. A treasury and risk management system can provide a company-wide view of:- All bank transactions and accounts

- Track payments and balances

Advantages of modern treasury management system for enterprises

The benefits of adopting treasury management tools software are as follows:

- Accessing cash flow data quickly

Businesses can track cash flows more rapidly due to streamlined and automated processes. With cash management software, real-time access to report data and account information is possible.Moreover, the drill-down features into entity-level data improve granular visibility. Teams can also access data without having to go through various spreadsheets and interfaces.

- Using idle cash for investments

Leaving money in a local account reduces returns and prevents the money from being used by the organization. This reduces the best use of available cash and increases the credit lines. The cash management cloud tracks surplus/idle cash and uses it for growth-related activities or investments. - Calculating the cash balances

To achieve their day-to-day tasks, businesses must maintain an ideal cash balance. The cash management system aids in the tracking of cash balances in- Intercompany accounts

- Multiple bank accounts

- Nations’ currencies and entities

It also helps in the automatic uploading of regular bank reports for more cash visibility and speedier reconciliation.

- Effectively improving borrowing

To cut financial stress and improve stability, businesses must constantly analyze cash flows. Cash management software aids in identifying the areas and periods when a cash shortage is expected. This enables treasury tools to plan ahead of time by cooperating with other departments. It helps in avoiding reactive actions that lead to overborrowing or penalties. - Improving fraud detection

Cash flow risk management includes:- Managing liquidity risks

- Interacting with cash

- Liquidity management

Businesses with little cash may experience significant liquidity shortages. To limit various treasury risks, automatic reconciliation using cash management software detects errors or fraud in transactions or payments.

- Improving efficiency

Across regions, automated data collection takes real-time data from multiple banks, ERPs, and TMS. The treasury team’s capacity is also optimized for high-value tasks like- Cash forecasting

- Risk management

- Cash management