Key Challenges in Check Processing

This e-book will walk you through the options for processing checks on the parameters of processing cost, check float reduction and resource requirement.

Key Challenges in Check Processing

Despite checks being the Achilles? heel for A/R departments, suppliers have no choice but to comply with the preferences of their buyers. The challenges with processing checks could be classified as follows:

Speed of Payment Processing

The major disadvantage for suppliers is that checks come with a float of approximately 3 days. This is also one of the reasons why check payment is favored by buyers. But then there are several external factors that come into play and further delay processing. The reason for slow processing could be attributed to scanning checks and remittances separately, depositing payments in banks and manually keying-in data for reconciliation. Together, this delays payment reconciliation by 3-5 days. This is the reason suppliers are reluctant to accept checks – payments hit the bank much later than the actual payment date and suppliers end up having to support longer credit terms than intended.

Processing Costs

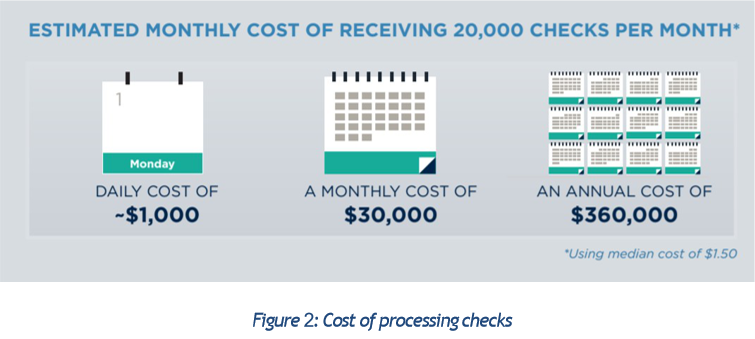

As per a survey by the Association for Financial Professionals, a company could end up spending as much as $30,000 for processing 20,000 checks a month.  According to the survey, receiving a paper check is 5 times as expensive as ACH For small and medium-sized businesses with low dollar value transactions, the cost of processing checks directly eats into the profit margin.

According to the survey, receiving a paper check is 5 times as expensive as ACH For small and medium-sized businesses with low dollar value transactions, the cost of processing checks directly eats into the profit margin.

Resources Requirement from Credit and Collection Effort

Processing checks are low-value manual work and do not add value to credit and collections. Being a highly manual process, it is also prone to errors. It is a double-whammy since check processing requires resources to be moved from credit and collections, without adding any value towards lowering DSO or working capital.