Five ways to make your cash flow projections more accurate.

Learn how to improve your cash flow projections to gain a better understanding of making better liquidity decisions.

Cash flow projections: Definition and advantages

What are cash flow projections?

Cash flow projections estimate the cash flows of your firm over a specific time. A forecast often covers the next 12 months, but it can also be for a shorter period of time, such as a week or month. A projected cash flow determines an organization’s future financial status. Hence, it is crucial for treasury for projecting cash flow.

Advantages of projecting cash flow:

Estimating future cash flow projections can improve a company’s performance. There are many advantages to forecasting financial flows, including the ability to:

- Prepare for cash difficulties: Cash flow projections are early indicators of a company’s liquidity. It forecasts different scenarios to plan ahead for liquidity crises by manual override and time series model. Projected cash flows provide companies with the vision to apply corrective actions.

- Fine-tuning payment and collection methods

- Selling assets

- Approaching creditors for loans

- Use cash surplus: Businesses rarely benefit from having a large amount of idle cash. Projection can help in identifying possible surpluses and allowing cash managers to properly utilize excess funds. Organizations must use surplus cash to meet that goal, whether they invest or use it to build a competitive advantage. Scenario planning can help project the impact of specific investments or decisions as firms look to deploy spare capital.

- Manage FX risk: Foreign exchange risk is the chance that a company loses money due to currency changes in foreign financial transactions. When a corporation engages in financial transactions denominated in a currency other than the currency in which it is based, it is exposed to foreign exchange risk. FX risk can also affect investors. Projecting cash flows helps to spot the FX risks and leverage effective hedging strategies to mitigate them.

- Informed decision making: Treasurers can make data-driven, confident, and fast decisions for managing assets, enhancing funding, managing risks, and improving overall company treasury management through real-time forecasting, continuous data access, and precise insights.

The corrective actions could be :

By incorporating changes into the projections and examining the impact of each scenario on the cash flows, scenario analysis is improved. The ability to make regular projections also helps in the detection of trends and patterns.

Challenges in cash flow projections

Finance professionals have limited access to real-time data. They also need to track cash flows from several data sources. Cash flow analysis is a time-consuming, manual process that is error-prone. These process inefficiencies result in:

- Inaccurate data

- Lack of cash visibility

- Reduction in leadership’s capacity to make timely decisions

The following are the three main reasons behind this:

- Outdated systems: Most treasurers continue to rely on spreadsheets for forecasting. This process is time-consuming and manual. Some businesses build their own cash flow forecasting tools from scratch. But, this necessitates a significant investment in IT resources. TMS is also expensive and doesn’t provide much ROI to the treasury. Also, it requires proper training for the workforce. These tools are laborious and don’t allow teams to focus on strategic tasks.

- Different financial sources: Enterprises gather information from a variety of sources such as:

- ERPs

- TMS

- Bank portals

- FP&A, Payroll, A/R, and A/P teams

- Improper modeling: Calculated variance is usually high due to a lack of appropriate models or the use of an ineffective algorithm. Since suitable models are not used for different cash flow categories, the forecasts are usually inaccurate. Also, due to the use of manual modeling, the bandwidth left to make improvements or increase the frequency of variance analysis is low.

This procedure can cause delays in forecasting and reporting. Hence, treasurers don’t have much time to improve the forecasts. They also can’t make time-sensitive decisions.

Five ways to make cash flow projections more accurate

Here are five ways to help your company bring greater precision to the process:

- Determine the duration of forecasts: Companies must create forecasts based on their requirements. For example, a company with positive cash flow may focus on business expansion. So, they need to forecast for the long-term to invest early for greater returns. But a cash deficit firm’s focus would be debt management. So, cash deficit companies need to forecast daily or weekly to ensure they have enough working capital.

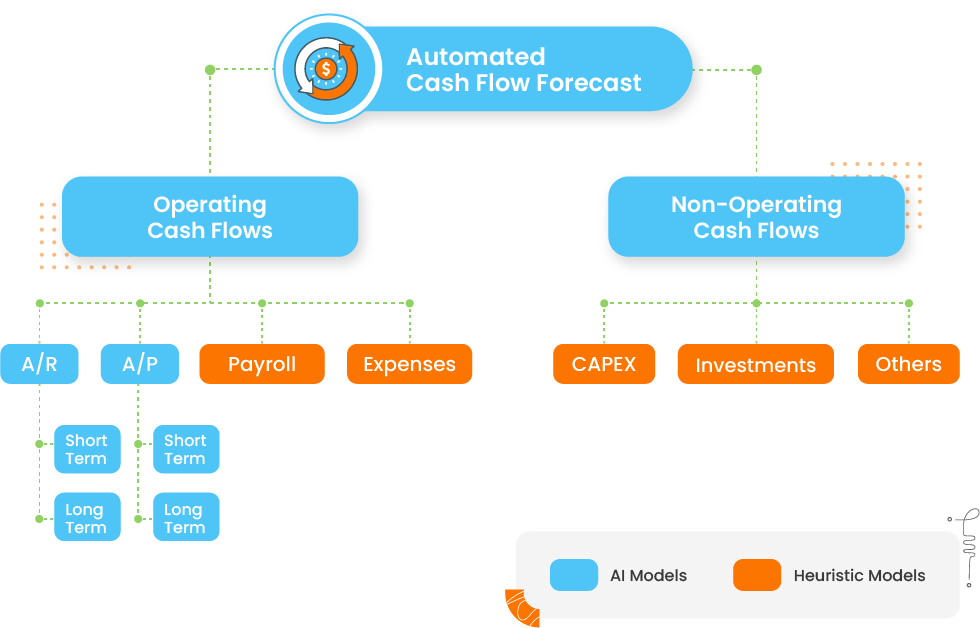

- Accurate data modeling: Different models should be used for suitable cash flow categories. For example, heuristic models should be used for Payroll, Expenses, CAPEX, Investment and Debt, etc. On the other hand, AI models should be used for hard-to-forecast categories like A/R and A/P. This helps to improve the accuracy of the cash forecasts.

- Add scenarios in forecasts: An AI cash flow forecasting software assists treasury in improving scenario analysis to avoid cash shortages since it provides the foresight to track current and potential cash shortages. It can assist companies in making better decisions by examining the risks and rewards of various options through accurate stress testing of best and worst-case scenarios.

- Automate all the processes: Automated cash flow forecasts provide a better picture of cash projection on a daily basis. Treasurers can better manage liquidity and borrow in advance at reduced interest rates. Easy connectivity by API/sFTP and dashboards lead to quick and continuous data access. This helps to improve and quicken the decision-making process.

- Identify and reduce variances: Variance analysis identifies deviations between the forecasts and actuals. Treasurers should identify the variance sources and track variances for different durations. Companies should perform variance analysis on a weekly basis to reduce variances. This helps in building the accuracy of cash forecasts by tweaking some changes in the forecasts.

Organizations are trying to limit the impact of economic fluctuations and make timely decisions. Hence, the demand to improve cash projection has intensified. Schedule a demo with us to get your hands on the best-in-class cash projection to increase the accuracy.