B2B Accounts Receivable Optimization: Maximizing Impact Beyond ERP with Microsoft Dynamics

- The current state of AR for mid-market businesses

- How to optimize Microsoft Dynamics to meet AR challenges

- Invoice-to-cash apps and their key features

- What to look for when selecting AR software

Introduction

Customers and cash are the lifeblood to businesses. Your cash grows when customers pay fully, on time and this, in turn, contributes to the growth of your company.

Managing cash flow is the chief responsibility of your accounts receivable (part of the finance function) team. They often run the risk of alienating customers by being overly aggressive in their pursuit of accounts receivables.

Balancing collections with a customer-centric approach is essential to keep customers happy and cash flow healthy. Software tools help create a healthy balance between process automation, customer delinquency prediction, and invoice collections prioritization based on predefined parameters, including the amount due and the financial health of the customer.

According to Kevin Permenter, research manager at IDC, “businesses of all sizes have turned their focus toward cash management and working capital. As a result, accounts receivable (AR) software, especially SaaS software, has been highlighted as a place to get a quick return from digital transformation efforts.”

In this article, we look at the various methods businesses adopt to improve AR efficiency. We also discuss how ERP software like Microsoft Dynamics provide a starting point for AR automation but needs to be extended with niche AR solutions to achieve faster processing speed and boost collections.

The Current State of AR for Mid-Market Businesses

1.1 AR function as a strategic business partner

Today, the AR team has transformed from being a desk that handles invoices and receipts to a strategic partner that helps make key business decisions. The AR team’s fund forecasting models and insights into cash flow positions help the leadership team make critical decisions around mergers & acquisitions, capital expenditure, and geographic expansion.

Technology plays a pivotal role in the transformation of AR teams. AR managers and executives no longer have to spend hours matching invoices or applying cash manually. OCR engines, web-parsers, and other automated remittance capturing software save the AR team much time and effort.

AR automation software improves efficiency by reducing errors and supporting decision-making through features such as collections worklist prioritization, aging analysis, and credit risk management.

While enterprise organizations have been the front-runners in adopting AR technology, midsize businesses too have been aggressively pursuing AR solutions to manage cash flows and stay ahead of competitors. AR teams at midmarket companies increasingly look to automation to help them free up cash locked in aging invoices. The pandemic has further accelerated the need to optimize paper-intensive AR tasks given the remote work conditions and lockdowns experienced across the globe.

But, only a limited number of companies can boast of fully automated AR workflows. According to a research survey, only 11% of businesses claim their AR processes are fully automated while 60% say that they use a mix of automation and manual efforts to manage receivables. 24% of the businesses continue to depend on manual processes for AR tasks such as payment collections, receivables management, and cash reconciliation.

As a result, there is a large scope to improve the AR functions in small and midmarket businesses (SMBs). Automating AR can help reduce costs and improve the payment processing speed. A study by PYMNTS reveals that U.S. suppliers face $3.1 trillion accounts receivable problems. 66% of SMBs in the US face frequent cash shortfalls. Without the cash reserves and credit lines that large enterprises enjoy, SMBs are likely to face higher risks of closure if the AR problem aggravates.

1.2 Inefficiencies in manual AR processes

If your finance team hasn’t migrated to an automated AR system yet, you could lose time due to invoicing and reconciliation errors.

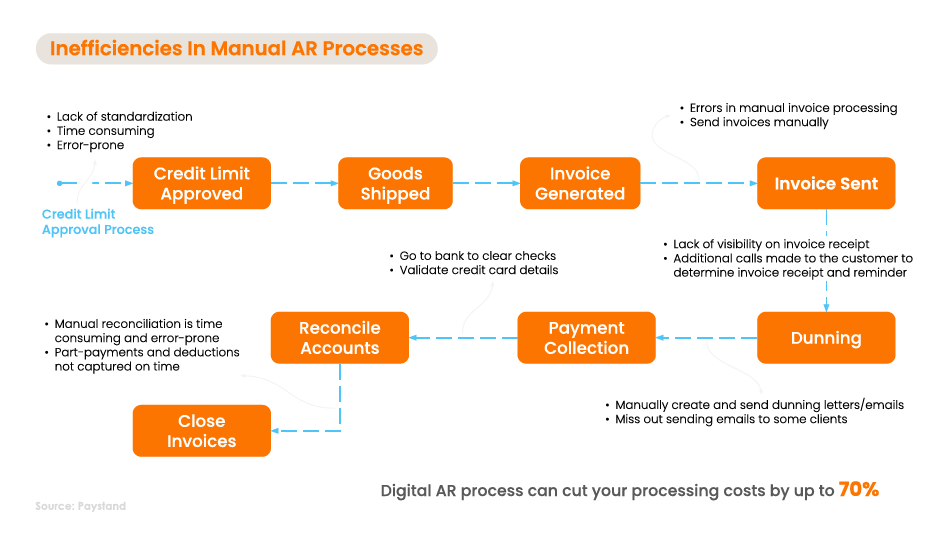

Let’s take a look at the inefficiencies in a typical manual AR function in the below flowchart. The red dotted lines in the flowchart indicate manual processes and what’s likely to go wrong.

For example, in manual or semi-automated AR processes, once you have invoices in your accounting system, you’ll either have to email those invoices or mail them in envelopes to your clients. This makes it difficult for you to track if the client has received the invoice.

You need to manually check this by calling the client. A few days down the line, you’ll need to call the client again to remind them of the payment due dates. More calls are needed to persuade them to pay and to validate their payments. This increases your expenses and reduces efficiency.

You may be able to relate to at least some of the challenges discussed in the graphic above. Automating the steps in your AR process helps improve efficiency and cuts costs by up to 70%.

1.3 ERP software, accounting systems, and Excel for AR management

Many companies continue to use spreadsheets or manual methods to manage their accounts receivables. 69% of small businesses rely on Excel to track invoices and expenses. This not only leads to errors but also doesn’t help your business scale up.

ERP software is another tool that many SMBs invest in to optimize their AR workflows. 48% of SMBs in the B2B sector say they rely on the limited functionality in accounting or ERP systems to manage credit and collections.

ERP systems offer basic features to help you digitize invoices, track outstanding amounts, create AR reports, apply cash, and close invoices. While this helps to some extent, it may not prove entirely helpful. Due to the limited AR functionalities that ERP has, you would be forced to supplement it with manual efforts or coding scripts that further complicate the system.

Before we look at the shortfalls in an ERP’s AR, here’s a quick snapshot of the key stats that capture the current state of AR in mid-market businesses.

ERP systems offer basic features to help you digitize invoices, track outstanding amounts, create AR reports, apply cash, and close invoices. While this helps to some extent, it may not prove entirely helpful. Due to the limited AR functionalities that ERP has, you would be forced to supplement it with manual efforts or coding scripts that further complicate the system.

Before we look at the shortfalls in an ERP’s AR, here’s a quick snapshot of the key stats that capture the current state of AR in mid-market businesses.

The current state of AR in mid-market businesses: A snapshot

U.S. suppliers face a $3.1 trillion accounts receivable problem, with 66% of the U.S. SMBs facing frequent cash shortfalls

48% of the SMBs in the B2B sector depend on ERP or accounting systems to manage credit and collections

87% of firms that automate AR functions have achieved faster processing speed; 79% of them have improved team efficiency and 72% have saved operational costs

How to Optimize ERP for AR Challenges: A Look at Microsoft Dynamics

Enterprise resource planning (ERP) software solutions like Microsoft Dynamics offer multiple modules to support different functions such as CRM, sales, finance, and production. Tight integration between the modules helps the management team get access to company-wide data from a centralized location.

While MS Dynamics offers many functionalities and enables you to store and analyze your financial data, it may not cover all aspects of working capital management and cash flows.

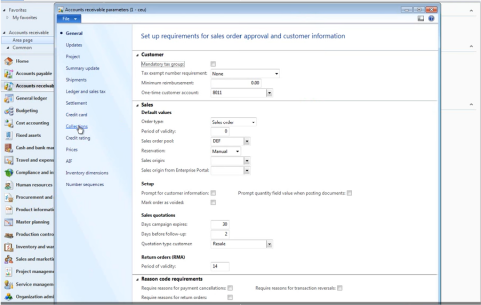

While ERP solutions from the Microsoft family have significant finance & accounting capabilities, the functionalities are often not sufficient to meet all your accounts receivables needs. For instance, while the ERP helps digitize invoices and make journal entries, it has limited capabilities for specific AR processes such as credit risk management and payment processing.

Fig. Collections management workflow in Microsoft Dynamics (Source)

Here are five accounts receivable activities that you can optimize within ERP to free up cash and strengthen your working capital.

1. Payment processing: It is essential to provide your customers with multiple payment options to enable quick and easy payments. If you don’t offer customers their preferred payment methods, you’re likely to have a higher days sales outstanding (DSO) due to delayed payments. The integration of the payment system and accounting system is also vital to avoid double efforts.

You need to invest in payment connectors and third-party support for point-of-sale (POS) systems and payment processing to enhance the efficiency of Microsoft Dynamics. You also need to set up separate workflows for processing credit card payments, wireless transfers, etc., making it tedious and expensive for fast-growing mid-market companies.

2. Collections management: Microsoft Dynamics lets you create collections pages to track your open accounts and also offers customer aging snapshots. But it lacks advanced features to help collection agents prioritize worklists using AI-based algorithms. Manual efforts are also required to complete dunning processes.

3. Cash application and reconciliation: Reconciliation matching rules in Microsoft Dynamics help you match your bank entries with those in your ledger. But it has limitations in ensuring straight-through, same-day cash application for other payment modes such as lockboxes, e-wallets, etc. Matching incomplete or part-payments is also difficult with the ERP.

4. Customer credit approval: Standardized credit approval processes enable credit teams to make accurate credit decisions and onboard customers faster. It also ensures that important credit decisions are approved through the right hierarchy. Automating the approval process helps plug loopholes and save time. It ensures that sales teams do not change credit terms without pre-approval. Proper credit approvals are important for healthy credit risk management.

5. Credit risk management: Managing customer risk is crucial to AR. You do not want to offer a customer a large credit, only to find the business going bankrupt a few weeks later. While Microsoft Dynamics offers features to update credit attributes of customers and create scoring groups, many of the steps involved require manual intervention. The tool also doesn’t offer strong AI capabilities to power predictive risk management models.

ERPs like Microsoft Dynamics help digitize some aspects of the AR process, but you may have to put in additional manual efforts to ensure their successful completion.

Microsoft Dynamics offers basic or standard versions of most finance workflows. But customizing the available features to meet your specific demands is not easy and requires coding support. You either need to take your IT team’s help or pay external consultants for it. This delays processes, complicates the usage, and increases expenses.

With so many bells and whistles, Microsoft Dynamics can feel overwhelming. This often leads to errors, delays, and the absence of uniform practices. These limitations arise because the primary focus of ERPs like Microsoft Dynamics is to unify your workflows for smooth operations and not to augment them.

With so many bells and whistles, Microsoft Dynamics can feel overwhelming. This often leads to errors, delays, and the absence of uniform practices. These limitations arise because the primary focus of ERPs like Microsoft Dynamics is to unify your workflows for smooth operations and not to augment them.

Enhance Microsoft Dynamics with Invoice-to-Cash Apps

One big advantage that ERP software including MS Dynamics offers is the ability to integrate with various types of out-of-the-box (OOB) or third-party software. This helps extend the functionality of the ERP and improve customer satisfaction.

Connecting Microsoft Dynamics ERP with third-party best-in-class AR automation software helps fill in the gaps and optimizes the ERP for the AR function.

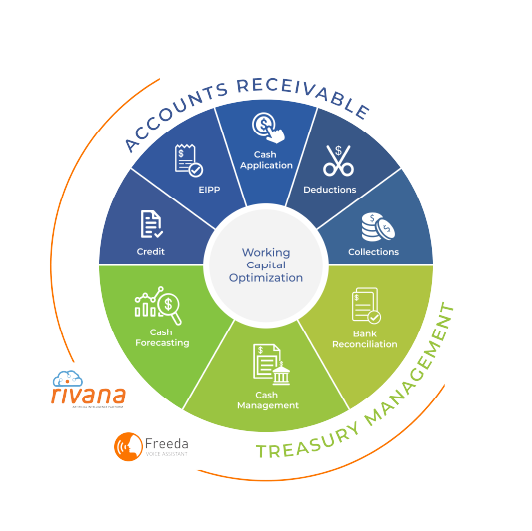

AR is only one of the many aspects that your finance team works on. But it plays a crucial role in your business’s success because it manages the cash assets owed to your company. Any inefficiency in your AR processes affects working capital availability and your company operations.

3.1 Key functionalities needed in out-of-the-box AR solutions

When extending Microsoft Dynamics’s AR capabilities with out-of-the-box integrations, you must be careful to choose the right solution. Here’s a list of functionalities that you must look out for in your AR solution:

- Invoice Delivery and Tracking

- Automated Dunning

- Collector’s Worklist

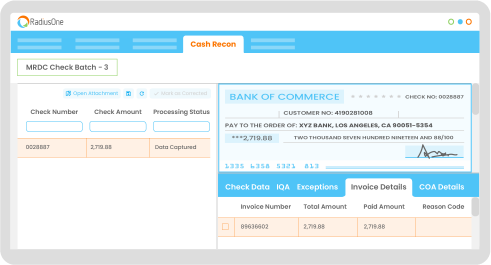

- Automated Cash Reconciliation

- Deductions and Dispute Management

- Online Credit Application Forms

- Credit Scoring Models

- AR Analytics

- VoIP Calling

- Multiple Payment Options

Fig. Automated remittance capture in RadiusOne AR Suite

Other good-to-have features to consider are:

to delay receiving payments from clients or risk damaging customer relationships due to unavailability of customers’ preferred payment options.

Fig. Multiple payment options supported in EIPP Cloud

3.2 Other things to look for when selecting an AR software

In addition to the functionalities in the OOB accounts receivable software, you must also consider the following factors when shortlisting AR solutions.

The Promise Of ROI: How HighRadius Supports High-Growth Companies

Digital transformation has taken the economy by storm this year, and we are now seeing this trickle down to companies’ accounting and finance departments. Nearly 93% of CFOs at US firms with at least $25 million in revenue are currently transforming their accounting operations with automation.

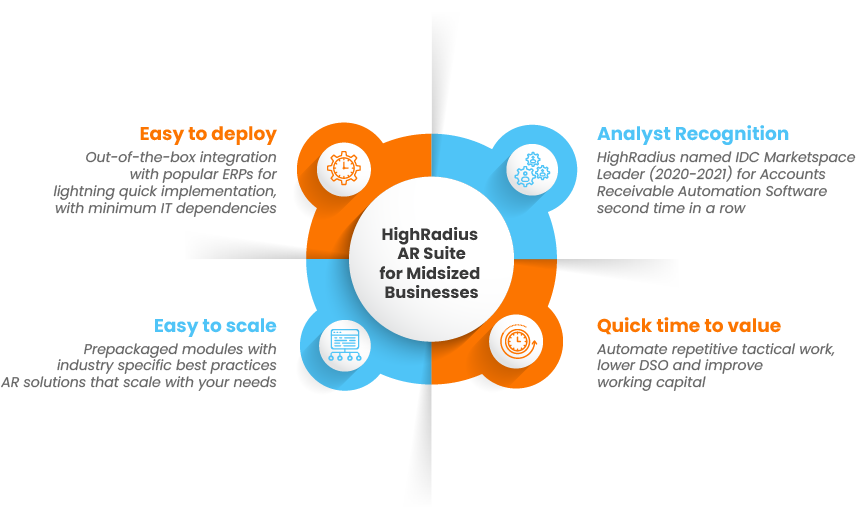

HighRadius is a leading fintech company focused on optimizing order-to-cash processes and treasury operations by leveraging automation across credit, electronic billing, payment processing, cash application, deductions, and collections, powered by AI and integrated receivables platform for major companies globally. With lightning-fast remote deployment, minimal IT dependency, and prepackaged modules with industry best practices, HighRadius is the ultimate choice for your company’s order-to-cash processes.

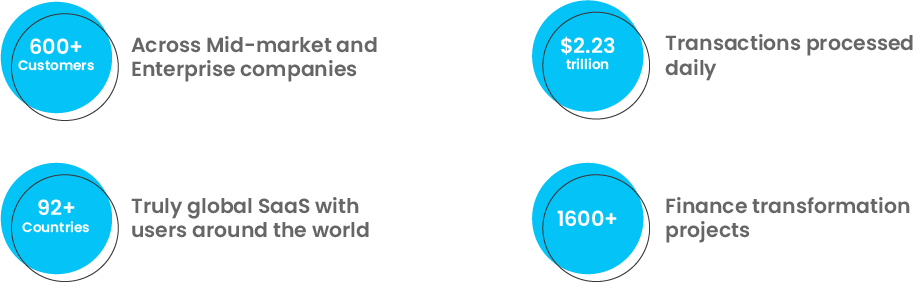

HighRadius by Numbers

Trusted by Leading Mid-sized Businesses

AR automation for hundreds of other clients who use the same ERP software as you do.

Let your receivables run on auto-pilot so that your finance teams can focus on what matters most to your business. Check our website to learn more about us.

If you want to talk to somebody in person and learn more about our products, schedule a time here and we’ll connect with you.