Moving Beyond Spreadsheets for Cash Forecasting

An actionable summary that examines the challenges of manual cash forecasting with excel and how Artificial Intelligence enables better decision making.

Cash Forecasting is the Top Priority for Treasurers

According to PwC’s 2019 Global Treasury Benchmarking Survey, cash forecasting has been the highest priority for treasurers for the last three years. Cash is often regarded as the lifeblood of an organization as it enables the proper functioning of a company. However, when it comes to forecasting cash, most companies are lagging behind primarily because of manual processes posing operational challenges.

The HighRadius 2019 Cash Forecasting Survey revealed that 91% of organizations still rely on spreadsheets for cash forecasting. However, excel-based forecasting continues to bog down treasury professionals with its complex functions.

“We’ve always done it that way” is a common excuse that one encounters.

Day in the Life of a Treasury Professional

Performing manual cash forecasting

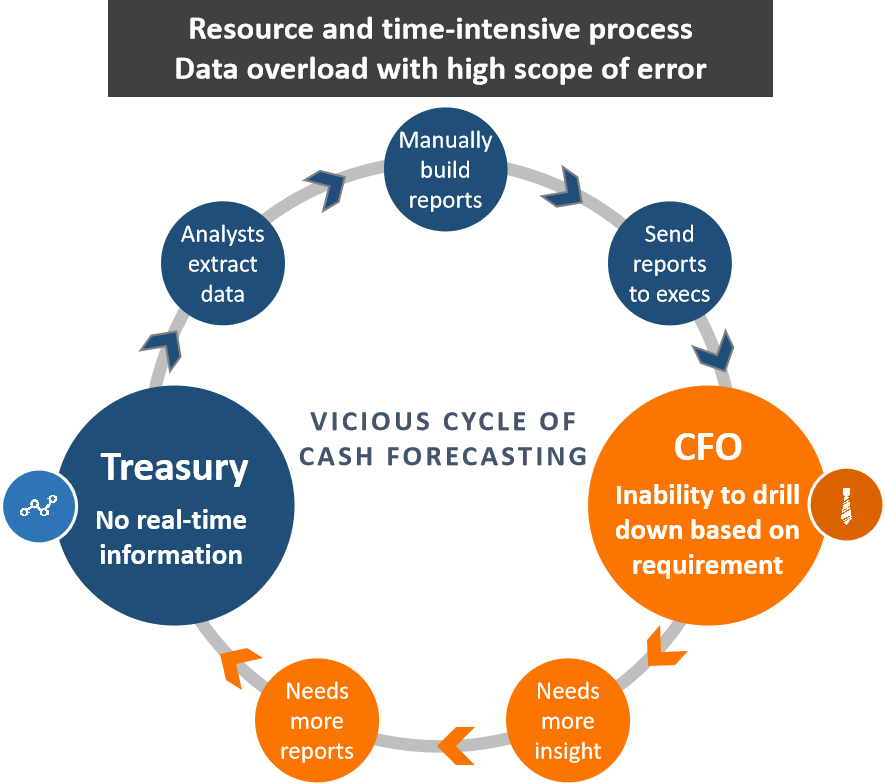

Treasurers consider manual Cash Forecasting their biggest challenge because:

- Excel based processes are inefficient and error-prone

- Hard to collaborate across departments

- Hard to get data from different sources (ERP, Banks)

- Absence of regular variance analysis to analyze/improve process

- Hard to know individual department-level forecasts

- Lack of confidence in forecast beyond a one or two week duration

The Vicious Cycle of Excel-Based Cash Forecasting

Get Rid of this Cash Forecasting Dilemma

Even in large enterprises, treasury teams are often small in size and overburdened. Automating a particularly time-consuming part of their daily routine can free them up to focus on more strategic work that brings value to the business.

In today’s blink-and-you’ll-miss it, data-heavy business landscape, data silos act as bottlenecks for making swift decisions. Adopting AI-enabled technology empowers treasury teams to evolve from a purely operational role to a strategic role, spending less time on extracting data and more time on providing insightful, trusted foresight that enables the CFO to plan for what’s next.

AI-enabled Cash Forecasting

Day in the Life of a Treasury Professional

with AI-enabled cash forecasting

The role of treasurers is to make short and long-term decisions, even from manual

forecasts. Here are the benefits that AI-enabled cash forecasting bring to them:

- Automating highly manual, low-value and error-prone tasks

- Accuracy based on real, historical data

- Increased confidence in decision making (both short and long-term)

- Flexibility and ease to do ‘what-if’ scenarios/modeling.

Summary

Cash Forecasting is the top Priority for Treasurers

91% of Organizations still Rely on Spreadsheets for Cash Forecasting

Manual Cash Forecasting Involves:

- Data Gathering

- Collaboration with Teams

- Consolidation

- Variance Justification

- Report Sharing

Spreadsheet-Based Reports are Inherently “ DEAD ON ARRIVAL” When they reach the Treasurer or CFO

Automation Allows Treasury Teams to Focus on Strategic Tasks

AI-Enabled Cash Forecasting Enables Treasury Teams to

- Use Technology to Gather and Consolidate Data

- Have Increased Confidence

- Make Short-term Decisions

- Make Long-term Decisions

Start Leveraging AI-Powered Cash Forecasting Cloud Today

Request a demo with one of our AI consultants

Visit highradius.com/treasury for free demo

- Higher forecasting accuracy with AI replacing spreadsheet formulas

- Fully automated cash forecasting with daily updates

- Accurate 1 to 12-month cash forecasts for optimized long term investment and funding

decisions