Payment Service Directive(PSD2)

An actionable summary of how European Union Regulations impact the working capital, and how an organisation should plan its next steps to drive the regulation.

Payment Service Directive(PSD2)

Directive #2:

Payment Service Directive (PSD2)

What is Payment Service Directive (PSD2)?

The second Payment Services Directive (PSD2) is a significant step in the commoditization of Europe banking sector that focuses on improving the security, innovation, and market competition. This key aspects of this directive includes: Extension of regulated transactions: Scope of regulated transaction has extended towards any currency transactions as well as towards One-leg transactions Stricter customer authentication: Payment Service Provider (PSP) obliged to ensure a stricter customer authentication whenever they access their payment account by verifying customer biometric, PIN or security question as well as a hardware token or phone. Internal dispute resolution: Execution and application of adequate and effective complaint resolution procedures, and also stressing out maximum time for processing customer complaints. Payment initiation services: Regulation of payment initiation service providers (PISPs)† to provide secure communication, inform PISPs about payment initiation, and treat all initiated payments equally. Account information services: Access to the user?s account to the third party providers for secure account information aggregation services.

What it means for your OTC team?

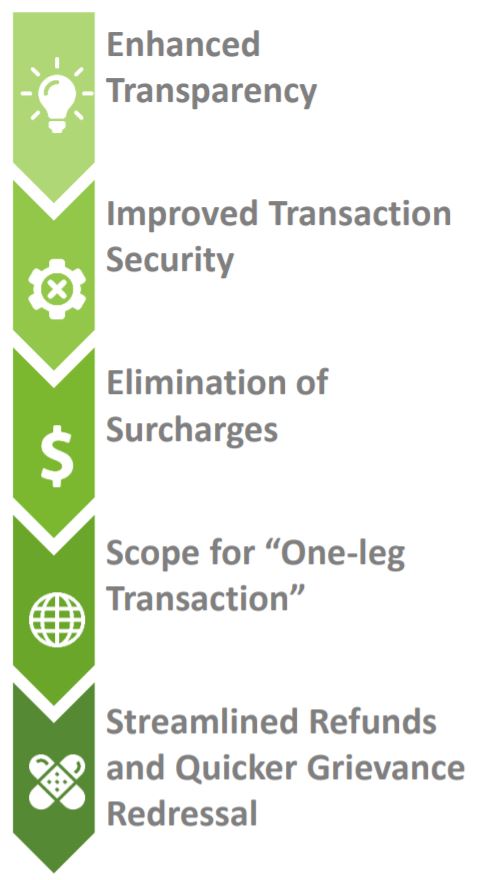

Simplifying through the multitude of jargons, the PSD2 directive would contribute in a seamless payment processing with an additional component of security. Here is why customers would want to adopt the electronic payment because of PSD2:

- Look for a PSD2 compliant portal.

- Increase the security measures of customer authentication.

- Ensure compatibility with Account Information Service provider.