Improve your Accounts Receivables with Sage Intacct & RadiusOne

This e-book outlines key Accounts Receivables (AR) concerns in mid-sized businesses and reviews the areas of improvement. Understand the benefits of using adaptive AR automation solutions with easy integration and fast deployment for improving the overall time-to-value. Understand how RadiusOne AR Suite built for Sage Intacct can empower finance executives to set their AR priorities straight for achieving high ROI with a faster time-to-cash.

Executive Summary

1.1 It’s Time to Prioritize Receivables

The ever-changing climate of business has prompted mid-sized businesses to look for dedicated technology offerings that can help in reducing the burden of outstanding receivables and ensure business growth and continuity. With long and rather intensive AR processes, mid-sized businesses often steer away from focusing on improving their core competencies as they operate with limited resources and cash shortages.

The introduction of automated AR solutions continues to disrupt the traditional practices for mid-sized and large businesses alike. But the major concern is that businesses looking to easily integrate Sage Intacct with automated AR solutions don’t really have a lot of choices. As a Sage Intacct customer, would you say you have the freedom to choose and implement cloud-based applications without having to worry about the concerns of overhead costs or IT infrastructure requirements? Adopting a sustainable AR automation solution that can easily integrate with Enterprise Resource Planning (ERP) systems such as Sage Intacct could be the key towards maximizing business revenue and minimizing Days Sales Outstanding (DSO) with improved management, monitoring, and control of critical AR processes.

In this ebook, we will be reviewing the key AR concerns in mid-sized businesses and review the areas of improvement. Dive in to understand how adaptive automation solutions like RadiusOne AR Suite built for Sage Intacct – ensures efficient integration that improves overall time-to-value. Custom built for hyper-growth mid-market companies with deployment timelines as low as 4 weeks, it ensures ease of integration while providing improved performance and productivity. Designed as an AI-powered solution, learn how the solution is fit-for-purpose for Sage Intacct users to enable real-time execution of AR operations from a unified platform, improving efficiency and accuracy of cash application, cash collection, invoicing, and payment processing.

Reviewing Receivables Health

Most mid-sized companies are plagued with limited or no visibility into their end-to-end AR processes that result in operational inefficiencies. For example, day-to-day operations are affected by paper-based processes with high overhead costs and excel-based processes that are time-consuming and error-prone.

On top of that, most of the FTEs in mid-market companies are involved in handling multiple processes simultaneously. An analyst might be tasked with handling both Credit and Collections processes or a single role may be involved in handling both AR and AP processes. Poor receivables health is a major obstacle that leads to a volatile cash flow position. Let’s look at the key areas of concerns leading to bad AR health:

2.1 Key Areas of Concern

-

Manual paper-based system

-

Lack of visibility

-

Lack of standardized credit policies

-

Compliance and governance issues

-

Transparency issues

-

Manual dunning

-

Organizational silos

-

Long and expensive integrations

Circling the same song on a different day, finance teams are all too familiar with manual, paper-based systems that come with high labor and transaction costs. On top of being time-consuming, these manual systems come with concerns of being inaccurate, incorrect, and reduce the overall time-to-cash. In the absence of a centralized control system, finance teams constantly struggle to get their hands on accurate and timely financial reports.

With multiple sources of data in different formats, finance teams do not have clear visibility into transaction details and customer history that is stored in the backend of the ERP systems. The domino effect in the absence of visibility leads to bottlenecks in day-to-day operations for payment processing and dispute management leading to an increase in bad-debt write-offs.

The overall time-to-cash is critically affected in the absence of standardization. In most mid-sized businesses, sales teams often extend credit limits without validating or assessing the creditworthiness of that account. Subjective credit evaluation of the customer account puts businesses at risk to increased cash flow problems as customers fail to pay in time. Furthermore, finance teams have no visibility into the credit limit evaluation history for any particular account. In the absence of clear credit policies and guidelines, the credit scoring model is largely affected leading to increased bad-debt. Today’s customers want flexible payment terms in the post-covid economy as they prefer the flexibility to pay according to the terms set. It is vital for companies to implement structured credit policies and procedures to ensure that their customers do pay on time.

The primary threat to business revenue can be risky customers who don’t pay invoices on time as well as external threats such as fraud attempts including phishing and whaling. Mid-sized businesses often ignore adhering to compliance guidelines when it comes to payments. According to a study by BullGuard, 43% SMBs have no cybersecurity defense plan in place. Not meeting compliance requirements such as the Sarbanes-Oxley Act (SOX) increases the probability of businesses facing cyber-attacks, security breaches, and the risk of sensitive data in the wrong hands.

The handling of high-volume invoices using outdated, manual, and paper-based methods makes it difficult for finance teams to keep track of everything. This results in increased payment delays while affecting the overall cash flow. In the absence of a streamlined process to keep track of essential customer information, transaction details, and documentation – companies struggle to maintain transparency which leads to backorders, delays, and increased bad-debt.

When it comes to handling collections, manual dunning can be very hectic and time-consuming, especially in the absence of a prioritized worklist to keep track of customer accounts. This results in decreased efficiency and performance on the collector’s side due to poor oversight on critical at-risk accounts leading to a longer recovery timeline. According to Pymnts, 14.7% of B2B receivables are overdue on average.

Companies may lack access to real-time data required for the smooth functioning of order-to-cash processes. There is a large disconnect between inter-departmental teams to stay updated with the latest information regarding customer data, transactional details, and approval hierarchies. This leads to expensive errors affecting the overall revenue stream while delaying the time-to-cash.

At times, businesses steer away from opting for a new solution due to the time-consuming, expensive, and largely complex implementation timeline. The new solution may require intervention from the company’s IT department to properly integrate with the system.

To understand the key areas of improvement, here’s a short checklist for you to assess your AR health.

An Ideal Partnership: RadiusOne AR Suite and Sage Intacct

3.1 Closing the Automation Gap with Adaptive Integration

While there is a sea full of automated AR solutions in the market, Sage Intacct customers have limited options of scalable and adaptive integrated cloud solutions. There’s a dire need for mid-sized businesses to opt for a solution that employs industry-specific best practices and strategies to save essential revenue and maximize working capital by enabling faster cash conversion.

Designed to automate and fast-track key receivables functions – RadiusOne AR ensures easy integration with Sage Intacct with lighting-fast remote deployment and minimal IT dependency. With robust and flexible integration support for Sage Intacct, the solution aims at streamlining AR processes while successfully eliminating hours of manual and paper-based workload and enabling improved visibility, control, and efficiency.

3.2 Building the Perfect AR with RadiusOne AR Suite and Sage Intacct

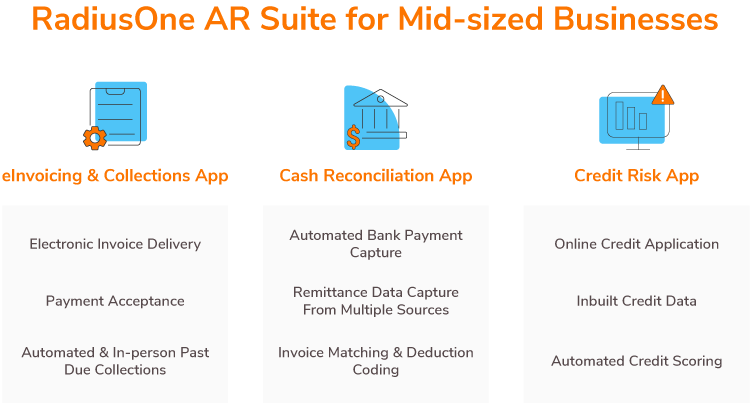

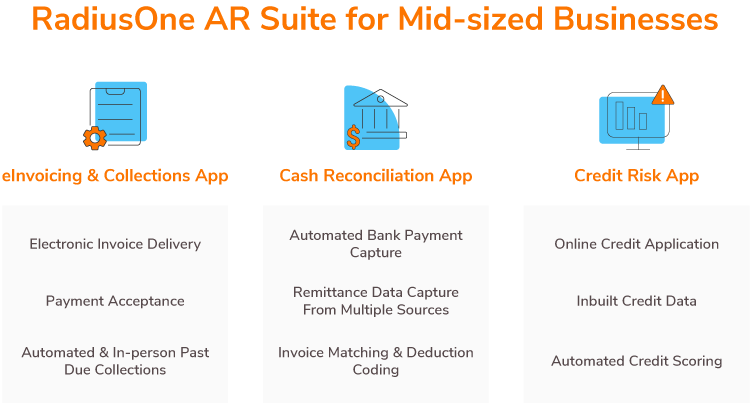

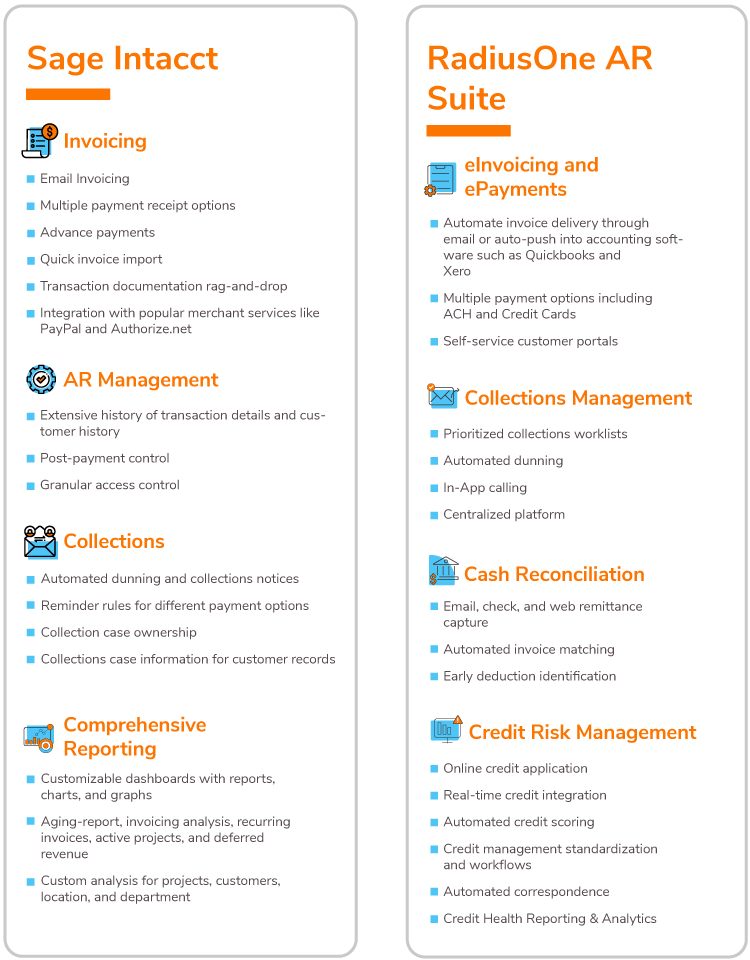

3.3 RadiusOne AR Suite Feature Set

1. eInvoicing & Collections App: RadiusOne AR eInvoicing & Collections App enables improved collector efficiency, minimized bad debt write-offs, reduced DSO, low-cost invoicing, and payments via ACH and credit cards.

a. Collector Dashboard – Prioritized Collections Worklist: Prioritize collector worklists with pre-loaded collections strategies based on industry best practices, tailor-made for mid-market companies. Enable configurable collector dashboards with auto-recommend account-level actions.

b. Automated Dunning: Via email with easy-to-create correspondence templates. Send and track en masse collections correspondence to scale collections outreach.

c. Native VOIP Calling: Enable your collectors to call directly via the app with CTI (computer telephony integration) and centralized access to collaboration history, avoiding the hassle to collect account details and previous correspondence.

d. Faster, Frictionless e-Payments: Enable ‘Pay Now’ option embedded in dunning emails to get paid faster- no registration, no sign-in; guide customers to a guest payment page and make payments in their preferred format including ACH and credit cards just a few clicks.

e. Invoicing Across Emails and Customer Portals: Automate the delivery of invoices and account statements through email or push the information into popular SMB A/P software including Quickbooks and Xero.

f. Self-Service Customer Portal: Enable customers to access and manage their invoices and account statements, create disputes, and make payments in multiple formats including ACH and credit cards through a single self-administered portal.

2. Cash Reconciliation App: RadiusOne AR Cash Reconciliation App enables automated cash reconciliation across diverse payment and remittance sources and formats including emails and web portals, with automated invoice matching and dispute identification.

a. Email Remittance Capture: Pull remittance details from emails and email attachments using AI-enabled technology to ensure accurate data capture across all remittance file formats and languages.

b. Check Remittance Capture: Auto capture remittance from check stubs with template-agnostic technology.

c. Web Remittance Capture: Web robots to log in, navigate, and capture remittance information from customer portals and popular Accounts Payable networks with the help of Robotic Process Automation.

d. Invoice Matching: Enable automated customer identification and invoice matching.

e. Deduction Identification: Identify deductions at the source based on short-payments or over-payments to enable early resolution and faster recovery.

3. Credit Risk App: RadiusOne AR Credit Risk Management App enables automated credit risk evaluation and credit scoring to standardize the credit approval process and enables credit teams to make faster and more accurate credit decisions.

a. Online Credit Application: Speed up credit application processing by capturing complete and valid information for new credit applications with an easy-to-use template, integrated with your credit system for faster customer onboarding.

b. Automated Credit Scoring: Enable automated credit scoring with built-in credit data, pre-loaded with models and algorithms configured based on industry-specific best practices, to auto-assign risk score, risk category, and credit limits.

c. Credit Management Workflows: Standardize workflows for credit management to ensure that important credit decisions are approved through the right hierarchy including approvals for new credit applications and periodic reviews and credit requests for existing customers.

d. Process Compliance & Decision History: Ensure process compliance and standardize credit management process by indexing all credit data and decisions for new applications and current portfolio. Enable informed credit decisions with access to credit history.

e. Automated Correspondence: Automate customer collaboration via email with easy-to-create correspondence templates for credit events including credit acceptance or denial.

f. Credit Health Reporting & Analytics: Gain end-to-end process visibility with out-of-the-box reports and dashboards to track team productivity and key credit metrics including credit utilization, bad-debt, and customer onboarding time.

3.4 Data Safehouse Catering to Your Every Need

With HighRadius, users can utilize their Sage Intacct data in an optimized manner to increase AR process efficiency and productivity. This is how you can leverage data to take your AR processing to the next level:

-

Easy access to customer data

-

Seamless management of AP portals

-

Early deduction identification: handling of disputes

-

Convenient check payments with Mobile Remote Deposit Capture (mRDC)

-

Insightful reporting and analytics

The RadiusOne AR Suite of Apps comes with a centralized customer data repository where businesses can gain access to essential information including transaction details, invoice data, payment commitments, credit limits, and correspondence history. Finance teams can have a 360-degree view of customer data to fast-track credit reviews for various customer portfolios.

Data-driven models play an important role in achieving business goals by making use of real-time data. RadiusOne AR makes it possible for AP professionals to easily integrate with the ERP along with the ability to utilize any given dataset. The solution is capable of identifying trends while maximizing business performance. Businesses can match invoices to the individual account for a faster time-to-cash.

Dispute management often requires manual aggregation of scattered information from different systems and sources that are time-consuming and affects the daily operational efficiency. The Cash Reconciliation App by RadiusOne AR Suite helps in identifying deductions at the source based on short-payments of over-payments for faster resolution and recovery.

In many cases, the remittance data captured by the bank has limited information and hinders the successful reconciliation of payments with the open invoices. Re-keying remittance data is a manual, time-intensive, and error-prone process which delays the cash reconciliation process. RadiusOne AR provides a technology-enabled solution called Mobile Remote Deposit Capture (mRDC) to save essential time and effort to reconcile payments.

Businesses rely on various crucial metrics to make effective decisions based on organizational goals and therefore, data comes to be the front-runner for the same. The Credit Risk App by RadiusOne AR Suite provides real-time insight into crucial metrics such as credit utilization, bad-debt, and customer onboarding time. Mid-sized businesses can utilize these analytics to effectively take corrective action, proactive measures, and modify any AR process or strategy.

Wishlist that Comes True with RadiusOne AR Suite and Sage Intacct

The top priority for business leaders in this economy is to streamline AR processes using data-driven insights while improving working capital and optimize cash flow. With in-depth market research and multiple successful collaboration efforts within mid-sized businesses, the RadiusOne AR Suite of Apps is designed to be a simple, fast, and easy to deploy solution that caters to key business needs such as:

-

Lightning-fast remote deployment with out-of-the-box integration

-

Effortless data exchange

-

Support for remote working teams

-

Proactive risk management

-

Reduce operational costs

-

Reduce Days Sales Outstanding (DSO)

-

Optimize working capital and improve cash flow

It comes with prepackaged modules with industry best practices and supports lightning-fast remote deployment for easy integration with Sage Intacct with minimal IT intervention. The solution is enabled with a plug-and-play feature and ‘out-of-the-box’ connectors which help in faster deployment without any coding or appliances for installation. Furthermore, customers are provided with continuous support during the implementation phase.

Seamless data flow between HighRadius and Sage Intacct is made possible with the help of REST APIs. Data points such as invoices, customer data, and posting of A/R payments are procured to and from Sage Intacct using the REST mode of communication.

Remote working teams are facilitated to work uninterrupted with a centralized solution for easy access to information, streamlined collaboration, drill-down analytics, and reports for proactive AR management.

With the help of real-time insights and reports, businesses can handle the complexities such as customer disputes, payment terms, credit risks, and short payments. A centralized reporting platform can be beneficial in being proactive while taking the necessary steps to curb any potential risk or damage.

AR automation helps in the elimination of manual and paper-based processes to reduce the time and effort required to complete tasks such as remittance aggregation and invoice matching to save on AR operational costs. This facilitates teams to work efficiently with quick and real-time access to information for minimized lag in performance and productivity. Re-allocate essential resources to focus on critical downstream processes like Credit and Collections.

Enable faster time-to-cash and minimize DSO with the best-in-class credit and collections strategies for a prioritized customer approach, eInvoicing, and automated payment processing. As payments get collected on time, businesses can reallocate resources to focus on at-risk customers and invoices.

Stay on top of customers and scale collections outreach processes with ready-to-use correspondence templates for timely payments and a faster time-to-cash. Enable auto-linking of the remittance and payment information and automate invoice matching to ensure straight-through cash posting with zero-touch and minimal exceptions. Utilize a centralized platform to get easy and fast access to customer information to periodically review credit limits and payment terms and achieve lower rates of write-offs.

Conclusion: A Leading Choice to Supercharge your AR

With a requisite to realize new levels of operational efficiency and survive in the growing competitive market, mid-sized businesses need to adopt AR solutions that can help improve the receivables process control for better ROI achievements. Finance leaders can strengthen their Sage Intacct platform with RadiusOne AR integration to improve visibility and monitoring capabilities, implement effective workflows, achieve fewer billing errors, significant overhead and labor reduction, and strategize cash management. Built to seamlessly complement Sage Intacct, the latest offering by HighRadius aims at empowering mid-sized businesses to optimize cash flow operations and focus on business expansion and growth. Get a demo of RadiusOne AR Suite for your business today.

Why HighRadius

Founded in 2006, HighRadius is a leading Fintech company providing an end-to-end order-to-cash solution to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes. In 2020, the company processed over $1.3 trillion in transactions and is trusted by leading Fortune 500 companies. HighRadius achieved unicorn status by surpassing $1 billion valuation after its Series B funding. The company has been named to the Forbes 2020 Cloud 100, the definitive ranking of the top 100 private cloud companies in the world. CB Insights has recognized HighRadius on the 2020 fintech 250 list of fastest-growing start-ups. HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months.

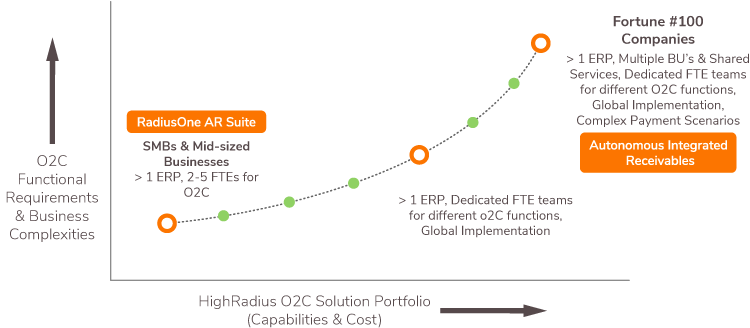

6.1 Securing a Scalable Future

HighRadius is dedicated to providing solutions across the different stages of business growth. Starting from SMBs with a single ERP system, 2 to 5 FTEs, an enterprise-grade company with multiple ERPs and dedicated FTEs for handling different operational functions and global implementations, or Fortune 100 companies with shared services and multiple business units – the company caters to every business need. HighRadius’ scalable approach to the Order to Cash portfolio of solutions ranges from the RadiusOne AR Suite to the Autonomous Integrated Receivables Platform.

With the introduction of the RadiusOne AR Suite, HighRadius has the breadth and depth of capabilities to meet the AR functional requirements across all stages of business growth. As companies grow and business complexities increase, the AI-Enabled Integrated Receivables Platform provides a more robust set of capabilities, while the Autonomous Integrated Receivables Platform is HighRadius’ most powerful set of solutions serving our customers with the highest levels of functionality requirements.

6.2 Why RadiusOne AR Suite?

The RadiusOne AR Suite by HighRadius is a complete accounts receivables solution designed for mid-sized businesses to put their order-to-cash on auto-pilot with AI-powered solutions. It leverages automation to fast-track key accounts receivable functions including eInvoicing & Collections, Cash Reconciliation, and Credit Risk Management powered by RadiusOne AR Apps to improve productivity, maximize working capital, and enable faster cash conversion.

Designed as an affordable, quick to deploy, and functionality-rich solution – it is pre-loaded with industry-specific best-practices and ready-to-plug with popular ERPs such as Sage Intacct. The solution enables AR teams with tools to automate clerical receivables tasks while becoming more effective in credit and collection activities. Featuring as the perfect partner, the RadiusOne AR Suite of Apps enables real-time execution of AR operations from a unified platform, improving efficiency and accuracy of cash application, cash collection, invoicing, and payment processing.