12 Strategies For CFOs To Reduce OPEX in Mid-sized Businesses

This eBook focuses on understanding the impact of operational costs on the overall revenue of mid-sized businesses. Explore the challenges and cost reduction strategies within Accounts Receivables, Accounts Payable, and Miscellaneous Cash Management to improve the bottom line.

Executive Summary

1.1 The Need of the Hour

Operational costs reflect the costs that your business incurs on a regular basis. With cost-cutting becoming a necessity, mid-sized business owners need clear insights into their day-to-day operational expenses. The situation is such that if you shout ‘cost reduction’ in a room full of mid-sized business owners, you’ll probably start an extensive discussion.

When it comes to analyzing the bottom-line impact, operating expenses is the topic of the conversation to cut overhead costs. According to Pymnts, 50.1% of mid-sized firms cite operating expenses as a major problem area.

Source: QBE North America 2022 Mid-Sized Company Risk Report

To stay on top of business expenses, finance executives need to:

- Evaluate the current operational model as a top priority to ensure balanced cash flow

- Create cost-reduction strategies to avoid bottlenecks that become a roadblock to success

Saving on operating costs could help in expanding fund growth, deal with bad debt, lower overhead costs, and stay on top of the competition. In the subsequent chapters, we’ll walk you through a detailed operational cost analysis covering areas within Accounts Receivables, Accounts Payable, and Miscellaneous Cash Management.

The Unmet Needs: Why Cost Optimization?

Most businesses are fighting for survival amidst an unbalanced economy, unreliable suppliers, and a remote workforce. Here are some critical challenges faced by mid-sized businesses owing to bad financial health:

2.1 Impact of the Uncertain Economy

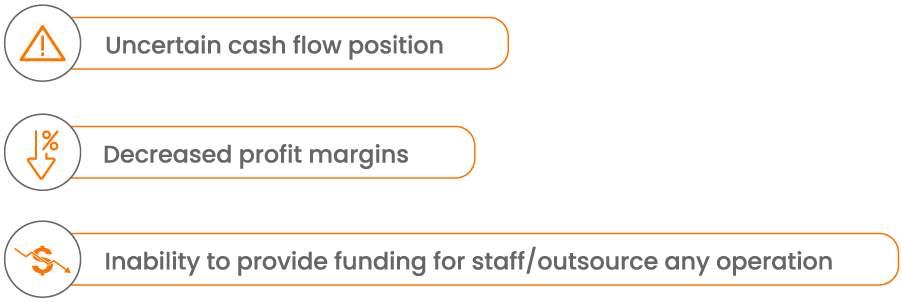

Due to higher revenue churn and increased uncertainty in the financial ecosystem, businesses are struggling to survive. Here are some listed impacts of a bad cash scenario:

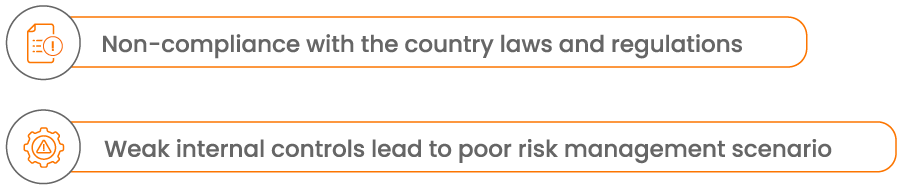

2.2 Increasing Fraud Risk

Finance teams also deal with increased fraud risks triggered by the economic shutdown. This includes issues like asset misappropriation or even bonus maximization schemes. Here are some essential fraud risk parameters:

2.3 Low Market Demand

The low market demand affects the financial stability, cash flow, and causes worries about revenue. There’s no clear way to determine or evaluate the current market situation.

To reduce operating costs, the first step is to assess potential leaks across finance and non-finance processes and their overall impact on business productivity and profit.

12 Strategies to Reduce Operating Costs

There are many ways by which mid-sized businesses can save on operating costs, this e-book focuses on mainly three core areas: Accounts Receivables, Accounts Payable, and Miscellaneous Cash Management.

3.1 Accounts Receivables

As a growing mid-sized company, organizing and understanding operational expenses is key to understanding the bottom-line impact. With budget and resource constraints, poor expense management can cost you millions of dollars.

To reduce costs, you need to streamline processes so that you can cut down the associated expenses. It’s important to evaluate the process costs involved in managing accounts receivables to analyze operating costs.

Here are some of the important elements in AR that may help in significant time and cost reduction:

1. Optimized Resource Utilization

i) Challenge

- In most mid-sized businesses, full-time employees (FTEs) are involved in simultaneous operational processes like cash reconciliation, collections, and dispute resolution. This can create a bottleneck that affects the overall AR efficiency

- With business growth, the scale of operations and transactions also increases, which has a direct impact on net resources required to get the job done. Your revenue might be growing, but at the same time, operational resource requirements could be leaking dollars

ii) Cost Resolution Measure and Benefits

- Identifying clerical tasks and procedures that can be digitized and eliminate the need for manual intervention

- Minimize business disruption where FTEs could focus on high-priority tasks leading to better business performance and cost-savings

2. Cutting Down on Bank Integration Costs

i) Challenge

- Bank lockboxes incur a monthly transaction fee. If you opt for a bank key-in service for capturing remittances, you incur additional fees, depending on the number of characters. The data captured by the bank has limited information and does not support the successful reconciliation of payments with open invoices. Furthermore, bank key-in is manual, time-intensive, and error-prone, which delays the cash reconciliation process

- Traditional cash application includes manual invoice-remittance matching and posting into the ERP. This results in a longer time-to-cash and a bad-cash scenario

ii) Cost Resolution Measure and Benefits

- Eliminate the need for bank key-in with a technology-enabled solution such as Remote Deposit Capture to save on key-in costs

- Digital payments reduce the concerns of mail floats, which is the time it takes for a check to be processed and deposited into the business account. This helps in a faster cash conversion cycle and eliminates the need for lockboxes (used for check payments)

- Businesses can opt for solutions providing automated cash reconciliation for easy payment trails. This will help in automated remittance aggregation through different sources like emails, vendor portals, and checks and enable invoice matching for auto-posting cash while analysts could focus on exception handling

3. Cutting Down on Invoicing Costs

i) Challenge

- According to research by Levvel, the average cost to process a single paper invoice can reach up to $15, which affects the overall revenue stream

- Businesses following the traditional method of invoicing need to manually enter the incoming invoice data while sorting them into different categories

- Moreover, paper-based invoices involve further expenses to print and then mail or fax the invoice

ii) Cost Resolution Measure and Benefits

- Faster and automated invoice delivery through email or web portals helps in potential savings by reducing the cost per invoice

4. Streamlining Payment Processing Costs

i) Challenge

- Outdated paper-based systems require manual processing that is error-prone and costly

- Decoupled payments take a lot of time to be reconciled with the remittance information

The estimated cost for checks stands at $4 to $20 per payment

- With fewer payment methods available, customers are more likely to not pay on time, which affects the cash inflow

ii) Cost Resolution Measure and Benefits

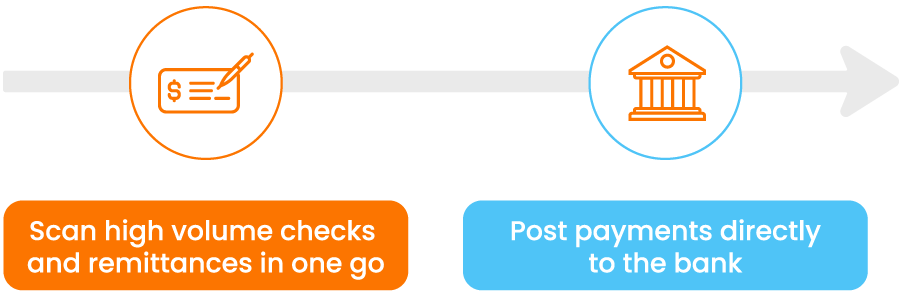

- Remote Deposit Capture can be used to scan large batches of check payments and send the scanned image directly to the bank. This helps in cutting down the costs linked with manual handling and transportation of checks to the bank

Figure: Remote Deposit Capture Process

- The use of payment gateways can allow customers to pay for multiple invoices at the same time. This helps in eliminating the need for manually reconciling payments and gives better control of the cash inflow

5. Cutting Down on Compliance and Security Costs

i) Challenge

- The integration of digital payments can prove to be expensive when it comes to compliance and security costs to avoid delinquencies

- In cases where businesses choose not to adopt PCI compliance, the merchant service provider may ask for non-compliance fees

ii) Cost Resolution Measure and Benefits

- Businesses should review the PCI compliance fees that some merchant service providers charge

- Opting for an all-around PCI-DSS compliant solution will help in lowering overhead costs

6. Cutting Down on Credit Integration Costs

i) Challenge

- Individual subscriptions to credit agencies may include additional fees depending on the scope and coverage of individual reports

ii) Cost Resolution Measure and Benefits

- Opting for a solution that has in-built integration with numerous credit agencies without any individual subscription fee will help businesses save a lot on credit processing

7. Cutting Down on Paper-Costs for Back-Up Documentation

i) Challenge

- Many businesses end up taking the paper-based route for backup documentation. This adds to the infrastructure costs for managing such a large volume of documents

- Lack of visibility in keeping track of customer data, late payments, credit limits, and payment terms can lead to excessive bad-debt write-offs

ii) Cost Resolution Measure and Benefits

- Businesses can leverage digitization to stay on top of SOX compliance with reduced complexity, a better understanding of operations, and cost savings

- With a central repository of customer data, businesses can retrieve all the essential customer information like payment history and invoice data along with payment commitments

3.2 Accounts Payable

8. Strategizing on AP: Paying Early vs. Paying Late

i) Challenge

- Delaying the payments may lead to payment penalties, slower delivery times, lost credit, and unwillingness from the vendor to fix defects, slower response times, and bad payment terms

Source: Accounting Coach

ii) Cost Resolution Measure and Benefits

- It’s advised to negotiate and have absolute clarity on payment terms and prices in the communication with the vendor. Longer payment terms and regular review of the terms on the basis of volume discounts and trade credit will help in improving the working capital

3.3 Miscellaneous Cash Management

9. Sales & Marketing

i) Challenge

- Many businesses fail to look over the data to set accurate sales and marketing budgets. This may affect a huge percentage of the revenue generated

ii) Cost Resolution Measure and Benefits

- It’s critical to quantify the actual spendings in sales and marketing to keep track of the costs involved

- To decrease the cost of sales and improve the returns, sales staff should spend more time researching customers’ creditworthiness

- For marketing purposes, it’s essential to review the expenditure in software used for campaigns, development, and propagation of marketing materials

10. Inventory Management

i) Challenge

- Depending on the industry, inventory maintenance may come with additional costs. This includes taxes, material handling, equipment maintenance, utilities, and inventory purchases

ii) Cost Resolution Measure and Benefits

- Reducing the on-hand inventory along with the carrying costs is an effective way to reduce operating costs

11. Infrastructure Investments

i) Challenge

- Infrastructure costs may include additional facility costs like housekeeping and utilities

ii) Cost Resolution Measure and Benefits

- Negotiating better lease terms for office space is a possible solution to reduce expenses

- A shared workspace for employees and customers could prove to be fruitful where the staff can share desks and equipment

12. Outsourcing

i) Challenge

- At times, deliverables may be required to have a quick turnaround time which can cause internal resource crunches

ii) Cost Resolution Measure and Benefits

- Outsourcing certain tasks in accounting, marketing, IT support, or product development could help in time and cost savings

- High-yield functions can be completed with a quick turnaround time and can result in significant savings

Conclusion

As businesses keep growing with new-age disruptions, it becomes critical to review and optimize operational costs that have a direct impact on business profitability. Understanding the current state of expenses is the first step towards optimizing operational costs.

With effective cost-management strategies, businesses can reduce process complexity and enhance process efficiency while simultaneously reducing costs and improving cash flow and working capital.

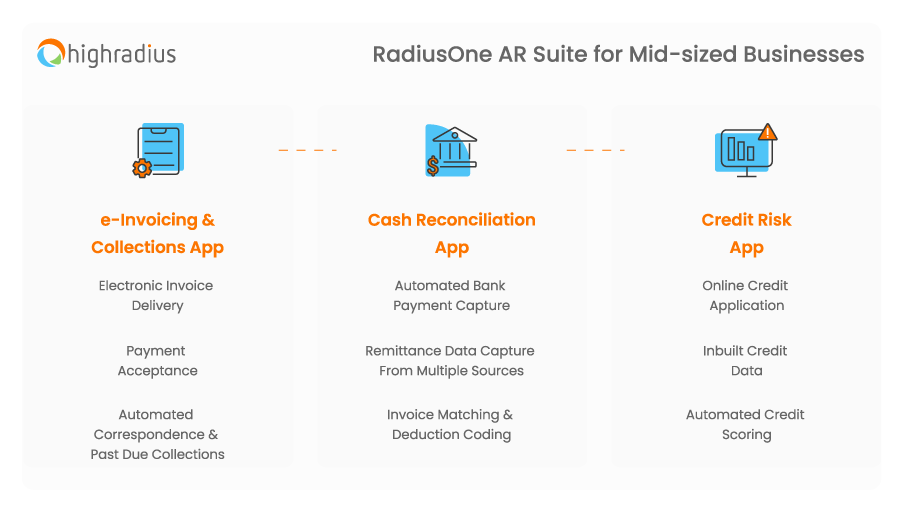

RadiusOne AR Suite by HighRadius

The RadiusOne AR Suite by HighRadius is a complete accounts receivables solution designed for mid-sized businesses to put their order-to-cash on auto-pilot with AI-powered solutions. It offers three AR modules — eInvoicing & Collections, Cash Reconciliation, and Credit Risk Management to improve productivity, maximize working capital, and enable faster cash conversion. Affordable, quick to deploy, and functionality-rich, the solution is pre-loaded with industry-specific best-practices and ready-to-plug connectors for popular ERPs such as NetSuite, Sage Intacct, and Microsoft Dynamics.