Economic Volatility Is on the Horizon: How Cash Forecasting System Can Help

Understand the role of cash forecasting during an economic crisis and learn three best practices for cash forecasting during a volatile environment

What is the role of cash forecasting in global uncertainty?

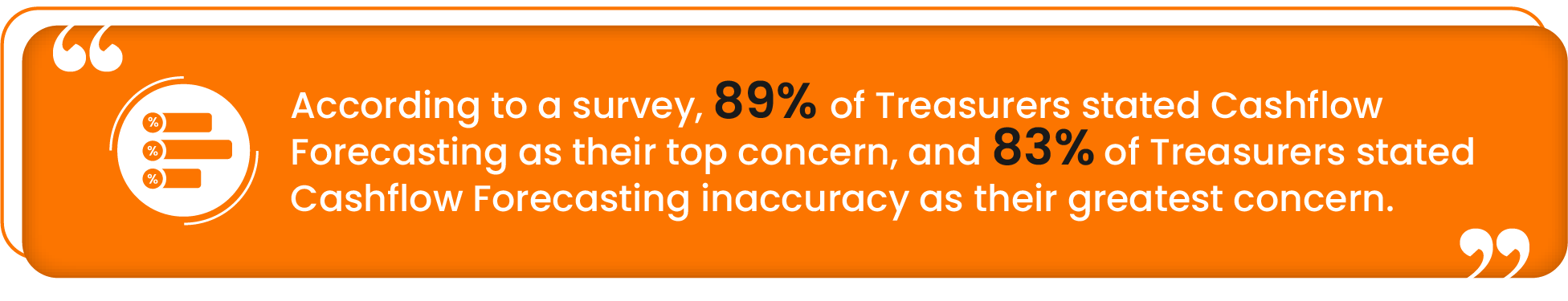

CFOs are demanding greater accuracy at regular intervals and more frequent updates to current cashflow forecasting data for tackling market volatility. The treasury department must frequently re-forecast during a recession since working capital is a big concern, but acquiring data and working with teams is time-consuming.

During high economic volatility, measuring the Cash Conversion Cycle (CCC) during high economic volatility becomes necessary to make working capital decisions.

A real-time cash flow forecast gives companies the crystal-clear perspective they need to implement corrective measures like tweaking payment and collection procedures, selling off assets, or approaching lenders. It allows the treasury department to make decisions based on current economic conditions rather than a potential budget that may have been set months ago. Businesses that consistently carry out cash forecasting can foresee potential financial shortfalls and prevent missing payments.

3 Best practices for cash forecasting during a volatile environment

01 Focus on weekly cash forecasting

Frequent forecasting over several time horizons, such as weekly cash forecasting, can help understand market movements like changes in raw material prices, interest, and commodity rates. It can also give the most precise, up-to-date picture of short-term cash balances and anticipated liquidity needs.

The weekly cash forecasting makes businesses more aware of the specifics of their operations. Cash inflows could be significant one week if a lot of receivables are collected, while cash outflows could be significant the next week if rent and payroll are due.

Here is the following importance of weekly cash forecasting:

- They provide a clear view of your potential cash position. Hence, weekly cash forecasting allows companies to act quickly to overcome a liquidity crisis.

- Investors or banks frequently need the information to determine whether any proposed financial help is adequate or excessive.

02 Perform variance analysis frequently

Variance analysis is a quantitative method for estimating the discrepancy between projections and actuals. Variance in cashflow forecasting refers to the disparity between the forecast and actual for a particular accounting period. Variance analysis aids in spotting potential risks, mitigating them, and making proactive choices regarding adjustments to needed corporate plans.

Using the conventional technique, it is challenging to pinpoint the real cause of the deviations between the forecast and actuals. A cash forecasting system digs deep into forecast deviations across complex cash flow categories like A/R and A/P, regional and corporate levels to identify, document, and address the causes of forecast variances. To improve the cash forecast accuracy by 90-95%, AI also makes further revisions to the forecast by assessing past and present forecasts and the high variance categories over various time horizons.

03 Improve visibility and accuracy of cash forecasting

Only 33% of businesses are successful in improving their cash flow visibility. Monitoring cash flow in real-time is essential for maintaining stable business operations. Companies should adjust their business continuity plan to identify and address any vulnerabilities in crises. Unfortunately, due to process limitations, most businesses do not have complete visibility into their financial flows, which leads to inaccurate cash forecasts.

As a result, businesses frequently overborrow or borrow late with higher interest rates due to their failure to predict impending cash shortages. Delaying payments for longer periods might result in penalties, such as paying late fees or poor relationships with external stakeholders.

Accurate forecasts enable timely and efficient collaborative planning and facilitate treasurers to make fact-based decisions. Accurate forecasts increase the ability to:

- Run various scenarios in cash forecasts to stay wary of market fluctuations

- Meet short-term and long-term cash needs

- Manage working capital

- Control financial and interest rate risks

- Fund for business growth strategies

How a cash forecasting system helps to stay ahead of the curve at a time of economic volatility

How to respond to a crisis with a cash forecasting system

- Use baseline forecast as a reference

Treasurers can regularly track current and future cash flows based on the forecasts. A baseline forecast is critical to analyzing and tweaking the forecast models. This leads to proactive cash management. - Incorporate internal and external data into forecasts

Determining the right data sources helps in ensuring accurate data for fetching reliable cash forecasts. Considering historical performances and incorporating seasonality trends and external factors such as raw material price fluctuations and customer patterns helps improve forecast accuracy. - Detect early signs of cash crunch

Accurate data and real-time reporting are useful to identify potential cash crunches or spikes so that the CFOs don’t just stick to making short-sighted decisions. Through precise cash flow forecasts, CFOs can better devise effective decisions to mitigate the impacts of potential financial threats.

Impact of accurate cash forecasting

- An optimized cash conversion cycle.

- Better scenario planning to take proactive steps to combat future cash flow issues.

- Superior decision-making towards investments and borrowing over longer time horizons at low-interest rates.

- Accurate estimation of quarter-ending cash position by keeping the balance sheet up to date.

- Ease in the identification of what-if scenarios for both short-term and long-term liquidity planning.

- Lower variance between forecasts vs. actuals.

Benefits of HighRadius cash forecasting system

- Increased accuracy in cash forecasting

The software eliminates the likelihood of human errors and captures real-time information. It also compares historical data to recent data and improves forecast accuracy for the short-term and long-term.

For instance, a global technology distributor focused less on customer-level drill down due to different payment terms and discounts. Their treasury teams spend 55+ hours/week consolidating and forecasting and 32+ hours/week for A/P and collections teams to gather and share data. With HighRadius automated treasury solution, they are able to streamline forecasting across continents and improve cash forecasting accuracy up to 94%. - Better scenario analysis

The cashflow forecasting software provides manual override (spreadsheet-like feature) to easily stress-test multiple scenarios. It also helps to automate modeling scenarios across numerous cash flow categories, regions, and currencies. - Capturing multiple customer-specific variables and payment trends

The automated cash forecasting system helps predict customer-specific payment dates accurately by incorporating multiple customer and invoice-level variables. External factors such as raw material fluctuations can also be considered to capture trends to generate cashflow forecasting. - Improved variance analysis

It supports drill-down-functionality into forecast variances across cash flow category, regional, and company levels to spot, report and fix the reasons for the variations. - Increased ROI

The software eliminates many slash-and-burn resources needed to build and implement business strategies. Working more swiftly and effectively can provide considerable soft-dollar and hard-dollar savings.