S/4HANA Migration: Enabling Order-to-Cash Operations Continuity

Understanding the need and challenges associated with ERP migration to S/4HANA and the four-step framework to a successful migration effort.

S/4HANA Migration: What and Why ?

Launched in 2015, S/4HANA is built on SAP HANA, an operational database and an in-memory computing platform from SAP. With many organizations planning to migrate to S/4HANA, an important question is how best one manage change to ensure that the migration project is a success. This eBook addresses these questions especially in the context of order-to-cash operations.

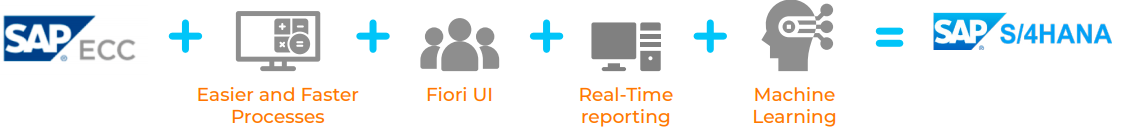

Before we jump into the migration process, here are some of the most compelling reasons why many organizations are planning to upgrade to S/4HANA:

- Easier and Faster Processes: S/4HANA runs on a universal ledger, where all the data from different financial transactions are stored in a single table, in contrast to multiple ones in ECC. Thus inserting new data and accessing the existing is very fast and the business always runs on a single version of data.

- Better User Experience: S/4HANA has a much better user interface because of which the users do not have to memorize the transactional codes anymore for quick access as they had to do earlier. An SAP benchmarking study points out that transactions processing is about 40% faster with the Fiori UI when compared to SAP GUI.

- Real-Time Reporting capabilities: S/4HANA provides the user with real-time reporting capabilities and better predictive analytics in comparison to the standard reporting mechanisms available in the previous versions. You no longer have to depend on business intelligence tools for basic reporting and dashboards.

- Machine Learning with SAP Leonardo: SAP Leonardo is a digital innovation system from SAP comprising different technologies such as IoT, Artificial Intelligence, Blockchain and, Machine learning. S/4HANA already incorporates the machine learning features from Leonardo in its cash reconciliation and invoicing modules, among others, thus making way for faster decision making. Native machine learning capabilities could unlock a world of possibilities across order-to-cash especially in credit, deductions and collections.

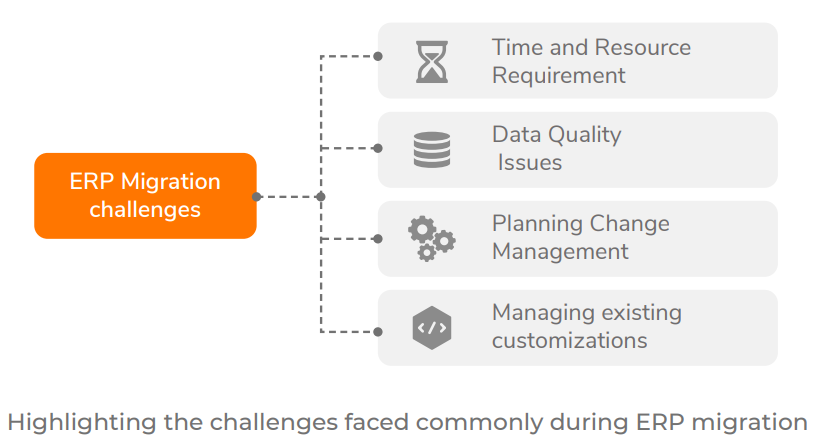

Knowing the challenges

Apart from these innate advantages with S/4HANA, the ERP migration process could be your opportunity to standardize overall business processes, and introduce changes in the system to improve efficiency and compliance.

Even before you embark on the ERP migration process, here are the top challenges that you would have to consider:

- Expensive and Time-Consuming process:

- ERP migration is a mammoth task and could go on for a very long time, sometimes extending to several years as IT teams have to collaborate with all business teams right from core operations/supply-chain to finance functions including A/P, A/R and, accounting.

- Involving business teams in these projects for long durations of time would not only be expensive for companies strictly in terms of man-hours spent but also impact their productivity for day-to-day operations.

- Data Quality:

- Given the complexity of running large organizations, ERPs on their own are not enough and companies rely on disparate systems, spreadsheets and other tools to perform operations.

- Lack of standards for storing data is often the biggest challenge and incomplete or missing data and multiple versions of the same data increase the complexity of the migration project manifold.

- Underestimating the scope and costs of data migration process especially to the universal ledger in S/4HANA could be the biggest pitfall that project owners should avoid

- Change Management:

- Study after study states that operational disruption is a routine challenge during ERP go-live. In case of finance functions this is a big problem as teams are no longer able to close books during period ends.

- Project leaders routinely point to organizational change and people issues as the reasons for these disruptions.

- Given the scale of ERP migration projects, project managers are better off understanding nuances of how teams and even individuals use the current system and prepare a structured training plan that focuses on how to standardize these operations in the new version.

- It is also very important to keep communicating to everyone who is impacted by the migration project. Communication channels are also very important as not everyone has her own preference for consuming such content whether it be the company’s internal social network or the bulletin boards or in-person meetings.

- Business Process Re-Engineering and Custom Functionality:

- Moving to a new ERP or a new version of ERP allows room for business process re-engineering while taking into consideration some of the new technology innovations

- At the same time, native ERP functionality is not enough for specialized functions such as order-to-cash. So teams relied on customizations for many years.

- Custom codes fundamentally pose two challenges:

- only a small subset of the functionality is used by the teams in fact a study commissioned by SAP found that only 23% of the custom functionality was supporting critical business processes

- People who requested for that custom functionality or people who built that may no longer be in the organization leading to a lot of effort in understanding why that code exists and whether it is critical for running operations

- ERP migration is also the right time to eliminate non-critical customizations and tweak existing processes to run on out-of-the-box functionality to simplify future migration projects

The Migration Methodology

The migration to S/4HANA could be carried out as one of the following three transition scenarios:

- New Implementation: This is the kind of migration in which a customer is moving from a current version of SAP or even from a Non-SAP ERP to S/4HANA. The final system requires an initial load of data, hence post-implementation of the S/4HANA module, the master as well as the transactional data is migrated to the new platform from the legacy system.

- System Conversion: Also termed as the “lift and shift” transition process, it involves a complete conversion of the SAP business suite into the SAP S/4HANA Business suite.

- Landscape Transformation: This is the kind of migration scenario being applied by organizations that use different ERP systems across several business units in multiple geographical locations, and want to consolidate their entire system into one global SAP S/4HANA system.

The Implementation Methodology

SAP has released various project implementation methodologies over time. The latest one of them, which has also been discussed extensively as a part of a successful migration to S/4HANA, is SAP Activate.

The SAP Activate methodology states that any ERP migration projects has four main steps, which are as follows: Prepare, Explore, Realize, Deploy (PERD).

Migration Approach for O2C

While taking inspiration from SAP Activate, here is the migration methodology followed by our customers to successfully migrate O2C systems to S/4HANA:

- Follow the Best Practices: You start with benchmarking your O2C processes against best in class organizations. The next step in this phase is to perform an analysis around what is a part of the new system to which you are about to migrate.

- Pre-assembly and Realization: One of the most important stages of the implementation methodology, this covers all the cutover activities that include the different steps involved between pre-planning and deployment. Part of this process also involves migrating the data to the new system and getting ready to run a pilot with end users.

- Solution Validation: This is the stage where you involve the end users and guide them through the standard functionality of the newly adopted solution, through show and tell sessions. Learn more about the additional requirements or gaps in the system according to them, so that you can decide on a way to include it in your new system with minimum modifications.

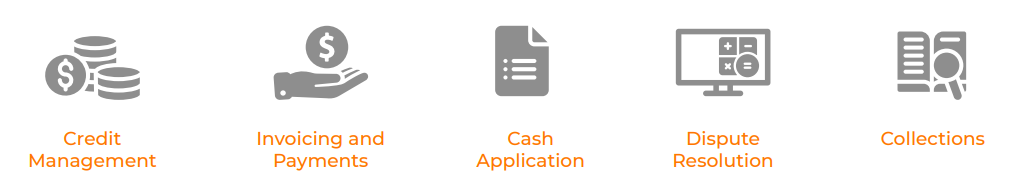

- Credit Management features :

- Credit rule engine for automatic risk scoring and credit limit calculation

- External credit rating agencies integration

- Automatic update to master data on credit limit approval

- S/4HANA Invoicing and Payments features

- Present open invoices to customers

- Initiate payments and support disputes while doing so

- Cash Application features

- Perform basic Cash Application activities such as closing open invoices

- Dispute Management features

- Automatic Reason coding for disputes

- Log claims into the system with manual support

- Integration with trade promotion systems

- Collections Management features

- Generate Prioritized Collections Worklist on a day-to-day basis

- Capture notes and Promises to Pay for customers

- Configure collection rules and strategies based on aging and payment behavior

- Agile Builds: Post the validation stage, all that remains to be done is to incorporate additional functionality in the system as per end user needs and industry best practices while making sure that there is a business case for each requirement. This requires prototyping and frequent validation of the results with end users to ease platform adoption.

The latest module of SAP S/4HANA offers a lot of features for different stages of your Order-to-Cash. Let us drill down to each one of them and see all the functionalities that you would be able to enjoy natively in S/4HANA.

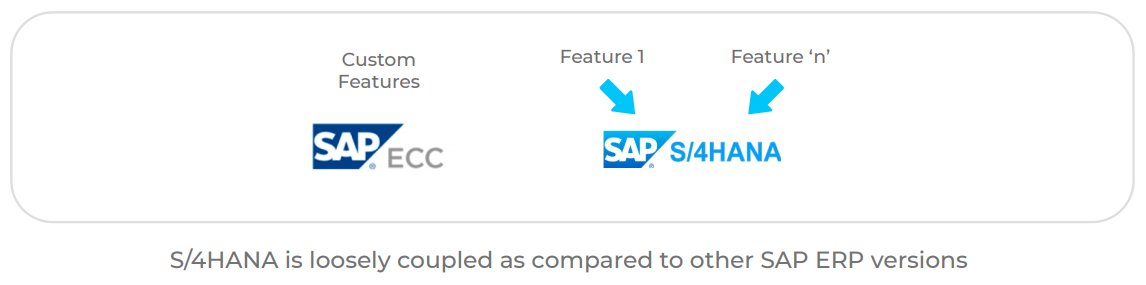

Build vs Buy

There are two approaches that organizations could take for incorporating custom functionality 1) leverage internal IT teams to built in-house and 2) configure cloud solutions that integrate into S/4HANA. Here are two reasons why organizations are gravitating towards SaaS cloud solutions.

- Faster ROI: With getting a solution built in-house, the project tends to have an extended timeline given the complexity of sharing resources for various IT projects. ‘Buying’ a technology on the other hand helps you achieve a positive ROI faster with speedy implementation.

- Future Proof: When you opt for the ‘build’ approach, maintenance is also a challenge. In contrast, ‘buying’ a solution positions outsources the responsibility of maintenance to the vendors.

Each of the below module enhancements could be one sprint in order to ensure successful migration.

I.Top Enhancements in the Credit Module

- Online credit application from where credit information from customers can be captured automatically

- Artificial Intelligence enabled blocked order resolution

- Automated correspondence for verifying bank and trade references

- Integration to credit insurance firms and public financials providers

II.Top Enhancements in EIPP (Electronic Invoice Payment and Presentment)

- PCI-DSS compliance with processor tokenization

- Level III processing for 40% less costs and secure transaction

- Integration to print and mail providers to send physical invoice copies

I.Top Enhancements in Cash Application Module

- Remittance aggregation from e-mails, web portals, EDIs and paper

- AI- enabled OCR with self learning capabilities for capturing remittances

- Customer Identification using email domain and MICR

II.Top Enhancements in Dispute Management Module

- Auto-aggregation of backup documents such as claims, proofs of delivery and bills of lading

- Pre-deduction support to settle disputes even before the payment has been made

- AI-enabled dispute validity predictor

- Automated correspondence to customers for credit memos and dispute denial

- Integration to retailer and customer portals for one-click dispute

- Automated settlement of trade-based deductions

III.Top Enhancements in the Collections Management Module

- Automated Mass Correspondence for segmented audience

- In-built editable templates that can be auto-populated with customer details

- Payment date prediction with Artificial Intelligence

Once any organization goes through these sprints, it would be >90% ready to run the business operations on S/4HANA. The only hurdle to cross would be the change management bit where the project managers need to monitor user adoption and create training and onboarding plans to ensure a smooth transition into the new system.

Conclusion

S/4HANA migration is your opportunity to streamline O2C operations while building capabilities through cloud based enhancements that would be future proof and prevent multi-year IT projects every time the organization decides to migrate to a new version or even change the ERP to something else. The below figure illustrates this loosely coupled system that simplifies IT landscape while also providing all the features to run the O2C function efficiently.

About Highradius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadiusTM Integrated Receivables platform reduces cycle times in the order-to-cash process through automation of receivables and payments across credit, electronic billing and payment processing, cash application, deductions and collections.

Powered by the RivanaTM Artificial Intelligence Engine and FreedaTM Virtual Assistant for order-to-cash teams, HighRadius enables organizations to leverage machine learning to predict future outcomes and automate routine labor-intensive tasks. The radiusOneTM B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales

outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may

achieve strong ROI in just a few months. To learn more, please visit www.highradius.com

HighRadius’ Integrated Receivables Platform

Integrated Receivables optimizes accounts receivable operations by combining all receivable and payment modules into a unified business process. The Integrated Receivables platform provides solutions for credit, collections, deductions, cash application, electronic billing, and payment processing – covering the entire gamut from credit-to-cash.

The HighRadiusTM Integrated Receivables platform stands out by enabling every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, and faster dispute resolution while improving efficiency and accuracy for cash application, billing, and payment processing.

HighRadiusTM Integrated Receivables leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier Accounts Receivable process to the buyer Accounts Payable process.