Sample GAP Analysis For Cash Allocation Automation

This ebook outlines the necessary steps for GAP analysis, showcasing the intricacies of the scoring model and vendor evaluation for the proposed automation project.

Vendor Evaluation & Executive Buy-In

In our previous eBook titled ‘Sample RFP for Cash Allocation Automation’, we explained with examples, the essential aspects of how should organisations float RFPs when inviting bids for automating their cash posting process. The eBook covered the sample topics, questions and scope of work templates specific to cash allocation which would help them gather the necessary information to make an informed decision. The same can be accessed by clicking here.

In this eBook, we cover the activities which follow after vendor proposals are received. Titled ‘Vendor Evaluation’, we intend to explain how companies could streamline the all information shared by all the vendors so that they can make an apple to apple comparison of the proposals.

Vendor Shortlisting

Any RFP issued by an organisation is sure to receive a windfall of responses from vendors of all shapes and sizes. These vendors would be presenting their own version of the solution to the RFP questions.

How should you conduct preliminary scrutiny of these bids to shortlist solutions which come closest to your requirements so that your team can spend its valuable time choosing between only the most worthy competitors? The answer lies in choosing the right set of parameters to be included in your primary scrutiny. Some of the most common criteria which firms use to perform this screening process include:

- Setting Broad Budget Limits to Exclude Outliers

- Setting Clear Expectations Related to Infrastructure

- Adherence to Submission Rules & Guidelines

GAP Analysis

3.1. What is GAP Analysis?

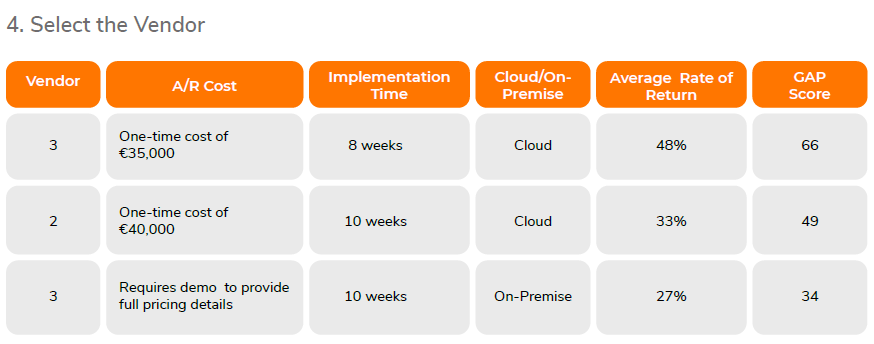

GAP analysis is a powerful tool to measure the gap between the automation project goal and its anticipated results. It shows where you are, calls out where you want to be and then bridges the gap between these two. GAP analysis is conducted by assigning certain scores to the respective vendors. These scores would also help the C-suite to evaluate and finalize the vendor.

For example, the GAP score of vendor A is 80, and the GAP score of vendor B is 55. Due to more GAP between vendor B and the project’s anticipated results, B would not be selected. With a higher score, vendor A would be selected for the automation project.

GAP analysis is conducted to make it easier for the C-suite to make a decision on which vendor would be selected for the automation project. GAP analysis provides a clear view of which vendor is the best for the project.

3.2. Steps to conduct GAP Analysis

GAP analysis is a powerful tool to measure the gap between the automation project goal and its anticipated results. It shows where you are, calls out where you want to be and then bridges the gap between these two. GAP analysis is conducted by assigning certain scores to the respective vendors. These scores would also help the C-suite to evaluate and finalize the vendor.

1. Form a Committee for Evaluation

Establish a committee of stakeholders comprising representatives from internal teams such as IT, Sales, Credit & Collections. The motive behind the formation of this committee is to ensure that there are subject-matter experts evaluating the solutions & matching their requirements phase-by-phase. This committee would be in charge of forming a scoring model to conduct GAP analysis.

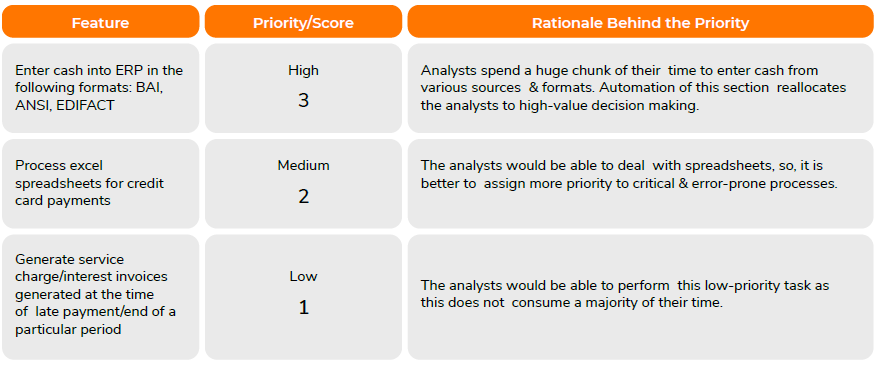

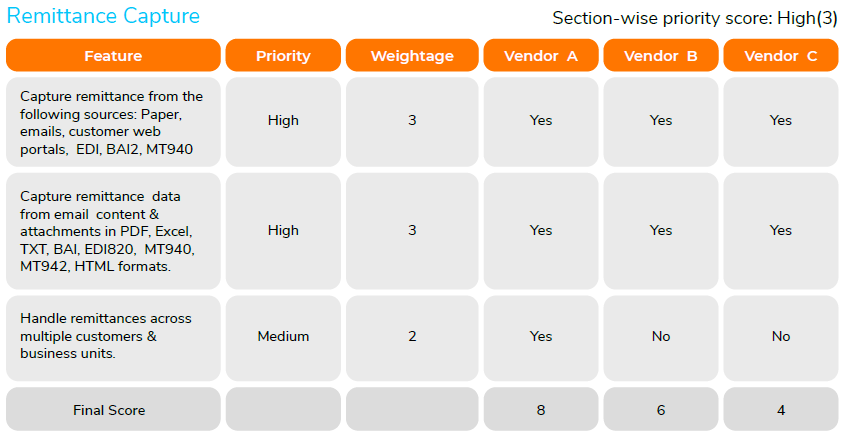

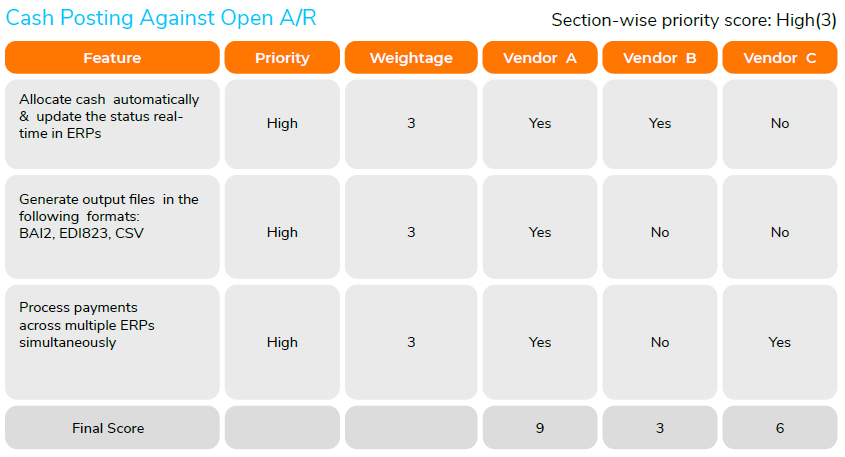

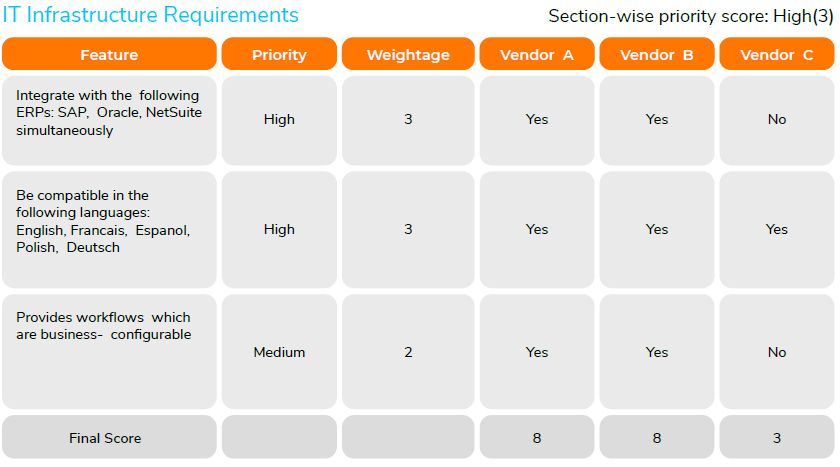

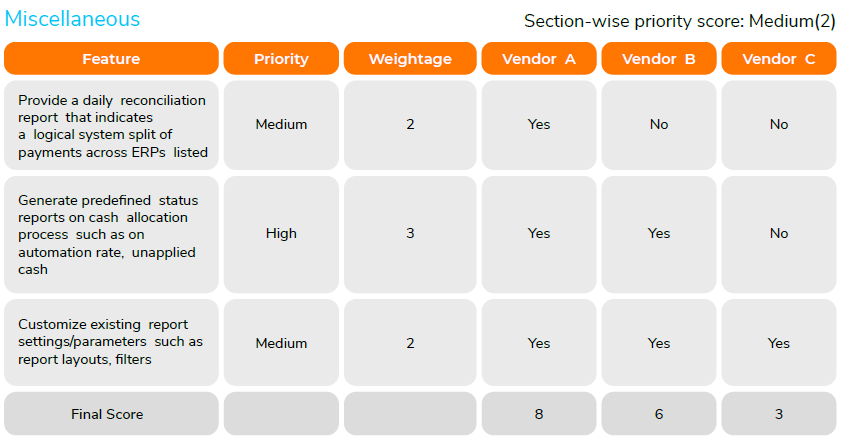

2. Assign a Score to Each RFP Question

Assign a weightage score to each parameter in the RFP. The stakeholder committee should determine the priority levels such as high, medium and low, and according to that, weightages should be assigned. For instance, for high priority, the weightage score could be 3 points, for medium priority, it could be 2, for low priority, a weightage of 1point could be assigned.

Also, prioritise the individual sections or chapters in the RFP based on the organizational preferences so as to help deciding between vendors with close scores . For instance, IT support might be a big challenge for some companies which might result in them picking a vendor who scores better on IT support even though his GAP scores are similar to another. The below-mentioned example shows the rationale behind the priority assignment.

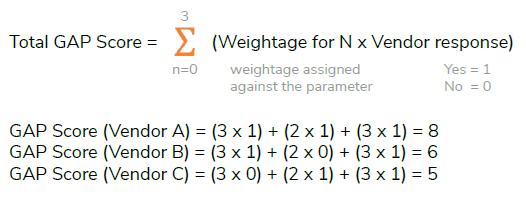

3. Calculate GAP Scores

Calculate the GAP scores of the shortlisted set of vendors and present this report to the

C-suite. The next step is to compare the vendor scores, and if the senior management feels

that there is a need to deep dive into certain feature provided by the vendor, a request

should be made for a product demo.

About HighRadius

Order to Cash & Treasury

Automation, prediction & insights

powered by Artificial Intelligence

Learn More