Segmentation Dimensions

Segmenting customers for Collections into buckets of strategic accounts and providing an insight into Collections process for faster operations

Segmentation Dimensions

An ideal collections segment comprises both dynamic factors such as the past-due amounts and static factors such as the current mode of invoicing. This chapter outlines the seven key static and dynamic variables that 200+ collections teams use to segment customers and collect 150% faster when compared to the industry average.

Mode of Invoicing

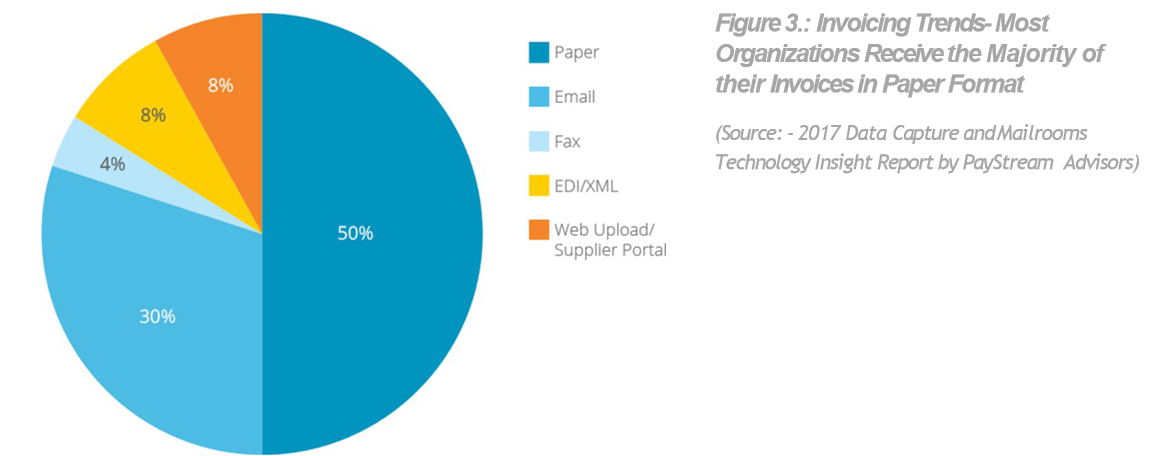

Customers could be segmented based on whether they have e-invoicing or paper invoicing. Customers who need paper invoices would need proactive invoice delivery as printing and sending the invoice via snail-mail would take more time. Moreover, paper invoicing is erroneous and prone to getting lost or stuck before reaching the customer. The process would further be more complicated for a customer with many invoices. In comparison, customers with e-invoicing would receive invoices in real-time with instant notifications. Moreover, the evolving technologies make room for tracking invoice delivery and integrate invoicing with customer A/P portals. This deep etched difference calls for a different strategy in the collections process. The mode of invoicing is considered to be an important segmentation dimension.

Customers could be segmented based on whether they have e-invoicing or paper invoicing. Customers who need paper invoices would need proactive invoice delivery as printing and sending the invoice via snail-mail would take more time. Moreover, paper invoicing is erroneous and prone to getting lost or stuck before reaching the customer. The process would further be more complicated for a customer with many invoices. In comparison, customers with e-invoicing would receive invoices in real-time with instant notifications. Moreover, the evolving technologies make room for tracking invoice delivery and integrate invoicing with customer A/P portals. This deep etched difference calls for a different strategy in the collections process. The mode of invoicing is considered to be an important segmentation dimension.

Fast Paying Vs. Slow Paying

As a member of the collections team, you would agree that fast paying customers would not require as many reminders and notices as a slow-paying customer. The payment trends could be arrived at using Average Days Delinquent (ADD) metric. ADD is the average number of days the invoices are past due i.e. the amount of time between invoice due date and the date it is paid. The calculation of this figure will help your company evaluate, along with other calculations, the overall performance of your collections department and your ability to convert A/R to cash. It is self-explanatory that a slow-paying customer would need more collection efforts and have a higher priority in the collections worklist. This segregation is hence important for better collections output.

High Risk Vs. Low Risk

Identifying high-risk customers and initiating appropriate customer correspondence is one of the top priorities for collectors to reduce receivables risk and prevent past-due A/R. This risk classification could be based on credit scores and risk categories of the customers. By using improved modelling and customer management strategies to target ?At Risk? customers, progressive collections teams could reduce bad-debt write-offs by decreasing their portfolio?s overall exposure levels and by helping customers with proactive contact before they reach the highest stress point with piling up past- due A/R. This differential and focused approach help companies reduce delinquency in the early stages. Segmenting customers based on risk level and exposure is one of the primary measures adopted by leading A/R teams.

Type of Account: Large Vs. SMBs

The 80-20 Rule in collections states that 80% of the revenue comes from the large accounts which account for 20% of the total customers. Collectors more often than not focus only on the invoice value while identifying ?who to call? from the collections worklist and prioritizing accounts for correspondence. This misguided approach means that the mid-market collectables fall through the cracks as they are many in number but have lower invoice values. The collectors can enhance the collections process for SMB accounts by dispatching bulk emails for mass correspondence. The trending technologies in the market allow mass correspondence with account-level customization which further enables personal engagement with the customers. The large accounts, however, may demand tailored communication on a case to case basis based on factors such as invoice value and the number of days after the invoice is past-due. This distinctly marks the prerequisite of different collection strategies for different types of accounts.

Percentage of invoice dollars greater than 30 days past-due

Percentage of invoice dollars greater than 30 days past-due accounts for the dollar value of the invoices that are 30 days past due out of the total dollar value of all the past-due invoices. This parameter gives a measure of the number of high-value invoices that are due for more than 30 days. Monitoring ageing bucket value for 30-60 days and 60-90 days is especially important given that 52% of invoices that are beyond 90 days past-due are written-off according to Atradius.

Payment Method: Check Vs. ACH

Check payments are widely prevalent in the USA and even now account for more than 46% of all B2B transactions by volume. Customers who pay through checks need to be sent reminders earlier than those who pay via electronic mediums for invoices that are approaching due-date. This is because the check payments need time to hit the bank. This not only poses the threat of time lag between collections process initiation and cash posting but also leaves room for inaccuracies in customer correspondence. In comparison, the payments made by customers via ACH, wire or Credit Cards hit the bank near real-time and it is feasible to apply cash same day and update open A/R. Moreover, these customers could be provided with self-service portals to make payments. These self-service portals could solve the twin problems of invoice deliveries and payments.  The vast difference between collections approach for customers paying through different mediums calls for different collection segments and strategies.

The vast difference between collections approach for customers paying through different mediums calls for different collection segments and strategies.

Number of deductions and invoice disputes

If the number of deduction line items generated by a customer is very high, it showcases the reluctance of the customer in making full payments and the tendency of disputing invoices. From a collections point of view, processing invoices with unresolved or valid deductions may not be as fruitful as expected. Two scenarios come into picture here:

- The whole invoice is disputed

- The customers are ready to make a short-payment

The best approach towards these scenarios would be either to try and identify pre-deductions or to collect the feasible short-payments as soon as possible and further create a deduction. This would help in early creation, and sharing of the disputed invoice with the deductions team and further ensure that the collections worklist is not clogged with such line items. Typically, the disputed invoices, while being managed by the deductions team, get stale knocking one ageing bucket after another and end up increasing past-due A/R in a larger ageing bucket like 90+ days. In this scenario, the collectors should correspond early (even before the due date for a large invoice amount) with such customers to minimize the number of days for which the invoice is past-due and be proactive with writing- off of genuine cases of invoice disputes. Clearly these customers need a strategically cut approach to ensure fruitful collections efforts with minimum cost.  The above characterizes the key segmentation dimensions a collections process must embrace. The next chapter delves deeper into how to alter strategies and figure out actions based on customer segmentation.

The above characterizes the key segmentation dimensions a collections process must embrace. The next chapter delves deeper into how to alter strategies and figure out actions based on customer segmentation.