Must-Have Skills for the Treasury Professionals In The Age of AI

Learn how AI and automation could help Treasury professionals in doing more with less and play the role of strategic advisors in the organization.

Executive Summary

The role of treasury has become increasingly demanding over recent years with the rise of digitalization, emergence of new technologies and strategic input needed in the office of the CFO.

With growing responsibilities, Treasury has to better tackle challenges such as limited resources, deploying technologies such as artificial intelligence (AI), robotic process automation (RPA), and data analytics, and streamlining treasury operations. By being tech-savvy, treasuries can attain scalability promptly and drive business growth by putting their skills to use strategically instead of doing manual tasks.

This ebook provides detailed insights into skills that new age treasury teams require to scale up and become the strategic advisors to the CFO.

Survey- Demographics

Overview

HighRadius conducted a joint survey in partnership with Treasury Webinars in Q2 of 2021, focused to help the treasury align with the current state of treasury skills.

There were 282 active respondents involved in the study. Respondents belong to small companies with around 25 employees to large companies with more than 5,000 employees.

| Industries | Percentage |

| Software/Technology | 39% |

| Construction | 14% |

| Manufacturing | 12% |

| Healthcare | 8% |

| Telecommunication | 5% |

The next section will briefly overview the skills treasuries intend to command in accomplishing their long-term career success.

Upcoming Skills Required by Treasury Professionals

The treasurer’s position is continuously changing due to rapidly evolving technology, globalization, and changing global economic scenarios. Treasurers are now being considered more of an ally in strategic decision-making than financial specialists. As the daily decisions made by the treasury are essential to the financial strategy of businesses, treasurers need to find a balance between hard and soft skills to perform value-added tasks.

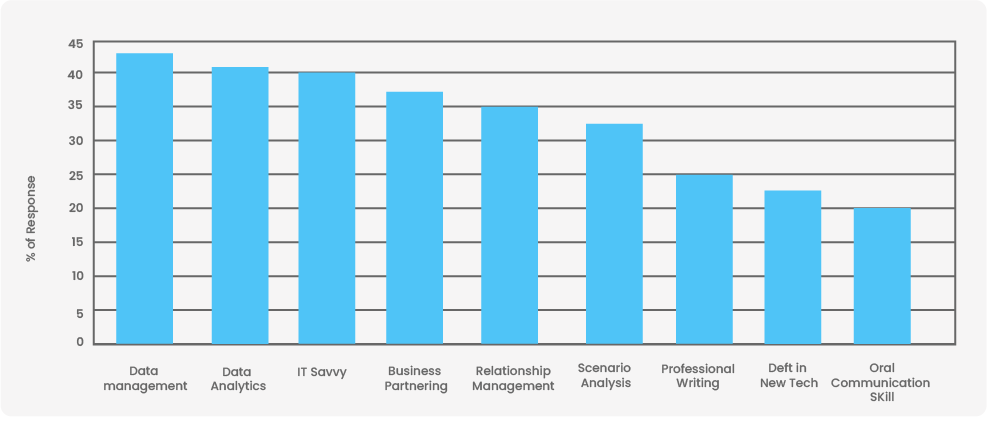

In a recent survey conducted by HighRadius and Treasury Webinars, we questioned treasury professionals across all company sizes, industries and roles what are the most important skills required for treasury professionals to be successful beyond finance/accounting.

- Due to reliance on sensitive data and the complexity of the treasury functions, having data management skills is very important for a treasurer.

- Respondents consider being tech-savvy to be the 3rd most important skill which indicates organizations’ reliance on technologies.

- Communication skills are considered the least important skill that companies should improve. This skill can be categorized as either very important or extremely important.

The upcoming chapters will cover the important hard and soft skills in detail and some of the key metrics that Treasuries use to measure their company’s success.

Since the past decade, the role of treasurer has evolved from a back-office function to a strategic advisor to the CFO and board. To sustain this advisory role with senior stakeholders treasurers must understand the vital skills and relevant experiences that will not only help boost their careers but differentiate them.

Hard Skills

2.1 Technical Expertise

cash flow management entails various functions which can be monotonous and error-prone. So organizations adopt different approaches, tools and technologies that aid in treasury processes. The adoption of cash management software helps in automation and eliminates possible human errors. With a variety of tools and smart functionalities, the whole cash flow management process is optimized by technology.

Therefore, it is essential to be aware of the treasury approach/technology that is prevalent across organizations.

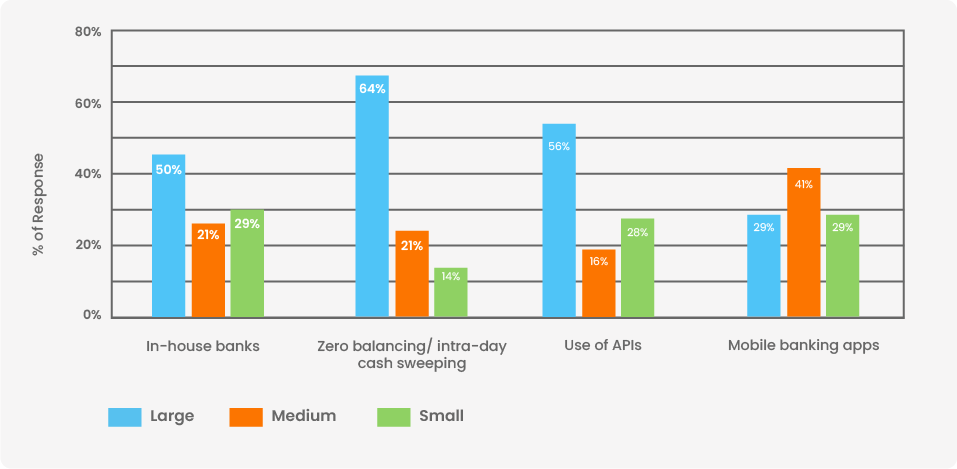

The above survey indicates various approaches organizations are leveraging to some extent for cash management.

- Large organizations actively adopt various approaches and tools with the majority of them performing intra-day cash sweeping and using API technology, as they tend to have the resources and a dedicated treasury team.

- Medium-sized organizations have a clear preference towards mobile banking applications and have a low adoption rate for other approaches as they are reluctant to venture and invest much but have to manage a significant amount effectively.

- Small-sized organizations have a low overall adoption rate for any of the above approaches and even fewer small organizations do intra-day cash sweeping.

2.2 Risk Management

The above graph indicates the metrics most commonly used for risk management by various organizations.

In an increasingly volatile environment with a growing number of regulations, the capacity to identify and monitor threats to the organization is critical. The mindset of the corporate treasurer should incorporate risk control, whether to avoid, accept or transfer, which is fundamental to the role.

A structured approach towards the risk management process accelerates the success of the Treasury by achieving liquidity in the face of risks. Identifying and monitoring risks can:

- Lead to more efficient resource planning and cash visibility.

- Maintain better tracking of project costs and more accurate estimates of return on investment.

- Broaden the awareness of legal needs.

- Bring flexibility when challenges arise or adjustments take place.

2.3 Capital structuring

Capital structure is the arrangement of capital from different sources to raise the long-term funds needed for the business. It is the combination of debt and equity securities that comprise a firm’s financing of its assets. Having a proper capital structure is how a company funds its overall operations and growth. Treasurers should be able to analyze and understand a company’s financial scenario so that they could maintain an effective capital structure. A proper functioning capital structure can result in:

- Increase in value of the firm.

- Utilization of available funds.

- Maximization of return.

- Minimization of cost of capital.

- Minimization of financial risk.

Soft Skills

3.1 Strategic Thinking

Over the years, the treasurer’s role has become more strategic. Day-to-day treasury responsibilities have been automated due to technological advancements, which has saved a lot of time on manual work and exposed treasurers to more strategic responsibilities or activities that require more strategic, critical, and analytical thinking.

3.2 Communication

Having the ability to communicate both verbally and orally is critical in today’s technologically driven treasury. The role of a treasurer involves working intimately with different departments to clarify the monetary concerns to the C-suite executives and the stakeholders. Having strong communication skills will be vital as adopting new technology means forming external partnerships and working closely with banks, fintechs and service providers. Organizations will constantly be looking for ways to leverage the latest tools, and treasury employees should be helping to drive this conversation.

3.3 Underlying Business Sense

Treasurers must have a thorough understanding of the business practices that exist in their organization; being able to comprehend such practices and obtain insights will aid in achieving the organization’s strategic goals. That’s why many treasuries are now trying to give treasury professionals more exposure to the rest of the business. This can be achieved through job shadowing, internal training, and getting staff into strategic meetings.

3.4 Change Tenacity

Technology is going to play a key role in future treasuries, from enabling strategic insights to automating daily manual tasks. Treasurers need to be tech-savvy. Existing employees should be trained on technologies like artificial intelligence (AI), robotic process automation (RPA) and data analytics as they have the potential to transform routine tasks like reporting and reconciliation, to strategic areas like risk forecasting.

3.5 Relationship Management

The role of the treasurer has always involved aspects of relationship building and stakeholder management but today, strong relationship building skills are more critical than ever. Treasury is now elevated to a business advisory role, supporting key business decisions. This brings with it the need to foster stronger relationships. Thus, maintaining a cooperative working relationship with banks, internal and external clients, board members, stakeholders, is essential for the treasurers.

What role does an organization play in upskilling its Treasury?

A recent survey conducted by Treasury Webinars shows that investment in the professional development of a Treasury team has increased over the past 12 months.

The key to long-term success for many Treasuries involves providing their people with the opportunities to transition into roles that are more skilled, value-based, and promising. Treasuries need to upskill their teams to prepare for future adjustments.

The below graph lists the top five metrics Treasury Professionals are adopting to upskill their employees.

Why are stretch assignments considered crucial for professional development?

Assigning the assignments or the action learning projects was the top response for the above survey. Opportunities to participate in stretch assignments, promote employee growth and talent development. Working on these projects inspires skill development, unleashes the employee’s potential, and can go a long way in accelerating an employee’s development gradually supporting the success of your organization.

Some examples of stretch assignments can be: delivering a presentation to a VIP client, leading the implementation of advanced tools to replace manual processes, heading the launch of a new product. Such assignments, when practiced, expand the skillset and provide industry exposure to a greater degree.

Checklist: 15 Ways To Help Your Treasury Teams to Upskill

| S.No | ACTIVITIES | YES | NO | PLANNING TO IMPLEMENT |

| 1 | Personalized Learning Plans Where Employees Can Choose Skills They Want to Excel and Learn Accordingly | |||

| 2 | Adopting and Testing Technologies within Your Business Model | |||

| 3 | Domain-Specific Training | |||

| 4 | Stretch Assignments or Action Learning Projects | |||

| 5 | Professional Certification or Credential Programs | |||

| 6 | Annual/Monthly Skill Evaluation | |||

| 7 | Reimbursement for Treasury-Related Conferences and Certifications | |||

| 8 | Formal In-House Training | |||

| 9 | Track Employee Engagement | |||

| 10 | Rewards and Incentives for Completing Training and Development to Reinforce | |||

| 11 | Utilizing Internal and External Experts for Webinars/Learning Sessions | |||

| 12 | Introduce Tool as a Project with Clear KPIs | |||

| 13 | Introduce Technology in Small Steps To Ensure Employees Gets the Basics Right Before Getting on the Complicated Part |

|||

| 14 | Lunch and Learn Sessions by Industry Experts | |||

| 15 | Engage End Users in Design, Development, and Deployment of the New Technology |

Summary

Treasurers have an opportunity to prepare for the future by broadening their skill sets and reassessing the value of treasury as a forward looking function. Talent management will therefore be vital, and traditional skills such as cash and risk management will no longer be sufficient. Heading towards the future, treasury professionals will require a range of hard and soft skill sets, combined with deep understanding of technology and data science.

These skills will be needed to help modernize treasury for the era of Artificial Intelligence (AI), Application Programming Interfaces (API), and Robotic Process Automation (RPA). In addition, well-honed communication skills would help ensure that treasury always has the ear of the C-suite and is consulted throughout in the strategic decision-making process.