Standardising O2C: AstraZeneca Global Finance Services Take Charge

- Discover how the leading multinational pharmaceutical and biotechnology company implemented a future vision of order-to-cash

- How AstraZeneca accelerated their order-to-cash journey to achieve end-to-end transformation

- Hear from AstraZeneca on their 5 key success factors

- Learn how AstraZeneca used 6 steps to ensure change management was implemented effectively

Part 1

Order-to-Cash (O2C) is a hugely complex, yet critical process for two reasons: 1) it crosses sales, order fulfilment, and finance, and 2) it touches the most valuable part of your organisation – your customer base.

Shared services have worked for decades at fixing the O2C problem, but rarely have companies managed to secure true end-to-end transformation or seen real success in standardising all processes across their operations.

To accelerate their O2C journey and achieve end-to-end transformation, AstraZeneca focused on three key areas – standardisation of operations, automation and digital transformation, and effective project management and coordination.

Impact Achieved:

- Substantially improved process standardisation (>80% globally), documentation, and process governance

- 85% reduction in Standard Operating Processes (SOPs)

- Significant progress in improving cost to serve metrics

- Switched the focus to performance, quality, and automation across SSCs

- Increased turnaround and response times, collections effectiveness, and Straight-Through-Processing rates (95%)

- A shift in value – finance function is a global role model, referred to as the ‘engine of finance, serving customers globally’

Part 2 : About AstraZeneca

AstraZeneca is a leading global biopharmaceutical business, with its innovative medicines used by millions of patients worldwide.

AstraZeneca has expanded to 5 main therapy areas in the past 2 to 3 years.

Delivered more than 2 billion doses of our COVID-19 vaccination, contributing 30% to the vaccines provided by all pharmaceutical businesses worldwide.

“Our purpose is to push the boundaries of science to deliver life-changing medicines. The best way we can help patients is to be science-led and share this passion with the scientific, healthcare, and business communities of the UK.”

– AstraZeneca UK Mission Statement

- In the UK, AstraZeneca employs 7,897 staff across five sites and supports around 41,000 other jobs.

- Global Business Services incorporates Order-to-Cash, Procure-to-Pay, and Global Finance Services.

- 2021 Annual Revenue $37 Billion

Part 3 : Challenges Faced by AstraZeneca

- Multiple SAP systems from acquisitions, all configured differently

- Decentralised SAP and process development

- Historical lift and shift migration – optional approach to centralization

Limited use of or any history of process governance - Limited documentation of processes

- Limited understanding of IT systems and SAP configuration

- Lack of comprehensive and maintained service book

- Extracting a single version of the truth and knowing where to prioritise

automation efforts

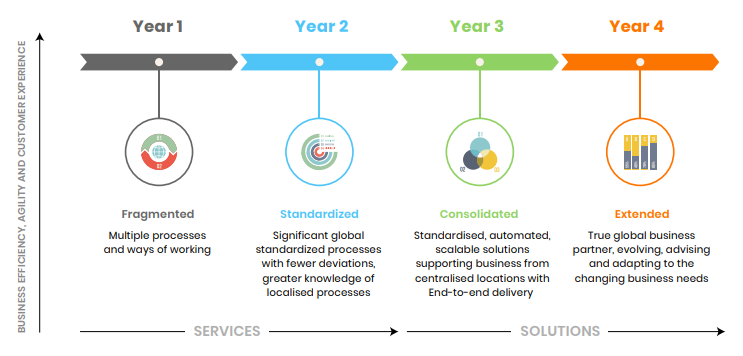

The Future Vision of Order-to-Cash

Global Financial Services at AstraZeneca set out to achieve ‘Excellence Through Innovation’ with the goal to deliver a service with world-class quality, reliability, and productivity with no failures and no fuss.

“Our mission was to provide global finance expertise at world-class quality, reliability, and productivity through a combination of enterprise partnership, deep capability, and living AstraZeneca values.”

– Global Process Owner, Order to Cash, AstraZeneca

A key success factor consisted of leveraging and embedding change and developing an exceptional finance talent pipeline, where leadership focuses on listening, building, and developing people.

Part 4 : The Journey to Success

AstraZeneca embarked on a standardisation and centralization process journey that involved huge collaboration from their Shared Services and Operations teams, resulting in an 85% reduction of Standard Operating Processes across the global finance function.

Operational Goals

- Engagement with all O2C operations teams

- Collaborative design process

- Understanding and determining deviations

- Working through standardisation with each SSC

- Inclusion of BPO and Captive Centres throughout

- Building and establishing process and documentation governance throughout

Key Success Factors

- Delivering a Standard Framework to Maintain Quality and Control

AstraZeneca needed to provide a documented, standardised process framework that could be followed by each operation to ensure consistency and efficiency. They managed this through five different frameworks:- Process Taxonomy – provides scope and a simple, intuitive structure to classify process information and allow Global Finance Services (GFS) and stakeholders to find relevant insight quickly.

- Finance Library – the central ‘home’ to create, manage and share process information including policies, standards, and standard operating processes.

- Supporting Information – training materials, articles, and management of deviations

- Process Home Pages – provides a community focus area for each process allowing customers to find relevant and important info quickly.

- Improve and Maintain – independent post-implementation reviews and assurance that processes are operating as intended.

- . Identifying Improvement Opportunities and Measuring Success

AstraZeneca focused on their overall cost to serve the organisation. This involved breaking down processes into unique areas and establishing metrics that could be tracked regularly and shared consistently.

As a result, they identified many manual processes that could be automated or removed completely in the areas of cash application and order entry.Improvement opportunities focused on performance and outcomes from the SSCs in the following areas:

- Collections efficiency – eliminating collection to terms KPIs

- Unapplied cash reduction targets

- Turnaround times – improving delivery time to customer and patient

Process adherence monitoring was implemented to ensure all teams in different locations were following the same steps and focusing on the same areas for improvement.

- Change Management & Training

The transition to, and ongoing evolution of, Shared or Business Services comes with major challenges. Transformation impacts technology, processes, and most importantly, people’s roles and responsibilities.

The impact on internal and external customers, senior management, and the Shared Services team, requires a well-planned and executed change management and communications strategy to enable success.AstraZeneca took the following steps to ensure change management was implemented effectively:

- Knowledge Capture – team members work closely with the Global Process Owner (GPO) capturing how each of the steps in the tasks and processes is performed.

- Standard Operating Procedure (SOP) 1 – information is entered into a bespoke tool and SOPs are created.

- First Review – SOPs reviewed by the team as a group and any changes highlighted, such as missing or incorrect information or deviations by country or SAP instances.

- SOP Draft 2 – SOPs are updated based on the review and reissued.

- The final draft is reviewed and approved by all members.

- Training – Teams are trained to ensure they understand the new standardised process and ways of working. Knowledge gaps for team members who will perform the process can be identified and cross-training provided.

- Working with the BPO – Key to Success

“Right from the start, we were extremely inclusive – we treat our BPO as part of our organisation – one team, one goal. They share our approach, provide input, and partner with us in multiple locations across all process towers.”

– Global Process Owner, Order to Cash, AstraZenecaCritical steps were taken to ensure BPO is an intrinsic part of the process:

- Ensured BPO senior leadership endorsement and support of change

- Included BPO operations colleagues in process design workshops

- Identified and eliminated processes no longer required

- Worked to form a more commercially aligned contractual agreement to support the change and the future vision of GFS

- An established baseline of process standardisation to be actively improved

- Celebrated and rewarded success throughout the process

- Supported personal and professional development with the BPO teams

- A unified approach to the process, people, and technology to operate with maximum efficiency across all of the SSCs

- Leveraging the Right Partner for Automation

AstraZeneca identified innovative automation solutions to drive their transformation journey. They selected HighRadius for AI-based cash applications and deductions management based on the tool’s scalability and 95% straight-through cash posting and automated deduction coding.

Automated deductions management has enabled AstraZeneca to:- Leverage Robotic Process Automation to auto-aggregate claims, proof of deliveries (POD), bill of lading (BOL) from emails, customer and carrier portals

- Automatically capture line-item data present in claim documents

- Auto-link claims, PODs, BOLs to their respective deductions so analysts can focus on quick resolutions

Extracting a single version of the truth and knowing where to prioritise automation efforts was a significant challenge with multiple SAP systems in place, across geographies, all with different configurations.

AstraZeneca worked with HighRadius to build a simplified architecture and identify several potential automation and digital opportunities across the end-to-end process, consisting of order entry, cash application, deductions, and collections.

“By leveraging end-to-end accounts receivable platform, we were able to increase turnaround and response times, increase collections effectiveness and Straight-Through-Processing rates. We are also able to track team KPIs in real-time. This has been a critical key success factor in demonstrating value to other parts of the organisation.”

“Extracting a single version of the truth and knowing where to prioritise automation efforts was a significant challenge with multiple SAP systems in place, across geographies, all with different configurations. HighRadius helped us prioritise these areas from order entry, cash application, and deductions, through to collections.”

– Global Process Owner, Order to Cash, AstraZeneca

What’s Next for AstraZeneca?

By demonstrating a sustained level of performance, quality, and positive business outcomes, AstraZeneca will bring in remaining O2C locally embedded processes into the GFS, delivering a true end-to-end process for all O2C functions.

AstraZeneca will continue to partner with HighRadius as they move to the next stage of the transformation journey, focusing on:

- Changing external customer behaviour to improve business performance

- Data attribute and master data improvement

- Prepare O2C for S4 HANA migration in coming years

- Prepare for future changes in healthcare impacting O2C

- Improve depth, breadth, and operational and process experience of teams to improve and sustain the capability to deliver plans

Valuable Lessons Learned

- Do not underestimate how long this can take, it is possible, believe you can do it!

- Investing in the hard work in preparation for the journey will pay back long term

- The success is worth it – celebrate small wins, recognize people and teams

- Quality of your people and working in partnership with IT is vitally important

- Your success can be inspirational to the rest of the business

- Don’t lose sight of what is important to the business and the value you are delivering

- There is no finish line, change becomes constant!