Strategic Credit And Sales Collaboration

An insightful summary on how to leverage credit and A/R data to lower operational costs

Strategic Credit And Sales Collaboration

While sales teams operate with a single agenda to `win as much business as possible, credit personnel on the other hand, are focused more on the profitability of sales and therefore apply credit rules cautiously to minimize credit risk and bad-debt write-offs.

Consequently, credit and sales teams are always at loggerheads.

In truth, credit and sales departments share many important goals. Both want their company to increase its revenue and profits. Each brings to the table unique customer knowledge that could help businesses grow.

Hence, it is imperative to leverage collaboration between credit and sales teams to ensure that credit departments do not simply act as gatekeepers to prevent bad credit decisions but also support company efforts to expand sales and meet growth targets.

Following are some avenues where past credit data could help the sales teams:

- Pricing decisions for profitable customers

- Intelligent payment terms

- Faster customer onboarding

1.1 Pricing Decisions For Profitable Customers

In the credit department, you always come across customers who consistently pay early or on time.

This could be an opportunity to brainstorm incentives for these profitable customers.

Consider offering a discount on a new product, or a sneak peek at one that’s yet to be revealed in exchange of increased order size. You could even introduce a customer rewards plan for targeted segments with a bigger appetite.

Record the results of each strategy to see if they were successful and use these results to decide if each tactic should become company policy.

Collaboration between credit and sales departments could lead to actions that unlock growth opportunities. Don’t let all that knowledge go to waste.

1.2. Intelligent Payment Terms

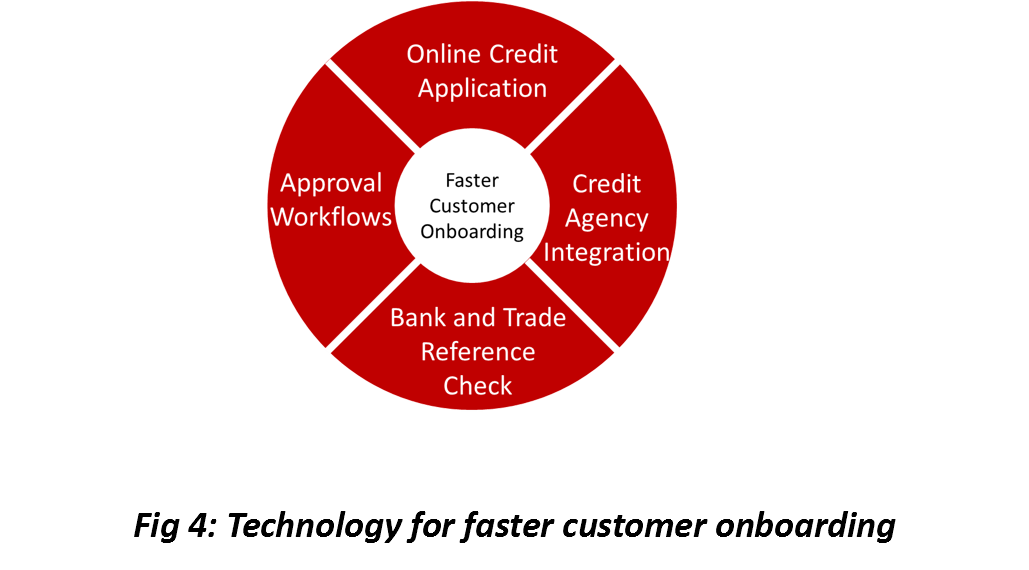

Payment terms have a big role to play in shortening the cash conversion cycle and improving customer relationships. Before companies can begin to harmonize their payment terms, they need to understand the three important components of terms and how they impact the actual customer payment period (Fig. 3).

– Payment terms: The payment term is what is typically defined within the contract, captured in the customer master data within the ERP system and then used as the basis of the calculation of the invoice due date. The payment term could be as simple as 30-days net, i.e., the due date is calculated as 30 days from the invoice date; however, there are many options related to payment terms that can affect and lengthen the actual customer payment period such as EOM terms, early payment terms, installments and so on.

– Payment cycle: The customer’s payment cycle will be affected when a payment is processed and received. If, for example, a customer only executes one payment run a week and only includes invoices due at that point, a proportion of invoices will always be paid late (or potentially early).

– Payment method: Some forms of payment result in “cash in the bank” more quickly than others; e.g., payments via direct debit are typically received the same day, while payments received by check take several days to clear.

While a combination of these factors affects the actual customer payment period, businesses have limited influence on the payment method and even less on the customer payment cycle.

The only way they could reduce the payment period is through dynamic, customer-specific payment terms defined in collaboration with insights from the credit department.

If the credit team realizes the potential to make the customer pay faster by changing the payment terms based on their past behavior and preferences, such insights could be incorporated in the contracts with the objective of faster recovery of dues and shorter cash conversion cycle.

To illustrate this, customers who are habitual late payers could have shorter payment terms or even late payment fees imposed on them to reduce DSO.

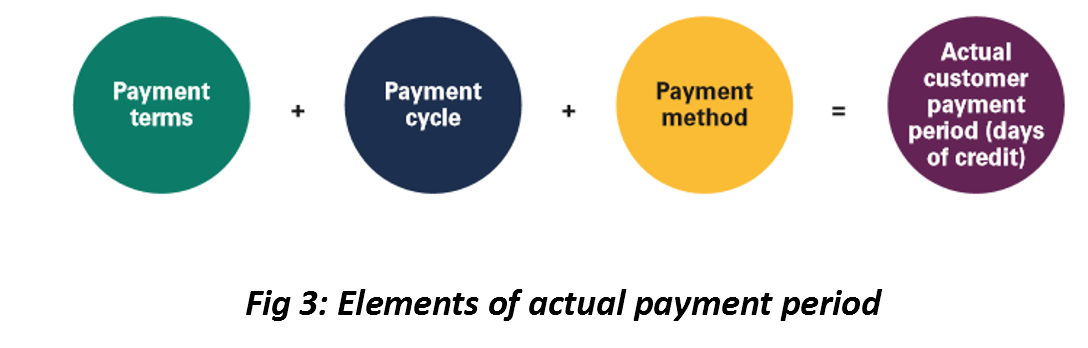

1.3. Faster Customer Onboarding

Customer onboarding is invaluable in that it creates the first impression for the customer as far as the A/R practices are concerned.

If well-executed at every touchpoint from the first contact to purchase and thereafter, it can be the beginning of a long and fruitful relationship.

Delays can kill sales. People lose interest as more time passes between contact and close.

Faster customer onboarding is therefore critical for faster revenue realization.

Current processes for customer onboarding employed by many organizations involve collecting credit and financial documents and individually engaging credit reference agencies to verify customer creditworthiness against other independent data sources.

Internal team communication for approvals via emails, fax, calls, etc. further delays the process.

While credit departments are only doing their job by performing credit checks to reduce risk exposure, if the process is confusing, overwhelming, or puts up barriers to the first order, one could lose the customer to a competitor who has a smooth onboarding process.

Technology enables online credit application for capturing complete and valid information from your prospects while eliminating paper costs and processing delays. Automation supports real-time credit decision, which may translate into higher closing percentages; near-instantaneous approval via workflows helps deals happen regardless of geography and integration with external credit rating agencies and bureaus for financial statements and customer credit history helps credit teams process applications faster, with minimal effort and maximum accuracy (Fig. 4).