The 11 Unbeatable Collection Templates

This ebook unveils the 11 most effective email templates that will help you collect your receivables faster. The ebook is a culmination of our work with credit and collection experts over more than 400 credit and A/R transformation projects across the world.

The 11 Unbeatable Collection Templates

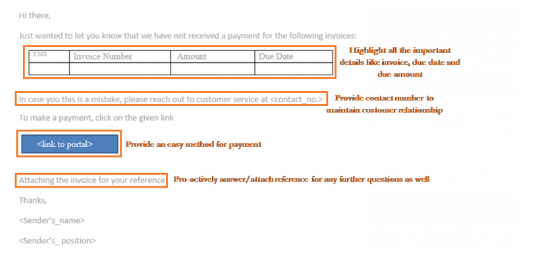

Pro-active payment reminders

Best-practices:

- Be polite ? remember that this is just a pro-active reminder; do not assume that the customer will default

- Clearly specify the invoices and the due-dates

- Urge them to make a payment with their earliest A/P run

- Share options for easy payment methods through an EIPP portal

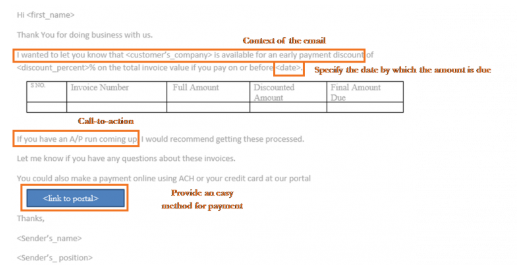

Early-payment discount reminders

Best-practices:

- Clearly call out the offer ? a discount on early payment

- Clearly spell out the date by which payment must be made

- Detail any invoices with the actual amounts to be paid ? this clears any confusion in buyers manually calculating final amounts

- Urge them to make a payment with their earliest A/P run

- Provide convenient payment options

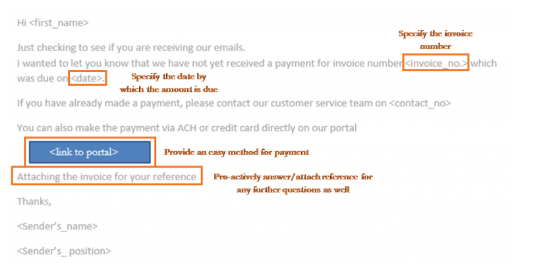

First past-due reminders

Best-practices:

- Clarify whether the customer has received any previous invoice copies

- Call out the invoices for which payment has been delayed ? specify the actual date

- Ask the customer to reach out to customer serivce in case of any issues

- Offer convenient payment options

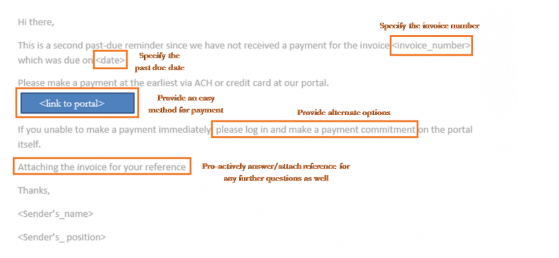

Second past-due reminder

Best-practices:

- Clearly inform about the delay in payment

- Call out the email as a ?second? past-due reminder

- Remind the customer to make a payment at their earliest possible

- Offer the option of making a payment commitment through your EIPP portal

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

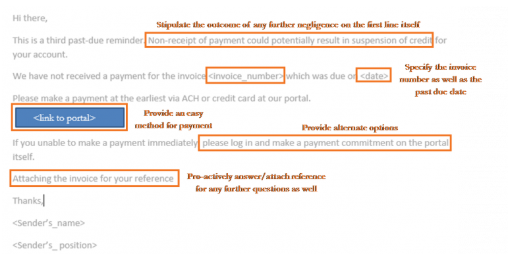

Third past-due reminder

Best-practices:

- Call out the possible outcomes for further non-receipt

- Drop any non-essential courtesy or flowery language

- Remind the customer to make a payment at their earliest possible

- Offer convenient payment options

- Offer the option of making a payment commitment through your EIPP portal

- Attach the original invoices to avoid further to and fro in requesting invoice information

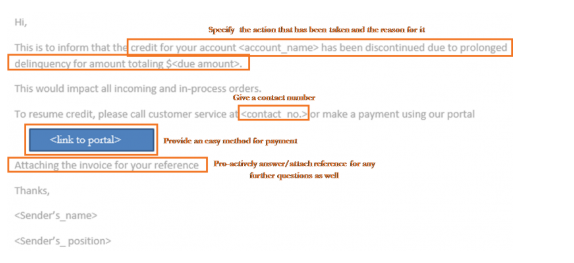

Suspension of credit

Best-practices:

- Inform about discontinued credit

- Clearly specify the reason for discontinuation of credit to the account

- Call out the total value of outstanding or past-due invoices

- Offer reaching out directly to a customer service representative as the first option

- Offer convenient payment options

- Offer the option of making a payment commitment through your EIPP portal

- Attach the original invoices to avoid further to and fro in requesting invoice information

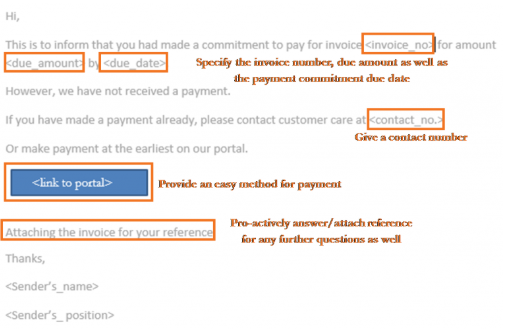

Default on payment commitment

Best-practices:

- Use this as a polite reminder about the unfulfilled payment commitment

- Include the details of the invoice, amount and promised payment date

- Ask the customer to contact a customer service representative for any help in facilitating the payment

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

Escalation notice

Best-practices:

- Clearly specify that this is an extra-ordinary circumstance in which the recipient is being reached out to

- Highlight all the information they need to help process the payment

- Offer convenient payment options

- Attach the original invoices to avoid further to and fro in requesting invoice information

- Use this template sparingly to avoid diluting its impact and value

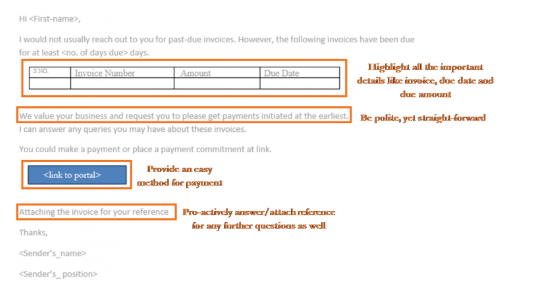

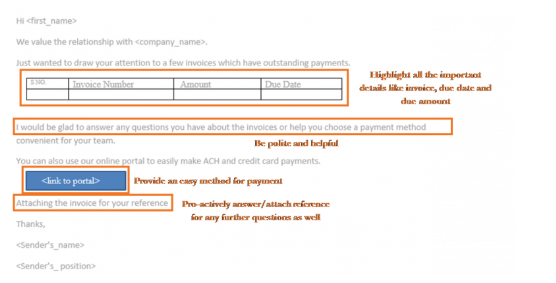

Collecting from key accounts

Best-practices:

- Appreciate the relationship with the customer

- Be polite and helpful with any additional details they may need in processing the payment

- Offer convenient payment options

- Attach the original invoices so that all information is available in one place

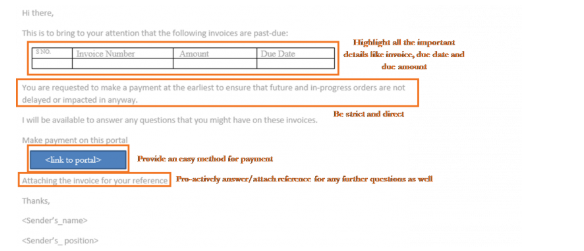

Collecting from Slow-paying customers

Best-practices:

- Share all information required in a single place

- Be up-front about the implications of continued delay in payments

- Offer support in answering any questions

- Offer convenient payment options

Collecting from Fast-paying customers

Best-practices:

- Be polite ? these customers have always paid you on-time

- Offer the benefit of doubt and ask them to reach out to customer service for any help

- Offer convenient payment options

- Attach the original invoices so that all information is available in one place