The AR Sweet Spot to Cap Revenue Leakage at the CFOs Office

Understand how autonomous finance can play a key role in weeding out revenue leakage situations.

The CFO offices’ dream: Zero revenue leakage

‘Zero Revenue Leakage’ is what every CFO strives for, but it is far from reality today. Often, either the CFOs office lacks control over processes that cause revenue leakage, or is unaware of the revenue loss their business faces year on year. In fact, most businesses make a provision for 2%-5% of their revenue to leak.

As per a recent study by EY, every company should expect to lose 1% to 5% of realized EBITA (Earnings before interest, taxes, and amortization) to revenue leakage while managing payables. This story is not much different as CFO offices struggle to collect due receivables attributable to auto-write off, delays in collections, and more.

But why should you worry about the revenue leak at all? Let’s put the cited 1-5% leak into perspective for a growing mid-market organization. When you generate $20 mn in revenue, the leak amount is in thousands, but as soon as you scale to $100 mn in revenue, you stand to lose anywhere between $1 mn to $5 mn annually.

In simple terms, higher revenue means a higher percentage loss in leakage. As a CFO, if your business is built on recurring revenue, or if you expect revenue growth, revenue leakage is going to be a recurring challenge for your business.

This eBook provides you with a quick 3-step rule on how to prevent revenue leakage with examples across accounts receivables processes at the CFOs office:

Anticipate accounts receivables issues and tap them at the point of origin

Analyze existing accounts receivables processes that cause revenue leakage and pivot

Adapt to digital solutions to safeguard your revenue and collect every $

This eBook uncovers these opportunities for CFOs to not only manage revenue but nullify the possible leakage.

Small revenue leaks but major consequences for the CFOs office

Mid-market businesses that rely on a steady flow of cash need to prevent revenue leakage by identifying the root cause as they scale their business.

A business losing money consistently due to revenue leakage can be extremely difficult to remain profitable. Revenue is a crucial metric for the CFOs office, as it provides insights into the past, present, and future of the business. Hence, revenue loss is an ongoing concern for the CFOs office. For growing companies the leakage numbers are often minuscule, which can be missed out by the watchful eyes of the team at CFOs office. This revenue leakage becomes a problem when it increases over time and causes significant loss of money for the organization.

While most organizations often suffer revenue leakage, it’s worse in businesses that operate using disparate systems, which creates data silos, leading to potential leaks that go unnoticed. As per a recent study, 49% of CFOs find it difficult to execute data that is not only timely but also accurate for driving quick and informed decisions.

While the lack of adequate data could be the root cause of revenue leakage, there are several other factors that either directly or indirectly cause loss of revenue. Let’s take a look at them in the next section.

Revenue leaks that put cash flow in jeopardy

Only 37% of finance leaders reported that they expect to achieve 95% or more of the revenue they originally budgeted for in 2020 when the pandemic hit. It is critical to dive deep and avoid loose ends in processes that lead to revenue leakage.

Here are some signs to watch out for revenue leakage across CFO offices:

- A prolonged DSO

- Disputed accounts receivable amounts

- Gradual increase in written off receivables amount

- Repeat defaulting customers

The CFOs office needs real-time visibility across these metrics to understand the situation, plug the revenue leak, and take the necessary measures to prevent any further loss of revenue. Let’s look at some of the common causes of revenue leakage in mid-market organizations –

3.1 Inefficient customer onboarding

Organizations without a strong credit policy for customer onboarding invariably end up extending incorrect credit limits, thereby increasing the credit risk. Revenue leakage occurs due to delayed or unpaid dues when your AR team assigns a miscalculated credit limit to your customer without performing a thorough analysis.

3.2 Lack of digital implementation

Many mid-market organizations that rely on manual approaches are susceptible to revenue leakage, due to their vulnerability to errors and inaccuracy. For example, if a customer is billed $10 for a product that costs $15, for 100 such units, you register a loss of $500. This very number can grow from $500 up to $500,000 for larger businesses.

Along with the increase in business complexities, digital native customers also expect a seamless experience during a transaction lifecycle. Moreover, the use of manual methodologies impact the productivity of the CFOs office, as manual tasks consume time and require more resources, resulting in added cost. Hence, the CFOs office in mid-market businesses must implement AR systems with automation capabilities, replace manual processes to minimize errors, and reclaim the resultant revenue leakage across the receivables process.

3.3 Ignoring unbilled receivables

Unbilled receivables is revenue that a business has accounted for but has not issued an invoice to the customer. It simply means that a business has provided the service but is yet to get paid. These transactions could either occur due to a manually-driven invoicing and billing process or a business understanding with the customer. Unbilled AR is a big challenge for the CFOs office as it hampers timely payment collection, and the lack of billing information could force the credit teams to incorrectly assess customer accounts, which could lead to late payments.

By effectively monitoring the unbilled AR, the CFOs office can make informed decisions on customer payments, and the resulting data will improve customer credit assessment and increase collectability.

3.4 Missed invoices and payments

Invoicing is the most common process with high revenue leakage risks. Without a streamlined invoicing workflow, CFO offices cannot collect due receivables on time. Especially when invoice generation and delivery is required for numerous accounts. The accounts receivables team must send accurate invoices on time to ensure that they’re paid what is due.

3.5 Erratic pricing and dynamic billing requirements

To stay competitive in a crowded market, it is a common practice for a business to offer discounts to customers and dynamically manage pricing. While the strategy is understandable, if discounts and pricing go unchecked, businesses end up selling products or services at a loss. Additionally, while making these offers, the finance team needs to cater to additional points such as profit post new discounted deals, surge in raw material cost, etc.

3.6 Not resolving disputed payments

Disputes in accounts receivables have a serious impact on an organization’s cash flow and severely affect its financial health. For example, dispute management can cost up to 30% of the total order to cash effort.

Disputed payments usually start whena customer acknowledges the invoice for the services rendered or goods sold, but refuses to make the payment citing unresolved issues regarding the transaction.

Without a proper plan of action for collections, the CFOs office would be in limbo on the number of payments that are in dispute and the status of each of those payments. On the other hand, the customers could lose trust in the organization due to a lack of dispute resolution, and may either not honor the payment or could take their business elsewhere. Either of these situations severely impacts business revenue.

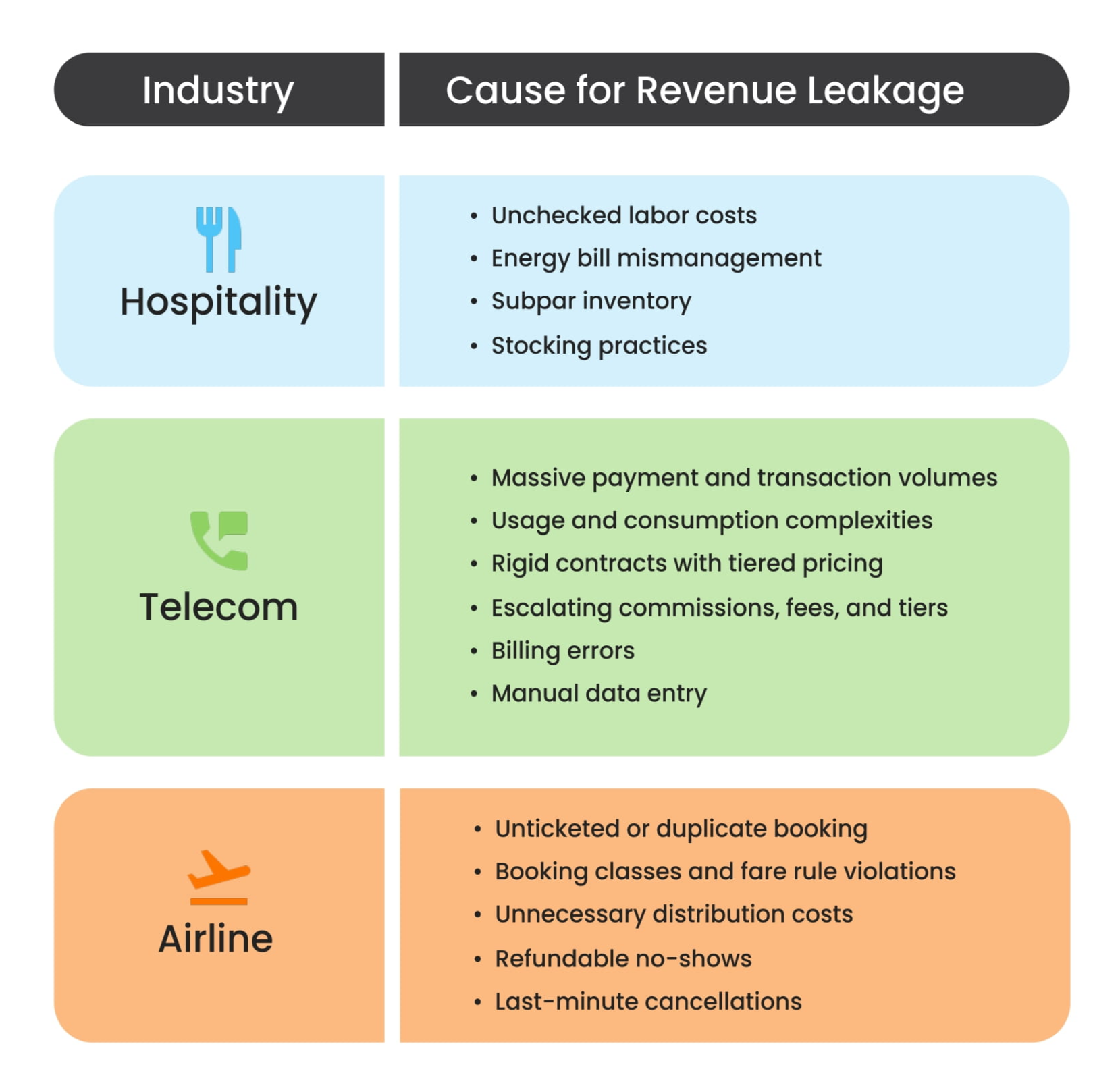

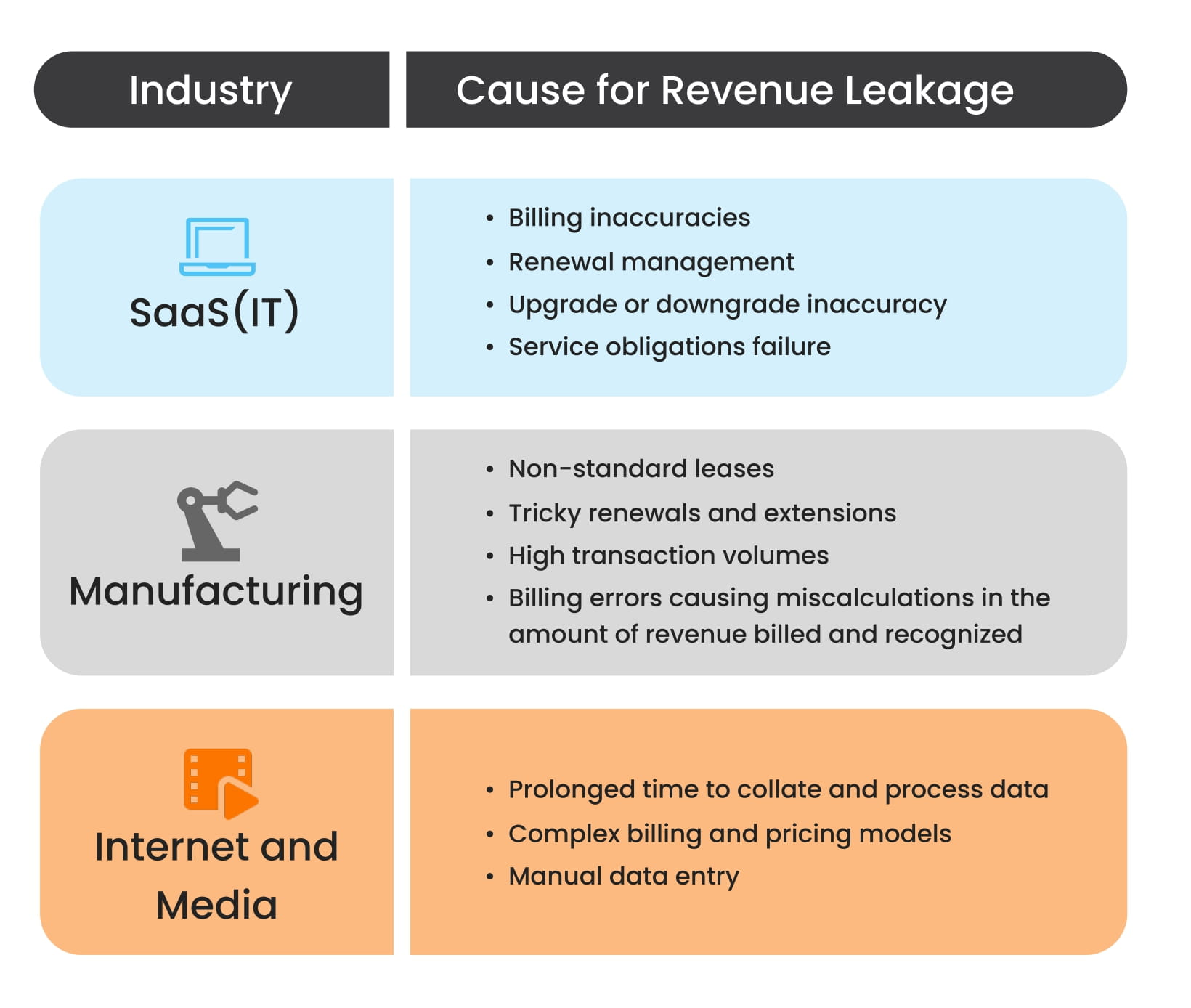

Industry-wise overview of revenue leakage sources

Here are the most common revenue leakage sources which CFO offices can tap to improve their profitability. The table is split across industries – hospitality, telecom, airline, SaaS, manufacturing, and internet & media.

Accounting the impact of revenue leakage

Now that we have uncovered the causes of revenue leakage and it’s point of origin across different industries, it’s also crucial to understand how it impacts accounts receivables processes:

- Impact on cash flow, DSO and DDO: Unpaid AR is one of the main causes of revenue leakage as it directly affects cash flow. As AR dues keep piling up and the CFOs office struggles to follow up with customers to clear outstanding payments, KPIs like Days Sales Outstanding (DSO) and Days Deductions Outstanding (DDO) will increase as a consequence. DDO is a crucial KPI for revenue leakage as invalid deductions will cause you to lose money if you cannot identify them.

- Increased Redundancies: One of the first signs of revenue leakage point to redundancies within the organization. These may range from employees to the operations they’re assigned. They not only cost you time but also hinder other essential processes that might benefit from an addition of personnel.

- Reduced Efficiency: When an organization is leaking revenue, the CFOs office will need to put in extra time and effort on tasks, thus decreasing the CFO’s bandwidth and efficiency.

- Reduced Process Visibility: For a CFO to course-correct, they need to have perfect transparency on the processes within the organization across all departments. Some leaks are incredibly difficult to find without the right tools and as a consequence, would silently affect other processes that seem fine in isolation. Therefore, process visibility takes a hit.

- Rising costs: The causality of all the challenges listed above eventually leads to cost overruns. These may include the cost of operations, customer acquisition, etc.

3 useful steps for a CFO to reduce revenue leakage

6.1 Start with Accountability

Accepting that there is revenue leakage is the first step to redemption for any CFO who cares about cash flow optimization. The CFO needs to take an overarching approach to identify areas that are causing revenue leakage and take the necessary steps to stop the loss.

6.2 Enable Better Visibility

More often than not, the CFOs office isn’t even aware of what is going wrong with the organization’s O2C process. Hence, CFOs need to have real-time visibility on key AR metrics that have the potential to bring down revenue. These could be –

- Average Delinquent Days

- Days Deduction Outstanding

- Post Hit Rate

Research shows that 35% of best-in-class services firms leverage time tracking to drive real-time visibility into project data. Having clarity and visibility on these key metrics can enable the CFOs office to better understand the pain points and optimize those key AR processes.

6.3 Action Digital Touchpoints

- A critical element that the CFOs office could use to decrease revenue leakage is to enable digital touchpoints. By digitizing the various business-customer touchpoints, CFOs can not only ease operations but also provide better data management, increase visibility on key AR parameters and improve the overall experience.

- For example, by enabling digital payments, a business can do away with paper-based check payments, which are error-prone and cause delays. Not to mention the time saved in having to collect, scan, and present the check for payment. Hence, digital collaboration could help you reduce revenue leakage and ensure consistent CX (Customer Experience).

Tried and tested methods; what worked and what did not?

Downsizing of departments

When most CFOs spot signs of revenue leakage, their first thought would be to downsize the department that has the most personnel. This might cut down costs, but when a bigger team wasn’t the problem in the first place, the revenue leakage will not stop either. Downsizing a department may also lead to reduced efficiency as the workload on remaining members will increase as they will need to perform additional tasks to compensate for the shortfall. Therefore, downsizing is not always the solution to revenue leakage.

Implementing ERPs and invoicing software

Manual processes and communication gaps are the biggest reasons for revenue leakage. When you introduce state-of-the-art software like ERPs and invoicing systems, it will help plug these leaks as they streamline processes. While this works in many cases, just using the software may not work out in the long run, as your requirements might evolve as your company grows.

Revenue assurance

While it is good to identify and stop revenue leakage, the best plan would be to prevent future leakages. Revenue assurance is the application of a process or software which identifies potential leaks and corrects data before invoices are sent to customers. This implementation works with almost every business, especially in the mid-market as it can reduce the risk of manual errors.

The role of autonomous finance in managing revenue leakage

Since the accounts receivables process is an enabler to a business’s revenue, fixing loopholes across the AR processes could significantly reduce revenue leakage. However, several mid-market businesses even today rely on a piecemeal approach to AR and use disparate solutions along with manual processes to manage mission-critical accounting functions. These include customer onboarding, invoicing, collections and payments.

These legacy systems are not only redundant but are expensive, error-prone, and counter-productive, all of which impact revenue negatively. Furthermore, this semi-automated approach to accounts receivables fails to deliver the necessary insights that businesses need to chart strategies to optimize revenue and increase their profitability.

Hence, mid-market organizations that want to plug revenue leakage in their AR processes must replace fragmented, siloed solutions with a single unified platform that can simplify, and optimize the AR system.

8.1 Automation ‘Must Haves’ for the CFOs office to plug revenue leakage

- Accessible and operational system across locations

- Easily customized to suit the needs of the CFOs office

- Automate manual AR functions

- Configurable invoicing support for globally distributed customers with multiple currencies

- Offer digital payment solutions to customers

- Provide intelligent and actionable analytics

- Implement advanced validations to ensure data accuracy

- Enable real-time dynamic decision making

- Integrate with existing applications(CRM, ERP)

8.2 Autonomous finance to manage revenue leakage

Since the most common cause of revenue leakage is attributed to manual inputs, introducing AI into the picture can help reduce these inputs and significantly limit the chances of triggering events that lead to revenue leakage.

8.3 Limited resources; maximum output

By automating the accounts receivables process, the CFOs office can manage resources efficiently and may not require to increase the headcount unnecessarily.

8.4 Reduce manual errors

The CFOs office can eliminate the possibility of manual errors through automation and reduce the cost of rework and correction. Moreover, it would also help to improve the turnaround time for AR tasks, improving the order to cash cycle.

8.5 Deliver superlative CX

AR automation could help mid-market businesses offer consistent customer experience (CX) and pave the way for repeat business. From offering digital credit application systems to e-payment opportunities, businesses can not only ease their operations and increase their cash flow but also keep their customers satisfied.

8.6 Manage disputes effectively

With real-time data at hand, the CFOs office is in a better position to handle payment disputes and ensure their proper handling and quick resolution. This ensures faster collection of payments and improves the cost of working capital.

It’s time for CFO offices to scale with HighRadius

Let’s paint a picture here: You plan a long road trip to a quiet cozy cabin with your family for the weekend, away from the city. You’re obviously fueled up in anticipation for the long drive that awaits you. At around halfway through the journey, in the middle of nowhere, your car suddenly starts steering to the left, only for you to stop and realize that you have a flat tire.

This is certainly a tough situation, which could potentially turn into a nightmare if you are missing the spare tire. The flat tire could have been caused by a small hole just a few kilometres from where you started but you ignored the signs, and now you’re stranded in the middle of nowhere, with little to no help.

Let’s look at this analogy from a CFOs perspective whose office is losing revenue due to an unknown or ignored leak. With increased revenue leakage, you will struggle to run your organization smoothly and you will reach a point where taking the accountability of revenue lost that could be recovered won’t reflect well for you or your team.

In this age of heightened competition coupled with an ever-changing economy, it’s important for mid-market businesses to identify sources of revenue leakage and tap them before it causes further financial problems. Simultaneously, the CFOs office across mid-market organizations must rethink their automation strategy and implement a one-system one-solution AR ecosystem to reduce leaks, provide alerts for critical issues and increase cash flow.

The RadiusOne AR Suite is designed to assist Mid-Market CFOs with their critical AR tasks. With RadiusOne, CFO offices can keep revenue leakage in check by:

- Converting cash faster with the prioritized collections worklist that will help you segment your customers based on their past payment behavior

- Easily communicate with customers as correspondence is made simpler and customizable with automated emails

- Following up on late-paying customers with integrated Native VOIP calling

- leveraging a dedicated self-service customer portal that helps you reduce invoicing costs and enables your customers to make payments via their preferred payment method and raise disputes, if required

- Reducing the cost of invoicing by 3 times by automating transactional tasks and reducing human error

- Resolving a majority of your deductions automatically, resulting in a reduction of human touch points and savings on valid disputes, high recovery rates and reduced write offs

And the best part is, if you are in the HighRadius’ ecosystem of AR automation, then your solutions can grow along with your business by leveraging the autonomous receivables solutions that HighRadius offers.

To know more, submit a demo request here!