The Migration Methodology

Understanding the need and challenges associated with ERP migration to S/4HANA and the four-step framework to a successful migration effort.

The Migration Methodology

The migration to S/4HANA could be carried out as one of the following three transition scenarios:

- New Implementation: This is the kind of migration in which a customer is moving from a current version of SAP or even from a Non-SAP ERP to S/4HANA. The final system requires an initial load of data, hence post-implementation of the S/4HANA module, the master as well as the transactional data is migrated to the new platform from the legacy system.

- System Conversion: Also termed as the ?lift and shift? transition process, it involves a complete conversion of the SAP business suite into the SAP S/4HANA Business suite.

- Landscape Transformation: This is the kind of migration scenario being applied by organizations that use different ERP systems across several business units in multiple geographical locations, and want to consolidate their entire system into one global SAP S/4HANA system.

The Implementation Methodology

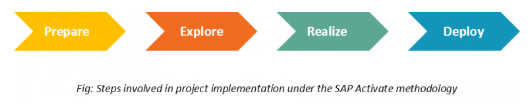

SAP has released various project implementation methodologies over time. The latest one of them, which has also been discussed extensively as a part of a successful migration to S/4HANA, is SAP Activate. The SAP Activate methodology states that any ERP migration projects has four main steps, which are as follows: Prepare, Explore, Realize, Deploy (PERD).

Migration Approach for O2C

While taking inspiration from SAP Activate, here is the migration methodology followed by our customers to successfully migrate O2C systems to S/4HANA:

- Follow the Best Practices: You start with benchmarking your O2C processes against best in class organizations. The next step in this phase is to perform an analysis around what is a part of the new system to which you are about to migrate.

- Pre-assembly and Realization:†One of the most important stages of the implementation methodology, this covers all the cutover activities that include† the different steps involved between pre-planning and deployment. Part of this process also involves migrating the data to the new system and getting ready to run a pilot with end users.

- Solution Validation:† This is the stage where you involve the end users and guide them through the standard functionality of the newly adopted solution, through show and tell sessions. Learn more about the additional requirements or gaps in the system according to them, so that you can decide on a way to include it in your new system with minimum modifications.

- Credit Management features :

- Credit rule engine for automatic risk scoring and credit limit calculation

- External credit rating agencies integration

- Automatic update to master data on credit limit approval

- S/4HANA Invoicing and Payments features

- Present open invoices to customers

- Initiate payments and support disputes while doing so

- Cash Application features

- Perform basic Cash Application activities such as closing open invoices

- Dispute Management features

- Automatic Reason coding for disputes

- Log claims into the system with manual support

- Integration with trade promotion systems

- Collections Management features

- Generate Prioritized Collections Worklist on a day-to-day basis

- Capture notes and Promises to Pay for customers

- Configure collection† rules and strategies based on aging and payment behavior

- Agile Builds: Post the validation stage, all that remains to be done is to incorporate additional functionality in the system as per end user needs and industry best practices while making sure that there is a business case for each requirement. This requires prototyping and frequent validation of the results with end users to ease platform adoption.

The latest module of SAP S/4HANA offers a lot of features for different stages of your Order-to-Cash. Let us drill down to each one of them and see all the functionalities that you would be able to enjoy natively in S/4HANA.

Build vs Buy There are two approaches that organizations could take for incorporating custom functionality 1) leverage internal IT teams to built in-house and 2) configure cloud solutions that integrate into S/4HANA. Here are two reasons why organizations are gravitating towards SaaS cloud solutions.

- Faster ROI: With getting a solution built in-house, the project tends to have an extended timeline given the complexity of sharing resources for various IT projects. ?Buying? a technology on the other hand helps you achieve a positive ROI faster with speedy implementation.

- Future Proof: When you opt for the ?build? approach, maintenance is also a challenge. In contrast, ?buying? a solution positions outsources the responsibility of maintenance to the vendors.

Each of the below module enhancements could be one sprint in order to ensure successful migration. I.Top Enhancements in the Credit Module

- Online credit application from where† credit information from customers can be captured automatically

- Artificial Intelligence enabled blocked order resolution

- Automated correspondence for verifying bank and trade references

- Integration to credit insurance firms and public financials providers

II.Top Enhancements in EIPP (Electronic Invoice Payment and Presentment)

- PCI-DSS compliance with processor tokenization

- Level III processing for 40% less costs and secure transaction

- Integration to print and mail providers to send physical invoice copies

I.Top Enhancements in Cash Application Module

- Remittance aggregation from e-mails, web portals, EDIs and paper

- AI- enabled OCR with self learning capabilities for capturing remittances

- Customer Identification using email domain and MICR

II.Top Enhancements in Dispute Management Module

- Auto-aggregation of backup documents such as claims, proofs of delivery and bills of lading

- Pre-deduction support to settle disputes even before the payment has been made

- AI-enabled dispute validity predictor

- Automated correspondence to customers for credit memos and dispute denial

- Integration to retailer and customer portals for one-click dispute

- Automated settlement of trade-based deductions

III.Top Enhancements in the Collections Management Module

- Automated Mass Correspondence for segmented audience

- In-built editable templates that can be auto-populated with customer details

- Payment date prediction with Artificial Intelligence

Once any organization goes through these sprints, it would be >90% ready to run the business operations on S/4HANA. The only hurdle to cross would be the change management bit where the project managers need to monitor user adoption and create training and onboarding plans to ensure a smooth transition into the new system.