The Perfect A/R Dashboard: 5 Reporting Dashboards Fundamental for Every Credit and A/R Leader

E-book on the Collections Operations Maturity Model: Lower DSO by Enabling People, Process, Data, Collaboration and Technology

Need of The Hour- A Perfect Dashboard

Importance of a Reporting Dashboard

How would you feel about driving a gorgeous Lamborghini that has no dashboard?

Just to help you imagine, while driving you would have no idea:

- If your fuel is about to finish (ride’s over)

- If your car has over-heated

- The exact speed of your car i.e. would you be able to slow down before you crash into another car

Would you feel safe in this adventurous/treacherous ride?

The answer is no.

The same applies to Accounts Receivable. Even if your A/R is running as smooth and fast as a Lamborghini (congrats!), you still need an insightful dashboard to keep you up-to-date with all the crucial metrics that will help to make accurate decisions for times ahead as well as to change course promptly if need be.

It is imperative for finance and A/R leaders to opt for a dashboard that ensures key working capital metrics are always your fingertips.

The following chapter explains the major challenges of not using a dashboard. It also elucidates the major drawbacks of working off a data-heavy, spreadsheets-based dashboard.

A/R Management Without Dashboards

1. Lack of visibility into performance and productivity

The inability to track the progress or regress of the credit and collections teams’ performance and productivity which inevitably affects the bottom-line as well as the top-line revenue of the company is a major concern for finance executives. For instance, they would not be able to track:

- If the credit team is setting the right credit terms

- The amount that turns into bad-debt

- If the collections team is collecting on time

- The volume of invalid deductions vs write-offs

Elementary metrics do not give full insight into the performance and productivity of team members. Hence, by ignoring these critical data points, executives might end up making inaccurate decisions.

2. Lack of access to real-time insights

Reporting is a time-consuming process. While making timely accurate decisions is imperative for finance leaders, opting solutions based on weeks/months old metrics and data can be catastrophic for the company. Therefore, it is extremely essential for finance executives to have real-time data and crucial metrics on their fingertips that can be easily accessed through a customizable dashboard.

3. Time-consuming traditional reporting

Traditional reporting tools may permit users to publish reports that contain KPIs and data visualizations, but they often require power user skillsets or assistance from IT. These visualization-based reports lack true analytic depth and don’t allow users to provide descriptive text that contextualizes the analysis. Plus, they don’t fill the need for published reports demanded by decision-makers, executives, and board members.

4. Data Overload

On average, 1000-10,000 payments are made in a B2B company. In order to crawl through these huge payment volumes which might include payment by a client paying for its open invoice or the result of a dunning process or payment along with a deduction. Manually collecting, segregating and analyzing these large volumes of data takes a huge amount of time and makes the reports data-heavy. Hence, inevitably it delays the reporting process.

Therefore, it can be safely concluded that the slow and non-responsive machinery that is usually used by businesses for reporting lacks the agility to respond to strategic business needs and take timely course corrective actions to avoid any future ordeals.

Key Considerations for a Perfect Dashboard

An accounts receivable dashboard for receivables management can quickly translate a company’s objectives into measurable metrics. It enables the executives to accurately measure today vs. organizational goals.

In short, an accounts receivable dashboard is a system that helps you monitor and measure where a company stands in terms of its cash management performance. It summarizes important performance indicators such as:

- Days sales outstanding

- Receivables ageing

- Accounts receivable turnover ratio

- Average days delinquent

- Top paying customers

- Activities by the collector

An accounts receivable dashboard gives collectors, managers, and executives instant access to both basic and advanced data elements to help them better understand the current state of their receivables and progress toward personal and organizational goals.

The main features that define an ideal reporting dashboard for accounts receivable should:

- Include all the up-to-date snapshots of crucial metrics, with “drill down” features for a more comprehensive view of the underlying data as and when required by the executives, directors as well as managers

- Facilitate quick answers to any query and include data filtering features to allow views by geographic region, customer industry and/or any other segmentation

- Cut through data overload and get to the metrics of relevance instantly to suit an executive’s needs

- Include forecasting as its major forte to predict future cash flows and payments by analyzing the existing data and payment history

While every company might have a different definition of an ideal dashboard based on their industry, enterprise size and even customer type, at a fundamental level, it should be able to highlight the major dents in the current A/R processes that might be responsible for vagaries in critical metrics as well as performance trends or patterns which if went unnoticed, might negatively impact cash flow and working capital management.

Executive Dashboard

While the executives want to cut through the surplus data and have a strategic overview of end-to-end receivables performance, they also want to adopt fast and instantly responsive dashboard machinery that empowers them with agility to respond to strategic business needs and take timely course corrective actions.

This is what an ideal dashboard for a finance executive looks like.

Days Deduction Outstanding Monthly Trend Report

Customer deductions continue to plague companies across industries selling through multiple distribution channels. Irrespective of their varying nomenclature as deductions, chargebacks or short pays, the results are always the same – erosion of the company’s bottom line.

In order to keep a check on how well or poorly the deductions team is handling the swelling volume of deductions, executives need to keep tabs on the growth or decay of days deduction outstanding over a period of time.

Key Metric Captured:

The key metric captured in this report is Days Deduction Outstanding. It illustrates how well or how poorly a company is managing its deductions. It is calculated by dividing the number of open deductions by the average value of deductions incurred over the last month.

Why is it essential for an executive dashboard:

While deductions might occur for n number of reasons, it is essential for an executive to know how fast the A/R team is able to process these deductions and add dollars to the bottom line based on the validity of the deduction.

Based on the monthly trend of DDO, the executive can decide on any requisite corrective course of action that needs to be taken for maintaining the DDO at par with the industry standards, if not better.

Total Open A/R by Segment – Monthly Report

While implementing intelligent tactics to “get paid” early and execute different collections and cash application strategies to apply the cash faster and close the open invoices without delay, the executive still struggles to have a holistic view of the total open A/R according to different customer segments.

Many companies use risk categories or geographical classifications as customer segments. However, the most ideal and vital segmentation of customer database would be in terms of dollar value, risk class, and nationality.

Hence, an executive dashboard should definitely contain a report that illustrates the total open amount for all the high-risk customers and high dollar accounts customers.

Why is it essential for an executive dashboard:

Usually, in order to understand the total open A/R, executives ask for different reports including: –

- Total open A/R by risk category

- Total open A/R by the dollar value of accounts

- Total open A/R based on geography

Now, they will have to sift through each of these reports, analyze and then make accurate inferences from the surplus data. This re-work of analysis and drawing accurate implications based on the existing reports that had been initially made by capturing the standing data defeats the entire purpose of the dashboard and reporting of cutting through surplus information and getting a clear and concise picture of total open A/R.

An ideal executive dashboard should instead consist of a report that enlists the total open A/R for high-risk accounts, high dollar accounts as well as any other necessary customer segment that might have a direct and most importantly a colossal impact on the company’s bottom line.

Taking a note on the crests and troughs of this report would help the finance executives monitor the growth or decay in the total open A/R for different customer segments and make accurate decisions to improve the conditions for each of these accounts.

Day Sales Outstanding- Monthly Report

Determining the day’s sales outstanding is an important tool for measuring the liquidity of the company’s current assets. Due to the high importance of cash in operating a business, it is in the best interest of the company to collect remaining receivable balances as quickly as possible. In order to monitor the wellness of the health of the collection of the accounts receivable team, it is imperative to monitor the rise and fall of this metric across months. It is also essential for an executive to note that the DSO for the company stays below the industrial DSO standards.

Key Metric Captured:

As the name suggests, the key metric captured is Day Sales Outstanding. Days Sales Outstanding (DSO) represents the average number of days it takes credit sales to be converted into cash, or when a company’s accounts receivable can be collected. DSO can be calculated by dividing the total accounts receivable during a certain period of time by the total net credit sales. This number will then be multiplied the number of days in the period of time.

To determine how many days it would take a company’s accounts receivable to be realized as cash, the following formula is used:

DSO = Accounts receivable / Net Credit Sales X Number of Days

The period of time used to measure DSO can be on a monthly, quarterly, or annual basis. If the result has a low DSO, then it means that the business takes fewer days to collect the receivables. On the other hand, a high DSO entails that it takes more days to collect receivables. In turn, a high DSO may lead to cash flow problems in the long run.

Why is it essential for an executive dashboard:

Days sales outstanding can vary from month to month, and over the course of a year with a company’s seasonal business cycle. Essentially, when analyzing the performance of the accounts receivable team of the company, DSO is a major consideration. If DSO is getting longer, customers are taking longer to pay their bills, which may be a warning that customers are dissatisfied with the company’s product or service, or that sales are being made to customers that are less credit-worthy, or that salespeople have to offer longer payment terms in order to generate sales.

The monthly trend report depicting the increase or decrease of DSO of the company over months empowers the executives with agility to proactively spot any “increasing-DSO” trend and take well-timed, accurate rectifying measures to prevent any future hazardous effect on company’s bottom line.

Hence, this report is a must-have for an executive’s dashboard.

Cash Projection Report for Next 7 Weeks

Accounts Receivable has a great impact on a company’s cash flow. Therefore, it is very important for finance executives to forecast receivables. Becoming involved with cash management and forecasting cash flow adds value to the organization. The cash projection report is a part of the Cashflow forecasting that is critical in maintaining or improving the financial stability of an enterprise.

It aims to provide a business with an estimate of incoming and outgoing cash over the course of a given time. Usually, conducted by reporting teams with an intention to determine the expected income and costs that the business will face over the time period specified in the forecast.

Why is it essential for an executive dashboard:

For most organizations, the objective of cash projection is to determine when cash shortage or excess will occur during the year hence informing the executives when to transfer funds to or from short-term investments. Rather than waiting until the accounting staff realizes there isn’t enough cash to cover that week’s checks, a cash projection gives management the ability to anticipate this need, so they can be proactive rather than reactive.

Another benefit of cash projection is to not only anticipate when to transfer funds but also to determine what is causing an excess or shortage. Is it due to timing, lower-than-expected registration for the annual conference, slow payment of dues, or worse yet the loss of members, etc.?

The key reasons why cash projection reports are essential for an executive dashboard is as follows: –

- Identify potential shortfalls in cash balances in advance—considering cash flow forecast as an “early warning system”.

- Make sure that the business can afford to pay suppliers and employees. Suppliers who don’t get paid will soon stop supplying the business.

- Spot problems with customer payments—preparing the forecast encourages the business to look at how quickly customers are paying their debts.

- As an important discipline of financial planning—the cash flow forecast is an important management process, similar to preparing business budgets.

- External stakeholders such as banks may require regular forecast. Certainly, if the business has a bank loan, the bank will want to look at the cash flow forecast at regular intervals.

Hence, it is one of the most important must-haves for the executive dashboard.

It’s no secret that collecting accounts receivable has its fair share of unique challenges. However, overcoming these challenges becomes systematic once the executives find an effective dashboard to track the metrics using real-time reports. This system should organize, categorize, and report the surplus data so that tracking important metrics and forecasting cash flow is automatic. With such a system in place, finance executives can be proactive in reforming their accounts receivable.

Process Specific Dashboard

Apart from having an ideal dashboard that provides valuable insights into the entire accounts receivable operations, it also needs to contain drill-down features on each of the individual processes. This is essential as it helps A/R managers understand which process or operation under accounts receivable is responsible for dipping metrics. It also enables the directors and managers to keep a tab on the key metric for each of the processes, the overall performance as well as individual productivity of each team (collectors, deduction analysts, etc.)

In this chapter, we discuss four crucial process-specific dashboards that are vital for finance executives’ decision making: –

- Collections

- Dispute Management

- Credit Management

- Payment Processing and Cash Application

Finance execs across all industries need to be aware of the health of their organization as well as the health of the processes that enable sound financial management. The sub-topics outlined further in this chapter shed some more light on process-specific dashboards that can be used to identify and evaluate the health and efficiency of the accounting and finance function as well as the financial health of the organization.

An ideal process-specific dashboard should easily be able to answer the following questions: –

- How have each accounts receivable bucket fared over time?

- Which specific currencies, geographies, invoicing unit, offerings, sales reps or customers need to be managed better or monitored closely? How has their historical performance been?

- What are our receivables position and their composition by age (bucket analysis)?

- Who are our top clients in terms of outstanding receivables?

- What is our risk exposure, especially for receivables beyond a threshold?

- Are the disputes being managed and resolved optimally?

- Are there receivables that we may have to write-off or transition to collections in the future?

- What specific combination of actions do we need to take to meet our target for Days Sales Outstanding (DSO)?

- Can the system leverage predictive analytics capabilities to assess payments at risk?

The answer to some of these questions might be available on the executive’s dashboard as well. The question here is even if these answers are not directly available on your accounts receivable dashboard, is it possible to get these answers through any drill-down features in a simple and faster way?

Collections Dashboard

While every business likes to make sales, selling without the timely collection of due receivables is as good as the on-paper sales agreement. As such, business owners often need to estimate collections of accounts receivable to project cash inflows to meet the company’s obligations. Understanding how to figure collections of accounts receivable can help finance executives identify an impending cash crunch before the business is in the middle of it.

The following dashboard elucidates the must-haves for effective collections monitoring.

CEI per Collector

The collection effectiveness index per collector is one of the most useful metrics a company can use to monitor the business’s financials. It measures the speed of converting accounts receivable to closed accounts by each of the collectors, which then indicates new methods or procedures that one can use to translate accounts receivable even more. If the CEI percentage per collector decreases, then that’s a key performance indicator that the company needs to put in place in policies or investigate the department in more detail.

Key Metric Captured:

CEI stands for the Collections Effectiveness Index and it is a commonly used metric to track a company’s accounts receivable performance. Put most simply, the CEI compares how much money was owed to the company and how much of that money was actually collected in the given time period, usually one year. The resulting percentage allows the company to gauge how strong their current collections policies and procedures are and whether or not changes need to be made.

It is calculated by the given formula: –

CEI percentages are pretty easy to interpret. The closer the percent is to 100%, the stronger a company’s collections processes and policies are. A low or dropping percentage means it is high time to re-evaluate the policies of selling on credit and the processes your collectors are following

Why is it essential for collections dashboard:

CEI per collector is an important metric to keep an eye on because accounts receivable is one of the biggest assets of any company. It also enables the finance directors and managers to keep track of the productivity of each of the collectors in the team. The higher your CEI, the stronger your policies and procedures and the faster you can turn invoices into cash, get the cash to the bank, and use it to meet financial obligations and grow your business.

On the other hand, if the CEI of the collectors is dipping then this report acts as a warning sign for reforming policies and strategies for the team

Day Sales Outstanding Monthly Trend

As discussed in Section 3.3, monitoring Day Sales Outstanding(DSO) on a monthly basis can be quite beneficial for an executive, it can also educate the collection managers more about their collection team’s effectiveness on shorter durations of time. DSO indicates the average amount of days it takes your company to collect funds after a sale has been made.

Key Metrics Captured:

Day sales outstanding(DSO)is used to calculate how quickly you are able to collect the money owed to you after the sale has been completed; the average collection period.

DSO= (Accounts receivable / total credit sales) x number of days in the period.

Interpreting this metric correctly is critical. First, it is important to note that each industry has a different average DSO, so you will want to do some research to see how yours measures up to your peers. Typically, you want DSO to exceed your terms by no more than half. So, if you operate on payment terms of 30 days and you’re seeing the payment in 45 days, you’re doing pretty well.

Why is it essential for collections dashboard:

We just went through a chapter describing how the performance of the collections team can be most accurately measured by including Collection Effectiveness Index(CEI) per collector and here yet again we talk about DSO which helps to understand the amount of time taken to collect funds after a sale has been made essentially determining the team’s performance.

On the surface DSO and CEI sound very similar, but there is a very important difference to note. DSO provides insight into collections during one point in time, usually periods of less than a year(monthly in this case).

DSO also is a measurement of time, how long it takes for you to collect on an invoice once it is sent. Whereas CEI measures the effectiveness of your collections performance over a longer period of time, generally a year although the formula can be manipulated for smaller segments of time. Additionally, CEI differs from DSO because it is not a measurement of time, it measures the overall quality of your collections processes.

Hence, it is essential to include both these reports in the collections dashboard

Contacts vs Payment Commitments vs Payment Collected- Monthly Trend

This report gives in-depth information about the various activities performed by collectors over a course of time. It elucidates that for a given month

- The total number of contacts created by all the collectors

- The total amount of payment commitment done by the customers against all their open invoices for that month

- The total amount of payment collected by all the collectors for that month.

By cumulating these data for a longer period of time, a new report is created that graphs the volume of each of these activities over months.

Why is it essential for a collections dashboard:

This report empowers the finance directors and managers with the knowledge of how each of these activities has been performed historically vs currently. It also helps them to identify any significant changes in the count of the activities being performed.

Top 10 Delinquent Customers- Monthly Trend

When extending credit to customers, you run the risk of accounts receivable going delinquent. Although you might be able to make future collections on the accounts, these accounts still require special procedures to ensure future business with the clients, explore different payment options, and decide whether legal recourse is necessary.

In order to ensure that no such extremity is required, a monthly report containing the list of total open amounts for each of these delinquent customer accounts on a monthly basis should be present is the collections dashboard.

Why is it essential for collections dashboard:

It is important for the finance managers to monitor all these delinquent accounts to proactively detect any excessive delinquency. For example, in the graph given in the collections dashboard, the total open amount for Glov TTP Tech has increased by almost 50% in one month. This calls for some serious dunning by the collectors in order to collect the due amount.

Similarly, if a new customer comes into the top 10 delinquent customer list, the manager can spot the account much earlier and hence if need be, revamp the dunning strategies for that customer.

Hence, by having this report in the collections dashboard, the finance execs can easily spot any specific need to change the dunning process or methodology for a particular delinquent account based on the increase/ decrease in their delinquency over a period of time.

Deductions Dashboard

Customer deductions remain an intractable problem causing revenue and profit dilution costing even mid-market companies man-years of back-office work and millions of dollars every year – depending on the industry up to 5- 15% of revenues. While deductions will never be completely eliminated, steps can be taken to reduce those that are considered “self-inflicted” and streamline processing of those that are “the cost of doing business”.

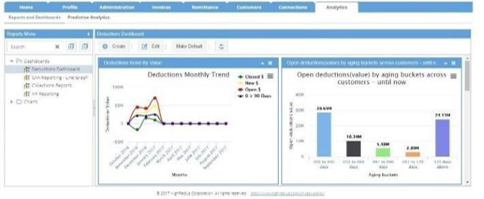

Hence an ideal dashboard for deductions would look something like this.

Deductions Monthly Trend

Deductions are a low hanging fruit that can add dollars to the bottom-line by recovering invalid deductions and improving the productivity of what is a very manual and tedious process. The volume of deductions provides the range of total deductions across different customers and time periods.

However, a report that depicts the dollar value of the open deductions, new deductions, closing deductions, as well as the deductions that have been open for 90+ days across months, can be extremely invaluable for the finance managers to make timely and accurate decisions based on the requirement.

Why is it essential for deductions dashboard:

This report is essential for finance executives as it provides a holistic view of the entire deductions process. For example, the graph used in this dashboard elucidates that the maximum amount of deduction taken by the customer was in May 2017. Also, the most number of 90+ days open deduction was in May 2017. This might have been an extremely hectic month for the deductions team. The reason for this might be a new acquisition or separation or degrading services.

In any case, this graph would have helped the manager to take note of this sudden rise in the value of deductions and hence implement accurate rectifying measures or change some existing policies or suppliers that would prevent any such increase in the dollar value of deductions in future.

Average no. of days to resolve deduction by owner

While it is essential to monitor the overall results achieved by the deduction management team, it is also imperative to keep a note of individual analysts’ performance. This can be measured by capturing the average days taken by a deduction owner to resolve all the deductions from his/her worklist.

Deductions can be the result of one or many errors in a company’s processes. So, it’s important to analyze, categorize and trend deductions by type, frequency, size, customer as well as owner. Compiling these statistics will allow the finance executives to determine where to focus their recovery efforts, route deductions to the appropriate person or department for resolution, conduct root cause analysis, and establish thresholds for automated write-offs.

Why is it essential for deductions dashboard:

Companies find it crucial to be at par with the industry standards and to maintain their metrics including an average number of days to resolve deduction. To ensure this, finance executives can use advanced reporting and analytics to monitor the growth or decay in the average number of days taken to resolve deductions by each individual owner. This enables them to spot early trends (good/bad) and hence decide on the best corrective course of action that can be taken to reduce the cumulative average number of days taken to resolve a deduction.

Top 10 Reason Codes- Last Month vs Today

Deductions are usually categorized into two types. Trade Deductions are deductions that can be called the “cost of doing business” whereas the Non-Trade Deductions can rather be referred to as the “cost of doing business poorly”. Hence, finance executives are always looking for any low-complexity fast system that can help them understand the operational issues that are leading to a growing number of deductions.

Why is it essential for deductions dashboard:

This report captures the top 10 reason codes and the dollar value of the deduction taken by the customers against each of these reason codes. Moreover, it comes in a monthly series format, thereby enabling the executives to understand the major operational issues responsible for the swelling dollar value of deductions. It can also help them understand if their policies or course corrective actions are taken to cut down the number of deductions is working as desired or not. For example, if a manager adopted a new strategy to reduce the number of deductions due to reason code A(say), yet even the next month the dollar value still increased, it would be an early indication that the strategy didn’t work and needs to change.

Non-Trade deductions are frequently preventable or controllable with improved processes and stricter adherence to customer compliance and routing requirements. This report will definitely help the finance executives to take better control over the swelling volume of deductions

Days Deduction Outstanding- Monthly Trend

Across industries, A/R teams are often responsible manage large volumes of payment deductions and discrepancies, which arise when customers dispute invoices, take advantage of discounts, or levy penalties because of fulfillment-related gaps. As AR teams are dependent on unstructured communication channels and have limited information, they must dedicate a disproportionate amount of time and energy to managing these deductions and disputes. Research shows that on average, 14– 16% of deductions and disputes are not valid, and consume 25–35% of the total order to cash effort. Each year, up to 5% of deductions and disputes are unresolved and written off.

Hence, to watch over this rising amount of deductions, companies use Days Deduction Outstanding as a key metric to track the speed and accuracy of the resolution of deductions.

Key Metric Captured:

As discussed in the previous chapter, the key metric captured in this report is Days Deduction Outstanding. It illustrates how well or how poorly a company is managing its deductions. It is calculated by dividing the number of open deductions by the average value of deductions incurred over the last month.

Why is it essential for deductions dashboard:

As a holistic metric of the entire deduction management process, it is essential to include this report in the deductions dashboard. Also to understand on how well or poorly the strategies being implemented to control deductions have been working out in the long run(last few months), this report has given managerial insights that can be leveraged to take accurate decisions to bring down the DDO below or at par with the industrial standards.

Resolving deductions as quickly as possible can improve receivables and free up staff to focus on activities that add greater value to the organization. Hence, by carving the perfect dashboard, finance executives can ensure a much flourishing bottom-line with a low investment of time and human resources in resolving deductions.

Payment Processing and Cash Application

Over the last few years, it has become evident to many that the B2B payments space is ripe (and longing) for innovation. A lot has happened to bring the space forward, but this is only the beginning. FinTechs are redefining electronic payments by making it possible to make the card, ACH, check and even cross-border payments within a single process that requires nothing more to initiate than the standard reports out of the company’s accounting system. Once payment is sent, it’s guaranteed to arrive with no further effort on AP’s part.

Inflow with these developments, the AP departments have realized that they need to stop paying suppliers with paper checks and move to electronic payments. While there’s an intention to head in this direction, most U.S. companies estimate that they are still making about 50 percent of their payments by check.

Therefore, the suppliers are left hanging in the air with the need to adopt processes for applying cash that can support both checks as well as electronic payments. They are also left with a need to observe how well their services are being adopted by their customers. Also, if they are implementing any automation solution, they feel the need to how much the system is able to capture.

The ideal dashboard for payment processing and cash application would look something like this.

Payment ERP Status by Month

As a holistic summary of all the payments including Electronic Fund Transfer(EFT) and checks that have been fully/partially processed or are still unprocessed or have just been posted on the account, this report gives a full telescopic view of the ERP status of all the payments done by the customers on monthly basis. It not only helps to understand the extent of each individual activity but also helps to paint a full picture of the cash application done by the A/R team.

Why is it essential for payment processing and cash application dashboard:

Cash Application though usually considered as a very tactical process of no strategic importance to the entire A/R actually plays a crucial role by effecting the downstream processes. For example, if the payment has been made by the customer yet due to a slow cash application, the payment has not been applied. Due to this, the customer account will still appear in the collector’s worklist instigating the collectors to contact the customer thereby spoiling the customer relationship and plausibly increasing the Day Sales Outstanding of the company.

Hence, it will be extremely invaluable for the finance executives to keep a tab on the total count of payments processed and applied by the cash application team. Also, in the case of dipping count, it will enable them to spot early and initiate new strategies or adopt new technologies to streamline cash application as well as other downstream processes.

User Exception Handling Productivity by Assigned User

The cash application process is highly manual, time-consuming, costly, and error-prone. Companies receive many forms of payment including check, ACH, wire transfer across multiple lockboxes or banks and customers often provide inconsistent remittance detail in a variety of formats like paper, EDI, email attachments, online portals. Manually juggling through this surplus data (sometimes inconsistent with illegible hand-written remittances), it results in a huge number of exceptions that have to be resolved manually.

Now the burden of resolving these exceptions lies with the cash application team. Hence, it is essential to monitor how accurately and quickly the cash application analysts are handling these exceptions.

Why is it essential for payment processing and cash application dashboard:

Like all other receivables processes, it is imperative to record the performance and productivity of each of the cash application analysts working on the resolution of deductions. This report consists of a note of the number of exceptions assigned to each analyst and the percent resolved by all of them.

By interpreting each of their individual performances and taking active measures to improve the productivity of each of the analysts, the finance executives can ensure the best results in exception handling and therefore cash application.

Number of ACH Transaction- Monthly Trend

According to a survey conducted by Ardent Partners, 71 % of B2B companies are now fully capable of paying their suppliers electronically. Moreover, 89 % expect that they will be issuing electronic payments to the majority of their suppliers by 2016.

At this time, it is important for both financial institutions and businesses to evaluate their electronic payment product portfolio. This analysis should be coordinated and compared against organizational needs and goals. This report helps the finance executives in doing a conclusive analysis of the same thereby generating concrete proof of their product’s ROI as well as laying down foundations for change and new technological adoptions if need be.

Why is it essential for payment processing and cash application dashboard:

Financial institutions that offer an appropriate electronic payment product mix can expect to enhance existing client relationships, attract new clients, increase revenues, and decrease both costs and the risk of fraud. Similarly, businesses that identify and adopt clear electronic payment strategies will realize streamlined business processes and significant bottom-line savings.

Hence, it is imperative to record the number of ACH transactions across different months to understand the working capacity of the payment solution as well as its adoption by the customers.

Check Capture Rate Across Lockboxes by Month

When executives give the go for using new automation technologies like optical character recognition for reading remittances from check stubs and other paper remittances, they like to know how accurately the system is able to automatically capture the information.

Why is it essential for payment processing and cash application dashboard:

In case of any challenge in capturing the remittances automatically or any lack of accuracy in the information captured, this report helps the execs to understand how well the new solution is able to respond to the remittance and capture information.

The monthly format helps them to map the capture rates across different months and hence detect any decaying in the trend thereby forewarning to take corrective measures.

Credit Dashboard

Your customers make up your portfolio of business. With a portfolio, comes credit risk. We’ve all had customers with a history of paying on time and those customers that pay, but they pay late. The key to keeping healthy cash flow and low DSO is to isolate the late payers. Late payers can have different credit limits and collection strategies applied to their accounts in order to reduce risk. Carefully monitoring payment trends with aging reports and implement a credit rating system to reduce overall credit risk.

The most accurate picture of how the customer pays is needed to make prudent credit decisions to reduce credit risk and decrease exposure to bad-debt. This can be done by taking support from the given dashboard.

Credit Limit by Strategy

The most common way businesses track creditworthiness is to pull the customers’ credit rating from a credit-monitoring firm. There are many credit-monitoring firms there; popular firms include Dun and Bradstreet, Experian, and Equifax to name a few. These firms allow you to check credit on an individual business. If you want your customer’s credit rating updated on-demand and available immediately for creditworthiness decisions, fintech also give you the opportunity to select a credit-monitoring firm that integrates with your account receivable or collections software system.

This report enunciates how many of your existing/new customers are with or without financials

Why is it essential for credit dashboard:

Having a report that can easily identify the amount of credit limit exposure with or without financial reports presently vs last month can help the executives understand how secure their credit risk is for a different set of customers.

For example, if there is an increase in the credit limit exposure of the existing customers who do not have any financial reports from December to January then it calls for a serious alarm for the credit analysts to prioritize download of reports for these customers.

Hence, it is one of the must-haves for a credit dashboard.

Credit Applications Submitted Monthly

A company needs to know what type of organization it may be extending credit to, hence making credit application an essential part of the process. Providing credit to a client that business leaders don’t know anything about may significantly increase a company’s risk of accumulating past-due bills or not getting paid at all. Processing credit applications online can get rid of all of these financing headaches while still providing your customers with the benefit of paying over a longer-term. Hence, many companies opt for online credit applications to onboard new clients.

Therefore, we have this report where the number of credit applications submitted by the customers per month.

Why is it essential for credit dashboard:

Finance leaders across the globe suggest that prospective clients should be required to fill out applications that detail all-important company information, bank references, trade payment references, business bankruptcy history and personal guarantees from the company owners. This will provide your company with an overview of a potential customer’s operations and current situation, and could help you find reviews that factor into your final decision.

This report helps to keep a tab on the number of customers (prospective clients) who have filled the entire form per month. It also helps the finance executives measure the adoption rate of the online credit application among its prospective clients. It enables them to have the flexibility to revamp the forms if need be based on the clients’ response hence making it an integral part of the credit dashboard.

Number of applications processed per owner

With the economy still uncertain, companies have to balance their need for acquiring new business and their need to get tough on risky customers. Not every client needs to be scrutinized – companies have to weigh the time and effort for evaluating a client’s creditworthiness as well as the risk of turning away a potential client. But in most cases, organizations can take additional precautions when it comes to doing business with new clients, short of investing in underwriting services.

Some of these tasks that can be performed by the credit analysts are as follows: –

- Check credit history

- Call references

- Find public information

This report outlines the number of applications processed by each credit analysts by performing the above tasks.

Why is it essential for credit dashboard:

As is the case with all other receivables processes, it is invaluable to monitor the performance of all individual credit analysts. Since they are entrusted with the very crucial responsibility of evaluating a potential client’s creditworthiness and assigning credit limits to them based on their credit scores, it is imperative to record how accurately and swiftly analysts are able to process these new applications.

Based on the count of new applications processed by each owner across different months, finance executives can devise new strategies and policies that will enable fasten customer onboarding. Hence, this report plays an important role in executives’ decision making for a better future.

Additional Metrics to Track

In this chapter, we discuss some additional metrics that should be tracked by finance executives to ensure complete optimization of accounts receivable management. Each metric either falls into the performance bucket, a measure of the process, or the productivity bucket where the focus will be on the efficiency of people.

Cash Conversion Cycle

Definition:

Every business tries to collect receivables as fast as possible while delaying paying A/P until the due date. Suppliers produce with cash, sell on credit and again collect in cash. The cash conversion cycle(CCC) looks at the amount of time needed to sell inventory, collect receivables and pay bills without incurring penalties.

How A/R performance impacts Cash Conversion Cycle:

Lower Days Sales Outstanding (DSO) directly leads to a lower CCC. Lower DSO can be achieved by setting the right credit terms with policies and speeding up the conversion of receivables. Companies are leveraging techniques and best-practices including electronic invoicing for fast, accurate invoice delivery, automated and prioritized collection processes and improved credit scoring systems to collect faster

Accounts Receivable Turnover

Definition

Accounts Receivable Turnover is used to quantify a firm’s effectiveness in extending credit and in collecting debts on that credit. The receivables turnover ratio is an activity ratio measuring how efficiently a firm uses its assets.

The receivables turnover ratio can be calculated by dividing the net value of credit sales during a given period by the average accounts receivable during the same period. Average accounts receivable can be calculated by adding the value of accounts receivable at the beginning of the desired period to their value at the end of the period and dividing the sum by two.

A high turnover ratio indicates a conservative credit policy coupled with an aggressive collections department, as well as a number of low-risk customers.”

How A/R performance impacts Accounts Receivable Turnover:

A higher ratio means A/R is being converted to cash infrequent intervals. The more frequently A/R is collected the higher cash flow and liquidity.

There are a number of different tactics that improve the accounts receivable turnover:

- Iterating and improving credit policy

- Standardizing collections correspondences with in-built templates

- Making sure the productivity of the employees is tracked

Aging Buckets

Definition

Customers are categorized into Aging Buckets based on the past due duration of A/R, e.g. Past Due 0- 30, Past Due 31-60, Past Due 61-90. A customer belonging to a lower aging bucket is low risk and a customer belonging to a higher bucket is high risk.

How A/R performance impacts Aging Buckets

Customer correspondence strategy and account coverage are critical to ensure that most receivables stay current i.e. within payment terms. By employing proactive reminders/early payment discounts before the invoice is due and dunning letters after the invoice is due will largely prevent invoices from aging. Collections departments have to focus on not letting accounts move beyond the 90 days bucket. This is one of the reasons why collections analysts rely on aging buckets to prioritize who to call.

Summary

Fueled with the most advanced dashboard and reporting system, finance and A/R leaders can easily rudder their accounts receivable processes through the headwinds of changing market dynamics as well as increasing competition. Real-time availability of important reports and metrics empowers them to prematurely spot any trends that warrant immediate attention, providing the legroom to respond to strategic initiatives focused on driving business growth.

HighRadius Receivables Analytics

HighRadius Receivables Analytics provides out-of-the-box reports and insights by connecting and analyzing data across credit and A/R data sources for analysts and managers to achieve an end-to-end overview across all credit-to-cash processes. Businesses are able to capture intelligence and insight to take corrective actions, modify A/R strategies and make proactive decisions. Replacing traditional reporting systems with out-of-the-box, real-time reporting and analytics saves time and provides organizations with the tools to implement a fully optimized accounts receivable management process and improve A/R performance.

Customizable and Dynamic Dashboards

Dynamic dashboards provide a snapshot view of your key A/R data for quick and easy data analysis/visualization

Advanced Drill-Down Functionality

Interactive drill-down functionality enables a thorough root- cause analysis and provides key operational insights

Process and Team Performance

Tracking Reports on individual process performance and efficiency provide metrics to gauge analyst-level and process-level productivity

Filters for Customized Data Visualization

Report filters provide greater flexibility to specify the user-specific information filtered on the reports

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadius™ Integrated Receivables platform optimizes cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by Rivana™ Artificial Intelligence Engine and Freeda™ Virtual Assistant for Credit-to-Cash, HighRadius Integrated Receivables enables teams to leverage machine learning for accurate decision making and future outcomes. The RadiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months. To learn more, please visit https://www.highradius.com/

HighRadius’ Integrated Receivables Platform

Integrated Receivables is a solution to optimize accounts receivable operations by integrating all receivable and payment modules to work as a unified business process. At the core of the Integrated Receivables platform are solutions for credit, collections, deductions, cash application, electronic billing and payment processing – covering the entire gamut from credit-to-cash. The HighRadius™ Integrated Receivables platform is a stand-out as it enables every credit and A/R operation to execute real-time from a unified platform across the credit-to-cash cycle.

HighRadius™ Integrated Receivables leverages Rivana™ Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively using machine learning for accurate decision making across credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOne™ network, closing the loop from the supplier A/R process to the buyer A/P process.