Three Must-Haves in AI Driven Best-in-Class Solutions

An insightful summary of what you should look for in† SaaS O2C solutions to improve metrics and satisfy customers at lower cost in the postmodern ERP environment!

Three Must-Haves in AI Driven Best-in-Class Solutions

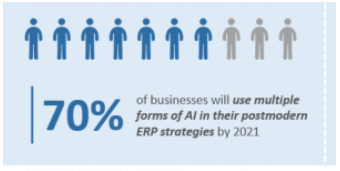

Instead of investing in antiquated on-premise systems, leading businesses have turned to SaaS and cloud-enabled solutions that are easy to implement, configure, and update. Moreover, in the last decade, artificial intelligence or AI has evolved from a far-fetched fantasy to practical reality, boosting operational efficiency and reducing costs beyond belief. Now, with the agility and flexibility offered by this strategy to select, integrate, and implement the best solutions without putting additional load on the IT and business side, it?s time for O2C leaders to leverage the latest technologies like AI in cloud solutions that are deployed through SaaS. Here?s how AI could significantly help you rudder your A/R in the right direction:

Instead of investing in antiquated on-premise systems, leading businesses have turned to SaaS and cloud-enabled solutions that are easy to implement, configure, and update. Moreover, in the last decade, artificial intelligence or AI has evolved from a far-fetched fantasy to practical reality, boosting operational efficiency and reducing costs beyond belief. Now, with the agility and flexibility offered by this strategy to select, integrate, and implement the best solutions without putting additional load on the IT and business side, it?s time for O2C leaders to leverage the latest technologies like AI in cloud solutions that are deployed through SaaS. Here?s how AI could significantly help you rudder your A/R in the right direction:

1. Eliminate the Cost Leaks of Deductions

Most A/R teams spend more time gathering documents, researching, and collaborating than validating deductions. Consequently, they don?t have bandwidth to focus on identifying and recovering high dollar invalid deductions which end up being written off. However, the latest application of AI in deductions management enables you to predict if a deduction is valid before you start working on it.

Most A/R teams spend more time gathering documents, researching, and collaborating than validating deductions. Consequently, they don?t have bandwidth to focus on identifying and recovering high dollar invalid deductions which end up being written off. However, the latest application of AI in deductions management enables you to predict if a deduction is valid before you start working on it.

- Eliminates time lost on valid deductions ? prioritize invalid ones

- Identify and control inaccurate write-offs

- Familiarize your employees with the concept of automation by implementing some form of the technology within the next 18 months

- Gain a deeper understanding of AI by kickstarting initiatives within the next two years

- Draw on your early successes to build a foundation for progress

- Determine in the next two to five years the practical benefits and opportunities of AI for you

2. Predict Customer Behavior While Collecting

More than 70% of all collections correspondence is directed at customers who would have paid even without the dunning email or reminders. Even the static prioritization of worklists does not empower analysts to identify customers or accounts which do not require any dunning v/s those that need additional focus. The latest application of AI in collections enables you to predict your customers? payment date and shape the collection strategy needed.

More than 70% of all collections correspondence is directed at customers who would have paid even without the dunning email or reminders. Even the static prioritization of worklists does not empower analysts to identify customers or accounts which do not require any dunning v/s those that need additional focus. The latest application of AI in collections enables you to predict your customers? payment date and shape the collection strategy needed.

- Focus collectors? efforts on accounts with high delinquent probability

- Automated correspondence for others thereby increasing the total value/number of accounts managed

3. Proactively Manage Credit Risks

The credit limit tug-of-war between the credit and sales teams is quite common for most of the companies across the globe, with increasing credit limits or releasing blocked orders being the top two issues. It not only impacts the business?s cost, but also impacts the risks involved. However, the latest application of AI in credit management addresses this challenge by predicting blocked orders beforehand.

The credit limit tug-of-war between the credit and sales teams is quite common for most of the companies across the globe, with increasing credit limits or releasing blocked orders being the top two issues. It not only impacts the business?s cost, but also impacts the risks involved. However, the latest application of AI in credit management addresses this challenge by predicting blocked orders beforehand.

- Approval-ready credit review for large customers while automating for small customers

- Get sales to negotiate early payments vs. blocking orders due to low credit

Even if the solutions selected are best-in-class and are set to yield over-the-top results, the O2C team would still have to do a lot of manual work if the systems do not integrate and communicate. Turn the page to find out how top companies use the latest technology-driven software seamlessly and in synergy.