A Complete Guide to Unlock Sage Intacct’s Full Value: Harness AR Automation

- Guide to enhance your Accounts Receivables.

- Business Case with quantifiable ROI to support investment

- Process level deep dive

About

Digital transformation era has made leading technologies accessible to businesses of all sizes. This includes CRM, Enterprise Resource Planning (ERP) tools or even specialized point solutions.

A well-integrated technology stack, earlier available only to large multi-billion dollar organizations, is now available to small and mid sized businesses. All thanks to the rapid strides taken by technology vendors to learn the nuances of all customer segments.

This development is a testament to the direction in which mid-size businesses are evolving i.e optimizing processes, efficient collaboration and data-driven decision-making.

The evolution of ERPs from on-premise to cloud native has accelerated adoption across the globe. Notably there are specific ERPs available in the market that support corresponding levels of businesses.

Sage Intacct is a new generation of ERP and has seen tremendous adoption across industries. Here are a few reasons why-

- Support for Out-of-the-box functionality- Sage Intacct has a robust ecosystem of open APIs, to support domain-specific solutions

- Standardization- The product does not need an army of IT professionals to configure and implement

- Agility and Ease-of-use- Platform is easy-to-use, functionally rich, and offers hassle-free access to information

- Best fit- Although a lot of large organizations use Sage Intacct, it has transformed midsized businesses across industries

In this e-book, we will explore how to enhance account receivables processes with out-of-the-box functionality fit with Sage Intacct seamlessly.

Identifying the Hidden Value with AR Automation

2.1 Challenges with Scaling

Hyper growth businesses face challenges such as increased operational overheads, process inefficiencies, and manual dependencies. This is especially true for finance departments trying to optimize cash flows and eliminate risks. With the writing on the wall, many businesses seek to leverage technology to find solutions. This shift is particularly apparent among businesses in the technology, healthcare, wholesale, manufacturing and construction sectors.

Accounts receivable has been a major pain point for all finance leaders due to the following reasons:

- Tactical and time-consuming in nature: This results in bandwidth blockage and high costs

- ERPs digitize AR, but not automate: This results in challenges listed above and deviates focus from strategic activities like budgeting, forecasting, and cash flow management

2.2 Complementing Sage Intacct AR with out-of-the-box support:

Augmenting digitization to automation

Sage Intacct, in addition to encompassing core functionality, is also a strong base to deploy OOTB functionality.

2.2.1 What is out of the box (OOTB) support?

OOTB support can be defined as an add-on that enhances the process-level functionality of the base technology. In the AR context, OOTB functionality seamlessly plugs into Sage Intacct through its rich API eco-system and automates the function.

2.3 Show me the Value!

- Reduction in DSO- Significant improvement in collections with automated workflows

- Saved operational costs – Less manual intervention and drastic reduction in errors resulting in cost reduction

Additionally,

- FTE deployment by 60%- Zero touch processes save precious FTE hours spent on tactical and repetitive tasks

- Strategic focus- Finance heads can deploy focus to more strategic activities like budgeting, forecasting and cash flow optimization

Plugging the Gaps: How to Unlock Value?

Let’s dive deep into your account receivables, diagnose gaps, and access corrective actions.

Enhancing AR within Sage Intacct: Improving Collections, Cash reconciliation, Credit risk Management

3.1 Collections and eInvoicing

“Firms that rely on manual processes take 67% more time to follow up on overdue payments than those that use automated AR processes”

- Prioritized worklist and UI

Sage intacct supports a basic form of worklist. Often this results in challenges like difficulty in identifying critical accounts, haphazard communication, and increases the risk of write offs. Limited support for a collections UI also hinders the process. Given the limitations, collections is a more reactive process than proactive.

Add-on collections apps can optimize collections processes.

How?

Prioritized collections and an intuitive UI helps AR analysts by automatically prioritising high risk customers, and predicting any delinquency. AR teams can follow up on communication options based on priority and customer risk. This saves time, provides high visibility into cash flow, and lowers risk

A centralized dashboard gives full visibility into collections with intuitive tabs. Leverage real-time visibility into process health metrics (bad debt, DSO, CEI) for effective collections strategies

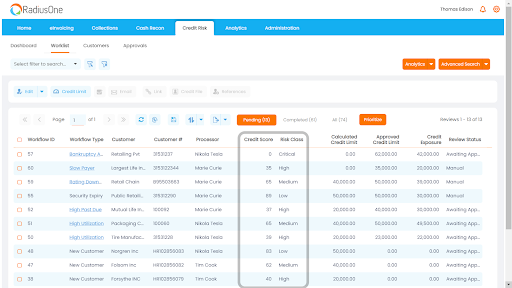

A real-time worklist with prioritized accounts and recommended actions. The prioritized list is created based on various parameters and scores to optimize collections.

- Automated dunning and VOIP calling

Sage intacct currently supports standard dunning process.However, a few functional enhancements can make the process truly automated. Given the volume of follow-ups, dunning processes need to be prioritized and supplemented by additional means like voice calling from within the system

Add-on collections can automate dunning.

How?

Automated dunning allows smooth communication with all accounts. Since all active accounts can be reached, risk of write-off decreases. Customer data is automatically pulled from the ERP and with the ability to auto attach invoices.

Auto correspondence- Customers can be segmented on different parameters based on business need.The collection strategies are auto-defined based on the segment of the customers for automated correspondences or prioritized worklist

In-App calling helps analysts easily pursue high risk customers. Notes and tasks can be set up basis the call and payments can be made on behalf of customers if they share credit card details over the call

- Buyer portal

Sage intacct supports payments in your customers’ preferred forms including Checks, cash, credit card, and funds transfer. However, lack of a central payment portal hampers customer experience and makes payments less efficient. Customers can’t view overdue invoices or accounts without a self-service portal.

Add-on Collections app improves efficiency of the payment processes.

How?

Central customer portal enables customers to view and manage invoices, view account statements, make payments, and supports the sharing of payment links.

Self-service customer portal also enables automated invoice delivery to customer web portals, setting up auto-pay and payment for multiple invoices at the same time. All this helps in faster payment processing.

- Dispute management

Managing customer disputes is a major pain point for AR teams due to their time sensitive nature, complexity, and limited visibility. With no central method to log and view disputes, Sage Intacct requires additional support.

Add on collections apps automate dispute management processes.

How?

With a central self-service portal, customers can log, view and track all disputes. Similarly, AR teams can create and identify disputes as well as assign a team member allowing faster action. Quick dispute resolution lowers the risk of bad debt and improves customer experience

Supplier side access to log and view disputes

3.2 Cash Reconciliation

“AR departments dedicate 24.5% of their staff to supporting invoicing and 23.2% to managing payments”

- Automated remittance gathering

Sage intacct supports remittance gathering, but the process is largely manual. Financial analysts aggregate and update payment processes from various sources like emails, web portals and lockboxes. The process is time-consuming and error-prone.

Add-on cash reconciliation apps can automate this process end-to-end.

How?

Advanced data aggregation engines capture all payment information from configured channels.

Email parsers gather remittance information received by email. These emails are auto-forwarded from analyst email-Ids to secure domains and mapped.

Web aggregation engines capture information from the customer and bank portal periodically.

OCR engine is capable of scanning checks and capture data seamlessly

- Automated matching process for invoice-payments-remittances

The final leg of a commercial transaction is to close the invoice once the payment is received. This process requires a lot of manual intervention within Sage Intacct. The remittance has to be matched to payment and both need to be matched to the open invoice.

Add on cash reconciliation apps can automate invoice matching end-to-end.

How?

Zero touch cash posting into Sage Intacct (ERP) can be done via automated matching system. It supports customer identification, multi-variant invoice matching with payments and remittances

The total amount representing open invoices is pulled from the ERP and the payment amount is gathered from remittance information. Both amounts are matched and updated in the base system

3.3 Credit Risk Management

Sage Intacct does not support any credit risk assessment functionality for potential and existing customers. This process of risk-mapping is entirely manual and error prone.

A well-defined credit risk management structure backed with specific functionality and workflow can mitigate credit risk

- Online credit application (OCA)

On-boarding a new customer is a hassle for a finance analyst as it involves thorough background checks, and ascertaining creditworthiness. With existing setup, OCA form needs to be sent out to potential customers for their onboarding which is done outside of the Intacct system.

Add-on credit risk apps can automate the on-boarding process.

How?

Suppliers can send OOTB templates for OCA to customers via email or host them on the company website. On-boarding process with integrated form is seamless and saves time. Additionally, this ensures mandatory fields are filled and a workflow can be enabled for approvals from senior management.

- Automated credit scoring

Assessing creditworthiness for awarding credit limits to potential customers is largely a manual task.

Credit analysts currently rely on existing commercial knowledge or credit agencies. Analysts need to manually browse multiple data sources to pull relevant data and plug into the credit score formula.

Add on credit risk apps can automate the credit assessment process.

How?

Automated credit data aggregator supports workflows that can be set to fetch information from banks and trade references provided by customers in the OCA form. System can access trusted financials and data sources allowing visibility into credit history.

All aggregated information is processed through a formula, generating a credit score. The credit score is the basis for credit allotment, directly enabling risk mitigated business development.

- Credit utilization tracking

Keeping track of credit utilization enables the AR team to forecast cash flow and map exposure. Credit utilization is also an essential metric for further credit allocation. With no credit module available within Sage Intacct, keeping track of credit information is manual and cumbersome.

Add-on credit risk apps can automate the credit utilization tracking.

How?

Credit data aggregators track credit utilization data centrally in real-time. This data forms the basis to assess additional credit allocation requests. Credit analysts save significant time with automated tracking.

AR Benchmarking Checklist

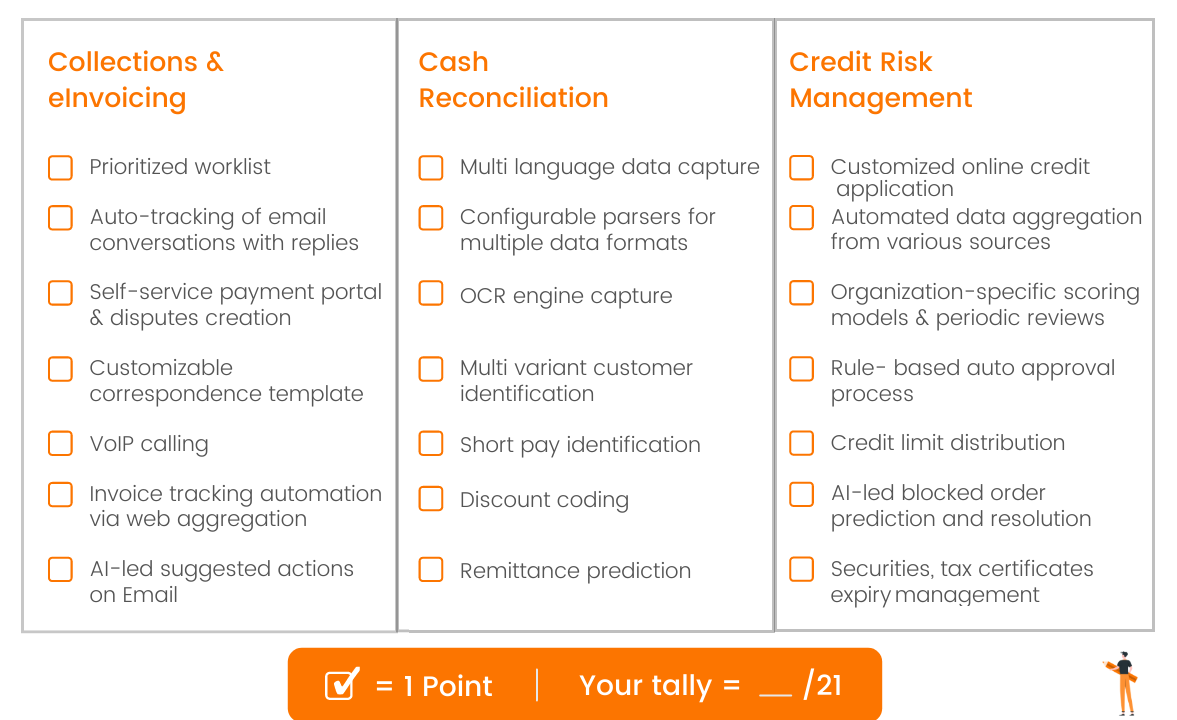

Here’s a quick checklist to benchmark and identify level of functional automation support with your Sage Intacct set up.

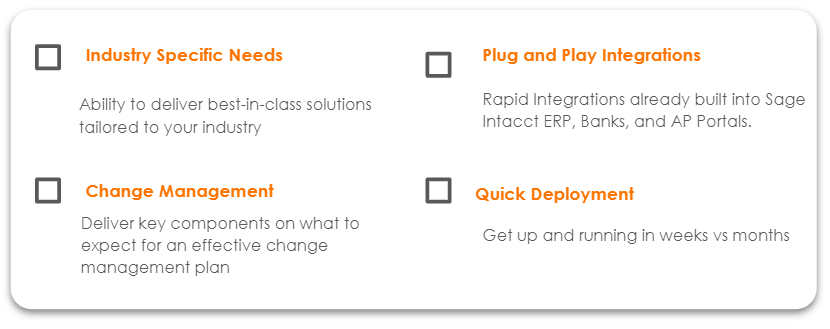

Deploying Scalable Technology

Rapid growth is forcing the CFOs’ office to adopt best practices like creating digitally-enabled finance functions and upskilling resources to drive digital transformation.

Given the IT resource constraints, mid-size organizations need to identify digital transformation programs that help attain desired results. At the same time the solution also needs to seamlessly plug into existing systems like ERPs with minimal disruption and resources.

The Road Ahead

The ROI and intrinsic value of supercharging your specialized ERPs like Sage Intacct with advanced out of the box tools is quantifiable. Hence, finance heads can create a clear business case for automation when facing decisions to scale operations.

These decisions include—hiring additional FTE vs automation and prioritizing strategic initiatives. The competitive market is amplifying operational problems as firms struggle to reconcile their invoices and minimize their own cash flow crunches. Investments in automation can alleviate many of these issues.