Non-Nerdy Guide to Artificial Intelligence in Cash Forecasting

AI is rapidly being leveraged in the consumer and business space. Learn how AI can refine cash forecasting for CFOs to make better decisions.

Introduction

As consumers in the modern world, AI is already deeply rooted in our lives.

We can’t think of life before we have started interacting with AI. For the last 15-20 years, AI in a variety of forms has increasingly become a part of the consumer experience. Today from product and entertainment recommendations, driving directions, on-call ride-sharing cabs to voice-enabled digital assistants – AI is used everywhere.

Business adoption has also started to pick up due to the following reasons:

- The tools and skills have become more commonly available now

- The cost-benefit trade-offs now make sense

- Even with the typically smaller data size of company-specific data – results can now be obtained

Many leading large and small companies are opting for AI in their Treasury and Finance departments.

AI has extensive applications in areas such as fraud detection, credit scoring, and certain types of regulatory compliance. These are all fields where the data and rules are very well defined and are very consistent across various businesses – this makes it easier to implement AI.

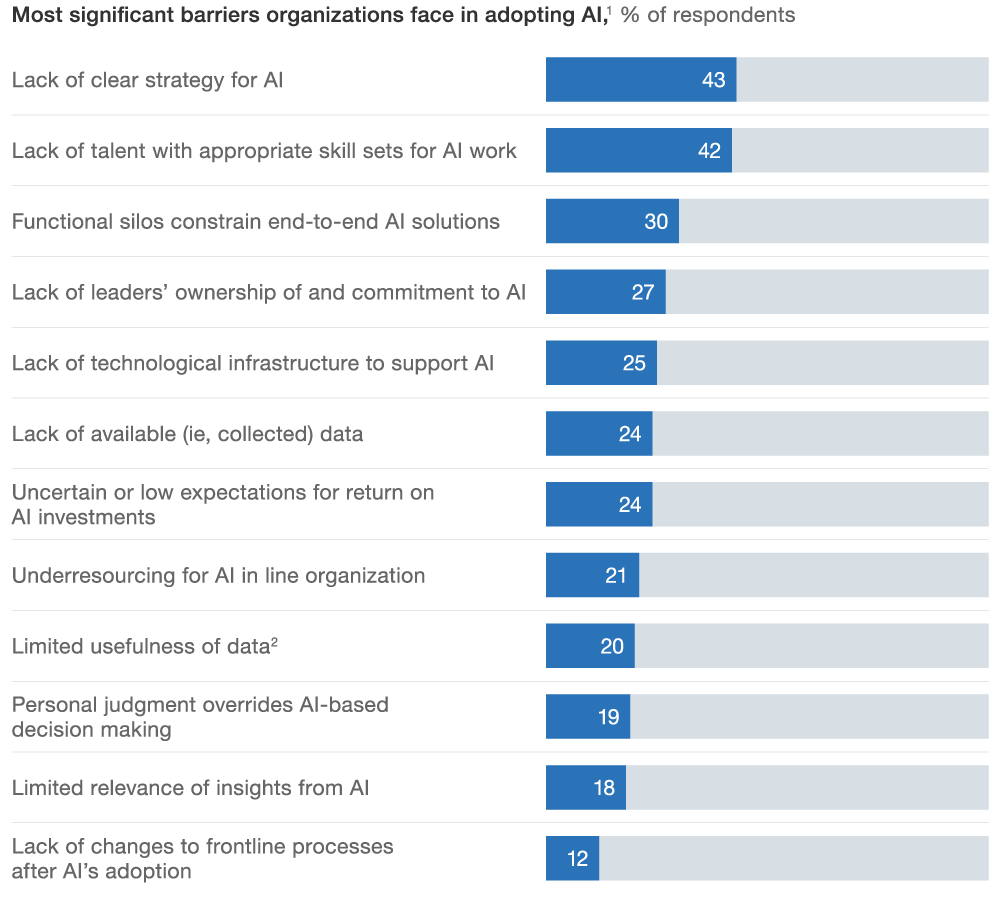

Despite many businesses considering AI, only a small portion of them are full-scale adopters. The adoption rate has been significantly low due to the following reasons:

Source: Mckinsey, AI adoption advances, but financial barriers remain

The most common reason why AI adoption has lagged is due to a lack of knowledge on how AI works under the hood.

How AI works under the hood

Artificial Intelligence Framework

1. Input Data: AI becomes irrelevant without data. Therefore, it’s necessary to feed adequate, relevant, and good quality data for training the models and testing the results frequently.

2. Processing: The processing depends on the type of data fed into the system. The choice and trade-offs between complex algorithms, complex techniques, and tools are dependent on the data, the type of output required and driven by an analysis of the data and the previous results. But the specifics of how it works are less important than whether it addresses the current pain points and gives useful results that are unique to the business.

3. Output data: The output data must be relevant, sensible, and consistent. There should be a way to estimate and evaluate past performances. The predictions and recommendations need to be consistent and readily usable, and the insights need to be available and actionable for making confident decisions.

Data-driven forecasting, when done right, provides accurate results that yield insights. It is essential to ensure that the input data is accurate since inaccurate output leads to poor decision-making. There’s a popular acronym in the world of tech – GIGO or garbage-in-garbage-out.

Use cases of AI in cash forecasting

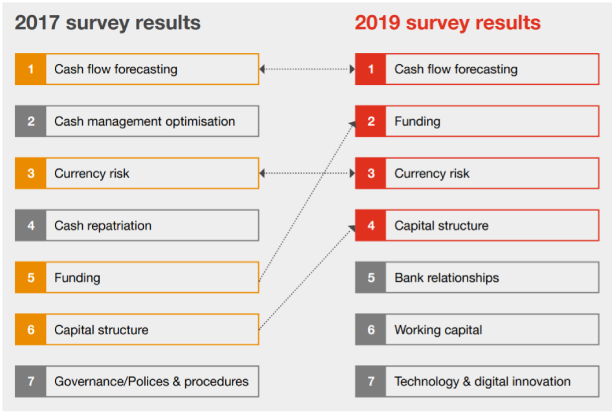

Source: PwC, 2019 Global Treasury Benchmarking Survey

Cash forecasting has been Treasury’s top priority for a long time. At the same time, cash flow forecasting has always been difficult to manage. As per PwC’s 2019 Global Treasury Benchmarking Survey, cash forecasting is ripe for optimization using Artificial Intelligence.

The surge in need for accurate cash forecasting is due to the following factors:

- Macroeconomic fluctuations such as inflation, recession and pandemic, currency fluctuations, and business cycles.

- Credit sources such as trade, bank, and consumer credit are changing rapidly.

- Timely decisions for borrowing, investing, M&A, etc., need to be taken during the volatile environment.

Applications of AI in cash forecasting

Effective modeling

Treasury professionals often lack the technical expertise to build quality models or the bandwidth and tools for accurate modeling.

It’s necessary to look at how data is incorporated into the models since some cash flow categories require different models and data. For instance, forecasting A/R needs input data of open A/R invoices, etc., and needs to be forecasted with AI models to build accuracy. In contrast, payroll forecasts are done with heuristic models and fed with data, such as total headcount with employee category.

Source: HighRadius

There are some important drivers for modeling, such as:

- Incorporating external data:

AI enables incorporating external factors to capture trends such as raw material price fluctuations to get a better sales forecast. This boosts forecast accuracy.

Source: HighRadius, Explained: The Data Driven Approach to Accurate Cash Forecasting

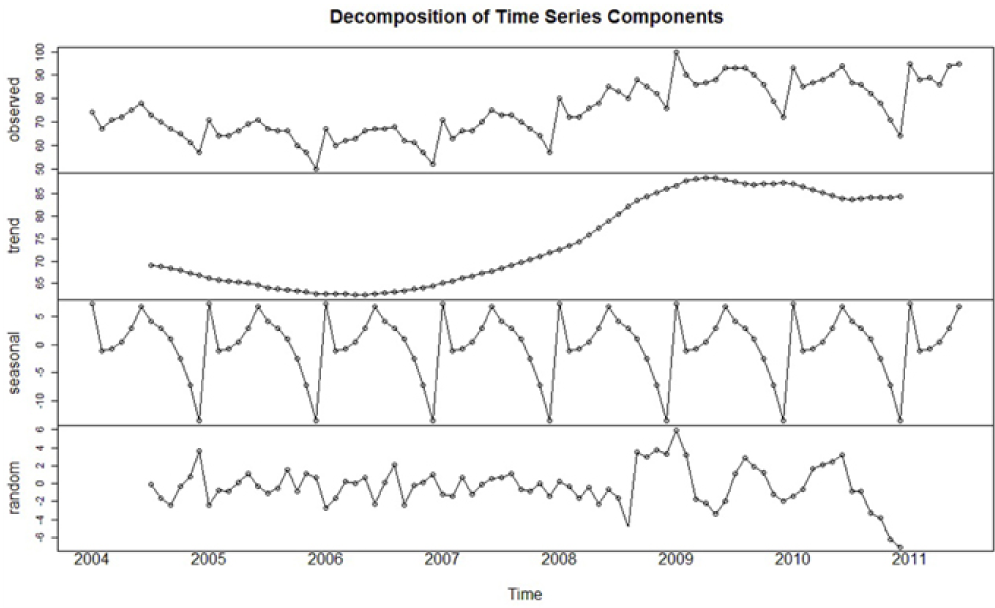

- Incorporating cash flow fluctuations through time series algorithm:

Source: HighRadius, Recession Proofing Your Business: Cash Forecasting During Age of Volatility

The time series algorithm prioritizes recent trends over historic ones to generate accurate forecasts. For instance, according to the previous situation or the current market sales, changes in stock prices, bank deposits, and withdrawal are predicted. Forecasting involves taking models to fit historical data and using them to predict future observations.

Time series has three components:

Source: ResearchGate

1. Trend: A trend refers to an increasing or decreasing slope over a long time in the time series.

2. Seasonality: It refers to systematic and calendar-related repetitive movements. For instance, Christmas might be a peak season for some firms, whereas some firms might have their peak in the summer.

3. Irregularity/ Randomness: It refers to the short-term fluctuations which are neither predictable nor systematic. In an irregular series, these fluctuations dominate movements, masking the trend and seasonality.

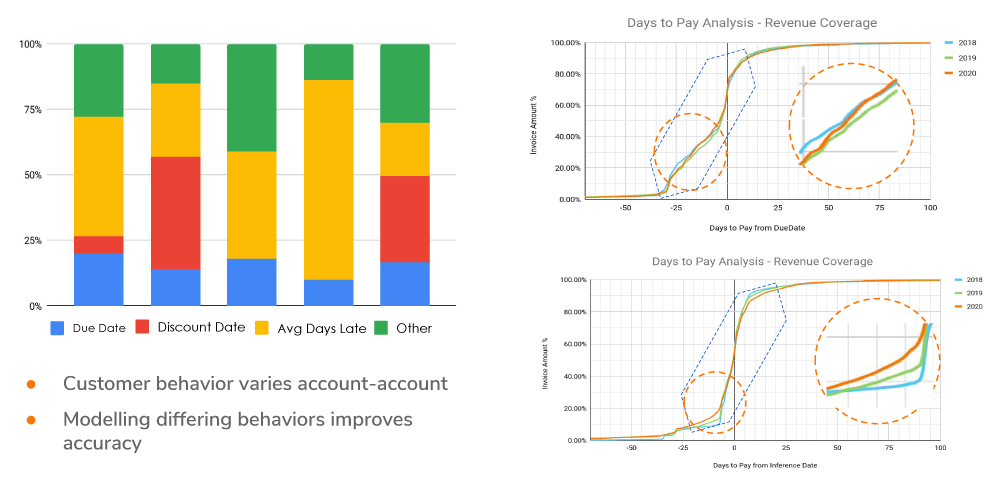

- Customer behavior in A/R:

Source: HighRadius Explained: The Data Driven Approach to Accurate Cash Forecasting

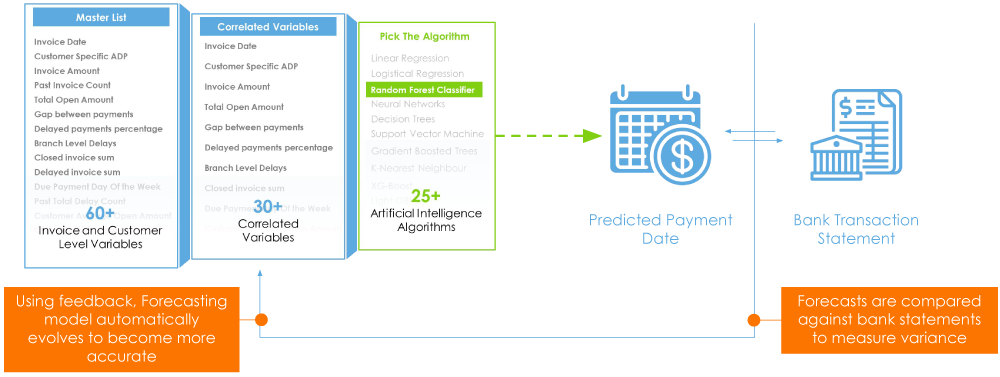

Capturing customer data is essential to understand trends and patterns in their payment behavior. Spreadsheets limit the use of multiple variables. Some accounts’ behaviors can be tracked through the ADP approach or weighted average, while other accounts with discount rates are complex to track. AI supports adding multiple variables for tracking the due dates accurately.

- Accurate and frequent variance analysis:

Source: HighRadius

AI enables performing variance analysis for various time horizons. The variance is improved eventually through the ‘closed-loop feedback system.’ A feedback loop allows reusing the AI model’s predicted outputs to train new versions of the model. It enables AI systems to know what they did correctly or incorrectly, providing them with data that allows them to adjust their parameters to perform better in the future.

Summary

Impact of AI-driven cash forecasting

- Reduced turnaround time: Accurate forecasting allows making fast-paced and strategic decisions to stay on top of market fluctuations.

- Improved cash management: Tracking the cash conversion cycle faster enables better liquidity management.

- Reduced idle cash: CFOs can allocate capital to their short-term and long-term goals with idle cash.

- Increased strategic investments: Decisions on M&A, and business expansions can be made properly and accurately.

Data-driven cash forecasting unlocks the untapped potential of Treasury by generating accurate forecasts and proactively navigating market volatility.