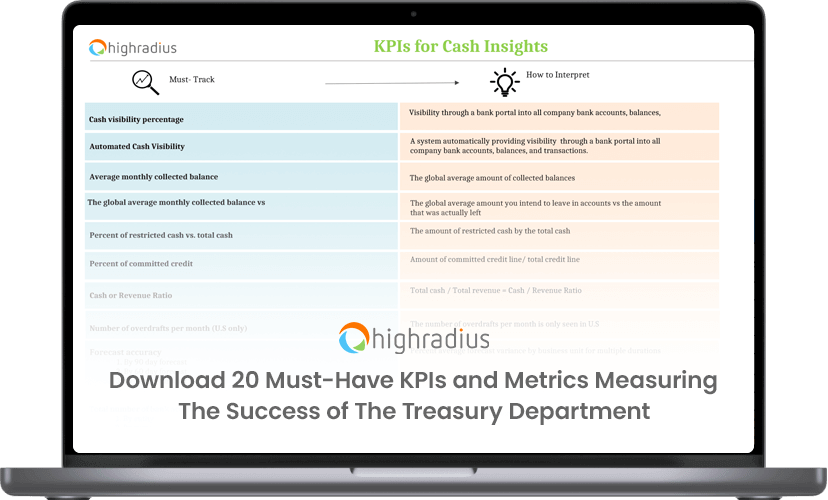

20 Must-Have KPIs and Metrics Measuring The Success of The Treasury Department

20 Must-Have KPIs and Metrics Measuring The Success of The Treasury Department

2 August, 2023

KPIs and metrics help demonstrate to the management the work which treasury is doing, and how the department is contributing towards the company’s margins.

Trusted by 1000+ Enterprise and Mid Market Businesses WorldWide