The use of hyperautomation has increased more quickly than ever in the post-COVID environment as companies from all industries compete for digital transformation. In a McKinsey survey, respondents said that their organizations were able to embrace digital innovations at least 25 times quicker than they would have anticipated in the pre-pandemic situation.

In the area of remote working solutions, respondents said that hyperautomation solutions were deployed 40 times faster. Let’s take a look at some of the mid-market finance specific use-cases for hyperautomation

1. Accounts payables

Receiving, processing, and disbursement of invoices from vendors that supplied the business with goods or services are all included in the accounts payable (AP) process.

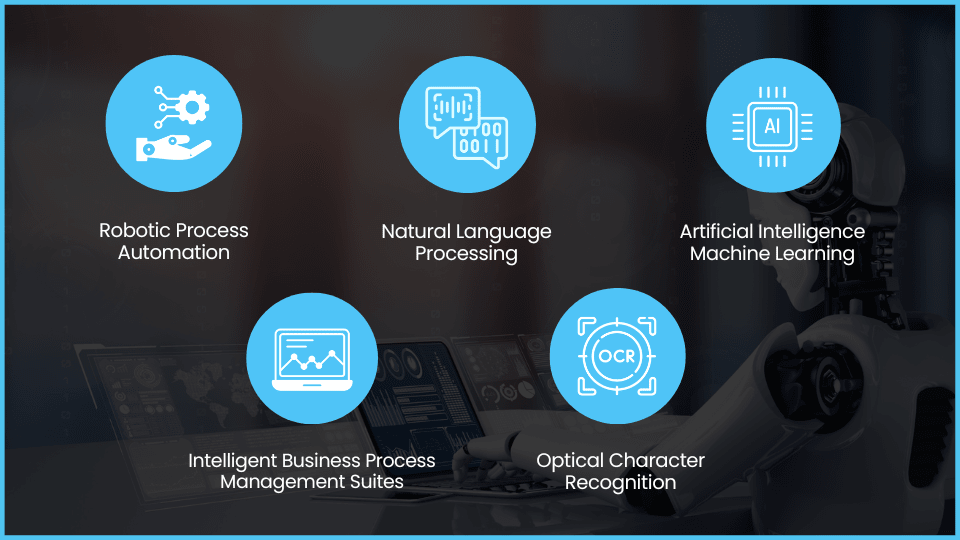

Traditional AP processes are manual, expensive, time consuming, and immensely error-prone. But, businesses can transform their payables process with the help of automation. Businesses may automate most AP process operations by combining RPA with machine learning and document extraction technologies like optical character recognition (OCR).

2. Accounts receivable

One of the most crucial financial tasks is keeping track of accounts receivable to prevent unforeseen cash deficits. A number of time-consuming tasks are involved in keeping track of unpaid invoices and applying cash once payments are received.

Knowing days sales outstanding (DSO), which is the length of time it takes to collect payment, is also useful. With RPA, there is no chance of forgetting anything, so you can effortlessly produce invoices, monitor their progress, and speed up payment.

3. Accounts reconciliation

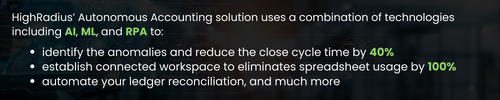

Account reconciliation and intercompany reconciliation are two common use cases for process automation. Whatever kind of reconciliation is being carried out, it demands a great deal of attention to detail and data gathering.

To find out if there are any differences between general ledgers and subledgers and outside paperwork, data may be analyzed quickly and precisely with RPA. If reconciliation is required, software robots can notify your staff and let them know immediately. This makes account reconciliation a perfect use case for hyperautomation.

4. Reporting automation

The decisions made by executives and stakeholders depend on the reports that finance departments produce. However, creating and delivering these reports can be time-consuming. The data may have changed during the time it took to manually construct a report, which could have an effect on the choice that is ultimately made.

Tools for robotic process automation can combine data from different sources to provide reports. RPA solutions may handle the procedure for everything from regulatory filing to annual investor reporting.

5. Travel and expenses

Hyper automation can be used to automate the paperwork and repetitive operations involved in travel and expense (T&E) processes. Here are some of the travel & expense processes that can be automated:

- Obtaining paper receipts for employee travel expenses

- Data extraction from receipts

- Verifying receipts to see if they comply with the company’s expenditure policies

- Restricting approvals and payments for products that do not comply with cost standards

6. Lending

Eliminating paper procedures would considerably improve the efficiency of day-to-day operations. Customers will have more knowledge of their borrowing options and be able to self-serve. RPA can minimize the amount of labor-intensive human effort by gathering pertinent data from loan paperwork.

- Customer management: Filling out paperwork and compiling client data the old-fashioned way requires a lot of time and effort. Even manually entering updated client data into the system is prone to human mistake, necessitating data entry and re-entry. By automating loan processing, inconsistencies and unwelcome delays in manually gathering financial data and other necessary consumer information can be readily reduced.

- Credit assessment: Never process a loan without first checking the customer’s credit report. However, the conventional method of credit analysis requires manually entering the client’s financial information onto a spreadsheet and adding it up using various formulae to produce the credit score. On the other hand, modern loan origination software enables lenders to easily extract from accounting software, tax returns, and other documents the pertinent financial data required for credit risk assessment.

- Loan monitoring: Allocating or initiating the loan process is followed by constant asset monitoring—monthly, quarterly, or even yearly. Manual data tracking is hardly error-free, particularly when hundreds of loan covenants are kept track of on spreadsheets. This conventional method causes an endless wait in loan processing. Hyper-automation in loan processing can be a boon for all parties involved, especially for clients and executives who have to cope with millions of spreadsheets full of data.

7. Other manual operations

Businesses can hyperautomate all the aspects of their processes and reduce the overall time, effort, and cost that goes into managing the tedious work. Automation can help in revamping the whole organization by optimizing various processes. Some examples include:

- Process account-based documents by email, media download, or other types of automation, and automatically load documents into an internal system that users can easily access by account

- Support compliance by automatically downloading updates from a variety of sites and loading data into specific tables for review.

- For security, forward suspicious emails for URL scanning and alert users if URLs appear malicious

- Automate IT audits including password strength tests. If a user’s password fails a strength test performed by the robot, the user receives an email requesting a password update that complies with password rules.