In today’s digital landscape, running a business without accepting credit card payments is nearly impossible. However, there’s an inevitable expense attached to this convenience—credit card processing fees.

A credit card processing fee represents the charge levied by payment processors for transactions conducted via credit cards. These fees typically hover between 1.3% and 3.5% per transaction, contingent upon various factors.

Factors include the chosen payment processor, credit card type, and merchant category code (MCC). Consider this scenario: processing a $1000 payment could translate to processing fees ranging from $13 to $35.

Accumulated over time, these fees can become a substantial expense for businesses. Hence, it becomes crucial to understand the nuances of credit card processing fees—their types, calculation methodologies, and the ways to reduce it.

This comprehensive guide aims to equip you with all the insights into credit card processing fees and how they work so that you can minimize the cost associated with it.

Credit card processing fees refer to the charges a business needs to cover whenever their customers choose to make payments using credit cards. Each transaction comes with various fee types, and the amount can differ based on the specific credit card being used. Broadly, there are three types of credit card processing fees. We will discuss them in detail in the next section.

All well-known credit card providers charge a minimal assessment fee from the merchant. For example, if you have a Visa credit card, you have to pay an assessment fee of 0.14% for every transaction you make via that particular credit card.

The assessment fees charged by the other major credit card networks are:

|

American Express |

0.15% |

|

Discover |

0.13% |

|

Mastercard |

0.01% for transactions above $1,000 and 0.13% for transactions below $1,000 |

You also have to pay a payment processing fee to the processor (the company that manages your card payment processes) for every transaction you make via credit card.

The credit card network may also charge additional payment processing fees as mentioned below:

The bank that issued your credit card charges interchange fees on your transactions. This amount is incurred by the card issuing bank that manages your credit card. The fee varies from company to company, ranging from 1.5% to 3.3% based on factors such as—the relative risk involved, current interest rates, and the amount of money you transfer.

The interchange fee of the four major credit card networks are:

|

American Express |

1.43% + $0.10 to 3.3% + $0.10 |

|

Visa |

1.15% + $0.05 to 2.4% + $0.10 |

|

Discover |

1.35% + $0.05 to 2.4% + $0.10 |

|

Mastercard |

1.15% + $0.05 to 2.5% + $0.10 |

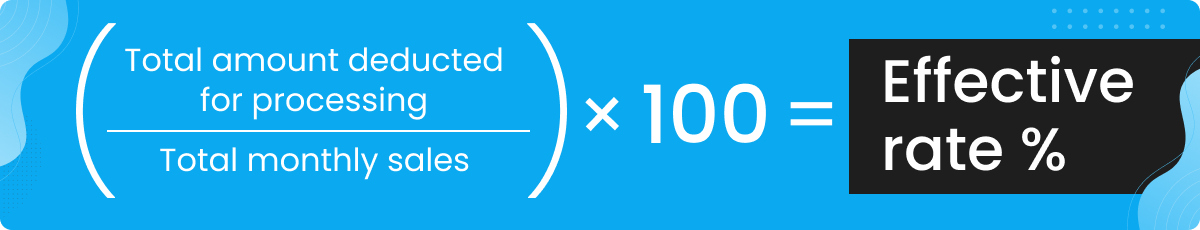

The best way to calculate credit card processing fees is by finding the effective rate.

The effective rate can be calculated by dividing the total amount deducted for processing by the total monthly sales. The amount you get after the calculation is your effective rate.

It is the total amount your credit card company is charging you for accepting credit card payments.

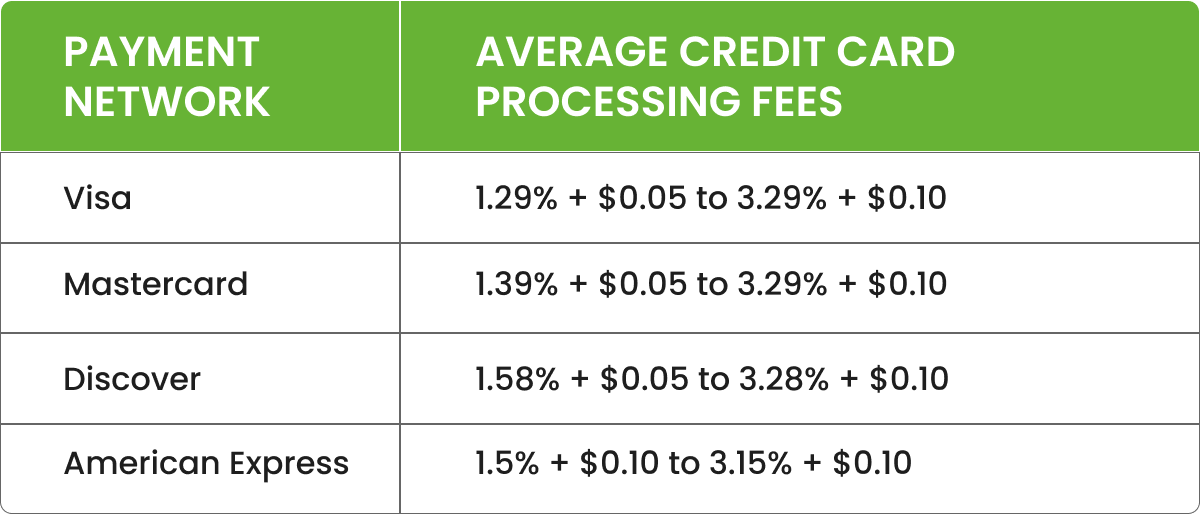

The average credit card processing fees for businesses can vary depending on several factors, such as the type of business, the payment processor used, the type of credit card used, and the volume of transactions processed.

Here are the average credit card processing fees for the four payment networks (also called “card networks”):

Sources: Visa USA Interchange Reimbursement Fees published on April 23, 2022, Mastercard 2022–2023 U.S. Region Interchange Programs and Rates, Wells Fargo Merchant Services Payment Network Pass-Through Fee Schedule, and Wells Fargo Payment Network Qualification Matrix effective April 22, 2022.

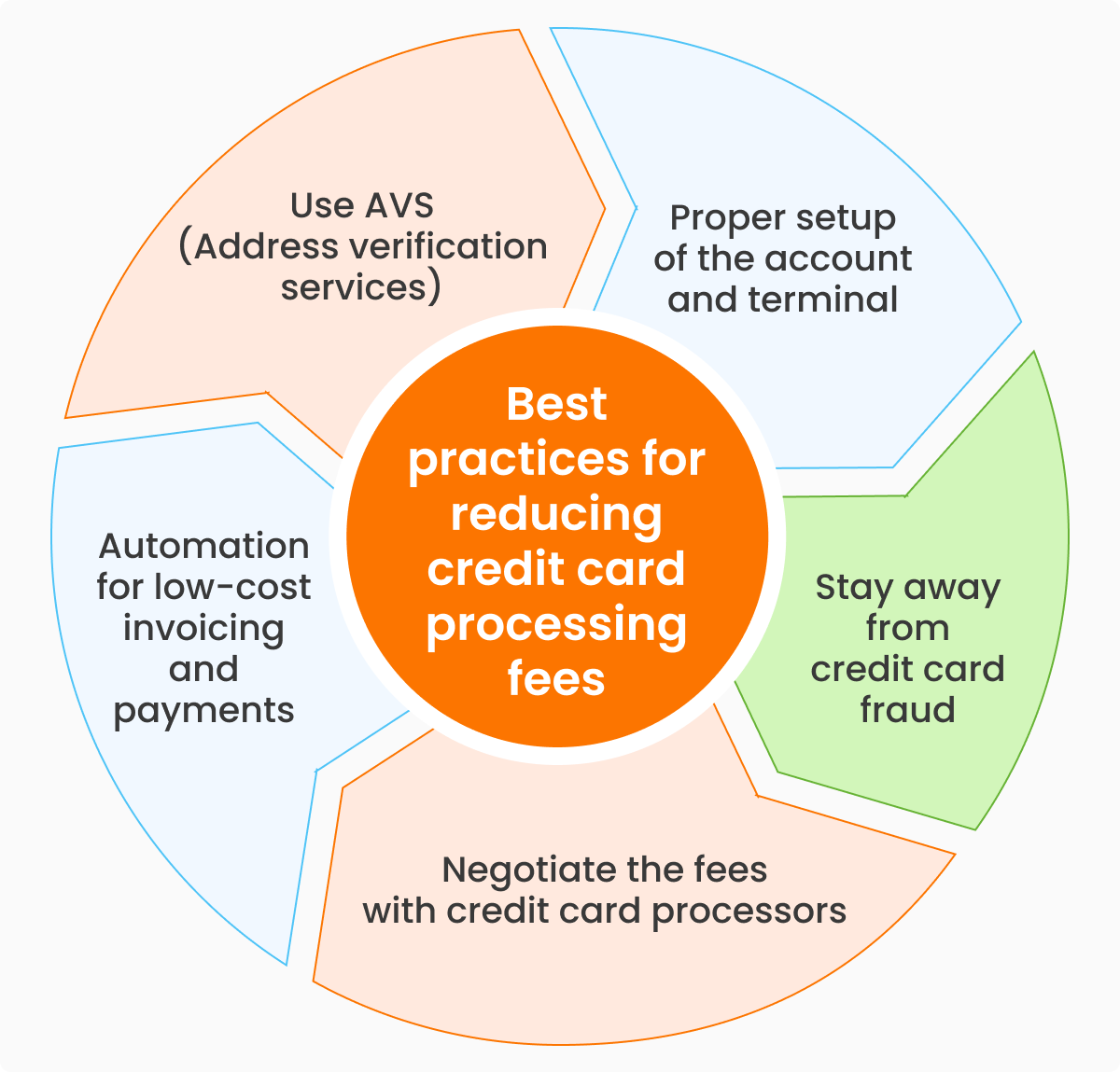

In today’s business landscape, being cash-only, especially for SMBs, is not a viable option as it could result in significant business loss. However, it’s essential to manage your credit card processing fees, as they could impact your profit margins.

Despite seeming insignificant, those small percentages can accumulate rapidly. While it’s not possible to entirely eliminate the credit card processing fee, there are ways that can help you save thousands of dollars each month.

Let’s explore these ways

As a credit card holder, you can use address verification services to verify your billing address with the bank. This simple fraud-fighting software has several advantages in the world of eCommerce, such as identifying legitimate customers and ensuring efficient working operations.

Customers have also reported that they’ve seen a 10% increase in ID verification matches when using AVS. After the address verification is completed, the bank sends an AVS code to the merchant, who can use it to approve or reject the transaction. Visa motivates businesses to use AVS and even promises a lower interchange rate for each transaction.

Small mistakes can often lead to higher processing fees and additional costs. Therefore, you must set up your account correctly right from the beginning. Your bank may charge more if you enter incorrect information while filling out your account details.

The same applies to how you configure your terminal, as it significantly impacts processing fees. Develop a habit of processing transactions every 24 hours, which reduces the transaction count within that specific period, resulting in lower processing fees.

The most effective way to avoid credit card fraud is by entering the right security information, which is a three-digit code that you can find on the back of the card. This protects the cardholder from any fraudulent activity since it validates the purchase.

You should also enter the billing ZIP code when prompted. This adds an extra layer of security to your purchase. Skipping this step can result in a higher rate due to fraud risk.

As a merchant, the most effective way to reduce credit card processing costs is by negotiating the fee with payment processors. The more transactions you show to the processor, the higher your chance of getting a lower fee. You can leverage the total transaction volume against the cost it takes per transaction.

Automation offers a streamlined solution for achieving cost-effective invoicing and credit card payments. By implementing automation, businesses can significantly reduce manual labor and associated expenses. You can leverage Highradius’ EIPP solution (electronic invoice presentment and payment) for low-cost invoicing and credit card payments, which provides e-billing and payment features.

The ERP payment gateway feature enables companies to accept credit card payments across multiple ERP systems. This helps reduce compliance and security risks by utilizing third-generation processor tokenization and eliminates the need for merchants to store transactional information.

It’s a good idea to take B2B credit card payments because a lot of your clients like doing business that way. This is especially true for smaller businesses and startups. If you don’t accept credit cards, you might lose out on a bunch of potential customers.

The average credit card processing fee per transaction ranges from 1.3% to 3.5% depending on the payment network.

Yes, credit card processing fees can often be negotiable with the payment processors.

The three parties involved in credit card processing pay the fee—the card network, payment processor, and card issuer.

Payment processors check several factors to set the appropriate credit card processing fee for each business. They consider the industry a business operates in, its credit track record, and the volume of sales. If a business handles many transactions, it is seen as less risky, and the credit card fees will likely be lower. However, if a business is just starting out or works in a riskier field, it might end up with higher fees.

To calculate a 3% processing fee, multiply the total transaction amount by 0.03. For example, if the transaction amount is $100, the processing fee would be $3 (100 x 0.03 = 3). The total amount charged to the customer would be $103.

ACH transfers, wire transfers, and corporate credit cards are commonly used in B2B payments due to their efficiency, security, and lower fees compared to traditional methods like checks. However, the best payment method for B2B transactions depends on the specific needs and preferences of the parties involved.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

HighRadius Collections Software automates and optimizes the credit & collections management process to improve collector efficiency, minimize bad debt write-offs, improve customer relationships, and reduce DSO. It provides a complete set of tools to optimize and automate the credit collections management process and enable the better prioritization of credit collections activities All the information you need (invoices, dispute information, POD, claims, tracking info, etc.) on each case is automatically presented in a collections work-space and is ready for use. Apart from the wide variety of benefits that it has, it also comes with some amazing features like CADE (Collection Agency Data Exchange), collector’s dashboard which has prioritized collections worklist, automated dunning & correspondence, dispute management, centralized tracking of notes, call logs & payment commitments along with cash forecasting functionalities. The result is a more efficient collections team that contributes to enhanced cash flow and reduced DSO.