Key Takeaways

- Payment integration involves connecting payment processing capabilities with other business systems to enable smooth, automated transactions and reduce manual errors.

- Integrated payment solutions allow businesses to accept payments in multiple currencies and across various geographies, expanding market reach.

- Integrated payment solutions automate AR workflows by integrating with ERP systems and e-commerce platforms, allowing for accurate recording and reconciliation of payments.

Introduction

Managing multiple payment methods and fragmented systems can be a nightmare for any business. Slow transactions, dealing with errors, and reconciling accounts can drain resources and hinder growth.

To tackle these challenges and boost customer satisfaction, business leaders need solutions that streamline payments. One effective solution is an integrated payment system.

In this blog, we’ll explore the benefits of payment integration and help you make informed decisions to improve your business operations.

Let’s start with a general overview of integrated payments.

What Are Integrated Payments?

Payment integration refers to seamless connection between a business’s point-of-sale (POS) system and a payment processor. This integration allows for automatic processing of various payment methods, such as credit and debit cards, without requiring manual entry or separate terminals.

This streamlined process enhances efficiency and reduces the risk of errors. Additionally, integrated payments can provide real-time transaction data, improving financial management and customer experience.

How Do Integrated Payments Work?

Integrated payment systems simplify transaction management by merging various payment methods into one cohesive system. Here’s how they work:

- Payment Capture: When a payment is made (via credit card, debit card, online banking, or digital wallets), the integrated system securely captures and transmits the payment information to the appropriate processor.

- Data Encryption: The system encrypts data to ensure security and protect sensitive financial information.

- Authorization: The payment processor communicates with the relevant banks or financial institutions to authorize the transaction. Funds are transferred from the customer’s account to the merchant’s account if approved.

Although multiple banks and networks might be involved, the integrated system makes this process appear effortless to the user, minimizing delays or complexities. Also, these systems automatically record each transaction and update the business’s financial records in real-time, reducing manual entry errors.

These systems match transactions with bank statements, eliminating the need for manual data storage and compilation. Payments are processed and posted directly to the corresponding sale or invoice.

In short, integrated systems automate tasks, allowing businesses to focus more on strategic activities rather than administrative chores.

What Is an Integrated Payment System?

An integrated payment system is a comprehensive solution that consolidates various payment methods into one solution, ensuring a unified transaction process. It connects with your existing business tools like ERP to provide real-time updates, enhance data accuracy, and improve customer experience.

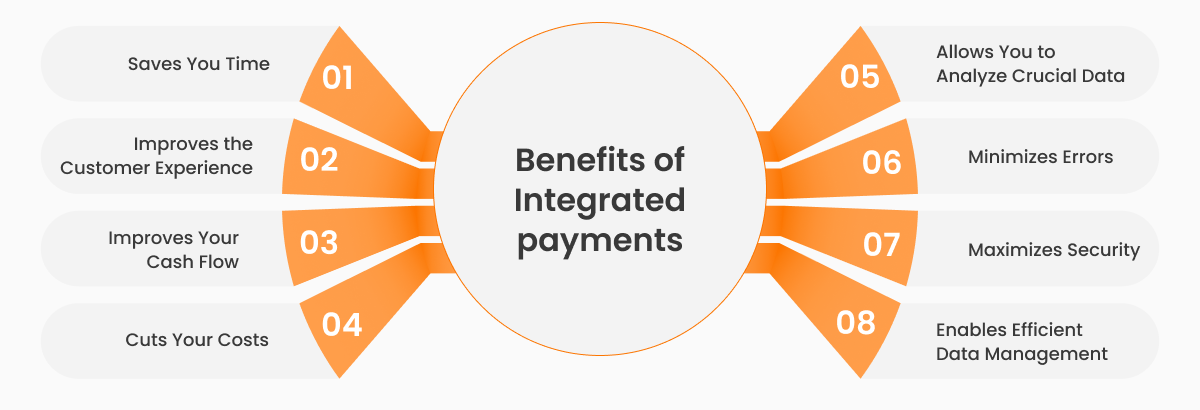

Benefits of Integrated Payment Systems

In recent years, integrated payment systems have become crucial for businesses. Many businesses now use integrated payment solutions to make the payment process more convenient and secure for their e-shoppers.

Here are the key benefits of leveraging integrated payment systems for businesses.

1. Saves you time

One of the most evident advantages of using an integrated payment service for merchants is the time saved through speedy processes. Redundant data-entry tasks are eliminated, allowing you to avoid repeatedly inputting the same details into various systems. This improvement in process efficiency shortens the gap between customer transactions and receiving earnings in your merchant account. Additionally, integrated payment systems often include features like recurring payments, which streamline billing and further save time.

2. Improves the customer experience

Seamless communication between integrated software solutions ensures that important data is not lost. This allows for quick resolution of customer inquiries, refunds, and disputes, enhancing overall customer service. Updates or transaction reversals are automatically reflected across all integrated systems, ensuring accurate and efficient customer interactions.

3. Improves your cash flow

Conventional payment systems can delay the transfer of payments to your merchant account, affecting cash flow. Integrated payment systems process payments in real-time, ensuring faster deposits and reducing lag time associated with manual processing. This improvement in cash flow helps businesses manage their operations more effectively and continue to grow with timely payments.

4. Cuts your costs

Processing payments through multiple systems can be time-consuming and costly, increasing labor and infrastructure expenses. Integrated payment platforms streamline payment processing, reducing the need for multiple applications and extensive human resources. This leads to substantial cost savings and higher profits compared to using conventional payment systems.

5. Allows you to analyze crucial data

Modern integrated payment systems often include data analysis features that provide insights into customer transactions. This capability allows you to track revenue, determine popular payment methods, and evaluate business performance across different periods and locations. By integrating payment processing with accounting software, businesses can quickly assess product performance, make informed inventory decisions, and access comprehensive reports from a single platform.

6. Minimized errors

Human error in manual data entry can be costly, both financially and reputationally. Integrated payment systems automate data entry and payment reconciliation, reducing the risk of errors and ensuring accurate financial records. This minimizes the costs associated with correcting mistakes and helps maintain customer trust.

7. Maximized Security

Integrated payment systems offer enhanced security through advanced measures like encryption and tokenization, which protect sensitive financial data from breaches and fraud. These systems are often PCI-compliant, ensuring that your business meets security standards without additional effort. With fewer manual inputs and more robust safeguards, your financial data remains secure against cyber threats.

8. Enables efficient data management

Integrated payment systems provide comprehensive dashboards and analytics tools that offer insights into payment trends, customer behavior, and overall business performance. This real-time data access helps businesses make informed decisions and improve operations over time. Efficient data management supports better forecasting, performance evaluation, and strategic planning.

By leveraging the benefits of integrated payment systems, businesses can achieve greater efficiency, cost savings, enhanced security, and improved customer satisfaction, all of which contribute to sustained growth and success.

5 Ways Integrated Payment Processing Benefits AR Teams

1. Automates AR workflows

Accounts receivable (AR) teams often face challenges managing transactions across multiple systems, leading to inefficiencies and errors. Integrated payment systems are crucial as they consolidate these processes into a single streamlined workflow. For example, HighRadius’ payment gateway automates the entire payment process by integrating with e-commerce platforms and ERP systems. This integration ensures that payments are accurately recorded and reconciled, streamlining AR workflows and allowing teams to focus on more strategic tasks.

2. Streamlines payment collection across channels

Modern AR teams must manage payments from various sales channels, including point of sale, e-commerce, and on-account transactions. That’s where integrated payment systems like HighRadius become crucial, enabling a cohesive management approach. HighRadius’ Payment Gateway supports secure electronic payment processing across multiple platforms and currencies. This allows AR teams to accept payments globally from various channels without the need for multiple systems. The integration simplifies payment collection and reduces the overhead associated with managing diverse payment methods.

3. Reduces processing costs

Credit card processing can be costly, and managing these costs effectively is crucial for AR teams. By integrating your credit card payment processing with your ERP, HighRadius leverages the rich data within your ERP to qualify for lower interchange rates, potentially saving up to 1% per transaction.

This process, known as interchange fee optimization, involves sending additional data about each payment transaction, such as product destination and line-item details, to qualify for lower rates. The resulting savings can be substantial, making it cost-effective to accept more credit card payments. Additionally, the Surcharge Management feature enables businesses to pass processing costs to buyers, further reducing overall payment processing expenses. Together, these features help AR teams manage and minimize their processing costs efficiently.

4. Enhances fraud protection

Fraud and chargebacks are significant concerns for AR teams, impacting both financial and reputational aspects of the business. Integrated payment solutions offer advanced security features to mitigate these risks.

HighRadius’s Payment Gateway incorporates robust security measures like encryption and card tokenization to protect sensitive payment information. By synchronizing digital payments with your ERP, HighRadius reduces the need to transfer data to additional parties, minimizing fraud risks. The solution ensures 100% global PCI compliance, safeguarding your business and customer data from potential breaches.

5. Improves payment reconciliation and compliance

Accurate payment reconciliation is essential for maintaining financial integrity and compliance with regulations. Integrated payment systems facilitate easier and more accurate reconciliation by automatically matching payments with invoices and records.

HighRadius’s Payment Gateway for SAP provides automated 4-way matching of payments with sales orders and invoices. This feature ensures precise reconciliation, eliminates PCI compliance costs, and simplifies the overall reconciliation process, making it easier for AR teams to maintain compliance and accuracy.

By leveraging integrated payment solutions like those offered by HighRadius, AR teams can benefit from streamlined workflows, reduced processing costs, enhanced fraud protection, and improved reconciliation and compliance processes. These advantages contribute to greater efficiency and effectiveness in managing accounts receivable operations.

How HighRadius Can Help?

HighRadius B2B Payment Suite offers comprehensive solutions that streamline financial operations, reduce costs, and ensure high-security standards. This suite is indispensable for businesses seeking to enhance financial performance and expand market reach.

Our integrated payment systems within the suite provide crucial benefits for modern businesses:

Cost Savings: Utilize Interchange Fee Optimizer and Surcharge Management to reduce payment processing costs by up to 20%, optimizing financial operations and boosting profitability.

Enhanced Security: Implement advanced security features, such as card tokenization and global PCI DSS compliance, to protect sensitive financial data and prevent breaches.

Improved Cash Flow: Real-time payment processing and ACH/eCheck options ensure faster access to funds, enhancing working capital and financial management.

Operational Efficiency: Automate processes such as cash application, authorization, settlement, and touchless reconciliation for payments, reducing manual effort and errors.

Diverse Payment Methods: Accept over 200 payment methods across 135+ currencies, including SEPA payments and alternative payment methods, to reduce buyer friction and maximize sales.

By integrating these features into a cohesive system, HighRadius enables businesses to optimize their payment processes, ensuring efficiency, security, and customer satisfaction in a competitive marketplace.

FAQs

1) What is payment method integration?

Payment method integration involves connecting various payment methods, such as credit cards, debit cards, and digital wallets, into a unified payment processing system. This integration allows businesses to handle multiple payment types through a single platform, thereby streamlining transactions.

2) What is an example of an integrated payment system?

An example of an integrated payment system is HighRadius. It processes payments, updates the company’s ERP with transaction details, and handles reconciliation automatically. This integration streamlines payment handling and enhances accuracy across financial operations.

3) What is the difference between integrated and embedded payments?

Integrated payments mean connecting a payment processing solution with other business systems, like ERP or POS, to streamline transactions and data. On the other hand, Embedded payments are built directly into a platform, allowing users to make payments without being redirected to an external site.