Chapter

01

Introduction

In this fast-paced world of midsized organizations, financial accuracy during month-end close is of utmost importance. To ensure that, the account reconciliation team goes all guns blazing to match the GL with the statements on time and with utmost accuracy. But in this whole process of reconciling the line items and closing the books, the accountants never had it easy.

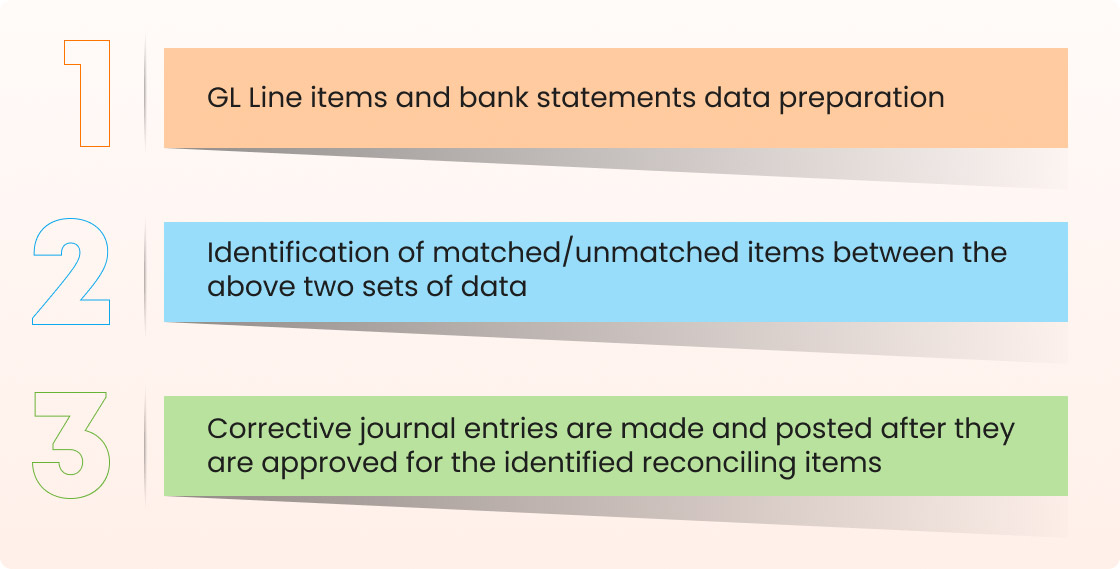

Daily, an accountant who is fetching data from the GL list and matching them has to adhere to a specific schedule to ensure that the following happens every day:

- GL Line items and bank statements data preparation

- Identification of matched/unmatched items between the above two sets of data

- Corrective journal entries are made and posted after they are approved for the identified reconciling items

However, in this whole process manual work becomes a snag. Let’s discuss in detail the responsibilities of an accountant.

Chapter

02

A Day in the Life of an R2R Professional:

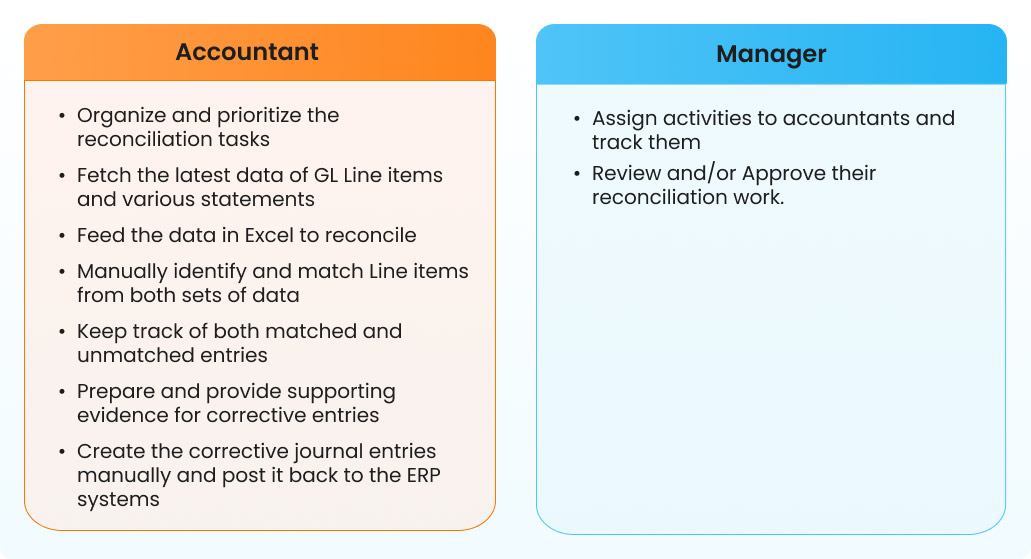

In the general run of things, an account reconciliation team has 2 roles, someone who will be doing the reconciliation work and someone who will review and approve their work with an overview of all the tasks. For easier understanding let’s call them accountants and managers for now. On a daily basis, this is the work that has to be done by them.

Accountant:

- Organize and prioritize the reconciliation tasks

- Fetch the latest data of GL Line items and various statements

- Feed the data in Excel to reconcile

- Manually identify and match Line items from both sets of data

- Keep track of both matched and unmatched entries

- Prepare and provide supporting evidence for corrective entries

- Create the corrective journal entries manually and post it back to the ERP systems

Manager:

- Assign activities to accountants and track them.

- Review and/or Approve their reconciliation work.

As we can see both accountants and managers have their own defined set of responsibilities which means they have to deal with different snags in their daily work all along.

Chapter

03

The Old School Reconciliation

With time everything needs to evolve to stand the test of time. Although there have been changes, a lot of mid-sized organizations still adhere to the old reconciliation process. Here we will be discussing the challenges faced by the accounting team while performing reconciliation the old way.

-

Accountants:

-

Organizing and picking a reconciliation task:

An accountant’s day begins with organizing, planning, and then picking up a reconciliation to work on. The accountant considers the priorities, deadlines, risk categories, and other important attributes to organize and prioritize his/her tasks. As this process is one of the starting steps of reconciliation and is mostly done manually, it results in a slower process and is much more prone to errors.

-

Fetching the latest GL line items and other statement records:

An accountant needs to fetch the latest GL Line item entries and other statements such as vendor statements and customer statements. Once there are 2 sets of data the accountant can move on to reconcile them for anomalies. They would then need to set these data in a workbook so that they can begin reconciliation.

One of the main challenges during this process occurred due to a lack of data centralization within the org. This means one has to pull in data from different ERP and non-ERP systems, making the whole process more time-consuming and error-prone. For vendor statements, supplier statements are not provided automatically so may need to be requested periodically to reconcile these accounts.

-

Reconciling GL line items and the statement records:

In this step, an accountant needs to begin identifying which GL Account Line items match with records and vice versa. Some certain sets of rules and criteria like transaction date, transaction amount, etc. are followed to match the books. As this process is done manually it requires a lot of time and effort from the accountants also it can succumb to human error.

Graphic

-

Substantiate the GL Account transactions:

After reconciling the duty of the accountant is to make sure that the statements are audit-ready. To do that a list of all bank charges, EFT charges, and interests for the Bank GL Account and any dispute charges and deductions from vendor statements and customer statements are needed to be prepared in a specific format. Manually doing this process means we are losing time in the process.

-

Create Corrective Journal Entries and submit them to ERPs:

Once the list is made the accountant moves on to identify the variances and unmatched transactions that have occurred. Depending on the nature of the discrepancy or variance, they need to record a journal entry in the GL Account to update the Current GL Account Balance to a Final GL Account Balance.

This process can lead to human error. Also, data being non-centralized and undocumented for mid-sized organizations wrong reporting can occur resulting in time loss in the close process.

-

Complete the tasks and send them for approval:

Once the reconciliation is done, the accountant needs to mark the tasks complete and send them to their manager for approval. As centralization is not always in place for mid-sized organizations, transparency can become a hindrance. Also, there is always room for human error considering an accountant has to take care of a lot of line items at once.

-

Managers:

-

Monitoring the reconciliation tasks:

In this work, visibility becomes the key. An accounting manager should be able to oversee all the reconciliation activities that are being done by the accountants. Also, an organized view is required so that the manager can have a view of tasks that are approaching deadlines, tasks that are getting delayed and have been open for a long time, and so on.

As the data is only sometimes centralized it becomes hard for the managers to see the process properly. This means it would take the manager more time to figure out if there are any snags in the process.

-

Approvals:

After completing the account reconciliation, the manager reviews and approves the line items. If any line items are rejected it is sent back to the accountant to work again.

Being a manual process, some tasks can stay in the queue for a longer period as it is done by a person one at a time. This makes the process much more time-consuming.

Chapter

04

HighRadius: The New Dawn of Reconciliation

So far we have learned how difficult it was for the accountants and managers to deal with all the work during the month-end close process. Thankfully, times have changed. With the inception of AI, most of the work done manually can be easily automated.

HighRadius’s Account Reconciliation Software provides an out-of-the-box formula set that can configure matching rules and match line-level transactions from multiple data sources and create templates to automate various transaction processing required for month-end close. Our solution can prepare and post journal entries, which will be automatically posted into the ERP, automating 70% of your account reconciliation process.

Let’s take a deeper dive and see how HighRadius is solving the daily challenges of the accountants and the managers.

Graphic

-

Accountants:

-

Task organization:

HighRadius can help you reduce days to reconcile by 30%. A well-organized representation of prioritized tasks is assigned to the analysts. With the GL account Reconciliation checklist, the task assigning and organization can be automated. One can view the lists of balance sheet GL accounts with current reconciliation status.

-

Fetching GL line items and statement records:

The system has scheduled data catalog jobs that run periodically or on-demand that can fetch GL Account Line items and other statements like bank statements, vendor statements, disputes, or deductions automatically. In the Highradius Account Reconciliationsolution, the data from the system of records are brought in automatically as and when needed periodically thus saving time and effort for analysts. A LiveCube which is an Excel-like interface by Highradius is also attached to the tasks. Analysts can launch the LiveCube from the task details screen to begin the reconciliation.

-

Reconciling GL line items and statements:

To make the reconciliation process faster, predefined rules must be set up, and the certification and decertification of reconciliation must be automated. The Highradius Account Reconciliation system contains a rule engine with a predetermined set of rules that executes the transaction matching automatically and divides the data into two sheets: Matched items and unmatched items. The reconciliation starts in the LiveCube. The analyst can then use a linked LiveCube to analyze the unmatched records. Following their findings, users can also pick records and shift them to unmatched sheets. Automated transaction matching significantly speeds up the process and guarantees reconciliation accuracy.

-

Substantiation of the GL Account transactions:

To streamline and standardize the gathering of supporting documentation and evidence, HighRadius offers preconfigured templates. With the configurable Livecube, the data preparation can be automated. This facilitates client audit readiness and can save an analyst’s time and effort.

-

Journal Entry and posting:

By offering pre-built entry templates and precise reconciliation details that are pushed into your ERP effortlessly, the Highradius Account Reconciliation solution removes all of your process bottlenecks. Analysts can use the Journal Entry Template or LiveCube to execute remedial Journal Entry postings. With this feature, 95% of the journal entries can be automated saving time and effort.

Banner: With HighRadius’ flexible AI-based rule engine achieve up to 90% transaction auto-match rate.( Book a Demo button)

-

Managers:

-

Visibility over all the Reconciliation tasks:

Highradius Account Reconciliation solution provides a highly customizable, elaborate, and comprehensive dashboard for reconciliation. This helps managers easily observe reconciliation schedules and task status thus providing them with better visibility. Customizable out-of-the-box reports and dashboards are available to monitor progress on reconciliation. Multiple out-of-the-box dashboard reports include Tasks Due by Dates, Tasks Due by Priority, Planned V/s Actual, Top Preparers with Open Tasks, etc. These dashboards can help the managers take proactive actions on potential delays thus ensuring improved days to reconcile.

-

Approvals:

Approvers can better organize and prioritize their work by filtering the tasks that need their approval with the help of the Highradius Account Reconciliation solution. With Maker checker workflow, high-risk tasks can be monitored and with custom workflow, multiple levels of approval can be added. The Approver can also view the LiveCube in read-only mode to ensure analysts are operating as intended. After that, approvers have the option to reject, approve, or put it on hold. The duty can also be segregated in a way that a manager can always review the tasks done by the accountants.

Chapter

05

Shake Hands With the Future

Reconciling the statements is one of the oldest methods to close the books on time. With time every process must evolve for a better future, and Accounting is no exception.

For a midsized organization issues like data traveling in silos, non-centralization, and reliance on manual work can be a speed breaker in their journey to success. AI can certainly come to clutch in such situations.

A very common question can occur, “is AI going to solve the problems or it’s just a fad?” According to a new ISG analysis, by 2027, close management software will be used by 50% of midsize and bigger businesses to expedite the close and have more control over the process. Thus it may be said that the world at large now believes in artificial intelligence and its potential.

So it is about time to shake hands with HIghRadius and be in the future, now.