Key Takeaways

- Budget variance analysis is a financial management tool that compares actual financial outcomes against budgeted expectations.

- Budget variance analysis uncovers trends and areas for improvement, guiding agile decision-making in response to market changes.

- Flexible budgeting, regular budget variance analysis, and advanced analytics refine budget accuracy over time.

Introduction

In the dynamic world of business, financial management plays a pivotal role in determining the success and sustainability of an organization. Budget variance analysis is a critical tool in this area, offering insights into how well a company’s financial plans align with its actual performance.

Budget variance analysis serves as a strategic lens through which businesses can assess their fiscal discipline and resilience. It goes beyond mere number crunching to reveal underlying trends, strengths, and areas needing improvement within an organization’s financial framework. This process is instrumental in fostering informed decision-making, enabling executives and financial managers to pivot swiftly in response to changing market dynamics or internal operational shifts. Ultimately, mastering budget variance analysis equips businesses with the foresight and agility needed to stay competitive and resilient in an ever-evolving economic landscape.

Keep reading the blog as we understand the significance of budget variance analysis, the process to conduct it, and some best practices to enhance the process further.

What is Budget Variance Analysis?

Budget variance analysis is a financial management tool that compares actual financial outcomes against budgeted expectations. By identifying variances, it evaluates performance, highlights areas for improvement, and informs adjustments to enhance financial planning and decision-making processes.

When businesses perform budget variance analysis, they systematically evaluate how closely their actual financial outcomes align with their budget projections. This process involves calculating the differences (variances) between actual figures and the budgeted amounts for various financial metrics such as sales revenue, expenses, profits, and cash flow.

Some common types of variances you may analyze include revenue variances, cost variances, and volume variances.

Pro tip: Businesses that use AI and a larger pool of data for cash variance analysis are likely to get better insights and forecasts.

Why Is Budget Variance Analysis Important to Your Business?

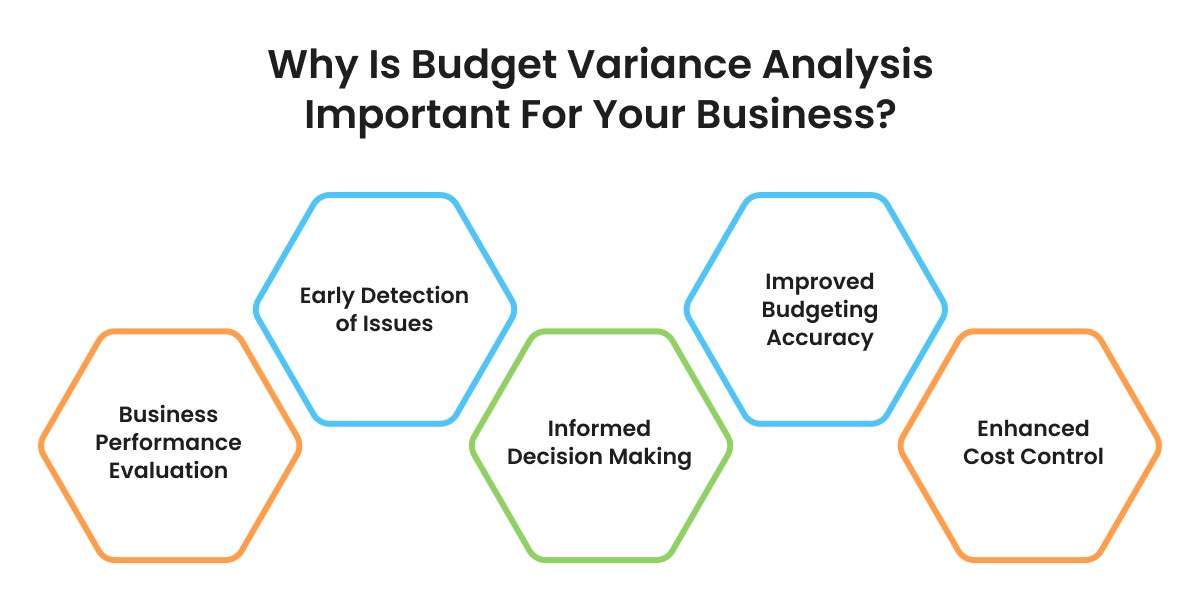

Budget variance analysis enables us to identify deviations from expected performance, understand their causes, assess their possible impact on overall business performance as well as identify corrective actions.

Additionally, enhanced cost control is facilitated by identifying spending discrepancies and optimizing resource allocation, ensuring efficient financial management and strategic alignment with organizational objectives. It is an important tool for your business as it offers several key benefits:

- Business performance evaluation: It provides a clear assessment of how well the business is meeting its financial goals.

- Early detection of issues: Variances highlight potential issues early, allowing for timely corrective actions.

- Informed decision-making: Helps in making informed decisions about resource allocation, cost control measures, and strategic adjustments.

- Improved budgeting accuracy: Facilitates setting realistic future budgets based on past performance and improving financial forecasting accuracy.

- Enhanced cost control: By pinpointing spending discrepancies, budget variance analysis aids in optimizing resource allocation and reducing unnecessary expenses.

Budget Variance Analysis Formula

Based on the calculation, the budget variance can be negative or positive. The former suggests that the organization is spending more than budgeted or has fewer earnings than projected. A favorable budget variance suggests that actual spending is lower or higher than projected expenses. The budget variance analysis formula comprises deducting the budgeted amount from the actual amount.

Budget Variance = Actual Amount−Budgeted Amount

Steps to Calculate Budget Variance Analysis

Even though conducting a budget variance analysis can be time-consuming, organizations need to identify if they have achieved their financial goals. Here’s a step-by-step guide to performing a budget variance analysis.

Step 1: Set clear objectives

Define the purpose and scope of the analysis, including which financial metrics and periods will be reviewed.

Step 2: Gather data

Collect actual financial data from accounting records and compare it to the budgeted figures for the same period.

Step 3: Identify line items

Break down the budget and actual data into specific line items such as revenues, expenses, and costs.

Step 4: Calculate variances

Compute the differences (variances) between actual and budgeted amounts for each line item, using the appropriate formulas. The formula is (Budget variance= Actual amount – Budgeted Amount).

Step 5: Analyze variances

Investigate the reasons behind significant variances. Some possible reasons could be changes in sales volume, cost increases, unexpected expenses, or other factors.

Step 6: Report findings

Summarize findings in a clear, concise report or presentation, highlighting key variances and their implications.

Step 7: Take action: Based on the analysis, develop action plans to address unfavorable variances and capitalize on favorable ones. Communicate findings and action plans to relevant stakeholders.

Budget Variance Analysis Example

Consider the following example to illustrate a budget variance analysis report:

- Identifying the line items for budget variance analysis:

|

Actual Value |

Budgeted Value |

|

|

Sales |

$100,000 |

$110,000 |

|

Expenses |

$50,000 |

$45,00 |

- Calculating budget variance for each line item using the formula:

Budget Variance= Actual Amount – Budgeted Amount

|

Actual Value |

Budgeted Value |

Variance |

|

|

Sales |

$100,000 |

$110,000 |

-$10,000 |

|

Expenses |

$50,000 |

$45,00 |

$5000 |

In this example we can see:

- Sales: Actual sales was lower by $10,000 so it was a negative or unfavorable variance.

- Expenses: Actual expenses exceeded budgeted expenses by $5,000 which makes it a negative or unfavorable variance

- Profit: Lower sales lead to more expenses. This means more cost to the company and a variance in profit than expected.

Best Practices for Budget Variance Analysis

To make sure you can gain important insights, identify patterns, and proactively identify errors by leveraging budget variance analysis, you can fine-tune the process by following these best practices:

- Conducting budget variance analysis regularly: Perform budget variance analysis regularly for various line items to catch issues early on and make timely adjustments. Optimum time frame for analysis would be monthly or quarterly.

- Ensure stakeholder understanding: Make sure all stakeholders understand the analysis results and their implications clearly.

- Comparative view of variances: Compare variances against industry benchmarks or prior periods for context.

- Agility and flexibility in budgeting: Be prepared to revise budgets based on actual performance and changing business conditions.

- Enhance future budgeting accuracy: Use the insights gained to improve future budgeting accuracy and financial decision-making.

Best Practices for Budget Variance Analysis

- Regular monitoring of line items

- Clear Communication with stakeholders

- Benchmarking against industry standards

- Agility and Flexibility in Budgeting

- Insight-driven Continuous Improvement in Budgeting

Make your Company’s Budget Variance Analysis Easy with HighRadius

HighRadius offers a cloud-based Treasury and Risk Suite that streamlines and automates treasury operations, including cash forecasting, cash management, and treasury payments. We have empowered the world’s leading companies, like Danone, HNTB, Harris, and Konica Minolta, to optimize their cash forecasting accuracy, make decisions faster with real-time bank data, and reduce bank fees.

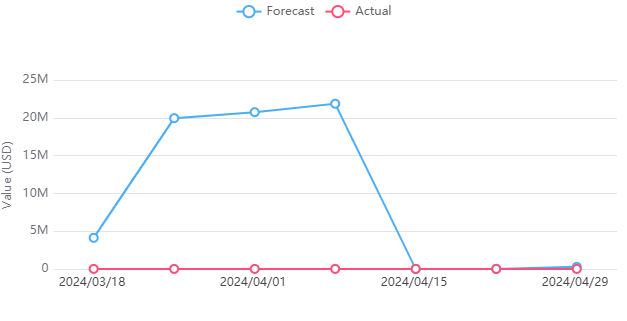

Our Cash Forecasting Solution leverages advanced technologies such as artificial intelligence (AI) and machine learning (ML) and integrates with banks and ERPs to get AR/AP data, improve ML prediction rates, and enable treasurers to achieve accurate, real-time cash forecasting. Businesses can forecast cash into any category or entity on a daily, weekly, and monthly basis with up to 95% accuracy, perform what-if scenarios, and compare actuals vs. forecasted cash.

Our Cash Management Solution automates the reconciliation process between bank statements and internal financial records, reducing manual effort and errors and increasing cash management productivity by 70%. With our treasury and risk solutions, treasury professionals gain instant, personalized insight into their cash positions with unparalleled global visibility. Businesses can forecast cash into any category or entity on a daily, weekly, and monthly basis with up to 95% accuracy.

HighRadius was recently recognized as a leader in treasury and Cash Flow Management by G2, underscoring our commitment to innovation and excellence in empowering finance teams worldwide. Discover how HighRadius can transform your cash forecasting and variance analysis capabilities to steer complexities and drive sustainable financial performance.

FAQs

1. How can variance analysis help plan a budget?

Variance analysis identifies where actual financial outcomes differ from budgeted expectations, enabling adjustments to future budgets. By understanding these discrepancies, businesses can refine budget assumptions, allocate resources more effectively, and improve overall budgeting accuracy and strategic planning.

2. How is the flexible budget useful for variance analysis?

The flexible budget is valuable for variance analysis because it adjusts budgeted amounts based on actual activity levels, providing a more accurate comparison with actual results. This enables businesses to isolate the impact of changes in activity levels on variances and make improved decisions.

3. How often should budget variance analysis be performed?

Budget variance analysis should be performed regularly, such as monthly or quarterly, to monitor financial performance effectively. This frequency allows businesses to identify variances promptly, take corrective actions promptly, and maintain proactive financial management to achieve their strategic goals.

4. What is the essence of flexible budget variance analysis?

Flexible budget variance analysis focuses on comparing actual results against a budget adjusted for actual activity levels. It highlights variances caused by changes in activity, providing insights into operational efficiency and helping businesses make targeted improvements in resource allocation and cost control.

5. What is flexible budget variance analysis?

Flexible budget variance analysis compares actual results with a budget adjusted for actual activity levels. It helps isolate the impact of changes in activity on variances, providing insights into operational efficiency and facilitating targeted improvements in resource allocation and cost control.