Key Takeaways

- A cost center in accounting is a business unit that incurs expenses but does not directly generate revenue, focusing on cost control and efficiency.

- Examples of cost centers include departments such as HR, IT, R&D, and customer support, which handle expenses but don’t directly contribute to generating revenue.

- Cost centers help businesses improve expense tracking, budgeting, and resource efficiency.

Introduction

A cost center is a part of a business that doesn’t make money directly but is essential for keeping things running smoothly. Departments like IT, HR, or customer support can be considered cost centers. While they don’t sell products or bring in any revenue, their work helps the entire business function better. By managing cost centers well, businesses can reduce unnecessary spending and ensure that support functions run effectively.

In this blog, we’ll explore what a cost center is in accounting, along with examples, types, and the benefits they provide.

What is a Cost Center?

A cost center in accounting refers to a specific department or function within a company that does not directly generate revenue but incurs costs to support revenue-generating activities. Cost centers focus on internal operations rather than sales or production and play a vital role in ensuring the business runs efficiently.

Common examples of cost centers include human resources, IT, and accounting departments. These departments focus on internal operations, such as maintaining employee well-being, ensuring smooth technological operations, and managing financial records.

Purpose of a Cost Center

The purpose of a cost center is to help a business manage and control its internal expenses effectively. It plays a crucial role in improving financial management and operational efficiency within an organization. Here are a few key reasons why cost centers are important:

- Expense monitoring: A cost center helps monitor and control the expenses of specific departments or functions.

- Overhead cost allocation: It enables accurate allocation of overhead costs to different areas of the business. This enables in devising of effective pricing strategies and efficient decision-making.

- Budgeting: Cost centers assist in creating and managing budgets for non-revenue-generating departments. This ensures that resources are allocated efficiently.

- Cost efficiency: By focusing on internal costs, cost centers help identify opportunities for reducing expenses and improving operational efficiency.

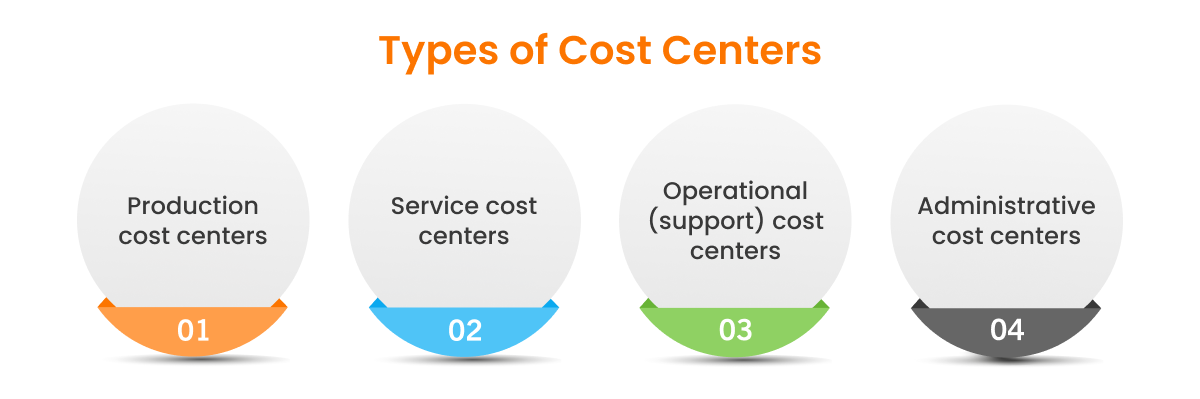

Types of Cost Centers

Cost centers are classified based on the nature of their activities and how they contribute to the overall business operations. Understanding the different types of cost centers helps organizations track and allocate costs more accurately. Below are the main types of cost centers:

-

Production cost centers

These include departments or functions directly involved in the production process, such as manufacturing units, assembly lines, or packaging teams. Their primary role is to support the creation of products, and the costs incurred here are tied to the production process, such as labor costs and machinery expenses.

-

Service cost centers

These focus on internal support services like IT, human resources, and maintenance. While they don’t generate revenue, they play a vital role in maintaining the infrastructure and workforce that keep the organization running efficiently. Costs related to internal support functions such as IT infrastructure, employee benefits, training, and equipment maintenance are allocated here.

-

Operational (support) cost centers

These are departments that contribute to the core business operations but don’t directly generate revenue, such as logistics, procurement, or quality control. They ensure that the production process runs smoothly by managing the supply chain, ensuring quality standards, and coordinating operations. Costs associated with inventory management, procurement, and transportation are allocated here.

-

Administrative cost centers

Departments like accounting, legal, and management fall into this category. They handle essential administrative functions such as compliance, financial reporting, and overall business governance, ensuring that the company remains legally and financially sound. costs associated with salaries of management staff, legal fees, accounting services, and office expenses are allocated here.

Benefits of a Cost Center

Cost centers offer a range of benefits that help organizations streamline their operations and improve financial management. Here are some key benefits:

-

Improved cost control

By monitoring expenses in specific departments, businesses can track spending patterns, identify inefficiencies, and make informed decisions to control and reduce costs. This enables more effective use of resources and minimizes unnecessary expenditures.

-

Enhanced financial transparency

Cost centers provide a clear picture of where money is being spent, making it easier to allocate resources appropriately and ensure transparency in budgeting and financial reporting. This clarity supports better financial oversight and governance.

-

Better budgeting and forecasting

With cost centers, companies can create more accurate budgets and forecasts by analyzing the expenses associated with each department or function. This helps in making more precise financial projections, leading to smarter decision-making and resource allocation.

-

Increased accountability

Cost centers assign responsibility for expenses to specific departments, encouraging managers to be more accountable for their budget and make cost-conscious decisions that align with business goals. This promotes a culture of ownership and financial responsibility across the organization.

-

Support for long-term planning and performance evaluation

Cost centers provide valuable data on departmental expenses, allowing organizations to assess performance over time and make informed decisions for long-term planning. By analyzing cost trends and aligning them with business objectives, companies can optimize their strategies, improve efficiency, and evaluate the financial health of various departments. This insight supports better planning and helps in setting realistic, long-term financial goals.

Example of a Cost Center

An example of a cost center is the IT department. While it doesn’t directly generate revenue, it is essential for maintaining smooth operations across the organization. The IT department handles tasks such as maintaining servers, managing software, providing technical support, ensuring cybersecurity, and overseeing network infrastructure. When organizing the IT department as a cost center, several factors should be considered:

- The specific IT functions and services the department will be responsible for

- The number of IT personnel required to manage these tasks

- Pay rates and benefits for IT staff

- Costs for software licenses, hardware, and network equipment

- Approved vendors for IT-related purchases and services

- Projected maintenance and upgrade costs for technology infrastructure

- The overall projected budget for the department

Limitations of a Cost Center

While cost centers are valuable for managing expenses, they come with certain challenges that can impact overall business performance. Here are some key limitations to consider:

-

Lack of revenue focus

Cost centers don’t generate revenue, so their performance is solely judged on cost control. This narrow focus can lead to efficiency at the expense of innovation, as departments may prioritize cutting expenses over finding new ways to add value or improve productivity.

-

Limited accountability for profitability

Since cost centers aren’t responsible for revenue generation, they lack direct accountability for the company’s profitability. This can result in cost centers operating efficiently in isolation but not contributing strategically to the company’s broader financial goals.

-

Overemphasis on cost-cutting

Excessive focus on cutting costs can lead to underinvestment in crucial areas. Departments might reduce spending on important functions like staff training or equipment upgrades, potentially hindering long-term growth and reducing operational efficiency.

-

Complex allocation of overhead

Accurately assigning overhead costs to cost centers can be challenging, especially in large organizations. Misallocation can distort financial data, leading to poor decision-making, and it may be difficult to track which departments are actually driving up costs.

How Can HighRadius Help Cost Centers?

HighRadius Record-to-Report Solution helps cost centers by automating and streamlining the allocation of costs across various departments or projects. It ensures accurate and timely tracking of expenses, supports budgeting and forecasting and provides detailed reporting to monitor financial performance, helping cost centers optimize resource use and improve decision-making. Additionally, it enhances visibility into the financial close process, enabling better compliance and internal control over cost allocations.

On a border note, our Financial Close Software is designed to create detailed month-end close plans with specific close tasks that can be assigned to various accounting professionals, reducing the month-end close time by 30%.The workspace is connected and allows users to assign and track tasks for each close task category for input, review, and approval with the stakeholders. It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it.

Our Account Reconciliation Software provides an out-of-the-box formula set that can configure matching rules and match line-level transactions from multiple data sources and create templates to automate various transaction processing required for month-end close. Our solution has the ability to prepare and post journal entries, which will be automatically posted into the ERP, automating 70% of your account reconciliation process.

Our AI-powered Anomaly Management Software helps accounting professionals identify and rectify potential ‘Errors and Omissions’ throughout the financial period so that teams can avoid the month-end rush. The AI algorithm continuously learns through a feedback loop which, in turn, reduces false anomalies. We empower accounting teams to work more efficiently, accurately, and collaboratively, enabling them to add greater value to their organizations’ accounting processes.

FAQs

1. What is cost center accounting?

Cost center accounting tracks expenses for specific departments or units within a business that don’t directly generate revenue, such as HR or IT. It helps monitor and control costs, allowing businesses to allocate expenses, improve budgeting, and optimize resource efficiency in non-revenue areas.

2. How to assign a cost center to a GL account?

To assign a cost center to a GL account, access your accounting software or ERP system, locate the specific GL account, and select the appropriate cost center from the chart of accounts. This links the expense or revenue to the cost center, enabling detailed tracking and reporting.

3. What is the difference between a cost center and a GL account?

A cost center is a department or unit within a business that tracks expenses but doesn’t directly generate revenue. A general ledger (GL) account, on the other hand, records all financial transactions, including both revenue and expenses, providing a detailed view of the company’s financial health.