Key Takeaways

- EFTs are digital transfers of money from one bank account to another. They usually process funds via an automated clearing house (ACH), while wire transfers are sent directly between banks.

- EFTs typically have lower fees and are reversible, whereas wire transfers are faster and have higher transfer limits but come with higher fees and are not reversible.

Introduction

In the world of business and finance, terms like “electronic transfer” and “wire transfer” are commonly used. Both refer to methods of transferring money electronically between accounts. But do you understand the difference between electronic and wire transfers? If not, you should.

Why? Because understanding the distinction between them is essential for navigating financial transactions effectively. With that in mind, we will cover everything from the differences between electronic and wire transfers to how they work. Let’s get to it.

What Is an Electronic Funds Transfer (EFT) ?

An Electronic Funds Transfer (EFT) is the electronic exchange of money from one bank account to another, accomplished through computer-based systems. This method allows individuals, businesses, and institutions to transfer funds quickly and securely without needing physical checks or cash transactions.

EFTs streamline financial transactions, reducing reliance on paper-based methods and offering convenience, speed, and security. They play a crucial role in modern banking and commerce, enabling efficient money management and facilitating economic activities globally.

Benefits of EFT

EFT offers numerous benefits:

- Speed and Convenience:

- EFT enables quick and secure transfers of funds between accounts electronically.

- Transactions are processed efficiently, often with minimal delay.

- Transactions can be conducted 24/7, providing great convenience.

- Reduced Paperwork:

- EFT reduces the need for physical checks and paperwork.

- This minimizes errors and streamlines record-keeping.

- Enhanced Security:

- EFT enhances security by reducing the risk of lost or stolen checks.

- It is a reliable method for managing and transferring money.

How Does the EFT Process Work?

An EFT involves the sender and the recipient of the funds. The moment the sender initiates the transfer, the funds travel through a series of digital networks, moving from the sender’s bank to the recipient’s bank.

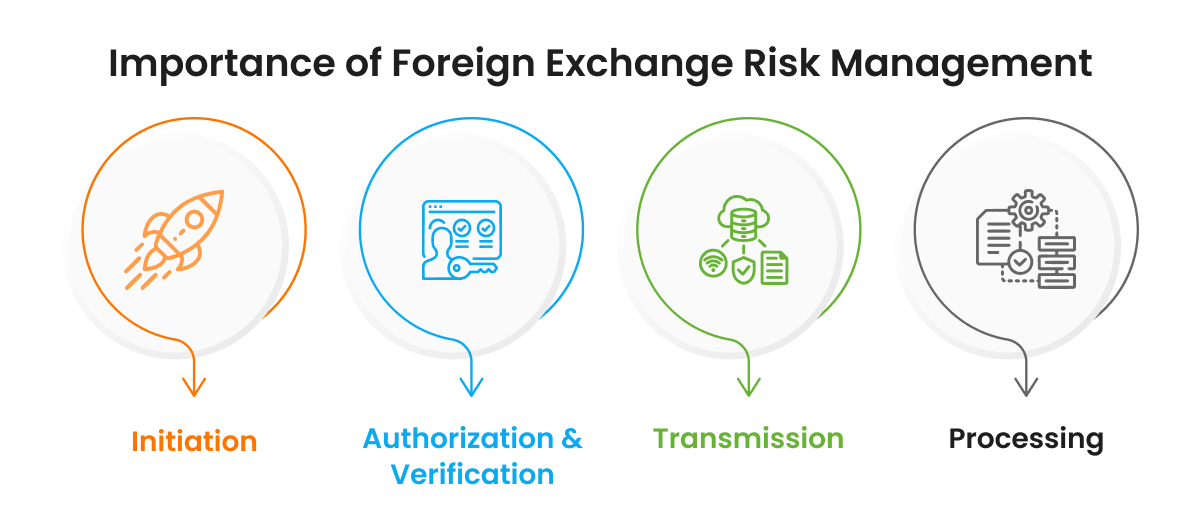

Here’s a step-by-step process of how EFTs work:

- Initiation: The sender provides their banking details and specifies the amount to transfer.

- Authorization: The sender’s bank verifies and authorizes the transaction, ensuring funds availability.

- Transmission: The transaction details are securely sent to the recipient’s bank through electronic networks.

- Processing: The recipient’s bank receives and processes the transfer, verifying the recipient’s account. The funds are then deposited into the recipient’s account electronically.

Types of EFTs

Electronic Funds Transfers (EFTs) encompass various methods for transferring money electronically between bank accounts. Key types include:

- Direct Deposits: Commonly used for payroll and government benefits, this method transfers funds directly into an individual’s bank account, eliminating the need for paper checks.

- Automated Clearing House (ACH) Transfers: These transfers are used for recurring payments, such as utility bills or loan repayments. They involve moving funds between banks through the ACH network, which processes transactions in batches.

- Wire Transfers: Used for fast and secure transfers, wire transfers move funds directly between banks and are often used for high-value or international transactions.

- Electronic Bill Payments: This method allows individuals to pay bills electronically through their bank’s online platform, ensuring timely payments and reducing the need for physical checks.

- Peer-to-Peer (P2P) Payments: Services like PayPal or Venmo enable users to transfer money directly to others via mobile apps or online platforms.

What Are ACH Transfers?

Now that we have covered EFTs and their various types in detail, it’s essential to delve into one of the most prevalent forms of EFT in the United States: ACH (Automated Clearing House) transfers.

ACH transfers are electronic payments that allow funds to be transferred between bank accounts within the United States. This system efficiently and securely processes various types of transactions, such as direct deposits, bill payments, and business-to-business payments.

ACH transfers typically involve two main types of transactions:

Credits and Debits.

- Credits include direct deposits of salaries, government benefits, or refunds into recipients’ accounts.

- Debits cover payments initiated by companies or individuals to pay bills, mortgages, or other expenses directly from their bank accounts.

The process involves batching transactions for processing at scheduled intervals, reducing the need for manual payment handling. ACH transfers are widely used due to their cost-effectiveness, speed, and reliability, making them a preferred method for recurring payments and payroll processing among businesses and individuals alike.

ACH transfers simplify financial transactions by leveraging electronic networks to move funds securely and efficiently across different financial institutions.

What Is a Wire Transfer?

A wire transfer is an electronic funds transfer method that allows individuals and businesses to send money from one bank account to another, domestically or internationally. Unlike other EFT methods, which may take a day or more to process, wire transfers typically provide same-day funds availability, making them ideal for urgent or time-sensitive transactions.

To initiate a wire transfer, the sender provides the bank with the recipient’s bank account details, including the account number and routing information. The sender’s bank then electronically sends the specified amount directly to the recipient’s bank, bypassing intermediary banks if the transfer is domestic or involving correspondent banks for international transfers.

Wire transfers are known for their speed and reliability but often come with higher fees compared to other EFT methods. They are commonly used for large transactions, such as real estate purchases, business payments, and international remittances, where swift and secure fund transfer is crucial.

Benefits of Wire Transfers:

Speed: Wire transfers provide fast processing, often completing transactions within one business day, which reduces delays compared to other methods.

Security: They offer secure transfers of funds between bank accounts, whether domestic or international, minimizing the risk of fraud.

Reliability: Wire transfers efficiently handle large amounts of money, making them suitable for substantial transactions.

Clear Paper Trail: They create a detailed transaction record, which is helpful for accurate record-keeping and resolving potential disputes.

How Do Wire Transfers Work?

Wire transfers are initiated when the sender instructs their bank, credit union, or a non-bank wire transfer company to transfer funds to the recipient. The sender must have sufficient funds in their account to initiate the transfer.

The sender also needs to provide the recipient’s name, contact information, and banking details, including the wire transfer routing number and the recipient’s bank account number. The sender’s bank then sends the payment instructions to the recipient’s institution, which deposits the funds into the recipient’s account upon receiving the instructions.

Here’s a step-by-step process of how wire transfers work:

- Initiation: The sender (person or business) initiates a wire transfer through their bank. They provide the recipient’s full name, account number, bank name, and routing number (for domestic transfers) or SWIFT/BIC code (for international transfers).

- Verification: The sender’s bank verifies the sender’s identity and the provided recipient details to ensure accuracy.

- Authorization: Once verified, the sender’s bank debits the sender’s account for the amount of the wire transfer plus any applicable fees.

- Processing: The sender’s bank sends a secure message through a secure network (like Fedwire or SWIFT) to the recipient’s bank with instructions to credit the recipient’s account with the specified amount.

- Intermediary Banks (for international transfers): If the transfer is international, the message may pass through one or more intermediary banks that facilitate the transfer between different countries’ financial systems.

- Receipt: The recipient’s bank receives the funds and credits them to the recipient’s account. This typically happens on the same day for domestic transfers, while international transfers may take a few days, depending on the countries and banks involved.

- Confirmation: Once the wire transfer is completed, both the sender and recipient receive confirmation from their respective banks.

Wire transfers are known for their speed and security, making them a preferred method for large transactions or when immediate access to funds is required. However, they often involve higher fees compared to other electronic payment methods.

Similarities Between Electronic and Wire Transfers

Here are the key similarities between wire transfers and electronic transfers:

- Electronic Format: Both electronic transfers and wire transfers are conducted electronically, using digital networks to move funds between bank accounts.

- Bank-to-Bank: They involve direct transfers from one bank account to another, bypassing physical cash transactions.

- Speed: Both methods are generally faster than traditional paper-based transactions, providing quicker access to transferred funds.

- Security: They utilize secure networks and protocols to ensure the safety of financial transactions, protecting against unauthorized access and fraud.

- Global Reach: Both electronic transfers and wire transfers can be used for domestic and international transactions, enabling businesses and individuals to send money across borders.

- Transaction Fees: Both methods may involve fees, which can vary depending on factors such as the amount transferred, destination country, and urgency of the transfer.

- Regulatory Compliance: They both adhere to regulatory standards and financial regulations governing electronic fund transfers, ensuring legality and accountability.

- Confirmation: Senders and recipients receive confirmation of the transaction from their respective banks, assuring that the transfer has been completed successfully.

By understanding these similarities, businesses and individuals can choose the most suitable method for their specific financial needs, whether for everyday transactions or larger international transfers.

Differences Between Electronic and Wire Transfers

Electronic transfers and wire transfers differ in several key aspects.

Speed: One of the main differences between EFT and wire transfers is the speed. Electronic transfers are typically faster for domestic transactions, often processing within hours or the same day. Wire transfers, while available for both domestic and international transfers, usually offer quicker processing times for immediate access to funds, although they can still take a few hours to a day depending on the transfer details.

Cost: Electronic transfers generally have lower fees than wire transfers, which can be costly due to additional charges for international transactions.

When considering costs, businesses often prefer electronic transfers for their lower fees, while wire transfers are chosen for their speed despite the higher fees involved.

Risk: Wire transfers are considered more secure but carry higher fraud risk due to their immediate processing nature. Electronic transfers are secure but may involve more checks and balances.

In terms of risk management, wire transfers are preferred for their higher security measures, while electronic transfers require careful monitoring to mitigate potential risks.

Security: Both methods utilize secure networks, but wire transfers offer additional security features like secure messaging protocols.

To ensure the utmost security, businesses may opt for wire transfers, while electronic transfers also maintain robust security through encrypted transactions.

Domestic or International Payments: Both electronic and wire transfers can be used for domestic and international payments. However, wire transfers are preferred for cross-border transactions due to their immediate processing capabilities.

When it comes to cross-border payments, wire transfers are chosen because they can quickly move funds across borders, while electronic transfers are suitable for both domestic and international transactions.

EFTs vs. Wire Transfers: Which Is Better?

Choosing between EFTs and wire transfers depends on specific needs and preferences rather than one being universally better than the other.

EFTs, such as direct deposits and online banking transfers, are convenient for everyday transactions within the same country or region. They often have lower fees and can be processed quickly, making them suitable for regular payments like salaries or bills.

On the other hand, wire transfers excel in speed and reliability, particularly for urgent or international transactions. They provide immediate access to transferred funds but may involve higher fees than EFTs.

Ultimately, the decision hinges on factors like transaction urgency, cost considerations, and the level of security required. For routine transactions within a country, EFTs may be more cost-effective. Wire transfers might be the preferred choice for high-value or time-sensitive transactions across borders despite higher costs.

Both methods offer distinct advantages, and the best choice depends on the specific circumstances and priorities of the transaction at hand.

About HighRadius: B2B Payments Suite

HighRadius offers a comprehensive, cloud-based solution to automate and streamline the B2B payments process for businesses. The B2B payments software features a robust payments module with a payment gateway, surcharge management, and interchange fee optimization. The payment gateway for SAP integrates with SAP and makes cash applications seamless.

Trusted by 1000+ companies to deliver speed-to-value, including P&G, Ferrero,Johnson & Johnson, and Danone, HighRadius has been a Gartner Magic Quadrant Leader 3 years in a row, placed highest in the ability to execute and furthest in the completeness of vision.

FAQs

1) Is EFT the same as a wire transfer?

No, EFT (Electronic Funds Transfer) and wire transfers differ. EFT is a broad category covering various electronic payment methods, including ACH, card transactions, and online banking transfers. Wire transfers specifically refer to direct bank-to-bank transfers, often involving international or large-sum transactions.

2) Are EFTs and wire transfers secure?

EFTs and wire transfers are generally secure due to encryption and authentication protocols. However, wire transfers, being direct bank-to-bank transactions, may involve higher security standards. EFTs, which include ACH and card payments, also prioritize security but can vary in vulnerability based on implementation and safeguards.

3) Are wire transfers faster than EFTs?

Wire transfers are generally faster than Electronic Funds Transfers (EFTs). Wire transfers are immediate and involve direct bank-to-bank transactions, often for urgent payments. EFTs, though efficient, can take longer depending on bank processing times and may involve intermediary steps.

4) What is the main difference between wire and electronic transfer?

Wire transfers provide immediate, secure transfers of funds between banks and are often used for large sums and international transactions. In contrast, electronic transfers include various methods like ACH and EFT, which are typically used for routine domestic transactions. While electronic transfers are generally slower than wire transfers, they are more cost-effective for lower amounts and recurring payments within a country.

5) What is the difference between electronic and wire transfer routing numbers?

Electronic routing numbers are used for electronic transactions like direct deposits and bill payments within the United States. Wire routing numbers, distinct from electronic ones, are specifically for wire transfers, facilitating swift, cross-border money movements between financial institutions globally.

6) When should I use a wire or an EFT Transfer?

Use wire transfers for urgent, high-value transactions requiring immediate clearance and international transfers. EFT suits routine, lower-cost domestic payments where timing is less critical. When choosing between them for your financial transactions, consider fees, speed, and destination.

7) Can wire transfers be reversed?

Once initiated, wire transfers are generally irreversible. If an error occurs, immediate notification to the bank is crucial. The bank may attempt a recall, but success depends on recipient cooperation. Prevention through accurate details and verification is key to avoiding complications with wire transfers.

8) Is EFT the same as a Wire transfer?

No, EFT and wire transfer are not the same. EFT refers broadly to electronic payments between accounts, including online transfers and direct deposits. Wire transfer specifically involves immediate bank-to-bank transfers, often used for urgent or international transactions.