Key Takeaways

- A financial audit reviews a company’s financial statements to assess their accuracy and completeness.

- Financial audits help increase transparency and accountability, mitigate risk and fraud, and ensure regulatory compliance.

- There are three major types of audits, including internal audits, external audits, and IRS audits.

Introduction

At least once a year, companies are required to undergo a financial audit, which assesses their financial health and reports about the same to all the stakeholders. This is a crucial process for every business adhering to accounting standards, as it helps convey that the company is performing well and ensures financial integrity.

In this blog, we are going to understand what a financial audit is, why it’s important, the different stages of a financial audit, and how to prepare for a financial audit.

What is a Financial Audit?

A financial audit is an accounting practice that involves evaluating an organization’s financial statements to determine their accuracy and completeness. Financial audits are usually conducted at the end of the accounting period by an external auditor who can independently assess the financial integrity of an organization.

During a financial audit, the auditor examines a company’s financial information through financial documents, journal entries, ledgers, etc. to determine whether the financial statements accurately reflect the position of the company. The entire auditing process could take anywhere between weeks and months, according to the size of the company and the complexity of their financial information.

Monitor your business’s financial health with our Monthly Financial Reporting Template.

Types of Audited Financial Statements

At the end of the financial year, a company prepares financial statements to help stakeholders understand its financial position. These statements include the income statement, balance sheet, and cash flow statement. The auditing process requires the auditor to go through financial documents to assess the accuracy of these statements.

- Income statement: An income statement indicates how profitable a company is by looking at its revenues and expenses. During an audit, the auditor checks the accuracy of income generated and whether the operations are bringing in more cash than is being spent. They might also suggest areas for improvement by looking at the operational processes of the company.

- Balance sheet: A balance sheet provides a snapshot of a company’s current financial position by assessing its assets, liabilities, and shareholders’ equity. The evaluation of balance sheets helps determine a company’s net worth and helps external stakeholders in making informed financial decisions.

- Cash flow statement: A cash flow statement shows the company’s cash inflow and outflow. The auditors check how a company is managing cash, including how it is generating revenue and spending funds and if there’s scope for improving the processes.

What is Reviewed Under a Financial Audit?

A financial audit reviews a company’s financial documents and processes to determine the accuracy of its financial statements. Here’s a closer look at what an auditor reviews during a financial audit:

- Financial transactions and account balances: Auditors take a close look at all the financial transactions made during an accounting period. They also check the account balances to see if the transactions have been recorded accurately.

- Internal documents and processes: Companies have to implement internal controls and effective accounting processes for compliance and auditing purposes. During an audit, the effectiveness of such controls and processes is evaluated. Auditors also review all the internal documents, including historical documents and transaction-related documents, to ensure that the books and records are free from errors.

- Internal revenue service (IRS) documents: An important part of auditing is to assess whether a company is complying with tax laws and regulations. Therefore, any documents related to tax returns and exemptions are also reviewed during an audit.

- Financial commitments: Another key thing that auditors have to evaluate are the financial commitments a company has made. For example, loans, employee benefits, rent agreements, etc.

- Financial statements: An auditor also checks a company’s previous financial statements to get a sense of their financial position. All of this evaluation eventually leads to the assessment of how accurate a company’s financial reporting is.

Why are Financial Audits Important?

Financial audits are crucial in the business industry and help different stakeholders understand how well a company is performing. It’s important that regular audits are performed at all organizations so financial and accounting processes remain transparent.

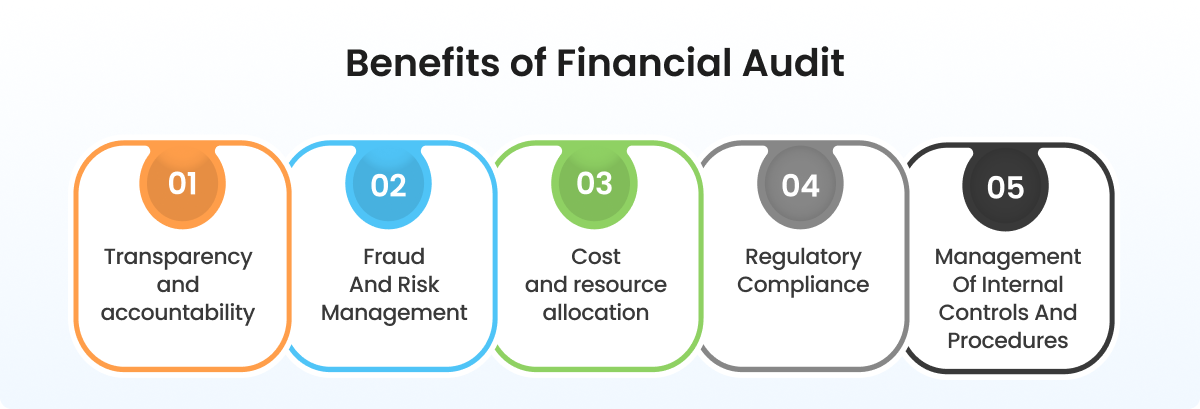

Here are the key reasons why financial audits are important:

- Transparency and accountability: Since audits are first and foremost responsible for evaluating financial statements, they ensure that a company’s financial reporting is accurate. In case of any discrepancies in the reporting, auditors can relay the information to all internal and external stakeholders.

- Fraud and risk management: A key reason for conducting regular audits is to check for any fraudulent activities. Audits also help to mitigate risks as they effectively look for any anomalies and errors in financial reporting.

- Cost and resource allocation: An auditing process can also help businesses determine if there are any areas for improvement that can enable them to better allocate resources and optimize their operations to be more efficient.

- Regulatory compliance: Another major reason why audits should be conducted regularly is to assess whether a business is complying with all the regulations and accounting standards.

- Management of internal controls and procedures: Any business needs to implement effective controls and accounting procedures so financial activities go on smoothly. Auditors are responsible for assessing the same and checking if the internal controls and procedures are being followed effectively.

What is the Difference Between Accounting and Auditing?

While both accounting and auditing ensure transparency, accuracy, and completeness when it comes to financial statements, the purpose of both processes differs.

Here are the key differences between accounting and auditing:

| Criteria | Accounting | Auditing |

| Purpose | The key purpose of accounting is to record, classify and summarize a business’ financial transactions to ensure seamless financial l operations and financial information accuracy | The key purpose of auditing is to evaluate a company’s financial statements to determine their accuracy and compliance with accounting standards |

| Frequency | On-going process | Conducted periodically (monthly, quarterly, or yearly) |

| Obligation | The obligation is to the company and its management | The obligation is to internal and external stakeholders |

Stages of a Financial Audit

Different companies may follow different auditing procedures depending on their size and requirements, however, the following are the four main stages involved in a financial audit:

- Planning: At the initial stage, the company is required to connect with a Certified Public Accountant (CPA) or Certified Internal Auditor (CIA) affiliated firm or auditor to determine the details of the audits. This may include scheduling the audit, determining the level of engagement, and the processes and procedures of the audit.

- Gathering financial information: During the second stage of the audit process, the auditors carefully identify and gather all the financial information they may need to evaluate the accuracy of financial statements.

- Testing: The testing stage requires the auditor to perform different tests in order to assess how accurate a company’s financial reporting is. The tests may involve reviewing transactions, checking account balances, and testing the effectiveness of internal controls.

- Reporting: Once the auditor carefully reviews financial statements and determines the effectiveness of controls, they prepare the audit report. The audit report comprises the auditor’s opinion on the financial integrity of the company.

What are the Different Types of Financial Audits

There are three main types of financial audits, including IRS audits, internal audits and external audits that help companies stay accountable and compliant.

- Internal audits:Internal audits are internal assessments of a company’s internal processes and procedures conducted by internal auditors. The purpose of internal audits is to offer an objective overview of the company’s operations and evaluate the effectiveness of implemented controls.Such audits are conducted by internal employees or a third-party company who are hired for these tasks. They help businesses identify areas for improvement, adhere to accounting standards, increase operational efficiency, and prepare for external audits.

- External audits:External audits are independent evaluations of a company’s financial statements and help assess the accuracy and completeness of financial reporting. External audits benefit external and internal stakeholders as they review the transparency of a company’s financial reporting.External audits are conducted by parties who are not related to the company in any way. Apart from assessing the financial statements, external audits help stakeholders improve-decision making and keep businesses accountable to all the parties having a vested interest in the company.

- IRS audits: Other than complying with accounting standards, businesses also need to comply with tax laws and regulations. An IRS audit reviews the same and checks if the reported financial information adheres to the tax laws. IRS auditors are also required to check if the amount of tax a company has reported is accurate.IRS audits essentially hold companies accountable when it comes to tax laws and ensure that they aren’t engaging in tax fraud.

How to Prepare for a Financial Audit?

To ensure the auditing process goes smoothly and is completed in the most time-efficient manner, businesses should prepare beforehand. In order to do so, the following steps should be considered:

- Keep all financial and internal information handy: All the information listed in financial statements should be supported by valid documentation. The same goes for transactions recorded in a company’s books. Therefore, businesses need to gather all the supporting documents to ensure the audit is conducted properly. Moreover, companies should keep documents like company bylaws and internal handbooks ready for review.

- Inform internal and external stakeholders: All the parties that could be affected by the audit should be informed beforehand. The stakeholders, including finance and accounting teams, shareholders, and external accountants should be made aware of when the audit is taking place so they can prepare accordingly.

- Create a checklist: Creating a checklist to ensure that all the tasks due before an audit are completed efficiently is a good way to prepare for a hassle-free audit.

How HighRadius Can Help Improve the Financial Audit Process

Accuracy is a vital component of any audit. Ensuring accuracy in financial reporting is essential for maintaining the integrity of your organization. Highradius can make a significant difference in enhancing the accuracy and efficiency of audits. The Highradius’ Record to Report solution streamlines the entire financial reporting process, ensuring all records are accurate and up-to-date. This minimizes the risk of human error and ensures consistency and compliance with regulatory standards.

At the heart of this solution is the Financial Close Management software, which provides a structured and efficient way to manage the financial close process, reducing days to close by 30%. The Close Checklist feature provides an efficient audit trail by ensuring that supporting documents, weblinks, and comments are readily available for auditors. Further, it ensures that businesses are audit ready by providing a clear view of all changes made to a task to maintain integrity of the close process.

The Month-end Close Task Workflow is another key feature, ensuring transparency, compliance, and a detailed audit log during auditing processes. Furthermore, Account Reconciliation Software enhances audit readiness by providing essential evidence for closing balances on specific dates, addressing a critical need for audits.

The LiveCube Task Automation includes automated data extraction and period-over-period rollover features, reducing manual intervention and increasing efficiency by 50%. These capabilities allow analysts to focus on critical tasks such as audit preparedness, adjustments, and reporting.

The Journal Entry Management module ensures accountability and integrity in journal entry postings. By logging all tasks worked on by preparers and approvers, this feature is essential for audit purposes.

Leveraging the AI and automation-backed Record to Report suite, your organization can achieve greater accuracy and efficiency in its financial processes, ensuring that internal audits are based on reliable data, leading to more effective and insightful audit results.

FAQs

Q1. What is the aim of a financial audit?

The aim of a financial audit is to evaluate a company’s financial statement and check if all the financial information is accurate. This process helps increase transparency and accountability for internal and external stakeholders, ensure adherence to accounting standards, and mitigate risk and fraud.

Q2. What is a financial statement audit?

A financial statement audit is the process of evaluating a company’s financial statements to determine their accuracy. These audits are conducted at least once a year by an external auditor with no ties to the company to provide an objective overview of the company’s financial health.

Q3. Can anyone do a financial audit?

No, not anyone can perform financial audits. A financial audit needs to be conducted by external firms that are CPA or CIA certified. This is especially true for external audits, although most internal auditors get CPA and CIA certifications as well. This is necessary to provide an objective view of a company’s financial position.

Q4. How long does a financial audit take?

A financial audit can take anywhere between a few weeks to a few months. The time frame depends on the size of the company and its specific requirements. However, generally, a financial audit takes around three months to review and report a company’s financial statements.

Q5. What are the two main types of financial audits?

The two types of financial audits are internal and external audits. Both help companies maintain their financial integrity by evaluating their financial information, operational efficiency, and effectiveness of internal controls. Internal audits can be performed regularly throughout the year, however, external audits are conducted once a year.

Q6. How often is a financial audit required?

The frequency of a financial audit depends on the type of the audit. For example, an internal audit can take place monthly, quarterly, or yearly depending on the company’s needs. An external audit however is usually conducted once a year at the end of the financial year.

Q7. Is a financial audit mandatory?

An external audit is mandatory for publicly traded companies that need to adhere to the accounting standards. Internal audits however are not mandatory, but public companies perform regular internal audits to determine their financial position and to prepare for external audits.

Q8. What is the purpose of a financial audit?

The purpose of a financial audit is to ensure that the information provided in financial statements is accurate. As financial statements reflect the financial position of a company to external stakeholders, it’s important that they are free of any discrepancies, anomalies, or fraudulent information.