Key Takeaways

- “Pay to the order of” on a check specifies the person or entity authorized to receive and deposit or cash the check.

- The different types of check endorsements include blank, restrictive, special, conditional, and qualified endorsements, each serving a specific purpose for transferring or securing the check.

- Pay-to-order checks offer secure transferability and clear payee identification, providing a reliable record of transactions.

Introduction

Despite the rise of digital payments, checks remain significant, with over 12 billion checks written annually in the U.S., according to the Federal Reserve. Understanding the intricacies of checks, especially the “pay to the order” section, can be daunting for newcomers.

However, knowing how to fill out and endorse a check correctly is essential for ensuring smooth and secure transactions in today’s financial landscape. To make it easier for you, we will cover everything about an important part of the check: the ‘pay to the order of’ section. Let’s get to it.

What Does Pay to the Order of Mean on a Check?

“Pay to the order of” on a check specifies who will receive the payment. This phrase identifies the payee, the person, or the organization entitled to the funds. When a check is issued, it directs the bank to pay the designated recipient, ensuring that the payment is made to the correct party.

In practical terms, the check’s bearer, or the person to whom the check is made out, can deposit or cash the check. The phrase allows for transferability; if the payee endorses the check by signing it on the back, they can transfer the payment to someone else.

This feature is crucial in check transactions, as it specifies who can legally access the funds. Understanding this section helps ensure that checks are processed correctly, preventing errors and ensuring that payments reach the intended recipient or are properly redirected.

Example of pay to order check

Below is the example of pay to order check

To endorse, sign your name on the back of the pay-to-order check. Optionally, write “For deposit only” and your bank account number below your signature for added security. This ensures the check is deposited into your account and not cashed by someone else.

How Pay to Order Check Work?

The Pay to order check process involves the following steps:

- Issuing the Check: The payer (drawer) writes a check, including the phrase “Pay to the order of,” followed by the name of the payee (recipient) on the designated line.

- Payment Amount: The payer writes the payment amount in both numerical and written form on the check.

- Signature: The payer signs the check at the bottom-right corner, authorizing the payment.

- Presentation: The payee receives the check and can endorse it by signing the back if they wish to transfer it to someone else.

- Depositing or Cashing: The payee presents the check to their bank for deposit or cashing. If the check is endorsed, the new holder can also deposit or cash it.

- Bank Processing: The bank verifies the check’s details and processes the payment, transferring funds from the payer’s account to the payee’s account.

What Are the Different Types of Check Endorsements?

Check endorsements are designed for various situations. The different types of check endorsements are as follows:

- Blank Endorsement: To perform a blank endorsement, simply sign your name on the back of the check. This type of endorsement makes the check payable to anyone who holds it, meaning it can be easily transferred to another person. It is the most basic form of endorsement and does not specify any restrictions.

- Restrictive Endorsement: To use a restrictive endorsement, write “For deposit only” on the back of the check along with your signature. This endorsement restricts the check from being deposited into your own bank account, preventing it from being cashed by anyone else. It enhances security by ensuring the funds go directly to your account.

- Special Endorsement: With a special endorsement, write “Pay to the order of,” followed by the name of the new recipient, and then sign your name. This allows you to transfer the check to another person or entity, effectively making them the new payee who can deposit or cash the check.

- Conditional Endorsement: For a conditional endorsement, write a specific condition on the back of the check, such as “Payable only if my account balance exceeds $500,” along with your signature. This endorsement imposes a condition that must be met for the check to be valid. It is less commonly used and can complicate the process.

- Qualified Endorsement: A qualified endorsement includes the phrase “Without recourse” along with your signature. This type of endorsement limits your liability if the check is dishonored or returned by the bank. It signifies that you are transferring the check but are not responsible for its payment if there are issues with it.

How to Fill in the Pay to Order of Section on Checks?

Below are a few do’s and don’ts for filling the Pay to order checks:

- Locate the Section: Find the “Pay to the order of” line on the check, usually on the left side.

- Write the Payee’s Name: Write the name of the person or entity receiving the payment on this line. Ensure the name is spelled correctly and written legibly.

- Double-check spelling: Verify the payee’s name for accuracy to avoid any issues with processing.

- Use Full Names: If paying an individual, write their full legal name. For an organization, write the complete name of the business or entity.

- Avoid Abbreviations: Refrain from using abbreviations or nicknames to prevent confusion.

- Review Before Signing: Before signing the check, review the “Pay to the order of” section to ensure everything is correctly filled out.

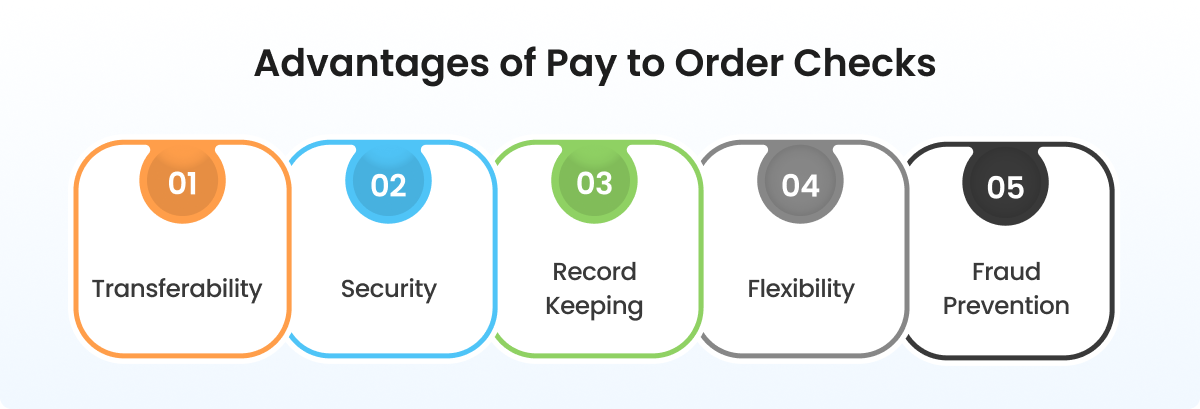

Advantages of Pay to Order Checks

Here is a list of a few major advantages of pay-to-order checks

- Transferability: Pay-to-order checks can be transferred to another person by endorsing them, making them versatile for different transactions.

- Security: The endorsement requirement adds a layer of security, ensuring that only the authorized payee or endorsed person can access the funds.

- Record Keeping: Checks provide a written record of transactions, which can be useful for tracking payments and managing financial records.

- Flexibility: They offer flexibility in payment methods, allowing individuals and businesses to issue payments without needing cash.

- Fraud Prevention: The endorsement process helps prevent unauthorized use and reduces the risk of fraud compared to bearer checks.

- Clear Payee Identification: The “pay to the order of” line identifies the intended recipient, reducing errors and ensuring accurate payments.

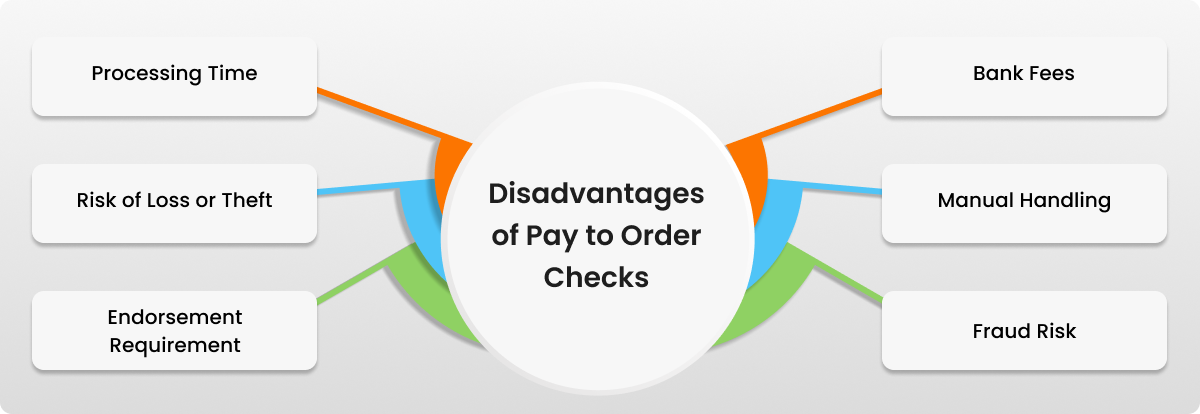

Disadvantages of Pay to Order Checks

Here is a list of a few major disadvantages of pay-to-order checks

About HighRadius: B2B Payments Suite

HighRadius offers a comprehensive, cloud-based solution to automate and streamline the B2B payments process for businesses. The B2B Payments software features a robust payments module with a payment gateway, surcharge management, and interchange fee optimization. The payment gateway for SAP integrates with SAP and makes cash applications seamless.

Trusted by 1000+ companies to deliver speed-to-value, including P&G, Ferrero, Johnson & Johnson, and Danone, HighRadius has been a Gartner Magic Quadrant Leader 3 years in a row, placed highest in the ability to execute and furthest in the completeness of vision.