Learn how you can Increase cash flow, improve worklist prioritization and reduce DSO through AI Powered Collections Management Solution

Most industries, apart from those that deal with consumers, work on a trade credit model. Suppliers and buyers enter into an agreement that refers to “payment terms,” which dictate the conditions under which a seller will complete a sale. Depending on the industry, payment terms may vary widely from ‘payment in advance’ to payment ‘90 days after the invoice date.’

In an ideal world, suppliers wouldn’t need collections teams as buyers would pay ‘in full and on time,’ every time. However, a survey revealed that 48% of customers do not pay on time, and businesses lose 52% of the value of receivables for invoices that are more than 90 days past due. In an effort to keep close tabs on the health of their receivables, finance departments have relied on a key metric – DSO.

A higher DSO implies lower cash on hand, therefore requiring companies to rely on borrowings to fund operations and keep business running. Collections teams are therefore necessary to maintain a low DSO, as they help convert receivables into cash and assist the finance team to reduce borrowing costs.

However, as most readers would agree, credit collection is no mean feat. Despite all the advances in technology, collections continue to heavily rely on old-fashioned dunning correspondence to remind customers and creditors about invoices that are due or already past due. Growth in businesses, through organic and inorganic expansion, has only meant more demand. This has led directly to more transactions with an ever-rising number of customers. The collections challenge is clearly not going away.

A great deal of insight into the future of collections management could be gained by looking at how collection processes have evolved over the years. The rest of this chapter takes a closer look.

While the collections team deal with several kinds of customers depending on the industry in which they operate, there are a few common collections challenges that occur across all industries:

1.Lack of Collectors to Deal with The Growing Volume of Due Invoices:

This is the most common problem faced by collections teams worldwide. Most collection managers find their teams overstretched. However, even adding more resources is not necessarily a perpetually scalable [1]solution. With growing businesses and receivables volume, the number of overdue receivables also keeps on increasing across various geographies. While initial positive impact in terms of DSO reduction may be visible with the onset, the costs of a constantly growing team will soon be unable to justify the results. Organizations will not be able to afford adding resources to dig into the mounting receivables volume.

2. Prioritizing Customers for Collection Activity

For years, collectionsanalysts have traditionally relied on ageing lists to find out the items which need to be worked on any given day. The flaw with this approach is that it does not take into account the variables which impact collectionsoutcomes. Some of these variables are discussed below.

3. Identifying The Right Contact at A CustomerOrganization

Supplier-buyer relationships are becoming very complex with businesses supplying to many independent business units or divisions within the same buyer organization. The problem of identifying the right contact for dunningis worsened by the lack of proper customer master data. Collections analysts remain unclear about whom to contact at the customer organization. For suppliers selling to large national retailers, such as Walmart and Target, such problems are even more common.

4. Applying The Right CollectionsApproach for Each Customer

Collectionsteams deal with customers and buyers of all sizes, from small mom and pop stores to large retailers. In the absence of a well-defined strategy to select the right mode and style of communication, customer correspondence becomes a challenge. The sheer volume of customers means that calling every customer is not the most judicious use of time. Variables such as past payment behavior and customer type should also dictate the mode of communication.

Collections analysts therefore are always challenged by their single biggest responsibility of reaching out to customers. In fact, studies show that collections teams have struggled with customer correspondence and close to 70% of collections calls go to customers who would have paid even without dunning notices or telephonic reminders.

5.CollectionsOperating in A Silo from Other ReceivablesProcesses

Many teams operating in the credit and accounts receivable processes are often seen as operating in silos. This modus operandi has significantly reduced operational efficiency. The disconnect between teams results in additional manual work and clerical collaboration required by collections teams to access data which is usually vital for their success:

Timely access to accurate data could greatly improve the effectiveness of collections operations. However, siloed systems and poor collaboration have meant that collections teams continue to lack the necessary means to improve efficiency.

6. Ad-Hoc Information Requests from Customers:

The customeris king, and as purported champions of a good customerexperience, collections teams have a hard time saying ‘no’ to customer requests. Customers routinely request additional invoice copies, account statements and bill of lading, proof of delivery, among other invoice and order-related documentation.

Most collections analysts spend at least 30% of their time catering to such ad-hoc requests given that the requested information is scattered all over the place. For example, downloading a proof of delivery document requires analysts to go to the carrier website, enter tracking numbers and then download the required materials. Declining ad-hoc requests from customers is not a solution, as it is only likely to delay payments. The solution has to be sought that brings all the necessary information to a single place for collections analysts to access and serve.

7. Measuring The Effectiveness Of CollectionsOperations

While DSO is a great metric to measure the overall health of accounts receivable, A/R managers and leaders struggle with performing a root-cause analysis when faced with higher than expected DSO. One of the more important factors that impacts DSO is ineffective collections operations. And the inability to accurately measure the performance of collections teams could very well be the Achilles’ heel of even the most successful A/R departments. Collections managers routinely struggle to find answers for questions similar to the ones described below:

While some teams and companies innovate with new processes and systems, others fail and falter as they continue plying old solutions to very new and unique problems and challenges. Due to the sweeping changes over the last few years, many teams are unable to deliver the results to which their previous finance teams were accustomed hence calling for a change.

Figure 5: Types of Collections Management Systems

While companies are diving in to employ the latest collections management software, it is important to obtain a very clear understanding of the different types of collections management solution available.

Receivables Master Data Management Systems

The most basic type of collections management solution will help the teams gain a consolidated view of all the customer accounts along with important information related to open invoices and customer contact personnel. This kind of system is most useful for teams which already have a solid communication execution and tracking platform in place. The primary purpose of such systems could be to help analysts review the data and manually prioritize and create their account lists for collection.

Dunning Activity Management Systems

The next level of solution includes functionality provided by receivables master data management systems described above, but also handle dunning activity. These systems serve as a means of record keeping to track all collection activity and correspondence. Some of these systems are also able to help collections team leaders to define strategies and rules based on various collection scenarios, which are executed by the collection analysts in the course of their work.

Correspondence Automation Systems

Considering that correspondence is the single most important activity performed by the collections team, it becomes justified that there exists a type of system that caters to this particular requirement. Ideally, a correspondence automation system should handle and maintain multiple correspondence templates that are needed by the collection analysts. In addition, these systems should perform correspondence activity across mediums including print and mail, email and fax, as well as keep track of all phone-based collection touchpoints. Compared to the previously outlined systems, these solutions are completely capable of automating manual work involved in creating correspondence, selecting accounts and contacts and then sending out emails or dunning notices.

Integrated Collections Management Systems

One of the challenges discussed earlier was how collections teams end up working in silos, isolated from key information that is crucial for successful collection outcomes. An integrated collections management system should be capable of linking all data-sources across the receivables domain – including deductions, disputes, payment processing and invoicing – and be able to present a single source of truth for collections teams with which to work. Organizations are already leveraging integrated collections management systems to free up their teams from the manual work involved in preparing collection lists, sending out email correspondence, searching for information and documentation from different teams and keeping track of overall collections activity. This automated process allows teams to focus on the most high-touch aspect of collection activity that involves dunning via phone.

Collections Management is indeed one of the most complicated of the accounts receivable processes. Further, leaders in the Collections Management field are faced with multiple challenges – both internal and external. However, most collections leaders identify correspondence management and correspondence automation as the lowest hanging fruit towards effectively transforming receivables operations.

The next chapters focuses on correspondence automation and explain how the approach towards customer correspondence requires a drastic overhaul.

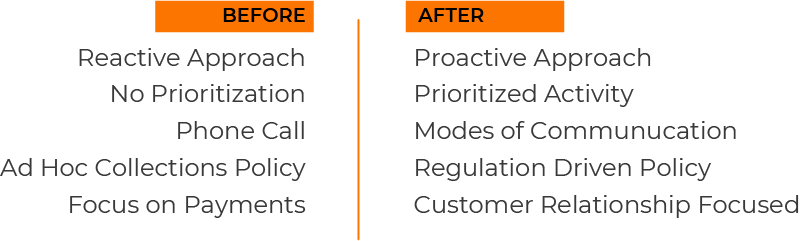

Evolution of Collections Management Practices

Like most processes in back-office finance, collections has traditionally been viewed as a linear operation. The single-minded objective of getting customers to ‘pay up’ led to a single-dimensional approach to collections management. Some of the trademarks of the collections teams which continue to operate with a traditional approach are outlined below.

A Reactive Approach

Typically, collections as a process was activated only when a customer had defaulted, and in some cases, only for a large default value. Such an approach does not see prior follow-ups and intimations as a norm, even for large amounts pending with risky customers. The limited team sizes combined with the overly simplified priority of collecting from larger customers meant that the teams could never reach out to 100% of the open accounts within the valid payment terms.

More Phone Calls Each Day Means Less Outstanding Amount

Phone calls were considered the best way of getting a customer’s attention about a late invoice payment. Phone calls did have a definite advantage with customer connection because the conversation was 1-on-1 and more personal. The direct call resulted in faster return of outstanding amounts. Therefore, connecting with the customer via phone was considered the most effective way to get paid. However, phone calls also meant more time spent for collecting a single invoice. This coupled with the tendency to call customers only after payments were due, meant that fewer customers could be reached on time. While high-touch customer connection using phone calls made sense, effective utilization continued to be a major challenge.

Collection Policies Created to Protect The Interest of Suppliers

In the past, companies maintained a very outbound approach towards collections management. The only objective was to get paid ‘on time’ and ‘in full.’ While the intentions were precise and objective, the means often came at a compromise of the customer experience. Policy making around collections lacked any incorporation of the customers’ needs and concerns.

A Confrontational and Persistent Approach Towards Customers

Irrespective of how some customers easily make a habit out of paying late, collection processes and systems have never really been kind to the customers either. In the absence of proper customer data and history, analysts and collection teams always saw rich dividends in applying a confrontational approach to the collection activity. If the dunning was serious and strong enough, the chances of getting paid were higher. However, the long-term impact of such an approach was not foreseen. Sometimes customers with good credit backgrounds and a history of on-time payments faced harrowing experiences because of one-off late payments.

Today, however the tactics have changed to a more strategic prioritization and correspondence to customers focusing more on maintain the customer relationship instead of ‘just getting paid.’

A Proactive Approach

Today, collections management stresses on understanding customer payment habits to create a win-win. In the proactive approach, collections teams are increasingly analyzing past data to weed out strategies and tactics which are no longer delivering results, and modifying them to align with the goal of collecting more and reducing the average collection period. This has been a major turnaround since collection teams no longer wait for invoices to be due, but are able to determine the right time for reaching out to each customer.

Prioritizing Customer Follow-Ups to Maximize Returns

As collections management continues to evolve into a data science, the biggest impact is on how collection teams plan their follow-up in the modern world. While it is mostly the norm to start following up before the payment is actually due, collections teams are spending a significant amount of time in figuring out which customer requires an earlier follow-up compared to the others. Teams are looking at multiple factors including payment history, indicators of delinquency and credit risk scores. Combined with easy access to enterprise-grade predictive analytics, teams turn data into well-informed decisions. This helps teams achieve better results from the collections effort by controlling delinquency and bad-debt.

Multiple Modes of Communication in Use

Phone calls could be more effective at the level of an individual collection. However, with hundreds of thousands of invoices requiring customer contact, the tide has changed to favor other technological solutions. The idea that modern businesses have tested and adopted widely is the use of multiple channels for connecting with the customer like emails. This is mainly because:

Therefore, using a mix of emails and phone calls on an as-needed basis is the most effective way to approach customers.

Collection Policies Driven by Regulatory Compliance

Collections policies have undergone tremendous change over the years. Business policy and reform have led to laws which restrict irregular and abusive procedures followed by collections teams. For example, Fair Debt Collections Practices Act strictly specifies prohibited conducts such as repeated calling, misrepresentation, seeking unjustified amounts, abusive language, among others, during a collections process. More than ever before, companies are bound to consider their customers’ expectations when designing internal policy, strategy and tactics around collections.

Strategic Relationship with Customers

With increasing competition, thousands of retailers and millions of products, end customers have more choices and the purchase decision-making has become an increasingly complex process. Retailers selling directly to consumers are often able to win customer loyalty simply with attractive pricing, affordable quality and a decent range of options. However, the business-to-business environment requires much more time and effort. Customers value relationships which extend beyond product quality and price competitiveness. The simple thought that loyal customers are least likely to default is driving a sea of change in how finance teams are approaching the collections challenge.

Since, correspondence is the cornerstone of the collections process, it is imperative to have an automation solution that caters to this particular requirement. Ideally, a correspondence automation system should handle and maintain multiple correspondence templates that are needed by the collection analysts. In addition, these systems should perform correspondence activity across mediums including print and mail, email and fax, as well as keep track of all phone-based collection touchpoints. It should also be capable of completely automating manual work involved in creating correspondence, selecting accounts and contacts and sending out emails or dunning notices. In short, correspondence automation should enable the collections team to:

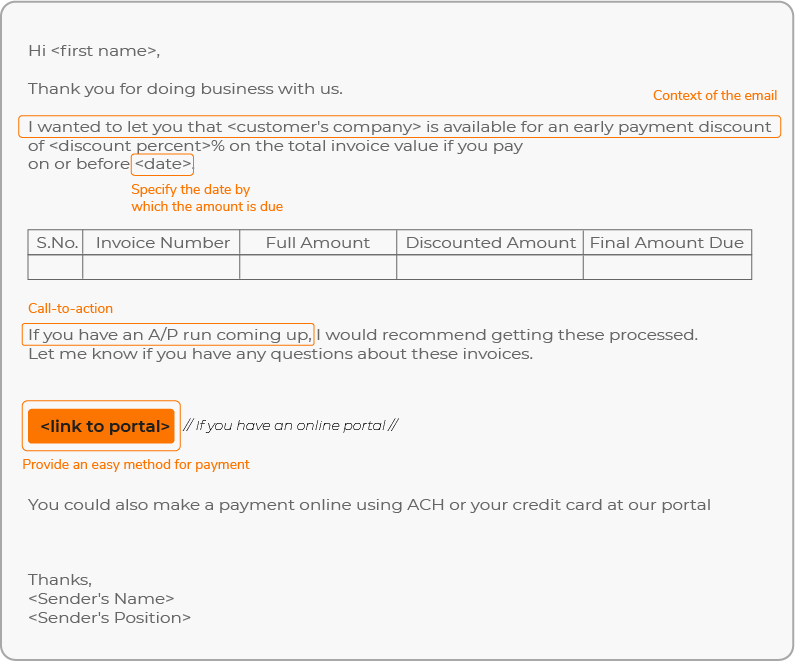

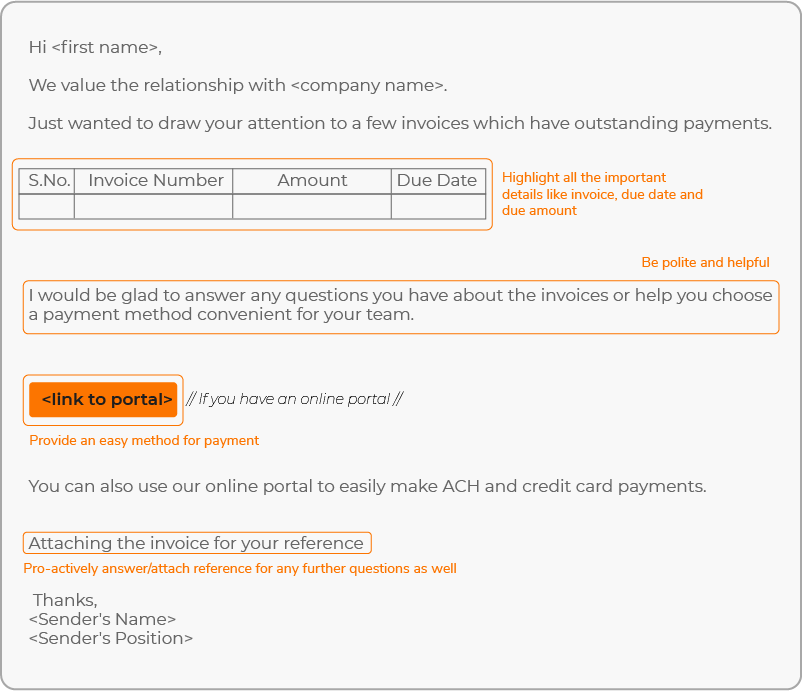

While deciphering the best strategies to select the mode and style of correspondence that would suit a particular customer during the collections process, it is imperative to analyze the following three points to choose the most effective solution:

Context

Before sending an email/fax/mail or calling the customer, the collectors should ask themselves once why are they sending or what they are going to ask about on the call. It is necessary to understand the major objective behind any correspondence activity. Is it about pro-actively reminding customers for upcoming payments or about solving any ad hoc queries of the customer, the collection analyst need to have a clear picture before initiating the correspondence activity. Based on this context, the analyst might need to change their tone/style of communication.

Time

Time is of extreme essence in collections domain. It is essential to note the time at which the correspondence is happening. Is it before the due date or after the due date? The language and the content of the message will definitely change based on this constraint. For example, if the collection analyst is sending an email as gentle reminder for upcoming open invoices then, the tone of the conversation can be direct but light without pressurizing the customer to make a payment whereas if the collection analyst is sending an email for third-past due reminder then, the tone of the email should be strict and direct emphasizing on the impact of any further negligence on credit utilization or previous orders.

Account Type

With the change in the correspondence approach over the years from ‘just-getting-paid-focused’ to ‘customer-relationship-focused’, the line of communication for different value accounts has also changed. For key account large customers, the style of communication is quite polite and thankful. Also, a little lenient as compared to that for other accounts. For fast-paying customers, the language of emails is polite yet direct whereas for slow-paying customers, it is demanding with stricter implications in case of failure to pay.

Moreover, the frequency of emails also differs. Where for fast-paying customers, it is about 7-15-20 days, whereas, for slow-paying customers, it is about 5-10-14 days. Based on these three pillars of customer correspondence, effective email templates can be created to deliver the best results, i.e., adding dollars to the bottom-line faster without hampering the customer relationship in the long run.

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Best-practices:

Advances in technology have enabled collections teams to increase operational efficiencies and eliminate some of the redundant, manual tasks that drain collections productivity. This has had a direct impact on DSO with companies noticing a reduction anywhere in the range of 5% to 10%.

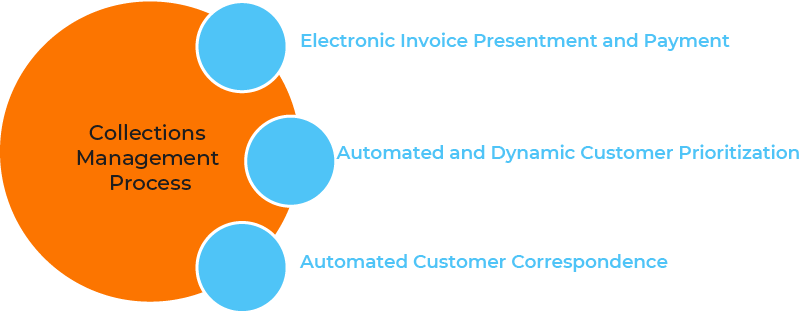

Most of the technology deployed for collections management is focused on solving at least one of the functional areas of the collections management process.

Figure 1: Functional Areas in Collections Management

In this section we discuss some of the technologies which are already helping collections teams perform better.

Electronic Invoice Presentment And Payment

As discussed earlier, customers not receiving invoices is one of the biggest reasons for delayed payments. The switch to electronic invoice presentment and payment (EIPP) helps collections teams ensure timely invoice delivery. Additionally, electronic delivery also provides the ability to keep a close watch to monitor if the invoice has actually been viewed or accessed by the buyer. Another aspect which helps in speeding up payments is the ability for buyers to pay electronically through a single system. Most EIPP systems accept customer payments through ACH and credit cards. At the same time, invoice and payment security remain top concerns for collections teams when evaluating EIPP solutions. However, a bigger concern, which directly impacts the effectiveness of such solutions, is the rate at which buyers in a particular industry or market are willing to adopt these electronic means of invoice delivery and payment.

Automated and Dynamic Customer Prioritization

Prioritizing collections is one of the main challenges faced by organizations today. Collections management solutions that allow segmentation of customers and have the ability to assign some collections strategy to each of these segments are a necessity to handle the growing business volume. Such solutions eliminate the manual work required by the analyst to create a daily or a weekly collections items list. The technology is capable of working in the background to evaluate factors including size of the customer, past payment history and behavior and other aspects to create a collections list. Team leaders benefit from such systems which guide the collections teams with recommended strategies and actions based on the particular category to which the customer is attached. In the end, the biggest benefits are clearly two-fold – standardization of collections activities based on customer categories and the elimination of the manual work required to prepare the collections worklist.

Automated Customer Correspondence

By establishing a single system for all customer correspondence, technology is able to empower collections teams to perform both strategic and tactical correspondence activity with customers without spending disproportional amounts of time.

By creating ready-to-use templates out of the most commonly used communication across customer accounts, it is possible to significantly reduce the amount of time taken to correspond with customers. Such systems make it possible for an analyst to select a group of ten customers in a batch, for example, and send an email to them via a single template which collects information relevant to each in their individual correspondences A major load could be removed from collections analysts by enabling these systems to respond to the ad hoc information requests from customers. Copies of due-invoices and other necessary documentation are automatically attached to the main correspondence.

Collections management technology is creating a huge impact on how collections teams work today. Most teams adopting new technologies deliver better collections outcomes with fewer resource while addressing the overall agenda of their organizations to maintain positive customer experiences without impacting cash flow and working capital.

To learn more about technology solutions used by leading companies for credit and collections management, visit www.highradius.com

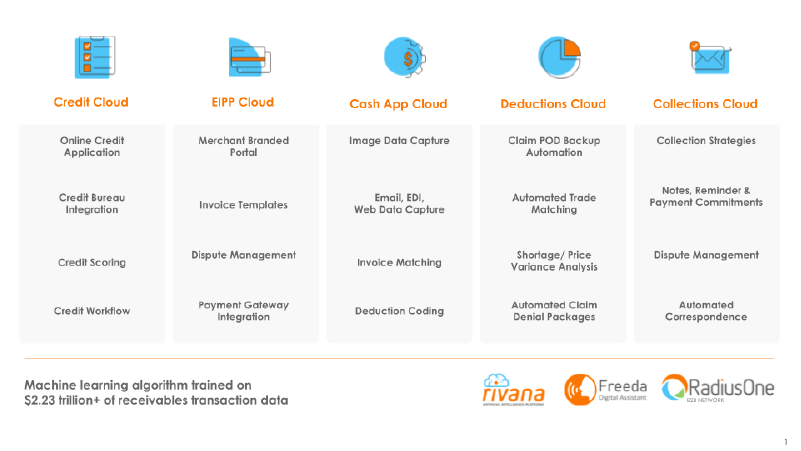

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company which leverages Artificial Intelligence-based Autonomous Systems to help companies automate Accounts Receivable and Treasury processes. The HighRadius® Integrated Receivables platform reduces cycle times in your order-to-cash process through automation of receivables and payments processes across credit, electronic billing and payment processing, cash application, deductions, and collections. HighRadius® Treasury Management Applications help teams achieve touchless cash management, accurate cash forecasting and seamless bank reconciliation. Powered by the RivanaTM Artificial Intelligence Engine and FreedaTM Digital Assistant for order-to-cash teams, HighRadius enables teams to leverage machine learning to predict future outcomes and automate routine labor-intensive tasks. The radiusOneTM B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

Integrated Receivables optimizes accounts receivable operations by combining all receivable and payment modules into a unified business process. The Integrated Receivables platform provides solutions for credit, collections, deductions, cash application, electronic billing, and payment processing – covering the entire gamut from credit-to-cash.

The HighRadiusTM Integrated Receivables platform stands out by enabling every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, and faster dispute resolution while improving efficiency and accuracy for cash application, billing, and payment processing.

HighRadiusTM Integrated Receivables leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier Accounts Receivable process to the buyer Accounts Payable process.

Predict your customer's payment date with AI-based Collections Software to ensure faster recovery

Talk to an Expert