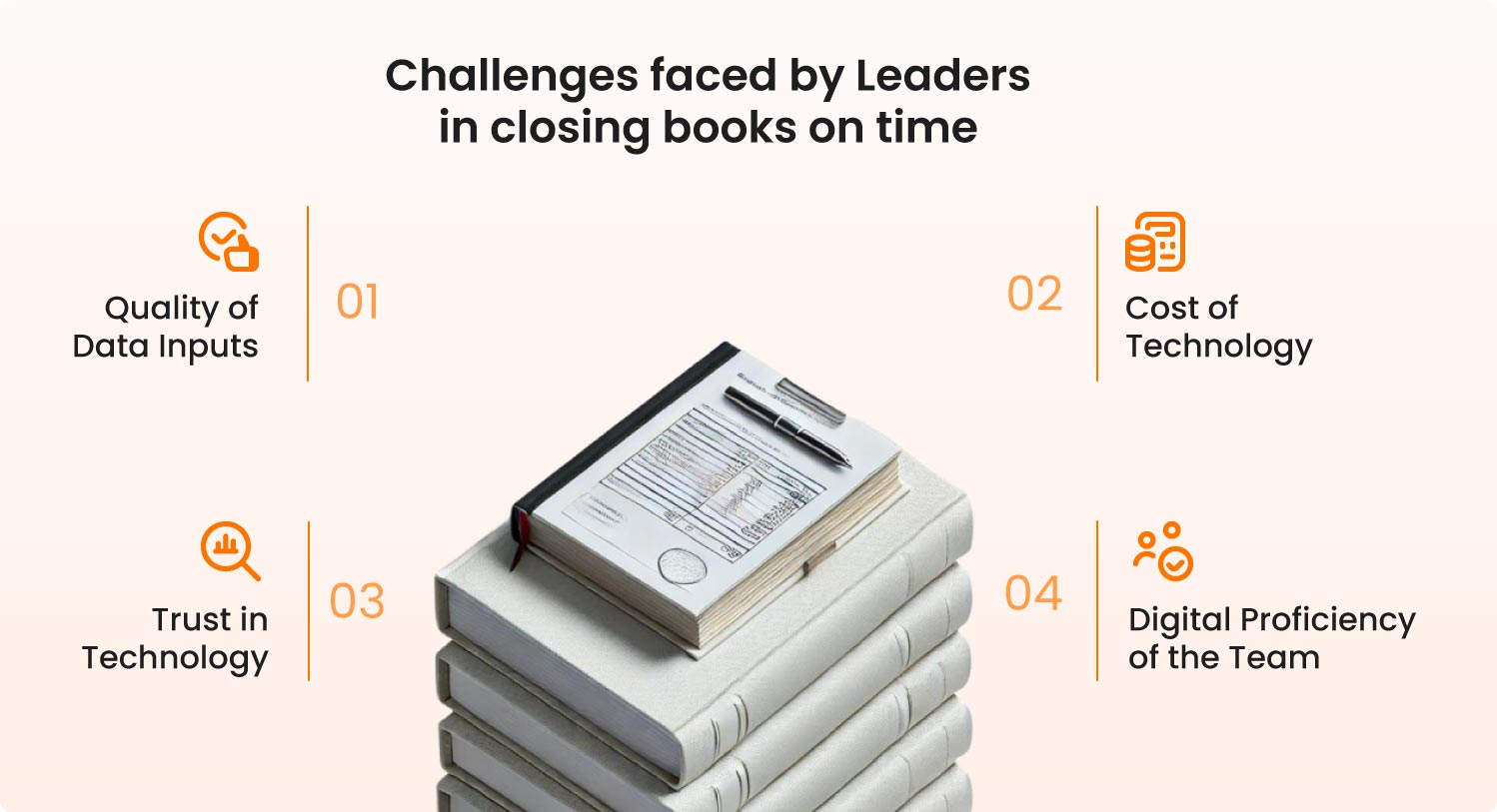

Companies that manage to close the books on time have tackled more significant challenges compared to those closing later. Not every company may think it’s worth the effort to speed up their close process. Are you one of them, or are you ready to tackle the challenges for a faster close?

Quality of Data Inputs, Trust in Technology, Cost of Technology, Digital Proficiency of the Team

1. Quality of Data Inputs

The speed and efficiency of the close process are influenced by the quality of data received. If the data inputs are poor, the accounting team ends up spending time correcting errors before using the information. Legacy systems in areas like accounts payable and receivable can complicate this if they don’t integrate well with the ERP. Rework is often needed due to errors in data entry or inconsistencies in data standards.

How do you solve it?

Invest in data integration and cleansing tools to ensure quality and consistency of your data. Implement data governance practices to standardize data entry and improve accuracy across different systems. Upgrade legacy systems to better integrate with ERP solutions, reducing errors and manual corrections. Establish clear data entry protocols and conduct regular audits to identify and fix data quality issues.

2. Trust in Technology

Finance teams, especially those handling controllership, often struggle to trust the accuracy of financial data generated using advanced technology. Despite investments in advanced systems, staff may still manually verify outputs due to concerns about accuracy and reliability.

How do you solve it?

To boost confidence in automated systems, implement strong validation and reconciliation processes. Regularly audit and cross-check data outputs with manual reviews to ensure accuracy and reliability for finance teams. Invest in training programs to help staff become more familiar with the system. Use systems with advanced error-detection and reporting features to further build trust in the technology.

3. Cost of Technology

A quicker close largely depends on substantial investments in technology. You will need to assess if the benefits of a faster close justify the costs of these technological investments. For some, the incremental advantage of a faster close may be worth the expense.

How do you solve it?

To justify investing in new technology, do a detailed cost-benefit analysis to measure the gains from speeding up the close process. Choose scalable and modular solutions for flexible investment based on current needs. Cloud-based options can be cost-effective with lower initial costs. Also, think about the long-term benefits like less manual work, fewer mistakes, and better compliance, which can balance out the initial expenses.

4. Digital Proficiency of the Team

To achieve an extremely fast close, accounting staff must effectively use available technology systems. This means they need to have both strong accounting skills and a high level of digital proficiency.

How do you solve it?

Provide ongoing training and development programs to improve the digital skills of the accounting staff. This includes offering workshops, online courses, and hands-on sessions with the technology. Encouraging a culture of continuous learning and support can help staff become proficient with new systems. Regular updates and communication about new features or system enhancements will keep the team up-to-date and efficient.